-

Posts

172 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Tom100

-

Great rec. Thank you!

-

Chinese buyers in Chiang Mai spark Thai fears for future stability

Tom100 replied to webfact's topic in Chiang Mai News

How do chinese/farang LEGALLY buy houses/land? I understand that foreign nationals cannot own land. -

Expats in Thailand urged not to worry about negative income tax

Tom100 replied to webfact's topic in Thailand News

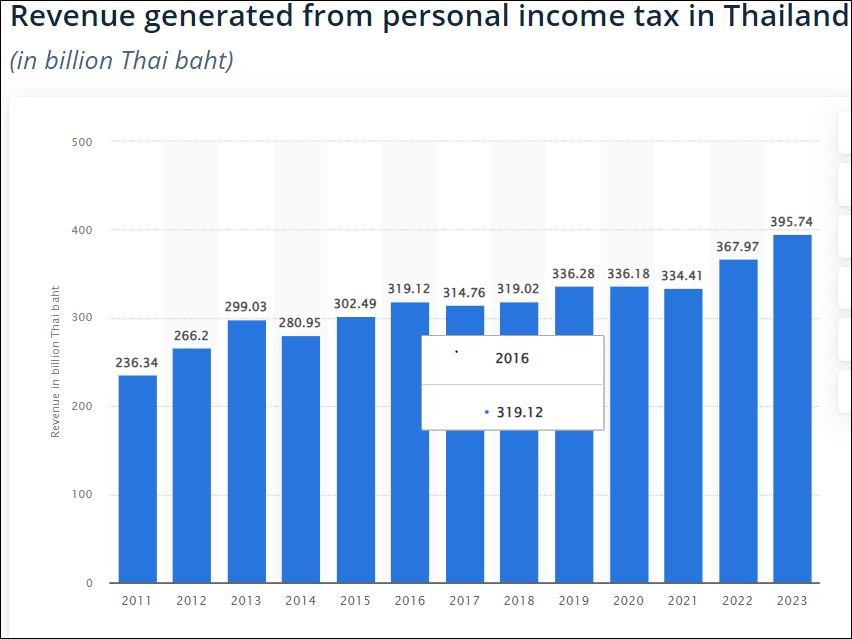

It is important because Thailand has a large deficit and is spending money faster than government tax revenues increase...The 2024 budget deficit is expected to be 693 billion baht with a 9.3% increase in y/y spending rise. Increased taxation of tourists/farang eventually will be required to fund the government social spending in this ageing country -

High cholesterol as a pre-existing condition?

Tom100 replied to JontS's topic in Insurance in Thailand

I admitted using a statin drug and PACIFIC CROSS increased my insurance premium while also saying I would NOT be covered for any related claims. So I paid a higher premium for less coverage. Buyer beware. PS What Bangkok Pharmavies offer good prices for generic lipitor? Big C sells it but the price is higher than back home. -

Gummies don’t work – so what can I try next .

Tom100 replied to Custard boy's topic in Thailand Cannabis Forum

The title should be that low-quality Thai-made gummies do not work because they lack THC and are poorly made. I bought many gummies in BKK and found that the quality and strength was VERY LOW compared to Canada and the US. The price was also higher despite low quality. Learn how to "decarb" cheap brick weed. Start with 50 grams for 1500 baht at Prickpot. https://www.leafly.com/learn/consume/edibles/what-is-decarboxylation -

