-

Posts

29,124 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pib

-

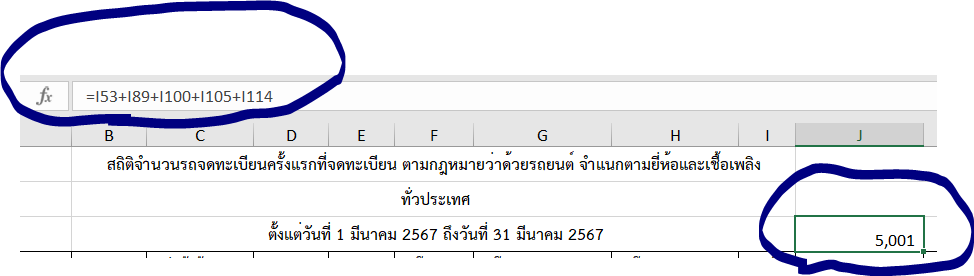

That's the spreadsheet I was using. I just downloaded it again at 9:45am/today/5Apr and still get 5,001. See the cells I have Excel totalling up which represent above mentioned RY categories.

-

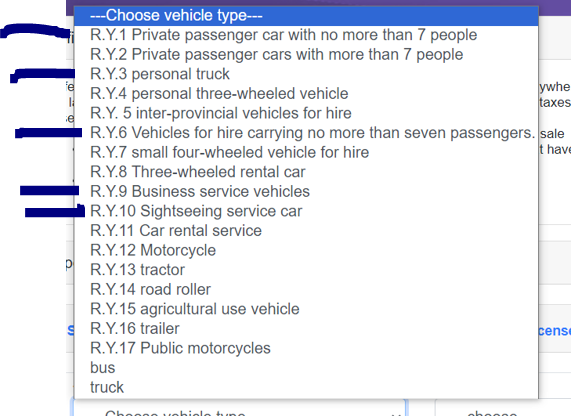

By using the DLT stats I can get the 5001 EV registered for March 2024 to match the autolifethailand article by adding the RY1 ,RY3, RY6, RY9, and RY10 categories. Definition of the categories below. And before someone says the RY9 business category must have many vehicles, well, no it don't as there was only a total of 10 ICEV/EV in this category for March with 1 of the 10 registrations being an EV registration.....that 1 was an Aion model. And yea, I don't think the journalist is identifying all the various RY categories being counted and the categories being counted has probably expanded over the last year as more EV manufacturers and models come to the Thai market.

-

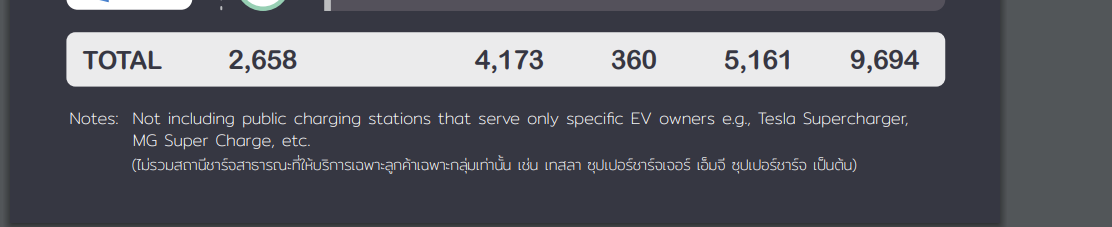

The chart/snapshot above didn't include the Notes area which explains why the MG charger network not being shown.

