- Popular Post

JimGant

-

Posts

6,616 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by JimGant

-

-

- Popular Post

- Popular Post

1 hour ago, Presnock said:if a "tourist" is only here for 175 days, he is not a tax resident so wouldn't have a tax id nor have to file taxes on any of the funds remitted into Thailand

Of course. But the "being a tax resident" aspect is not stated in their "get a TIN after 60 days." The below is a little clearer -- but how you incorporate the "60 day" rule is not:

QuoteIf you receive or remit assessable income in Thailand and reside in Thailand for 180 days or more, you need a Tax Identification Number (TIN).

https://www.expattaxthailand.com/tax-identification-number-thailand/

Anyway, if, like me, you'll never have any income -- remitted or worldwide -- that would be subject to Thai taxes -- forget getting a TIN. What could possibly happen? Besides, don't want my name in a TRD data base.

-

3

3

-

1

1

-

On 6/19/2024 at 2:20 PM, Mike Lister said:

thus far this year, because the law states a person will acquire a Thai TIN, within two months of exceeding the income threshold of 60k Baht. That means, well, you know what it means but perhaps you have a different slant on things.

Well, duh, I'm a tourist here for 170 days, remitting tons of assessable income during those 170 days. What now, dude?

-

1

1

-

-

20 hours ago, Presnock said:

well I have read the Thai Revenue Official English translation of the rules that we have to follow - includes having assessable income so must obtain a Thai tax ID number within 60 days

Does that include tourists, here for only 175 days, but sending tons of assessable income to Thailand during that period? Rhetorical question, I hope.

Rules that are not well thought out, and that have no loss of any tax receipts, and are realistically unenforceable -- seem to be ignored by Thai bureaucrats -- and could seemingly be safely ignored also by expats.

-

1

1

-

-

Maybe I missed it -- but did we get anything definitive about the Royal Decree's actual effect, namely:

-- LTR visa holders, at least WPs, have all remittances exempt from tax, including current (2024) remittances of assessable income..... (?)

-- Or, the Royal Decree effectively just grandfathers us under the old rules, namely, 2024 remittances of assessable income ARE taxable -- only if you wait until 2025, or later, will they be exempt. (?)

-

On 10/13/2024 at 3:04 PM, Ben Zioner said:

Section 7 In the case that a foreigner has applied tax reduction or exemption under this Royal Decree, and later does not comply with rules prescribed in Section 3, Section 4, Section 5, and Section 6 in any tax year, benefits will be suspended in that tax year."

How will they know? Still don't know what they'll want at year five, when you have to reconfirm your bonafides; but it would seem it would be same/similar to what you provided at initial application, namely, just current year's data. Thus, you'll probably just have to show year five data. So, if you didn't meet the requirements for years four, three, and two -- only you will know. Now, if you flunk the test for year five, they might insist on a look back to the previous years. Anyway, just an observation, as, unless the US goes out of business -- or BoI no longer accepts Tricare -- not much to worry about for me.