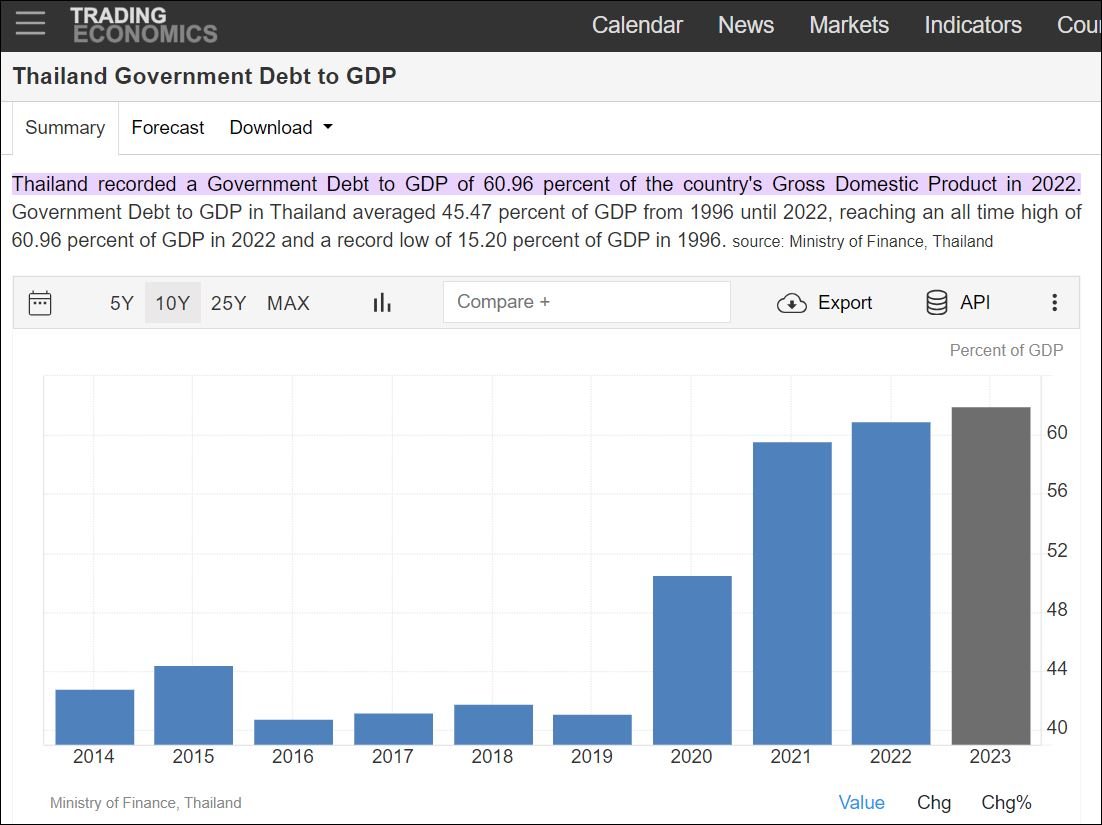

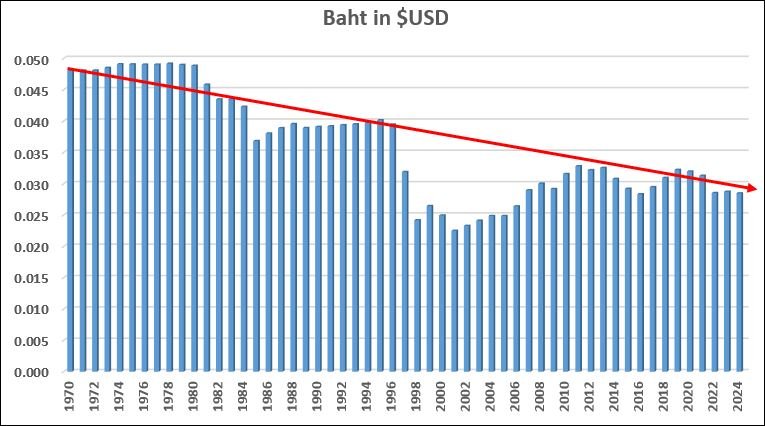

The Thai debt-GDP ratio will reach about 65% in 2024 -- up over 50% since 2019 (42% of GDP). The 3% annual deficit will be added to this. The economic slowdown will cut revenues while expenditures are rising. Any NIT would cause further fiscal deterioration. In plain english, the <deleted> would hit the fan because no foreign investors want to buy Thai debt because of the currency and political risk. GOOD NEWS for expats: The baht has been in long term decline vs. USD/Euro. Poor Thai fiscal management will assure the continuation of this trend.