-

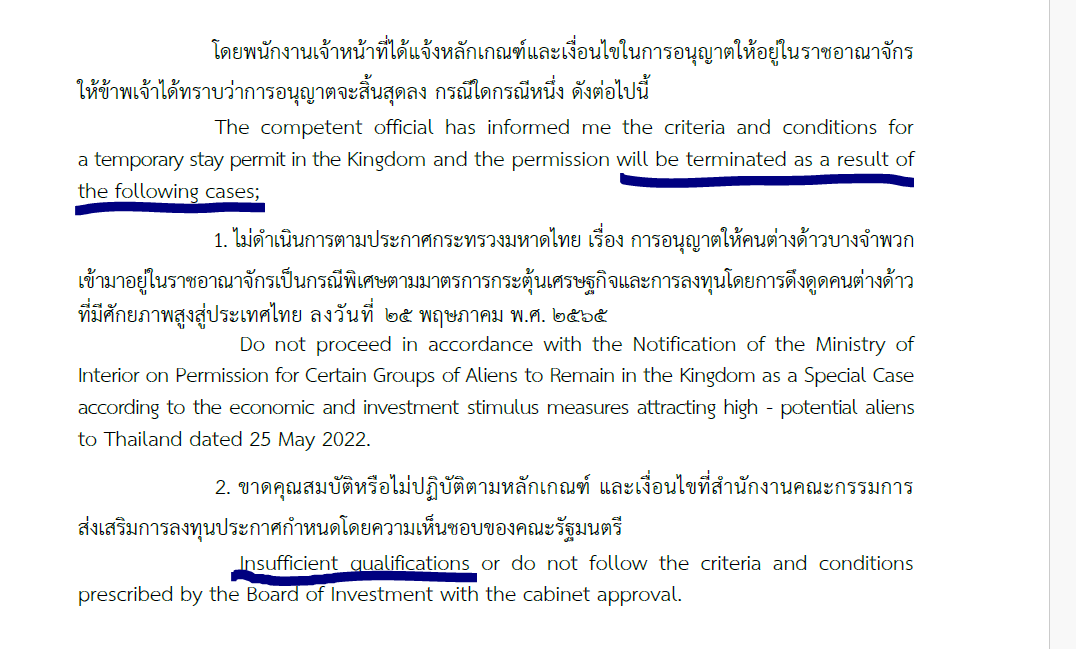

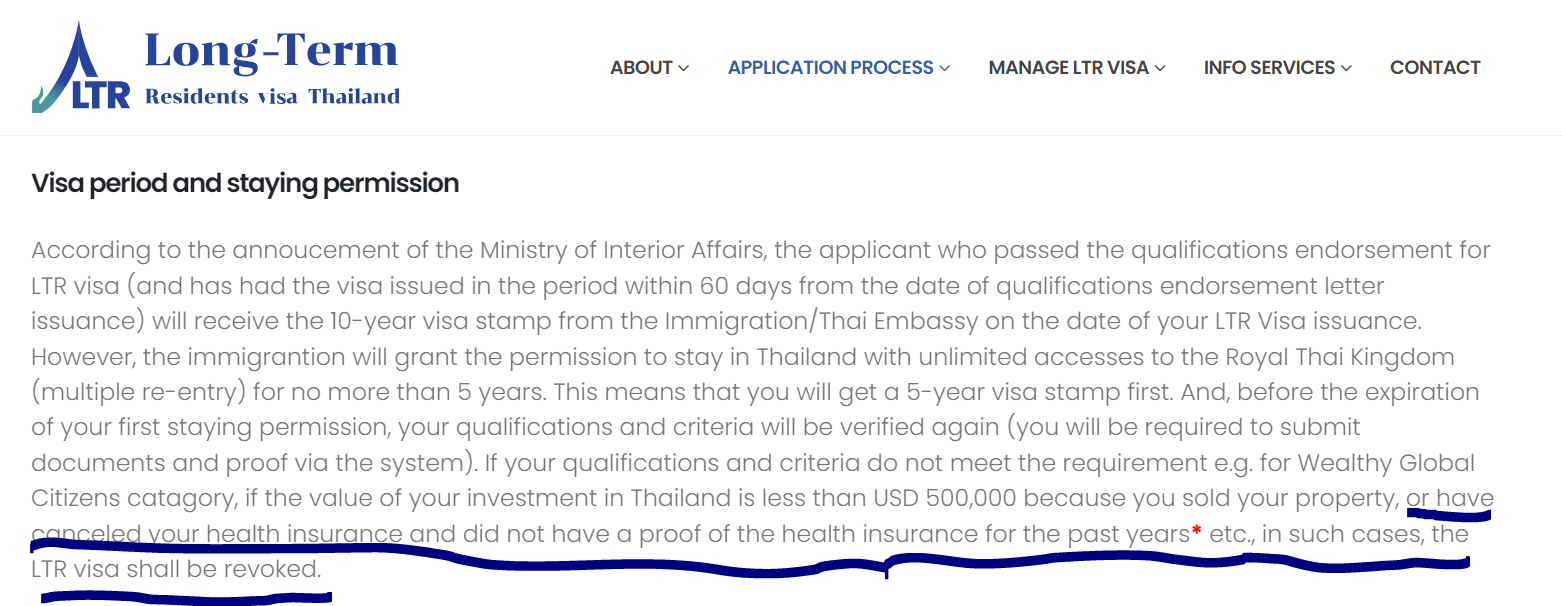

That's good to hear. Hopefully the 5 year renewal process will basically mirror the initial application process in that they will only ask for 1 or 2 years worth of various docs (I sure hope so) but we won't know for sure until mid 2027 when the first batch of issued LTR visas would be within approx 3 months of 5 year renewal. And since people "learned how to ride the LTR application bicycle" during the initial application then having/gathering the paperwork for the 5 year renewal will be easier. Unless BOI publishes some guidance on the LTR 5 year renewal process which would provide public notice to applicants I would guess the renewal process will mirror the initial application. However, keep in mind that BOI/Immigration (especially Immigration) could ask for additional documentation to prove if a person has maintained the visa requirements throughout the past 5 year period...they can do that for any type of visa. But I would expect (guess) they would only do this if they had suspicion a person was not maintaining the requirements and/or at the renewal time some event/policy change motivates BOI/Immigration to check to see if an applicant possibly failed to comply in maintaining visa requirements like maybe not maintaining an insurance policy or $100K self insure for several years after initially getting the visa approval but then getting a policy/topping-up their bank balance to $100K twelve months before the renewal. A person who fails to maintain all visa requirements throughout the visa/permitted to stay period is gambling (hoping) it will not be spotted/checked. Preaching to the choir I'm sure.

-

