UKresonant

Advanced Member-

Posts

1,420 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by UKresonant

-

Info 2. = Taxed only in UK "Article 19 Governmental Services... (2) (a) Any pension paid by the Contracting State or a political subdivision or a local authority thereof to any individual in respect of services of a governmental nature rendered to that State or subdivision or local authority thereof shall be taxable only in that State." https://www.gov.uk/hmrc-internal-manuals/international-manual/intm343040 (I'll have the same 3 Types of pension as you have in just over 6 years time hopefully , for DTA purposes).

-

Mentioned where? More like it's not mentioned in the UK DTA, it does not have a specific article. https://assets.publishing.service.gov.uk/media/5a80bddc40f0b623026953eb/uk-thailand-dtc180281_-_in_force.pdf e.g. https://www.gov.uk/hmrc-internal-manuals/international-manual/intm343190 (https://assets.publishing.service.gov.uk/media/5b05425fed915d1317445ed2/DT_Digest_April_2018.pdf (Thailand) Note 4. Treaty does not include an article dealing with Non-Government pensions. Also, no relief for State Pension or ‘trivial commutation lump sum’.) https://www.gov.uk/hmrc-internal-manuals/international-manual/intm332210 https://www.gov.uk/hmrc-internal-manuals/international-manual/intm343130 only has an article for government pensions it would seem "Article 19 Governmental Services... (2) (a) Any pension paid by the Contracting State or a political subdivision or a local authority thereof to any individual in respect of services of a governmental nature rendered to that State or subdivision or local authority thereof shall be taxable only in that State." https://www.gov.uk/hmrc-internal-manuals/international-manual/intm343040 DTA does have "Article 23 Elimination of Double Taxation..... (3) In the case of Thailand, United Kingdom tax payable in accordance with this Convention in respect of income from sources within the United Kingdom shall be allowed as a credit against Thai tax payable in respect of that income. The credit shall not, however, exceed that part of the Thai tax, as computed before the credit is given, which is appropriate to such item of income." Some are saying (can't remember who ) Thai RD won't insist on priority taxing rights under article 4. and it may be option as under article 23 and article 24. Will have to wait and see

-

I think I like that tax office then, if my pensions can remain as they are, taxed in the UK, one of my main concerns is that they would push that they have priority on taxation under article 4. It sounds like they are ok with DTA article 23 3, the tax in the UK is allowed as a credit against against Thai Tax. Sounds like they are allowing what is most beneficial for the payer. (I'm thinking from the position of whether 179 days is a limit, or it is practical to file there without getting caught between the two tax systems, so I could cumulatively be there say 271 Days cumulatively, based on past profile). Next Thing would be the supporting documents they will accept for the tax credit listing, whether practical or not. So the submission I'm thinking would be perhaps 1. Non-Gov Pension Element Gross amount with Tax Credit for tax deducted in UK (which is same as net remittance), tax credit against Thai RD tax computation 2. Government Pension Element Gross amount with 100% Tax Credit = against Thai RD tax computation 3. Private Pension A Gross amount with Tax Credit for tax deducted in UK (which is same as net remittance), tax credit against Thai RD tax computation 4. Private Pension B Gross amount with Tax Credit for tax deducted in UK (which is same as net remittance), tax credit against Thai RD tax computation 5. Savings equivl. 100% of one of the minor pensions(perhaps the Gov one, with P60 tax cert if remitted 2025 onwards). Gross UK income less tax credits for UK tax paid, leaves Thai tax to pay, but which should not be much more. Only Pensions getting remitted to Thai land, with only pensions remitted to a single UK bank account. Anything else is on the moon as far as they are concerned and would be getting expended in maintaining UK commitments anyway. What could Go Wrong I share your sentiment "I want to do the right thing and avoid any problems". I think I would need to go through the process with only the Gov and one minor private pension remitted as a trial, to have confidence (or a large number of confirming experience posts in 2025.

-

Yes would wish that will be their custom and practice going forward or at least Pension minus UK tax paid tax credit against Thai Tax = little bit Thai tax to pay. If they want to claim 1st rights to tax under DTA, would be an impossible situation, in the same way life is not based on tax years . Would be like yearly extensions of stay, limited use, to long to process before leaving the country again, or maybe not in Thailand at renewal etc.

-

Yes, I had similar earlier thoughts about sequencing if pensions were remitted If the "only taxed in UK Pension" element (1 of 4) did have to be listed/filed when resident, would it tag on the end, and hence not push the others to a higher tax band position. On the Savings front, being non-resident presently, from this year on I perhaps should isolate the exact amount of the UK only pension for a UK tax year in a savings account, and I would have a series of tax certified savings (income) packets to remit to Thailand if I became tax resident due to circumstances. Tracking savings before 2024 at a high level possible, but any tax trail impossible like you say way to complicated, as the previous criteria was only the year before.

