-

Posts

571 -

Joined

-

Last visited

Recent Profile Visitors

2,630 profile views

AndreasHG's Achievements

-

BREAKING: Trump deploys nuclear subs towards Russia

AndreasHG replied to FriscoKid's topic in Political Soapbox

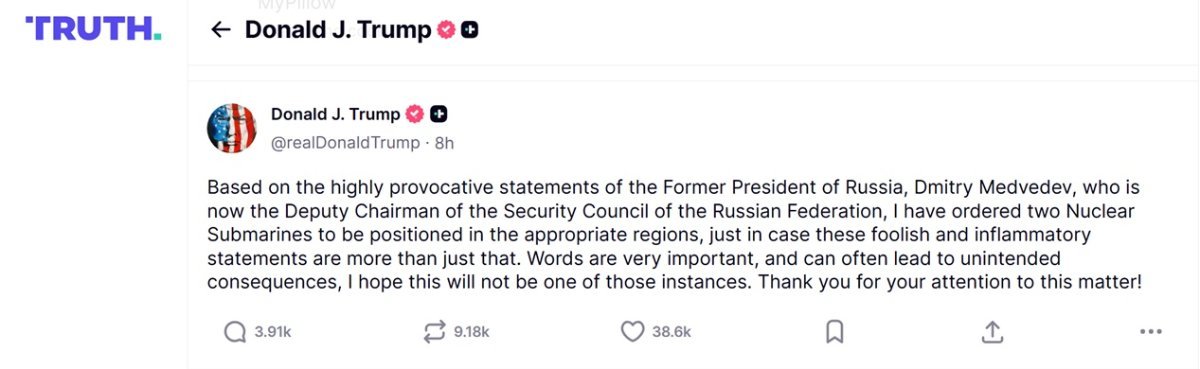

Great take! Below is Trump's bombastic statement, posted in Truth, regarding the redeployment of two nuclear submarines in response to the threatening words uttered by the Russian clown known as Dmitry Medvedev. But I agree with you. Trump is yet another clown, accustomed to masking with bombastic and hyperbolic statements actions that all his predecessors considered perfectly normal, like deploying nuclear subs that are not meant to remain docked in ports. -

Is Trump actually doing a better job than you expected?

AndreasHG replied to hotsun's topic in Political Soapbox

LOL. Really you never hear about: 1. Dollar depreciation since inauguration day? I can provide evidence if you are so incompetent that you cannot verify yourself. 2. Trump support to Ukraine? I can provide you evidence if you're so lazy that you can't even read a newspaper 3. Trump pushing Europe to rearm itself and spend 5% of GDP in defense? I can provide NATO official documents on the subject (they are public domain) 4. Tariffs and dollar depreciation make the American consumer poorer? Do you really believe the opposite is true? 5. Trump putting a serious and long overdue break on immigration? Questioning the Ius Solí? Deporting illegal immigrants to El Salvador? If you never hear about any of the above, the explanation is simple: they treat you like a mushroom, kept in the dark and fed with sh*t. I don't know what you did to deserve this treatment, but you surely know the reason, and that's enough for me. -

Is Trump actually doing a better job than you expected?

AndreasHG replied to hotsun's topic in Political Soapbox

Thanks! I will keep this in mind. 😊 -

Is Trump actually doing a better job than you expected?

AndreasHG replied to hotsun's topic in Political Soapbox

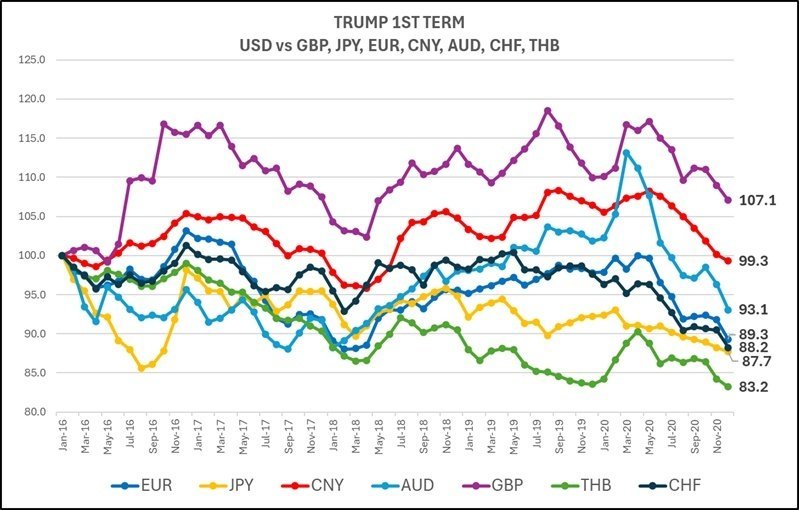

Data without intelligence is just numbers, and I've decided to help you for free. Let's put some intelligence behind the numbers to get actionable data, starting from the day the euro was launched (January 4, 1999). The chart below shows how many dollars a euro buys. As you can see, the general rule is this: Republican presidents make the euro appreciate and the dollar sink (blue arrows), while Democratic presidents do the opposite (red arrows). Invest your money wherever you want, but if you think Trump could be good for the dollar, you have an IQ problem. -

Is Trump actually doing a better job than you expected?

