-

Posts

29,060 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pib

-

Don't count on any grandfathering with any requirement change. In Oct 2019 when the medical insurance requirement for those with a Non-OA retirement visa/extension of stay came into effect there was no grandfathering. When the requirement was announced several months before 1 Oct 2019 some folks on OA's strongly felt they would be grandfathered...even some visa agents thought that way also. But we see how that turned out--no grandfathering with the exception of the Phuket IO.

-

I expect your early July mailing was via "registered" airmail vs regular airmail?

-

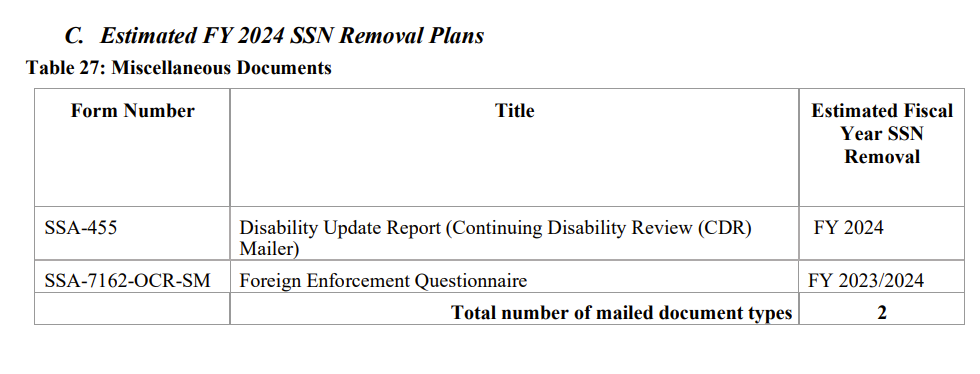

A BNC is meant to replace social security numbers on SSA forms but it's still multi-year work in progress. Some SSA forms have BNC numbers to replace a person's SSN (example are COLA notices that reflect a BNC but no SSN) ....others still reflect SSN vs a BNC like the 7162. SSA currently estimates it will by FY22/23 when SSN will be replaced by a BIC on the 7162 form. Summary: The 7162 is one of the forms that still reflects your SSN vs a BNC number....currently there is no BNC on a 7162. https://www.ssa.gov/legislation/Removing Social Security Numbers from Mailed Documents FY 2022.pdf

-

Yes...Visa requirements can always change....usually slowly over the years or a fast change. Like how Thailand has slowly raised income requirements over the years and without any grandfathering even implemented medical insurance requirements for some visa types. Now I don't even qualify for the novice knowledge level on Visas offered by Indonesia but the jess I get from the news article is Indonesia appears to be telling folks under the old/current style retirement visa is they will soon need to meet the higher income/investment requirements of the new Second Home visa. Kinda like if Thailand would suddenly announce that a few months from now those on Non O/OA type retirement visas will need to meet the requirements of the new LTR visa which has higher income requirements.

-

It the Chinese engine don't work out I'm sure China will provide a coupon for a 5% discount on Thailand's next submarine procurement.....and maybe even free shipping.

-

Another SSA regulation stating Manila FBU responsibilities in the FEQ program like what they need to do if you forward your 7161/7162 to the Manila FBU. WBDOC below stands for Wilkes Barre Data Operations Center. The Manila FBU has certain FEQ responsibilities and per SSA regulation just can't blow you off. https://secure.ssa.gov/poms.nsf/lnx/0302655007

