Rolo89

Member-

Posts

206 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Rolo89

-

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

Friends building has 5 out of 6 lifts closed due to damage, but the whole building has been signed off as perfectly safe in rapid time by an unnamed engineer. Said friend is staying away and wont stay in his flat on the 38th floor! -

Quake Jolts Thai Tourism: Rising Concerns Over Safety

Rolo89 replied to webfact's topic in Thailand News

yes the building code since 2007 was supposted to mean there wouldn't be much damage at all with an earthquake like this, it was strengthened in 2021. Only a fool would buy a new condo now without having an independant assesment on the building. -

Chinese Men Caught Removing Documents from Collapsed Building in Bangkok

Rolo89 replied to webfact's topic in Thailand News

Or the same earthquake 1000km miles away during the monsoon with the soft soil wet could distroy it. Tokyo was always called the city waiting to die, however that can withstand long powerful earthquake. Bangkok could be destroyed by a short one far away. -

Thai Economy Stable as Government Tackles Earthquake Aftermath

Rolo89 replied to snoop1130's topic in Thailand News

If even 10% of the buildings with significant damage are high rise condos then that's a huge problem for the Thai economy. They were already too expensive, if they're too expensive and poorly build it will be dire. The next earthquake could be 1 month away or 30 years away. Could cause so much more damage during the monsoon with the soft soil. -

Chinese Men Caught Removing Documents from Collapsed Building in Bangkok

Rolo89 replied to webfact's topic in Thailand News

BKK building do need to be up to earquake spec - that's why in 2007 buildings were required to meet earthquake specs! It's soft ground and near earthquake zones. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

You can't trust them. All they can say at the moment is from inital checks it appears to be safe, but futher more detailed testing is needed to verify there is no structural damage. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

Good post. Certain people won't have any time for common sence posts like this (they've probably invested in condos build in the last 20 years that could be worthless or worth way less than bought for). In Japan quakes of similar magnitude might have made a glass fall from a table and be a minor inconvenience, but that's about the extent of the damage. Not left buildings uninhabitable for the foreseable. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

Assessed! Freudian slip, they've assed it good and proper 🤣 -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

Yes, the drips round the side show they've tried to do something to the compromised structure. Looks like a patch job you'd do on an outbuilding. Not a structure with 44 floors of high end condos. It needed to be assed properly and then have a sign off on any remedial works. No chance this has happened. People are were paying high prices for these condos which aren't anywhere near the standard you'd expect. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

Not too far away from a park now open 24/7 so residents can sleep while their building is unsafe to be in. -

Chinese Men Caught Removing Documents from Collapsed Building in Bangkok

Rolo89 replied to webfact's topic in Thailand News

Chinese are involved in the construction of so many projects worldwide. They're involved in building a nuclear reactor in the UK. What could go wrong -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

And you know exactly what they're doing? The building won't have even had a proper survey yet. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

I feel re-assued now and will buy a unit there for 10฿ million 🤣 -

That'll be part of earthquake design to have the bridges snap away at one side to let the buildings sway. All the other new buildings with support columns cracked and supporting walls cracked are a big concern though.

-

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

I don't think it'll do any good. People have no confidence in the quality of all these new condos that were supposted to meet quake standards. A nail in the coffin for people thinking of investing in BKK condos. -

Quake Jolts Thai Tourism: Rising Concerns Over Safety

Rolo89 replied to webfact's topic in Thailand News

Anyone working in property is going to have serious problems. And the whole Thai economy is tied to the property market and constantly selling condos. This could be far worse for the economy than the tsunami -

Quake Jolts Thai Tourism: Rising Concerns Over Safety

Rolo89 replied to webfact's topic in Thailand News

Tourism will be fine, the condo market in BKK is going to have serious issues with how many earthquake proof structures had a lot of damage - the new buildings in the last 20 years were the worst effected. The older ones had next to no damage. No one will be putting their money in expensive condos in BKK with how poorly they delt with that quake. Several buildings are not allowing anyone in. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