AndreasHG replied to hotsun's topic in Political Soapbox

LOL. And who cares about what happend 15 years ago. I was not living in Thailand then, I was not spending my hard-earned money in Thai Bahts, and the President of the US was Barack Obama. Yes, things perhaps were better, hamburger and cola costed $2 and 25 cents. But it's very sad. Old men always remember the good old times but forget where they parked their car this morning, with their poor dog locked inside. Nobody deserves this ugly destiny. Not even you, my poor MAGA friend. -

Is Trump actually doing a better job than you expected?

AndreasHG replied to hotsun's topic in Political Soapbox

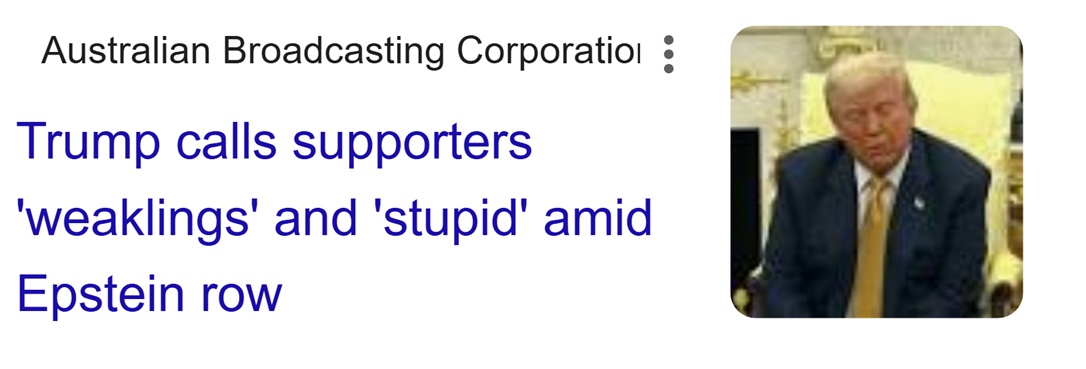

I have to admit I would have never expected to agree with the title of this oped but I do find Trump second term much better than his first one. Let's start from the first win, something I largely anticipated: I knew he was set to sink the US dollar and be instrumental to the appreciation of the euro (and many other currencies with it). He did it in his first term, and I was so sure he would repeat himself that I sold all of my US denominated assets and converted them into Swiss Franc and Euro, resulting in a 13% gain, after factoring in the loss of 2% recorded in the last two days. And it's only the beginning. It's just a matter of time he will prevail upon Powel and force the FED rates down, causing a further depreciation of the USD and of all the currencies loosely or tightly peg to it, like many currencies in Asia. Thank you Mr. Trump! Second win, and it's a big thing for me. He is strangling Putin and the Russian economy with him. He imposed Europe to stop purchasing energy from Russia, it's traditional supplier of cheap gas and diesel. As European I am ashamed that my European Union kept on purchasing these commodities from Russia. I understand the pressure Orban, the AfD, Salvini, and all the parties of the extreme right and left put on the EU Commission to keep the gas and diesel taps open. But Trump, despite Musk and Vance openly sympathizing with these right wing, pro-Russian leaders, stood his ground and ensured justice was made. The EU wil never buy energy from Russia again. But he is going much further than this. By imposing secondary sanctions on India and China, for Putin it is going to be game over. And I rejoice in anticipation of a Putin free world: Thank you Mr. Trump! Third win, and it's another big thing for me: he pushed Europe to arm herself and stand on her feet again, as it used to do before our former colony raised to its current superpower status and became Europe's sugar daddy. I will never thank Trump enough for forcing the Europeans to behave as grown-up men and women again, after 50 years of shame. Thank you Mr. Trump! Fourth win, and it's another big thing for me: by introducing new taxes (i.e. tariffs) and depreciating the US dollar he has made a big contribution to reduce global warming, much bigger than the millions of leftist right-thinking, organic veggie-burgers eaters would have ever done in their entire lives. A Swiss citizen consumes approximately 2.5 toe, which translates to roughly 29,000 kWh of electricity per year, while an American citizen in average consumes 7.76 tonnes of oil equivalent (toe) of energy per year, or about 89.97 MWh. It's shameful! A weaker US dollar plus additional taxes means that the average American consumers becomes poorer and is forced to bring its consumption down to more sustainable levels. Thank you Mr. Trump, future generations will remember you and your bravery! Fifth win, something I am delighted of: he is putting a serious brake on immigration. There was once a United States of America characterized by a deeply north European culture and dominated by a WASP elite (White Anglo-Saxon Protestant). This was before a massive injection of immigrants, especially Latin immigrants, turned the country in a sort of ugly copy of the banana republics south of the Panama Canal. Vulgar, loud, violent, ostentatious, corrupt to the bones, greedy, which knows no duties but only rights, where everyone aspires to become a rentier and no one wants to commit to working honestly, disrespectful of the law, the privacy and the property, armed to the teeth and ready to use force to impose the law of the strongest. America resembling everyday more Colombia rather than Friesland, North Holland, Cornwall, Jutland, or Nottinghamshire and Lincolnshire, with the latter being the homeland of most of the Pilgrim Fathers. Mr. Trump has put a stop to all this. America will go back to its cultural roots. And it's a win for America, and it's a win for the free world, for the rule of law, for the personal freedom of each one of us. That's the fifth reason I say thank you Mr. Trump. Notwithstanding the above I also recognize he has some shortfalls, and some serious ones. Especially his habit of diverging from the truth. However, let's be honest, who hasn't any shortfall? "Let he who is without sin cast the first stone". I won't be that one. -