The application form is totally online; that paper-based application is really just FYI so people can see what the application looks like without registering for a BOI LTR online acct in order to apply for an LTR. Yes, your 1040 numbers which are 1 Jan-31 Dec amount will not match another timeframe like 1 Apr 2023 to 31 Mar 2024. Use your most current income numbers and income documents to report your total income and then the 1040s will serve as secondary documentation. Include a short one page memo to expand any income you think needs clarify like maybe you have some income that is totally non-taxable/non reportable on a 1040 form or associated tax document when can make your income look lower than it actually is. Just for example anyone who receives a VA pension/benefit none of that money appears anywhere on the tax return and the govt does not provide any tax doc like a 1099 saying your got paid X-amount of VA pension/benefit because by law a VA pension/benefit is non taxable so the govt don't even provide a VA 1099.

-

From looking at the full article/numbers and comparing that to the DLT data/spreadsheet appears autolifethailand is now also counting some 100% electric vehicles outside of only the RY1 category of private vehicle not exceeding 7 passengers like the RY6 category of passenger vehicle for hire not exceeding 7 passengers. https://autolifethailand.tv/ev-register-march-2024-thailand/

-

Having a LTR visa does not mean you are automatically classified as a year round resident....no more so than if you have an Non OA, Non O, etc., and only visited Thailand a couple weeks or months each year. Heck, after getting your LTR visa you don't need to stay in Thailand....you might just visit Thailand occasionally....maybe a few days each year or ever few years, maybe 9 months a year, maybe XYZ. A LTR visa makes your "foreign" income tax exempt if you do stay in Thailand more than 180 per calendar year; but does not exempt any income "you make in Thailand" in case you plan to get a work permit with your LTR visa and work in Thailand. The Thai tax year is calendar year based 1 Jan to 31 Dec; not some other period like how many governments use a fiscal year of 1 Oct XX thru 30 Sep XX.