-

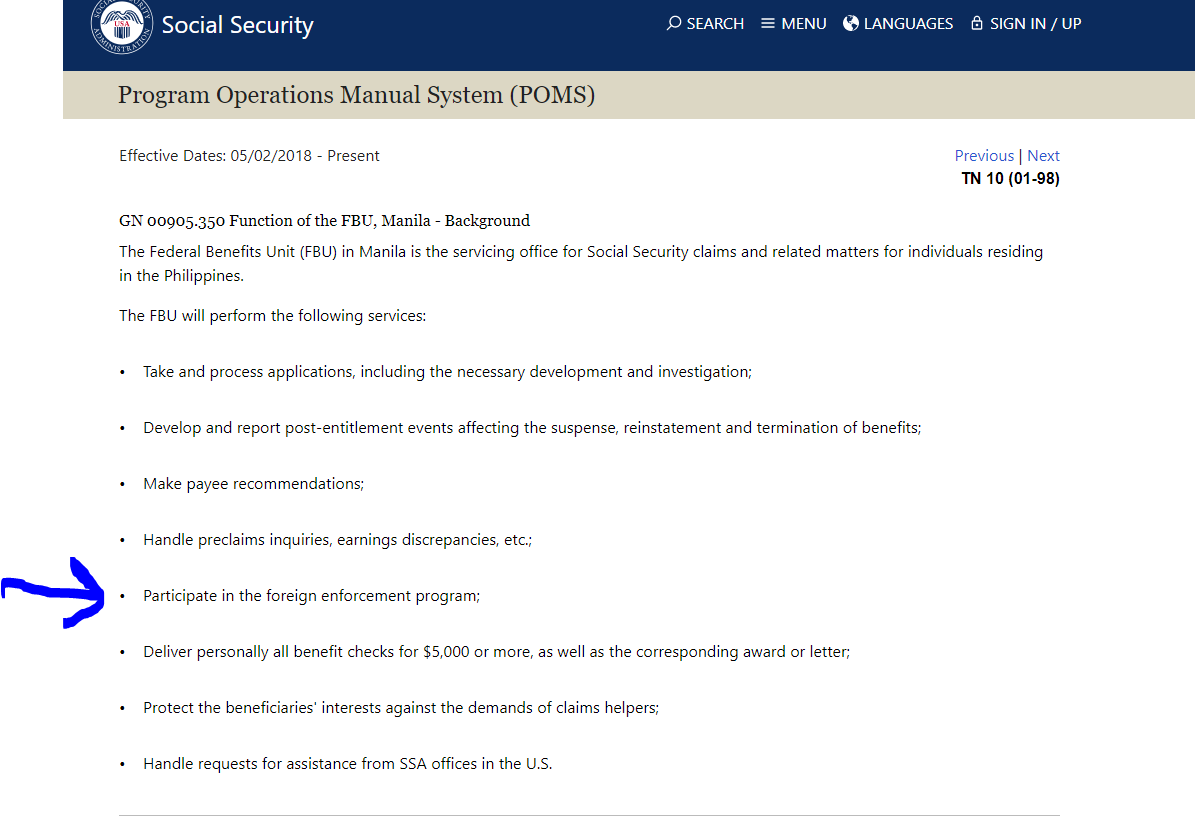

And the Manila FBU has a responsibility/duty to participate in the Foreign Enforcement Program (FEQ) per SSA regulation. https://secure.ssa.gov/poms.nsf/lnx/0200905350

-

As FYI in case anyone does have their benefit suspended in January because the SSA didn't receive a 7162/7161 from the 1st or 2nd notice, below snapshot/partial quote shows the Manila Federal Benefit Unit (FBU) responsibilities in trying to locate the beneficiary and get the FEQ answered (i.e., FEQ is formal name for the 7162/7161 program). Also shown is the duties of Office of International Operations (OIO) in Baltimore which is like the headquarters office for the FEQ program. Review the SSA weblink for full details. https://secure.ssa.gov/poms.nsf/lnx/0302655010

-

For folks with a U.S. address, the SSA/Medicare folks does mail a person a letter/form approx 3 months before turning 65 saying you will be signed up automatically for Part B unless you complete the form declining the coverage and return it. You must have missed that form...or the SSA sent it to the wrong address....etc. I'm not sure if that letter/form is sent to folks with an overseas address. It probably is although it may be worded a little differently from the letter/form that folks with a U.S. address get.

-

Whoops.....significant typo....I meant to say 2. Only taxable....vs 2. On taxable....

-

Dealing with the SSA for some issues/problems can extremely frustrating. Around 4 years ago when the wife started her SSA pension the Manila FBU messed up the Benefits Begin date....this was done during the phone interview. I was involved in that phone interview with the wife's and Manila permission. Well, although the advance paperwork that had been sent to Manila stated a benefit begin date of October and they the rep was told that again verbally during the interview the rep apparently made a typo and entered a June Benefits Begin date in the application he forwarded to HQ SSA in Baltimore for review/approval. The application was approved by Baltimore quickly like approx August...two months before October. However, just days after the approval a Jul and Aug combined payment was received...and then the approval notice that showed up in snail mail showed a June benefits start date vs October. We immediately contacted Baltimore and Manila....explained the problem...and Baltimore started the process to pullback/recover the Jul and Aug payments and they had to recover those payments before they could correct the wife's Benefit Begin date to Oct. The wife wanted the benefit to begin in Oct vs Jun and it made a significant difference in the monthly payment amount and added up to a lot over her expected remaining lifetime.....plus, it was simply October--not June--that she wanted and had requested. Manila even admitted to their typo/mistake in an intra-agency message according to a Baltimore rep I had talked to. Well, Baltimore recalled the payment from Bangkok Bank and within a few days of that payment being pulled back another payment for September arrived. Once again, we are on the phone to Baltimore and Manila...Manila really can't do nothing as Baltimore has the lead. Manila is mostly a middle man for a lot of SSA issues. Now, for the next 4-6 months and "many" phone calls to Baltimore, the Baltimore SSA boys & girls had major problems in getting the Benefits Begin date adjusted properly to Oct...they kept blaming it on "IT system checks and balances, issues. And this period of "fixing" the issue the Medicare folks started sending the wife premium notices since her SSA pension hadn't been restarted/reset correctly to October and the wife's SSA payment were in limbo....payments that would automatically pay her Medicare premium. Baltimore finally got it fixed by actually deleting the wife's application (which had the Manila caused typo) from their magic computer system which took multiple supervisors' approval to do so and then re-entering on the Baltimore end. That got the problem fixed and its been OK since. What a nightmare it was. But it "finally" got fixed....but it took around 4 to 6 months of many phone calls, emails, snail mail forms, etc. The SSA is definitely a bureaucracy that can be extremely frustrating and hard to deal with when a significant problem occurs with your pension. Thanks goodness that a SSA pension like this is a once in a lifetime event when you initially apply for benefits.