-

- Popular Post

- Popular Post

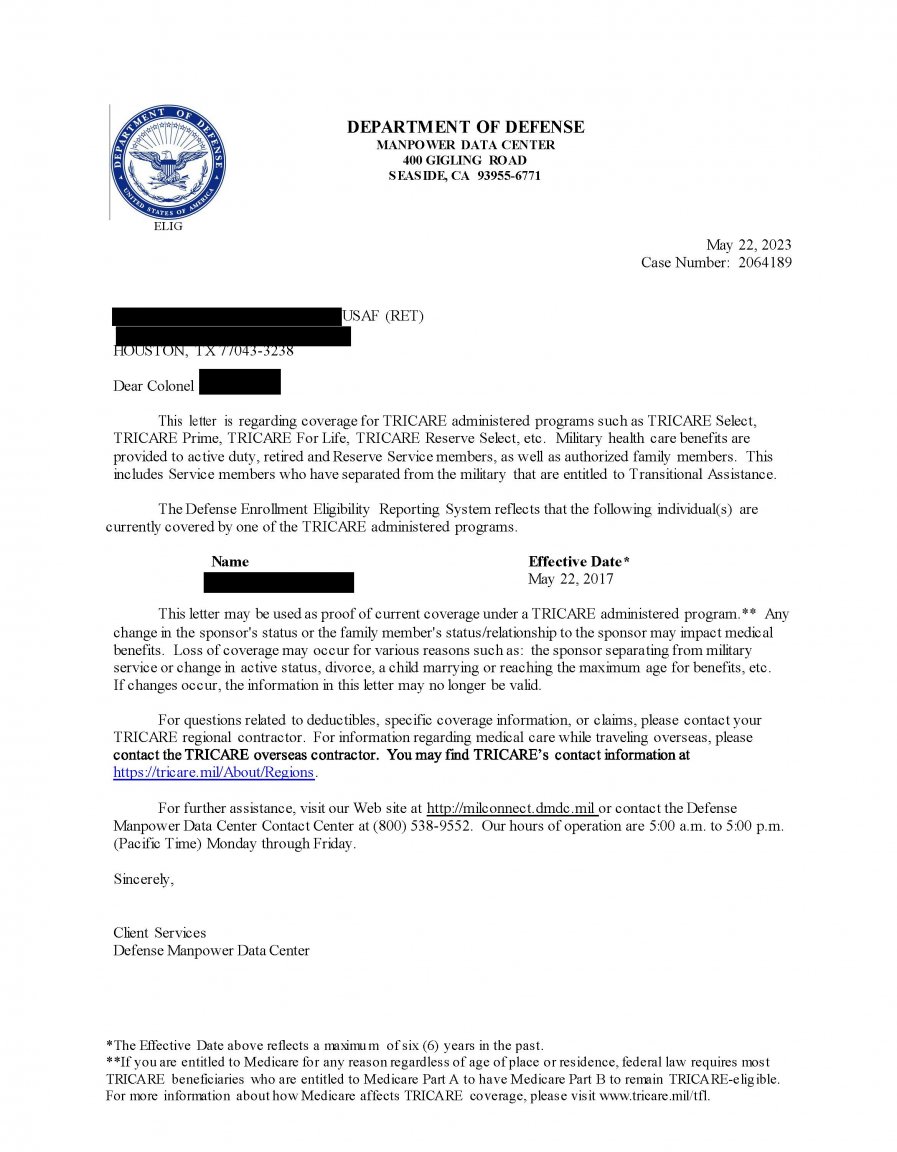

1 hour ago, oldcpu said:I believe it would be helpful if a sanitized copy of the letter of these successful LTR applicant individuals (with personal info from the letters removed) were posted on AseanNow, such that we could see the exact content that was acceptable to BoI.

Here's what I submitted -- successfully:

-

2

2

-

3

3

-

On 10/22/2024 at 12:13 PM, alphason said:

I am informed that the term "may be taxed" actually provides exclusive taxing rights only to that country.

This DTA language is derived from the OECD and UN Model tax treaties. "May be taxed" vs "may only be taxed" is simply: "May ONLY be taxed" gives exclusive taxation rights to the contracting country indicated -- and the other contracting country can't tax it. But "may be taxed" gives the contracting country "A" primary taxation rights -- but also gives contracting state "B" secondary taxation rights (context determines which is which).

What this means for you, the taxpayer, is that country A gets to keep all the tax receipts, same as if it had had exclusive taxation rights. But country B, per treaty, also has taxation rights -- but as secondary, has to absorb a tax credit for the taxes paid to country A. So, after the credit is absorbed, there may be no or negative taxes owed to country B (in which case, I wouldn't even bother to file a tax return, at least for this income, with country B).

What's the practical outcome of this? Well, after filing with country A, and paying the taxes due, you then look at filing with country B. If, after absorbing the tax credit from country A, you then owe no taxes to country B -- that's all. BUT, if after absorbing the tax credit you still owe a tax to country B -- then you owe the difference between your tax bill and the tax credit; and that delta, added to your full tax bill paid to country A, means that when the DTA gives secondary taxation rights -- your total tax bill may now be higher, 'cause you're now paying taxes on same income to two countries.