-

Is above a snapshot of the online form within your online BOI LTR account or just the example paper-based form you have photoshopped? You can't submitted a paper-based application; you have to use the online application from within your BOI LTR acct. Unless something has changed (and maybe it has) when filling out the online pensioner application form "within your BOI LTR online acct" for area (1) you enter the beginning and ending dates of the 12 month period your are reporting income on.....like 1 Apr 2023 thru 31 Mar 2024 assuming you were going to submit the application in early Apr 2024. Then there is a block to enter that income amount......the 31 Mar 2024 is within the current year and then there is a block to enter that total pension amount. There is no Box 1A like you have probably photoshopped in above.....just blocks for the MM-YYYY to MM-YYYY and then a block of the total pension income. Then there is an area (2) to enter other sources of income.....then the a block for the total of areas 1 +2. Unless something has changed from late 2022 when I applied the online form looks a little different than the example paper-based form anyone can download. DO NOT consolidate all the various forms/docs into one BIG document "because" the online application has specific areas for specific forms. Income area for income docs, passport area for passport, health coverage area, etc. You can consolidate all your income docs into one big income doc to be uploaded to the income area, but don't include anything unrelated like your passport, health coverage docs, etc. Do mix apples and oranges. And even when uploading income docs think what makes it easiest for BOI to review...if this means uploading "several" separate docs in one area then go that route. Like upload your pension docs/certificates in one doc but your tax return(s) as a separate doc.

-

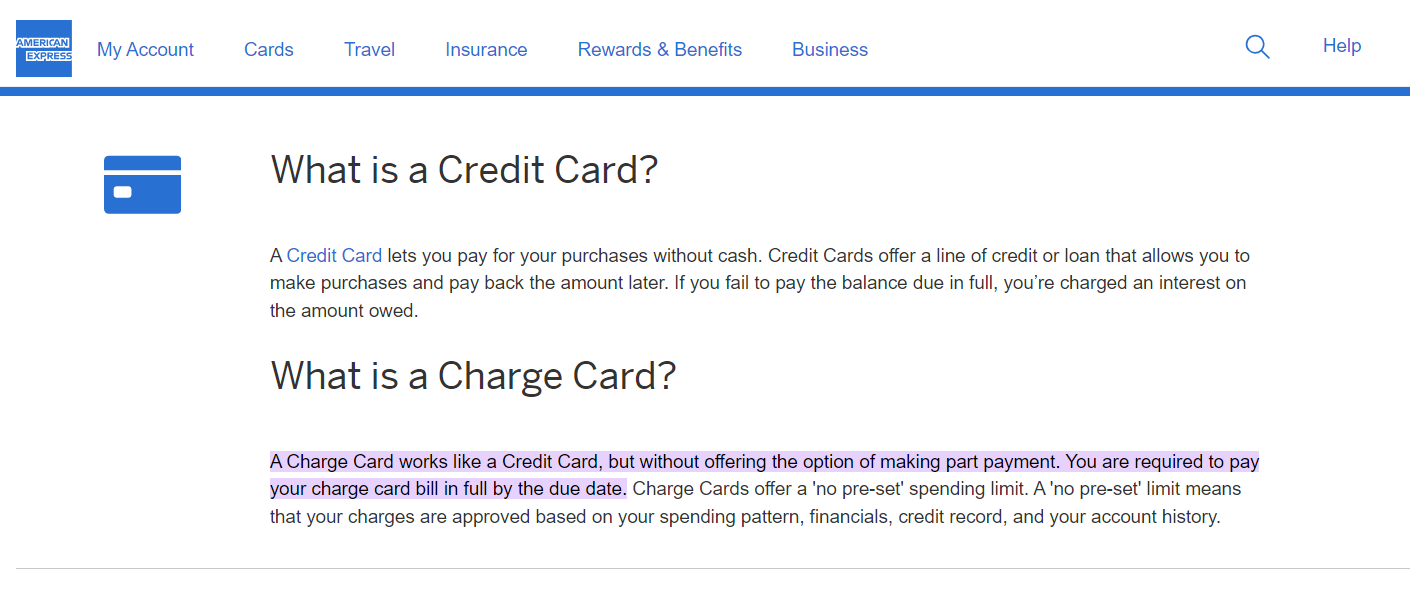

Understand....but it still relies on you being able to pay the monthly card bill. If you can't pay the monthly charge I expect AmEx would cancel/freeze the card. Plus, card companies can cancel/freeze cards on a whim preventing its use but freezing a bank acct with $100K is not likely to happen. Bottomline it still relies on you having the "cash" to pay the card bill. Contact BOI and ask....and I recommend you point out the difference between an AmEx Credit and Charge Card card which below AmEx webpage should do. https://www.americanexpress.com/in/credit-know-how/how-do-credit-cards-work/#:~:text=A Charge Card works like,full by the due date.