-

1. Yes 2. On "taxable" 401K/IRA. A Roth IRA is not taxable/reported on your tax return. Totally up to you as each person financial needs/desire and view of life expectancy is different. You'll get more per month if you wait beyond your FRA up to the age of 70. But if you start withdrawing early then of course you get a bunch of money before your FRA. A ballpark estimate is for every 1 year you started withdrawing before your FRA it will take approx 4 years of payments if you had waited till FRA to match the money you gained by stating SSA pension before FRA. Example: if your FRA was say 66 but you started drawing at 62, well, it would take approx 16 years of the higher FRA payment to match those extra funds you drew from 62 to 66. SSA/Medicare use Modified AGI to determine if you pay extra for your Part B. For the purposes of determining MAGI for Medicare premium purposes it's your tax return 1040 Line 11 AGI "plus" 1040 Line 2a Tax exempt income. Most people don't have any tax exempt income which is shown in Block 8 of a 1099INT which ends up on a Sch B worksheet which might end up going onto 1040 Line 2a. For most folks, 50 to 85% of a person's Social Security benefits aretaxable on their tax return and ends up totaled into the AGI. Up to you....if you don't feel comfortable go with a planner. But IMO there is so much good financial planning info on the internet now days unless a person has a lot of various investments and don't want to educate themselves with all the good, free info then go with a financial planner. And watchout for those planners with high fees and primarily recommend sponsored investments.

-

This all look normal to me based on what I think you are saying. The Standard Medicare Part B premium for 2022 is approx $170/month and for 2023 it goes down a little of $165.90. AND since you mentioned your taxable income in 2022 was in the 100K range due to a real estate sale if you also had around a $100K income on your 2021 tax return (repeat 2021 tax return which you filed in 2022) and you filed as a single then you are incurring the Medicare Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium which for 2023 will be 65.90 for Part B. An important note that any IRMAA for the upcoming 2023 year will be based on your 2021 tax return....when SSA determines if any IRMAA is required they look a person's tax return from 2 year back. When 2024 Medicare premiums come out any IRMAA will be based on your 2022 tax return. Also, double check if that real estate sale or another sale was really reported on your 2021 tax return that you filed in 2022. And regarding where you said you didn't signup for Part A or Part B, well, generally signup for Part A is automatic regardless of whether your address onfile with the SSA is in or outside of the U.S. And generally signup for Part B is "automatic" if have a U.S. address on-file with the SSA, but not automatic if having a foreign address. https://www.cms.gov/newsroom/fact-sheets/2023-medicare-parts-b-premiums-and-deductibles-2023-medicare-part-d-income-related-monthly https://hr.harvard.edu/files/humanresources/files/medicare_irmaa.pdf

-

Yea, talking to folks at the SSA 1800 call all customer support number for a lot of specific SSA problems often results in them referring you to another SSA number and saying they will send an internal message to that other SSA agency/department to contact you. Kinda like throwing a stick for a dog to go chase and after you throw the stick you run away before the dog gets back to you because you don't want to play stick with your dog. 410 965 0160 is not in Pennsylvania; it's the number for the SSA Office of Earning and International Operations in Baltimore Maryland. See below SSA webpage which shows the phone number. It also gives a FAX number where you can fax forms....also has a link to contact them via email where you could include an attachment like a completed/scanned 7162. https://www.ssa.gov/foreign/ Recommend you immediately mail your 2nd notice 7162 to Wilkes Barre via "regular" airmail; not "registered airmail. And maybe email/fax your 7162 to Int'l Ops to add another chance of your 7162 being recording into the magic SSA system.