-

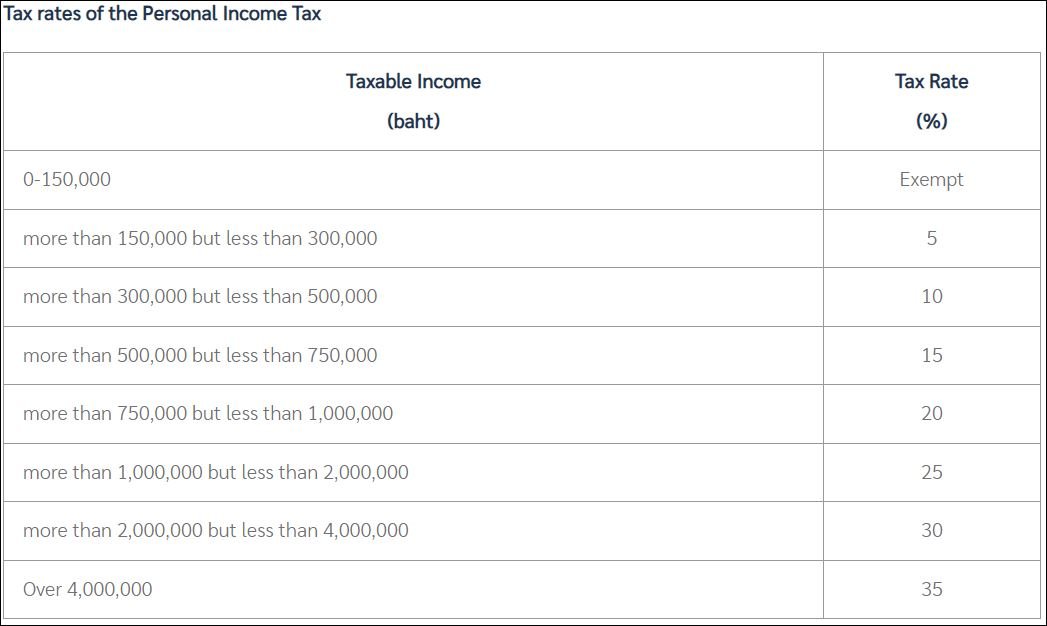

Thai personal income tax liability starts at 150,001 baht annual income (see chart from https://www.rd.go.th/english/6045.html). If a NIT increased income or "negative tax" up to this level (or any level) there would be an incentive to report income below the minimum tax threshold. Again, if you do not have accurate data on everyone in the country you cannot implement a negative tax scheme accurately. Maybe this will be solved if Thailand adopts a CBDC and forces everyone to use it? Maybe a negative tax will be announced to trick people into getting tax IDs?

-

Thailand would have to increase tax revenue to pay for a NIT. Maybe just tax farang on their remittances and global income! By 2023 almost 11 million Thais filed income taxes...but this was only about 25% of the workforce. "The main aim of the Revenue is to close tax loopholes which formerly allowed Thais and some wealthy foreigners to reap huge profits from overseas investments, currency speculations and cash buildups in offshore accounts often held for years. Separately, the Revenue has published new reporting rules for digital platform operators to allow it to collect information on sellers’ total income from their online activities, aiming to nudge more online product and service providers into the tax system. Many experts believe that the recent words of Lavaron Sangsnit are highly relevant to all recent tax announcements: “The world is getting smaller, more connected and traceable because of digitalization. In the past, it may have been impossible to detect tax evasion, but now it can easily be detected.” Now that Thailand has joined the Common Reporting System (CRS) of around participating 120 countries, financial institutions round the world will inform member governments of individuals’ transactions to fight tax evasion and protect the integrity of tax systems. In other words, when you send money abroad it is no longer a private affair." Source. https://www.pattayamail.com/latestnews/news/thai-revenue-releases-personal-income-tax-data-449478