-

Nope...credit cards not accepted as a substitute for cash in the bank for self insuring. During the first six months or so of the LTR program (until early 2023) BOI was accepting brokerage/retirement type accts based on stock value as an acceptable method to self insure but apparently they stopped accepting that method to self insure.

-

Yea...bad month for ICE and EV. I figure the buying spree from late 2023, cut-throat pricing causing people to be gun-shy right now, and increasing debt levels have sidelined a lot of potential buyers. And of those three factors I just mentioned I think the increasing debt level is having the "least" impact because debt level has been high for a long time and it just don't seem to stop many people from buying a new vehicle when they really shouldn't due to debt level. I figure around mid year sales will pickup a lot but I also think "total" vehicle sales for 2024 (ICEV and EV) in comparison to 2023 will be flat. I think EV will gain a "little" more market share and I say "little" because cut-throat pricing in ICEV will mostly balance-out with the cut throat pricing of EV at bay which will keep EV sales growth at bay for a year or so. All this cut-throat pricing in EV and ICEV will make a MAJOR change in new and used vehicles pricing for years to come....it's good something has finally breaking the back of high pricing of "new and used" vehicles in Thailand. Now if some world event like another oil price shock comes about then that will cause EV sales to surge...it has been around two years (back in early 2022) since the last oil price surge...and the beginning of another one may be underway. Time will tell said my wishy-washy crystal ball.

-

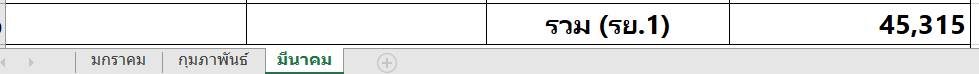

Per DLT data, RY1 Passenger Cars (7 people or less) registrations for Mar 2023 and Mar 2024 All RY1 (EV, ICE, Hybrid.etc) EV Only Mar 2023 66,061 6,204 (9.4% of All RY1) Mar 2024 45,315 4,720 (10.4% of All RY1)

-

Per DLT data, RY1 Passenger Cars (7 people or less) registrations for Mar 2023 and Mar 2024 All RY1 (EV, ICE, Hybrid.etc) EV Only Mar 2023 66,061 6,204 (9.4% of All RY1) Mar 2024 45,315 4,720 (10.4% of All RY1)

-

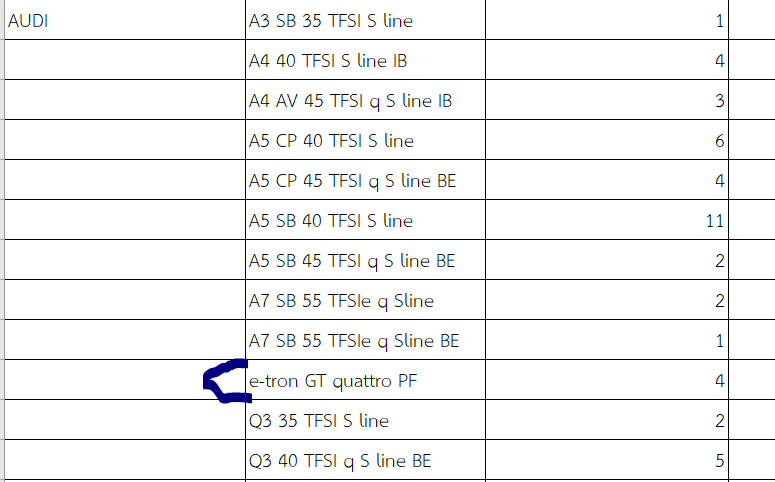

Not many Audi e-trons getting sold in Thailand. DLT registration data shows 2 in Feb and 4 in Mar. Feb 2024 March 2024