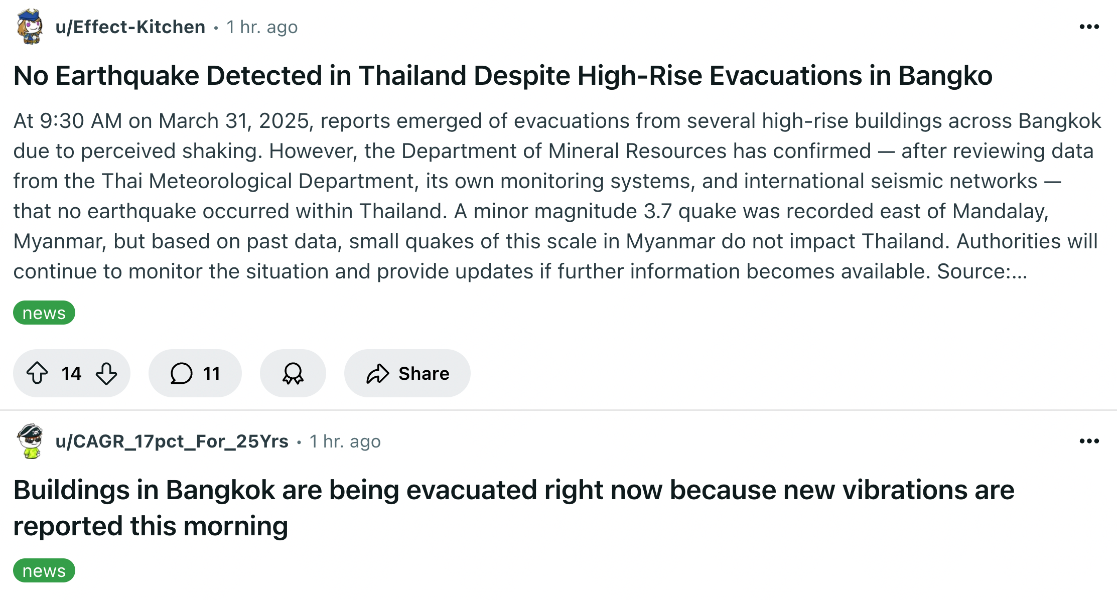

Lots of buildings were evacutated two hours ago, reports of another earthquake. But turned out to be false and it's due to structural integrity. https://www.bangkokpost.com/thailand/general/2991772/bangkok-buildings-evacuated-amid-reported-vibrations-cracks -

Thailand Ranks 3rd in Global QR Code Payments, China Leads

Rolo89 replied to webfact's topic in Thailand News

I always pay by cash. A cashless society gives them so much power and tracking. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

You conveniently ignore all the photos uploaded showing damage to support structures. Your bootlicking is weird. Thailand allows these companies building flats to maximise profits by being bribed. A truth is not anti Thai. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

None of this happened in the last mega quake in Japan which was far stronger and longer. The older buildings in BKK held up far better with less damage and the new ones with more stringent standards did not. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

I agree with this post from reddit. Interesting times ahead with many buildings that were clearly not up to the spec they were supposted to be on paper. Tokyo Japan 2011 versus BKK 2025 - damage So I have the (mis?)fortune of having both experienced the March 2011 Japan-megaquake in Tokyo, and now this past one in Bangkok. Some things that come to mind. Firstly, the Tokyo quake was much much stronger and lasted much longer, where the Bangkok one was far more mild and shorter. *However*.. photos of the damage to some Bangkok buildings and condo towers is just incredible given how mild the quake actually was. A 5 or 6 strength as felt in Bangkok should not have caused damage anywhere to this level. Several 'new' condo buildings in Bangkok have severe structural pillar damage that will likely lead to towers being torn down as that is basically unrepairable..etc. (well, TIT, so maybe the damage will be filled with plaster and repainted 😉 ). As well, it looks like the most severely damaged towers in Bangkok are the newer ones (that were supposedly built under more stringent quake standards) while those in built in the 90's sailed through the quake with little or no damage at all, including mine. For comparison, in the Tokyo 2011 quake there was almost no damage anywhere even near what is being found in Bangkok buildings all over, and certainly no highrise building collapses or condemned modern buildings. Thailand building methods, quake standards (and enforcement) have a very long way to go. This should motivate things in right direction going forward. Like in Japan after the 1994 Kobe quake, once the new quake standards come in place (and are seen to be enforced), new condos will be expensive to buy, and the older ones prestandard/pre-enforcement will be highly discounted, as they are in Japan due to perceived lack of safety. Interesting times ahead.. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

Earthquake proof apartment built in 2022: No one is allowed to live in there, people are allowed to line up to wait and enter to collect belongings. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

Crazy that it was approved for BKK with it's soft soil and having fault lines close enough to cause damage. Does dispell all those that claim new regs mean new buildings are safe. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

Rolo89 replied to CharlieH's topic in Thailand News

5 seperate buildings and some of them were started after then. With how long it takes to get these high rises build how many out of the thousands are supposted to adhere to the seismic protection code introduced in late 2021? 1%? and of the small amount that are supposed to adhere to the code how many actually do 25%? So maybe 0.25% of high rises in BKK meet seismic requirements.