-

First, Thailand does not have the $$ to pay for this with a weak economy and budget deficit at 2-3% of GDP. Second, a NIT requires a lot of good data to implement and Thailand does NOT have this data. Only about 10 million Thais pay income tax and the rest are in the informal cash economy so the government does not really know what their income is. A NIT increases the income of the poor up the the target income support level... but the government does not know how much the non-taxpayers actually earn so any NIT would be based on guesstimated incomes and people would have a huge incentive to underreport income to boost the NIT. Just like Western people on the dole may work for cash. Third, if Thailand cannot figure out the digital wallet giveaway after 1 year it will not figure out the implementation of a NIT in 10 years.

-

-

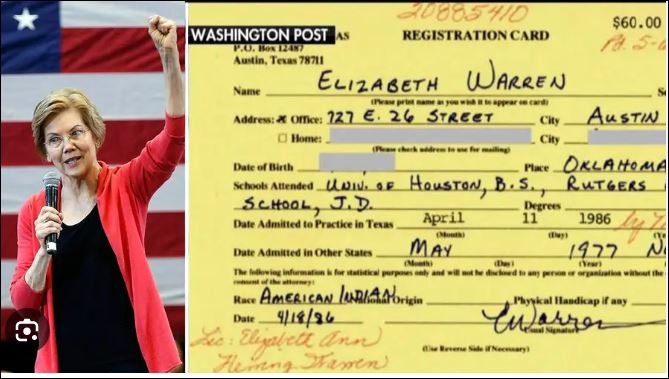

Here is the report. https://www.bia.gov/sites/default/files/media_document/doi_federal_indian_boarding_school_initiative_investigative_report_vii_final_508_compliant.pdf This work was supported by Senator (Democrat) Elizabeth Warren of Massachusetts who claimed falsely for many decades to be a "native american".

-

-

I just completed this quiz. My Score 80/100 My Time 56 seconds

-

J. Peterson: The Ironical Case of The Mad Male Loser

Tom100 replied to GammaGlobulin's topic in ASEAN NOW Community Pub

Smart and accurate post. I think the same of Peterson, a man full of anger at the world for not grovelling at his feet. What an ego! He makes Trump look modest. Thank you. -

1. I went to Bangkok Bank to open an account with my US passport. They gave me a form to take to US Embassy to certify. 2. I went to US embassy with Bangkok Bank form. US embassy had me complete their form letter which they stamped. 3. Bangkok Bank opened account after getting US Embassy stamped form letter.

-

Thailand to tax residents’ foreign income irrespective of remittance

Tom100 replied to snoop1130's topic in Thailand News

Foxx is correct. Other countries that tax their "tax residents" on international income include Canada, Spain, Italy, France and Portugal. Probably many more in EU. -

The absurdity of the LTR handling

Tom100 replied to SingAPorn's topic in Thai Visas, Residency, and Work Permits

Not absurd at all. I am happy you were rejected! Thailand does not need any more entitled angry expats. The Thai process is easier than that for obtaining some other retirement visas (e.g. Spain's Non-working (Non-lucrative) residence visa). I received my LTR in 3 months by following the rules and giving BOI all the docs they requested. No problem. Have a nice day! lol! -

Don Mueang Airport Recognized as Top Ten Budget Airline Terminals Globally

Tom100 replied to webfact's topic in Bangkok News

-

Thai lottery fever spikes as lucky numbers circulate ahead of April draw

Tom100 replied to webfact's topic in Thailand News

The lottery in Thailand is hugely popular despite the low odds of winning and the unfavourable payout ratio. The payout ratio for the Thai lottery is 60%, as compared to worldwide averages of 74% for bingo, 81% for horse racing, 95% for Las Vegas slot machines, and 98% for blackjack.