-

Yes...you can just drop by to ask questions. I guess you want to "show and confirm" your bank account statements will be acceptable to prove self-insure coverage. You will first have to interface with the LTR Customer Info reps right after entering BOI LTR venue (these reps are typically contractors vs govt employees)....explain to them you need to confirm the bank statement provide adequate proof and would like to get that confirmation from a BOI rep that actually reviews LTR applications. Hopefully, the BOI Customer Info rep will ask a more senior BOI govt employee to come talk to you on the subject and give you an answer....that's the way it has worked for me a couple times. Of course there is always the chance the day you just show-up/pop-in there is not something preventing the availability of a BOI rep to talk to you (like some meeting they are in, etc). It's my understanding from questions to BOI on this subject as long as the bank acct is a savings/checking or even a CD acct, PROVIDES A MONTHLY STATEMENT, AND THE FUNDS ARE IMMEIDIATELY ACCESSABLE TO PAY MEDICAL BILLS then the acct satisfies the self-insure requirement. BOI needs to ensure the type of acct allows immediate access to the funds and is not some acct like a stock market acct that could quickly go from having a $100K or more balance to a low balance due to stock market crashes...or the funds are locked in the bank acct for a set period I.e., 6, 12 months, etc) which does not allow quick accessing of the funds.

-

There is an interesting article in the 2 April 2024 Bangkok Post talking EV sales/loans along with total EV & ICEV sales/loans for 2023 and 2024. Google the following and you should find it easily: "Loans for electric vehicles poised to expand" The article has stats and projections (guesses) from three different Thai banks/subsidiaries : Krungsri, TTB, and Kasikorn. No doubt some of the projections are like real estate projections where realtors always say/project it's good time to buy real estate.... and of course companies such as banks always put a positive spin on their business goals/projections. Anyway, some interesting info like: - Krungsri wants to expand its current EV loan portfolio from 49% of total car loans in 2023 to 50% in 2024 - Krungsri plans to maintain NPLs for new car loans at a satisfactory level. - TTB hopes to expand its EV loan market share from 13-15% in 2023 to 20% in 2024 - TTB plans to maintain NPLs of new car loans to 1% in 2024 - Krungsri foresees intensified competition in both EV and ICEV - Krungsri forecasts an overall 3% decline in total vehicles but an increase of 63% for EV sales. (IMO Krungsri is wrong in it's EV sales projection growth for 2024...63% seems way too high to me....but hey, my crystal ball sucks seeing the future) Anyway, take a look at the article. And keep in mind the article is talking EV "and" ICEV sales/loans although the articles focuses more in EVs.

-

-

Perfect example of cost cutting making people gun-shy of buying right now. However, the price cuts during the ongoing motor show are definitely BIG and will result in short term high sales for certain models. But I figure right after the motor show many potential buyers will go to the sidelines waiting for more price cuts which will probably continue to come for EV "and" ICEV. Me thinks the price-cutting is not over for 2024...lot of throats being cut right now as the price war continues.

-

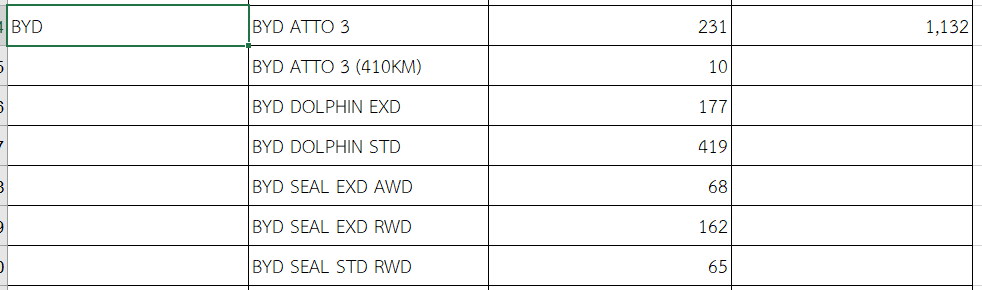

A snapshot from the Dept of Land Transport (DLT) showing BYD "registrations" for March 2024. Registration means the vehicle sale has completed the entire process and blue book issued. The 1132 number is the total number of individual model registrations...total of the column to the left. For the various Seal models, the EXD RWD model (a.k.a., Premium model) was the most registered Seal model followed by the Performance AWD model and Dynamic RWD model, respectively.