[Note for Yanks: Because of the so-called "saving clause" the US, if not an exclusive or primary taxation authority -- will always be a least a secondary taxation authority. Thus, gotch by the short and curlies. ]

-

1

1

-

-

This is a 'feel good' news story about moving from the US to Chiang Mai. Probably similar for most of us reading this, especially Yanks, who, for most of us, will have no new tax hit with the recent Thai proposals. And who get by just fine in the smoky season.

-

- Popular Post

- Popular Post

2 hours ago, chiang mai said:When the credit card company pays the landlord, the remittance has been made, on your behalf, for goods or services you specified and received whilst in Thailand.

Right, using the bank's money, not yours. Just like buying a condo, with the bank's money, not yours. What's the difference?

Nevermind. We seem to be on a treadmill with this subject. You go ahead and declare your Visa purchases to TRD, while I won't. Then we'll both be happy in our skin.

-

1

1

-

2

2

-

3

3

-

21 minutes ago, chiang mai said:

And if it is funded with assessable income?

What if I take out a 30 year loan and send it to Thailand to buy a condo. And I pay it back the next 30 years using monies that, if remitted to Thailand, would be assessable. But they're not remitted. Are you implying that that remitted loan to Thailand is actually assessable income, 'cause it will eventually be paid back by monies that should be considered ersatz remitted assessable income?

-

2

2

-

-

7 minutes ago, chiang mai said:

The cc transaction was made in Thailand, the relatives gift or loan to you was not.

So what? The landlord received his money in both cases -- in one case, he was paid with a loan from the bank to the tenant; in the other, he was paid by a loan from a relative to the tenant. The TRD only wants to know the source of that cash flow, not how it ends up. And both of these situations are loans. And by the way -- revolving credit is still a loan: Revolving credit lets you borrow money up to a maximum credit limit, pay it back over time and borrow again as needed. If, as you say, it is not a loan -- then what is it? Certainly not assessable income.

Not sure how you differentiate between borrowing money from my bank to buy a cheeseburger, using my Visa credit card -- and borrowing money from the same bank, to send to Thailand to buy a condo....

Having said that, using a debit card, like an ATM card, is a direct pull from your financial institution, and thus may be assessable income, depending on the source of those monies in your financial account. Thus, debit cards are certainly different from credit cards, or should be, in the eyes of the TRD.

-

1

1

-

-

12 minutes ago, chiang mai said:

TBH the debates would be more palatable if everyone were to focus on the rules rather than lining up to promote their personal for or against position, that way people can make they own decisions, without the advertising in-between.

You're kidding me? Just roll over, and file a tax return, 'cause THE RULES say your assessable income says to, even 'tho no taxes are owed? Yes, they say you might have to pay 2000bt if you don't -- in the very unlikely scenario you somehow show up on a TRD radar screen. And, the fear mongering you're mainly responsible for, namely, to somehow being scared for being subject to ten years of back audits. Jeez, talk about what any empty hole that would find, with everyone claiming "remitted next year," under the old rules.

So, you're saying we're all supposed to get in line behind you -- obey the rules, and file a tax return. Sorry -- as a disruptor of your misguided guidance -- I'll just say: barf burgers.

-

2

2

-

-

- Popular Post

- Popular Post

5 minutes ago, chiang mai said:I personally favour the negative taxation approach which only works if everyone files a return. If they do, the poorest in society get the support they need. But because people think that filing a return when no tax is due is cretinous, a useful supportive system can't be adopted.

Ridiculous comparison. Obviously if the masses were told they'd get money back from a scheme like an Earned Income Tax Credit -- they'd be lining up to file a tax return. Currently, however, filing a tax return, if no taxes are owed, is a wasted effort, to no one's advantage.

-

1

1

-

2

2

-

28 minutes ago, Yumthai said:

The issue being if no enforcement then rules become pointless.

Amen! It cretins pass a law that society views as absurd -- and thus is ignored -- then we can continue in a normal fashion -- the lawmakers are trumped by a sane society. Kinda like not filing a Thai tax return, in spite of a cretin law about about having to, even with no taxable income.

-

2

2

-

-

10 minutes ago, Thaindrew said:

all are "assessable", part of the assessment is if the funds fall under a DTA,

All are NOT assessable. The DTA dictates which income remittances are assessable -- and which are NOT.