-

3 months or 90 days enter by, so don't submit it until after 3rd Feb at the earliest ( should be the same as UK I presume) Not aware they want income proof for a single entry TR, we normally scan a postal bank statement with a balance of >£1000, the satement doubles as address verification. The minimum balance used to be 20k THB equivalent, (the same as the amount of cash you should have in your wallet on entry (or in exchangeable currency). The e-visa often has a template for a few similar visas. It may be have to type out "not thought applicable for the type of visa requested " convert to a .jpg and upload it the supporting document field of the non applicable question if that arises Dad uploads somethings not applicable to the SE TR as we have them anyway, but still one field to which we upload the not applicable jpg. They seem to have reduced the number of supporting document on the last one we did. I think the photo holding passport field had gone...

-

If they are going to vote on something, why not do something more practical, and make it no tax before the prior year and put an annual limit of say 2 or 3 million baht for remitting "savings" per year, the net size would be bigger, and would be more likely catch just fish they can eat. Having to explain potentially all inward remittance, is complex, and has great potential to deter inward and VAT spend going forward. They are copying other countries style of potentially introducing rules that have a high administrative overhead, and don't yield much of a practical benefit going forward. They just feel like they have done something.

-

Suggestion, add "of the following year" to the tail of "8" The proof the savings principle has previously been taxed may also become relevant / useful going forward? (I'm thinking of, for example I [whilst non-resident] save £1000 from taxed income in 2024 and put it in an isolated savings account, any interest is either not credited or immediately transferred out and I remit the principle to Thailand in 2030 [whilst resident]. Obviously would remit savings when non-resident if the opportunity & anticipation was prevailing.)

-

Depends what you bring into Thailand, if income, what type and source is the income originating from etc etc So as soon as you exceed 179 days in total any time within the Thai Tax Calendar year, your are tax resident in Thailand . some of it may be liable to Thai Tax... https://www.austlii.edu.au/au/other/dfat/treaties/1989/36.html Gov Pensions Article 19 Extract "2. Any pension paid to an individual in respect of services rendered in the discharge of governmental functions to one of the Contracting States or a political subdivision of that State or a local authority of that State shall be taxable only in that State..." Other Pensions Article 18 Extract "1. Subject to the provisions of Article 19, pensions and annuities paid to a resident of one of the Contracting States shall be taxable only in that State." At least you have Article 18, clearer than the UK DTA

-

https://www.gov.uk/hmrc-internal-manuals/international-manual/intm343040 If your NHS pension is classed as Government (Check the list for who pays it), that might not be a problem? May only be taxed in UK? Then It's been said you can get up to about 350k-400k with over 65years of age allowances, for that sent to Thailand, which could cover the UK state pension before tax is paid? I kinda share your sentiment on the subject though, especially as I've never been full-time in Thailand. I'm hoping they accept that pension, if taxed in the UK, that tax is offset with credit relief against Thai Tax (DTA article 23 3), waiting to see what they actually do. As it may cause me some difficulties! My Gov pension is relatively small, would only be a nice to have, I'm 4 years + away from the additional allowances, 6 years away from State Pension!

-

There are still a lot of pages on the web that still describe the old situation. It might be worth a sentence in the list for potential new retirees, as a hint to consider perhaps placing the 800k / 400k and other start-up provision whilst not yet tax resident. They should also not leave it to the last minute as in multiples it could impact Dad's Fx rate for his Xmas/New Year trip

-

Yes clarity would be good but I suspect that may not be simple to obtain. A. It looks like a possibility that the UK perhaps surrenders everything to Thai RD as soon as you click over the 180 Days under article 4 fiscal domicile, (I'm unlikely to ever be 365 Days in Thailand, the only year I exceeded 179 Days was a cumulative stays of about 270ish Days) As my UK Government Pension is the only element that would in that case remain to be taxed in the UK from Thai RD, which as a proportion of me pension stream would only keep me in Mama Noodles . (The other private pensions would continue to have taxed deducted at source in the UK) I think based solely on Taxation considerations, if the above prevails, and since I'm just over 4 years away from the over 65 enhanced allowances, it would seem Thailand is for me a sub 180 day affair with maybe majority years being Mama Noodles + non resident accumulation only. As taxation there would be higher especially for the next 4 years. Excepting a needs must situation of course! Importing 800k if taxed, Nope Importing 400k still, Maybe. Better start Record keeping, financials silos(new), and that Days in UK Vs Days in Thailand tracker file again, cloud drive of PDFs etc B. The other way is Pensions are taxed in UK, and they allow tax credits in Thailand, for the tax deducted in the UK i.a.w. UK DTA article 23 3), (Same concern sub age 65), similar to their generalized Sept announcement; 'DTA don't worry' ( unless from the UK maybe). C. Should they move Global Tax, perpetually similar to A above + worse. Will have to assume "A" above, until it is clear(er), but probably never definitive.