-

Reservations at the ongoing Motor Show seem tame. Please note some vehicle manufacturers at the show are not reporting their reservations daily amounts but instead will report a total amount on the last day (7 Apr) of the motor show. https://autolifethailand.tv/half-motor-show-2024-booking/ Car reservations for the first half of the 7 days of Motor Show 2024 total 19,157 cars. Top 5 : Toyota / Honda / MG / Isuzu / ChangAn Total reservations for the first half of the first 7 days at MOTOR SHOW 2024: 25 March – 31 March 2024 (first 7 days) total 19,157 vehicles. ** AUDI, BENTLEY, BYD, MASERATI, PORSCHE, ROLLS-ROYCE do not report total amount. Total amount will be reported on the last day.

-

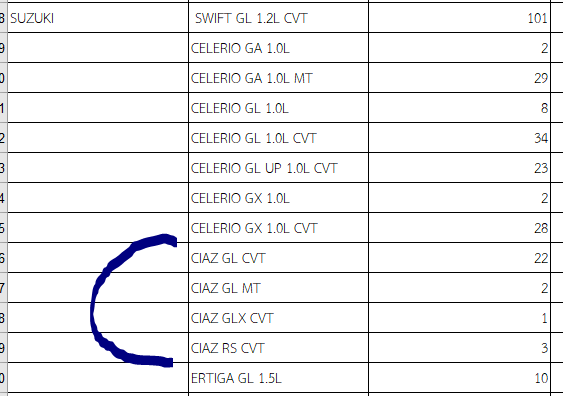

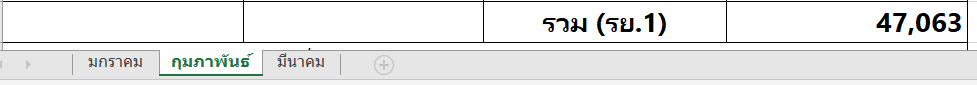

I see the Dept of Land Transport (DLT) has posted March 2024 vehicle "registrations." Registration means the sale has completed the process and vehicle blue book issued. For the RY1 Passenger Cars (7 or less people) the total registrations in Mar 2024 for EV "and" ICEV was 45,315. For Feb 2024 (which was a very weak month) the total RY1 EV "and" ICEV registrations was 47,063. So, the sales slump for EV/ICEV is continuing....actually got a little worst from Feb I expect folks are burnt-out from their end of 2023 vehicle buying spree and also gun-shy of buying right now due to ongoing cut-throat pricing. RY1 for Feb 2024 RY1 for Mar 2024 https://web.dlt.go.th/statistics/.

-

Yeap...assuming BOI accepts/understands what the note says versus wanting to see some "annual" document. I plan to play it safe and just get a new Tricare letter every year. Easy enough to get by logging onto milConnect via DSLogon to download the letter "or" just calling the DEERS folks who then email you the letter within a few hours.

-

Yet that answer goes against the note on their website and also against the STM8 form a person signs just before the LTR visa is issued...partial cut and paste from the STM8 form directly below. Also goes against another area of the BOI website (partial quota at bottom). And wouldn't it be scary if the LTR rep answer/response had a brain fart typo with that typo being the "not" in their answer....that is, the "not" was not suppose to be there. Partial Quote/snapshot from BOI website...doesn't specifically talk the $100K health insurance self-insure but its clear they want you to have health insurance coverage in the form of a policy "or enough money to pay medical bills." https://ltr.boi.go.th/page/visa-issuance-info.html

-

Plan for the worst...."monthly" statements since almost all banks provide monthly statements. I expect most everyone logs onto their bank/financial account(s) at least once a month...just be sure to download and save that monthly statement. Plus, most banks/financial companies show at least several years worth of past statements in case of not logging on frequently. And if going the insurance policy method just be sure to save an annual copy. If going the Tricare coverage method be sure to get an annual Tricare coverage eligibility letter as that letter reflects the effective coverage going back up to 6 years which confirms you have continuous coverage going back at least 6 years.