-

1

1

-

-

3 hours ago, Talon said:

How would one PROVE ATM withdrawals if they are all done through a foreign bank and none of those funds were deposited in any Thai bank?

Just keep your withdrawal slips (but, certainly, more efficient to have a statement from the financial institution where your ATM withdrawals come from). The big problem here -- assuming honest self-assessment -- is: What amount of those ATM withdrawals represent assessable, or non-assessable, income? Say your bank account, where your ATM withdrawals come from, is funded from three sources: Direct deposit from a private pension (which is assessable per DTA). A direct deposit from a govt pension (non-assessable per DTA). And monthly interest on this account (assessable per DTA). And both direct deposits, and reinvested interest income, occur at the same time -- at the end of every month. Now, we've come to no conclusion about FIFO vs LIFO (we've heard affirmatives for both options). But, this wouldn't matter in the above scenario, 'cause there's no time element to use as demarcation. So, what to do? To tell the TRD auditor that you "arbitrarily chose your govt income as the source of your ATM withdrawals" -- probably wouldn't cut it -- at least without a gratuity. So, necessary to go to proportions. If 70% of your monthly direct deposit is from your govt pension; and 30% from your private pension; and your monthly reinvested interest is 5% -- we have a proportional situation of: 65% non assessable income, and 35% assessable. So, on your Thai tax return, assuming enough assessable income to file one (or assuming you decide not to file because you don't have enough assessable income to have any taxes due) -- declared income from your yearly ATM activity is only 35% of the ATM amounts remitted.

-

4 hours ago, daejung said:

DTA are international treaties. DTA prevail on internal rules

You cannot change anything unless you re-negotiate DTA

I am French and worked in taxation

Yeah, you'd be right for France; but not for all countries:

QuoteIn most countries, treaties (including tax treaties) have a status superior to that of ordinary domestic laws (see, e.g. France, Germany, the Netherlands). However, in some countries (primarily the US, but also to some extent the UK and Australia) treaties can be changed unilaterally by subsequent domestic legislation.

QuoteHow serious of a problem are treaty overrides? In practice, most countries, including the US (which was clearly the target of an OECD Report), rarely override treaties, and when they do, in most cases the override can be justified as consistent with the underlying purposes of the relevant treaty. Moreover, treaty overrides can sometimes be an important tool in combating tax treaty abuse. Thus, I believe that if used correctly, treaty overrides can be a helpful feature of the international tax regime, albeit one that should be used sparingly and with caution.

-

1

1

-

-

- Popular Post

- Popular Post

2 hours ago, chiang mai said:NOT ONE OF THEM providing any useful constructive material or assistance by way of input.

Not constructive because it differed from your input -- or because they didn't provide an alternative input? You're smokin' something serious if you say the latter.

-

1

1

-

2

2

-

1

1

-

- Popular Post

- Popular Post

6 hours ago, StraightTalk said:It's clear that these individuals are targeting you (just as they did with Mike) and are intentionally disrupting the forum, with no real effort being made to address it

Just who are you? As one of the disruptors, I pride myself in doing a lot of research, where such research is plausible, to my contributions to this forum. That my discoveries diverge from Chiang Mai,'s -- or my personal grasp of logic diverge -- I'm sorry that this offends Chiang Mai. He's a pretty prickly customer -- as was Mike Lister before him. As such, it makes pulling their chains too tempting. So, sorry if such disrupts your concentration on the subject.

But back to you.... You, in one of your posts, implied I'm often wrong, when Chiang Mai was right. I asked for amplification, but didn't get any. I'd still like to get that, but if not, I'd just be curious as to your bonafides -- education, job, tax and govt work, etc. Just want to get a feel for where you're coming from. And if you're qualified to referee a discussion on taxes. Thank you for, hopefully, taking the time to present yourself.

But, if you don't, I'll understand.

-

1

1

-

3

3

-

On 12/27/2023 at 9:47 PM, Thailand J said:

US taxes IRA distribution if you are a US citizen.

If there is another state that is able to and actually does impose tax on the the same distribution then there will be an arrangement such as tax credit.