We're living in interesting times. Two of the people who contributed most to Trump's election are now at odds with him: Elon Musk and Keith Rupert Murdoch. It's hard for me to say which of the three gentlemen I despise most and which I find most abject and morally repugnant. The only positive thing I can say about these three crooks is that Rupert Murdoch doesn't live on federal government subsidies or bounce from one bankruptcy to another. They are a mirror of contemporary America, which increasingly resembles a South American republic.

-

Trump's most ardent supporters are in revolt

AndreasHG replied to BLMFem's topic in Political Soapbox

-

I am very late to this post. I apologize. Non inverter compressors run at two speeds only, one of which is the maximum speed, and the second one is off. It's either they run at full capacity, or they shut off. It's therefore no surprising that they achieve a lower temperature faster. They start from the very beginning running at full speed. Inverter units on the other hand modulate among a wide range of rpms. Usually, they start from a low rpm and they ramp up gradually as the pressure builds up in the refrigerant circuits. This prevents water hammer and thermal shocks. When they achieve the temperature set point, inverter units slow down and try to keep it as constant as possible. This greatly improves efficiency and comfort. But this is true especially for good quality inverters, having a wide modulation range, i.e. the capability of running at very low and very high rpm. There is plenty of cheap inverters in the market place which have a very narrow modulation field and seldom deserve more than one EGAT star. Non-inverter units, a.k.a. fixed-speed units, on the other hand cannot adjust their output to the thermal load. Either they run at full speed or they shut off. Therefore, when the temperature set point is achieved, they start cycling between OFF and ON. This is inefficient and particularly annoying when the unit is greatly oversized compared to the thermal load of the room in which it is installed. It is worst during cool days or during the nights, less so on very warm days. Every time the compressor starts pushing at full rpm, the refrigerant circuit suffer a water hammer and thermal shocks. And it wastes a lot of energy too, since the start up is the phase during which energy is consumed without any significant benefit in terms of comfort. If we compare compressors to a vehicle engine the fix-speed compressor would in essence be an engine running always at full speed with no accelerator. The only way to limit the speed is to shut the engine off, and then fire it up again when the speed falls below a certain threshold. The inverter compressor on the other hand is equipped with an "accelerator" controlling its rpm and adjusting it according to the desired temperature. Now you can chose between inverter and fixed-speed.

-

Hey genius, maybe it's because they voted for a president and a party that they assumed would reduce the debt. Don't you think so? Where do you think the 77,302,580 popular votes came from? Do you really believe they were all rednecks?

-

I don’t know how Democrats may be voting for Musk. He is seen as a right-wing extremist, which is not surprising given his white South African upbringing, at the time when apartheid went into crisis. I also don’t see many MAGA supporters voting for Musk. The most hardcore MAGA supporters never liked him and are still furious about his support for the H-1B immigration visa (Steve Bannon, for example). Tesla, however, is one of the most widely held stocks by retail investors and Elon Musk has an almost cult following. I assume he will take it from there, and from the "Proud Boys", from the "Oath Keepers" and from other neo-nazis groups like them. Those groups are always in search for a messianic leader to kill and die for and Musk fits the bill perfectly.

-

All of Elon Musk’s ventures depend on public funding to stay afloat. Back in 2024 and until weeks ago, Musk believed he had bought the Republican Party with $250 million in campaign contributions and secured many more years of EV tax regulatory credits for Tesla, plus a friendly boss at NASA and favorable contracts with the Pentagon. But he was mistaken. He mistook the United States of America for South Africa. $250 million in the United States is just pennies and not enough to buy anything in politics. In an article published today by WaPo, Maegan Vazquez lists 6 challenges that the new party will have to face to become a significant political force in the United States and break the back of the Republican Party. And let's make this clear from the beginning: money is not one of them. 1. Institutional barriers and ballot rules 2. Historical headwinds and recent challenges 3. Scope and strategy 4. Divisions among his potential audience 5. Garnering political allies 6. Patience You can read more following this link to the WaPo: 6 of the biggest challenges facing Musk’s new political party - The Washington Post

-

Maybe a little less than a crash, but still a significant depreciation. This is what happened during Trump's presidency. The dollar was indexed to 100 at the beginning of his presidency. Only the pound of Brexit Britain, which was led in quick succession by Theresa “Brexit means Brexit” May, BoJo “oven ready deal” Johnson, Liz "Lettuce" Truss and, finally, the best of them all Rishi Sunak, did worse.