-

Most people do "not" pay anything for Part A...it's free as long as you had 40 quarters/10 years of work of social security credits which I assume you did. It's Part B, repeat B, that cost $164.90 for 2023 (the basic premium)....it went down approx $5 from the 2022 premium. The wife and I have Part A and B coverage.....we each pay zero for Part A and will pay $164.90/month for Part B in 2023. https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/what-does-medicare-cost

-

Yeap...that's what I'm thinking. But who really knows. Maybe they have certain reps working certain types of applications with the rep(s) working the Wealthy Pensioner applications probably having a bigger backlog/workload since I think the previous stats showed Wealthy Pensioner applications exceeding all other categories of applications. Maybe a little workload leveling between BoI reps is needed.

-

Called BoI today to check on the status of my application submitted in late Oct...was placed on hold for approx 3 minutes for the rep to go check...when rep came back online she said it's still in the queue for first look. Estimated given for first look after submittal was 30 "calendar" days....that equates to approximately 20 business days. Rep said they have a lot of applications in the queue.

-

I submitted my application in late Oct and it also shows Screen 3 along with Pending. I know of another person who submitted in mid Oct and his also still shows Screen 3 and Pending. Wouldn't it be something if Screen 3 means Screener 3 who has been on leave....just not at work for some reason...and the BoI is just letting applications in Screen 3's inbox just wait for Screen 3's return to work.

-

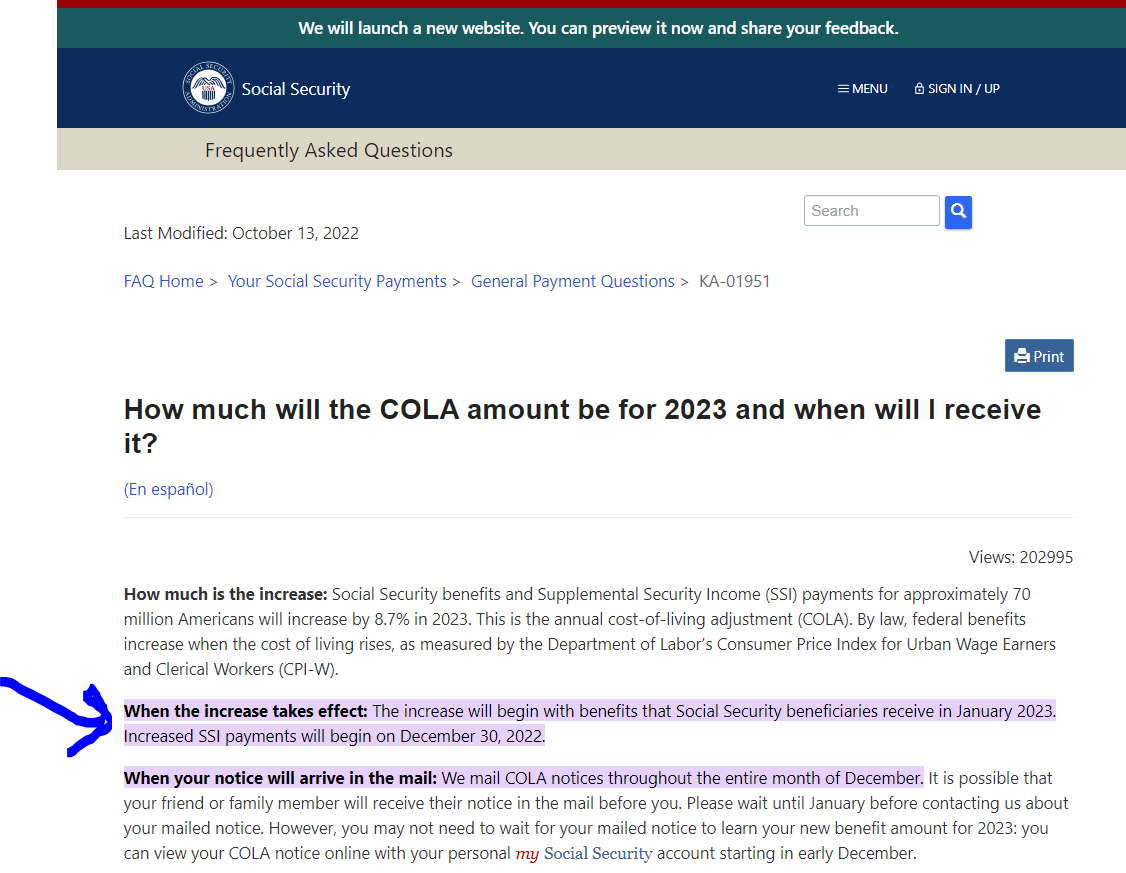

Yea....I see what you mean. I just looked at my online acct again and on the main page it does show the new amount added in for my "next" payment which identified for o/a 2 Dec. But I expect that is wrong, misleading wording on the main page because the 2023 COLA applies to benefits you start earning 1 Dec 2022 which are "paid" Jan 2023. https://faq.ssa.gov/en-us/Topic/article/KA-01951#:~:text=When the increase takes effect,the entire month of December.