Yes, since Thailand has primary taxation rights on an IRA, you'll get a tax credit against your US taxes for those Thai taxes. That no one has yet paid taxes to Thailand for an IRA remittance -- is just another verse to the tune, "all my remittances are last year's income." That song's been cancelled.

-

On 10/11/2024 at 12:34 PM, placnx said:

The Thai-US tax treaty does not contain the re-sourcing provisions of US treaties with many other countries, so it is not possible to make remittances to Thailand appear as foreign income when preparing Form 1116 on the US tax return. The result is that the only option is to get a tax credit on the Thai tax return for taxes paid to the US

Yes, because of when the Thai-US tax treaty was written, a paragraph addressing re-sourcing was not included. But, regardless of this omission, the Treaty still allows foreign tax credits for taxes paid on US remitted income to Thailand. How? With a Form 8833, whose instructions include: That a treaty grants a credit for a foreign tax which is not allowed by the Code.

Why the need? Because the US Tax Code says that foreign tax credits are only allowed for foreign taxes paid on FOREIGN income. Which remittances of US income, taxed by Thailand, certainly are not. But, a re-sourcing clause in a tax treaty -- or, when absent, a Form 8833 -- trumps the US Tax Code by allowing foreign income tax credits on US income taxable by Thailand -- by changing this income into pretend foreign income.

Otherwise, the tax treaty would be worthless in preventing double taxation. And you couldn't just reverse things, by having Thailand absorb a tax credit for US taxes paid on certain income -- when the treaty says Thailand has primary taxation rights on that income. Because with primary taxation rights, Thailand keeps all taxes collected, as it does NOT have to absorb a tax credit. To somehow say, sorry Thailand, because there's no re-sourcing clause in the treaty, you now have to absorb a tax credit, contrary to what's in the treaty. Nope.

Anyway, forget the lack of a re-sourcing clause. Form 8833 is your go-to form.

-

1

1

-

-

On 10/14/2024 at 2:37 AM, shdmn said:

It would be better to file even if you don't think you have to rather than having to deal with what may happen if you don't.

Out of curiosity.... If you're absolutely sure you have no taxable income for Thai tax purposes -- thus owe no taxes to Thailand -- what do you think might happen if you don't file? Yes, I know we're addressing 'risk tolerance' -- but that's exactly the point -- what, if any, risk exists? And if there's no risk, tolerance is not applicable. Nevermind.

-

1

1

-

-

On 10/14/2024 at 4:14 AM, chiang mai said:

There is no tax aspect to remitted "living expenses" which are nothing more than inbound funds which may or may not be Thai tax assessable.

Indeed. IMMO-TH.com is completely off-base with their observation. More unhelpful misinformation.

-

1

1

-

-

- Popular Post

- Popular Post

21 minutes ago, chiang mai said:I've gad enough of you guys, probably the same way that Lister did also when he left.

Yeah, amazing -- the same sensitivities. Coincidence?

-

3

3

-

3

3

Thailand to tax residents’ foreign income irrespective of remittance

in Thailand News

Posted

Is that a pension for services provided to a UK govt organization, including the military? If so, if that's the income remitted to Thailand -- this income is not subject to Thai taxation (per DTA), so no need to file a Thai tax return. [But, if a private pension and remitted, yes, subject to Thai taxes, per the DTA.]

Did the agent you used to get a Thai TIN ask you why you needed it? Did you mention private or govt pension? Probably not. They just had their hand out.

Anyway, common sense says, if you don't need to file a Thai tax return, 'cause you owe no Thai taxes -- no realistic need for a TIN. Yes, specific language says maybe you should get one. But, if you don't -- and no taxes owed -- what's the penalty for avoiding the hassle of arguing with a TRD clerk, who's also relying on common sense.

Not to belabor the point here, but to reference a thread, below, that thoroughly discusses TIN requirements. Pay particular attention to 'Troubleandgrumpy", whose arguments are sound and well-presented. Contrast this to Mike Lister's 'black and white' arguments, giving no room for an intelligent interpretation. Lister disappears during the thread -- but his 'black and white' arguments are assumed by poster Chiang Mai.

https://aseannow.com/topic/1327316-tax-id-number/