-

If that was the UK rule, I could sleep beside my old Motorcycles The UK rules tax manual is a bit like like paper mache RDRM12630 - Residence: The SRT: Temporary non-residence: Treaty non-residence An individual will be Treaty non-resident at any time if, at that time, they fall to be regarded as resident in a country outside the UK for the purposes of double taxation agreements, having effect at that time. An individual will be Treaty resident in the UK if, at the time, they fall to be regarded as resident in the UK for the purposes of double taxation arrangements having effect at that time.

-

Perhaps would agree if a UK government pension is your sole, remittance source (and you perpetually keep the records to hand), otherwise;- It may be an assessable income type , but nothing to pay, to explain a component of multi remittance events? In the case of a UK Government pension, in the worst case HMRC (conversation in 2018) reckoned you may even have to pay the tax and then get a immediate refund, but even if Thailand Claimed fiscal domicile article 4, priority taxing rights, you would end up with zero tax as covered by the DTA. In that case would it have to be noted on the form? What will they do in practice is yet to be seen. "Article 19 Governmental Services (2) (a) Any pension paid by the Contracting State or a political subdivision or a local authority thereof to any individual in respect of services of a governmental nature rendered to that State or subdivision or local authority thereof shall be taxable only in that State." Where as other stuff may be "Article 23 Elimination of Double Taxation (3) In the case of Thailand, United Kingdom tax payable in accordance with this Convention in respect of income from sources within the United Kingdom shall be allowed as a credit against Thai tax payable in respect of that income. The credit shall not, however, exceed that part of the Thai tax, as computed before the credit is given, which is appropriate to such item of income.")

-

Provided basis remains remittance, but it would probably always need some non-resident years. (This is all hypothetical for me on current plans as the earliest year I could be tax resident is 2027, the main thing is to to start recording taxed income, buffered / saved for later remittance). It's probably more do-able once over 65 and the additional allowance become available.

-

I'm horrified by the potential complexity it could become, as all my pensions are taxed in the UK. If the over 180 days over rides the tax residency in the UK, I would still need Thai RD to allow a tax credit on 10% of income remitted, and potentially they may issue a tax credit asking me to claim it against UK Taxes on the other 90%. I might be tax resident in UK and Tax resident in Thailand, maybe 270 days in UK tax year and 260 days in Thailand tax year, at the extreme, the tax years don't align. May need a Tax float of 150000baht to cope with interim double taxation. This assumes that only fully taxed pension is remitted and that is the only scope of a Thai return. It's just a headache waiting to happen. Would be flip a coin perhaps if the UK tax authorities would issue me a Certificate of Residence or not.

-

The Investing Year Ahead

UKresonant replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

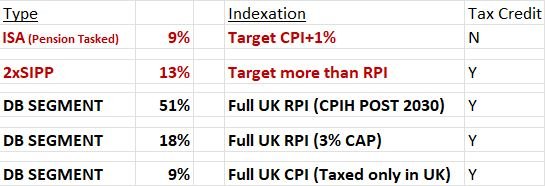

I can be a bit more aggressive on that bit which is providing 22% of my current income stream, but want to improve the numerical yield as target, whilst the percentage yield is reduced in those portfolios, so the numerical escalation becomes increasingly more certain in theory. [They financial advice was to resist the apparently big Money opportunity back in 2018, so quite happy on some one else is worrying on the 69% and the 9% is straight out the Treasury Much lower Cash stash, Vs more secure and escalation of income stream. Will have to do until the next segment (probably State pension) arrives in six years (seems so far away at the moment ) Interestingly (or not) all the DB segments are from the same continuous employment, but I think Thai RD will only accept the 9% as being always taxed in the UK, if I had to file. Lower cash stash makes the Thai interface more difficult now perhaps, but set in stone and avoids temptation, the advisor was correct I think.] [Some folk that are/were in 'safe' Lifestyle Defined contribution pensions, which had been increasing bonds as a share of the portfolios, as their customers became older, got a bit of a shock when the 'safe' bond prices dipped in to 2023! Can we retire?=No (or get burned.] -

Oh I hope not, that tax clearance Cert was a PITA when it was on the go before and much happiness was expressed when it was no longer a thing. Imagine an urgent matter arises and you get a call on a Friday evening to come home (country) a.s.a.p, then there is a public holiday on Monday, you can't confirm your flight until you get an audience and get that stupid bit of paper