UKresonant

-

Posts

1,335 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by UKresonant

-

-

A shallow population deline is probably a good thing. So getting it back to a shallow decline, rather than a steep decline is what may be useful.

Much better than a lot of the net zero BS, which frequently sounds like sales pitches from interested factions, rather than than long term analysis.

Population decline does not fit to well on certain spreadsheets though.

-

1

1

-

1

1

-

-

- Popular Post

TAT should do a recount perhaps.....

-

1

1

-

5

5

-

28 minutes ago, Greenwich Boy said:

I will be returning to the UK in June and having read reports here (can't find them) that the METV requirements have been relaxed a bit I might apply for one and complete the full set of tourist visas! If anyone has applied succesfully recently perhaps they could clarify some points from the embassy website.

1. Bank balance of £5k for six months. Do they need six separate bank statements or is money on application ok?

2. Confirmation letter from employer or pension statement. I neither work or take my pension. Will showing the bank statement above work or am I scuppered.

3. Travel records of the last 12 months. Will a word document simply stating where and when I have been be sufficient?

If the METV gets rejected am I likely to get a SETV and just have to swallow the cost difference?

Many thanks

For. Travel history we just scan the stamps in the passport and edit it as one JPG on the PC,. If it is just Thai that's fine but if no stamps on some destinations, list with stamp pics and convert to JPG for upload....

-

1

1

-

-

32 minutes ago, Ben Zioner said:

I would expect the typical retired UK middle manager to bridge that gap with a private pension. Look at @topt 's post.

Augmented with Investments perhaps or purchased annuities, or timed asset disposals.

Private pensions were / are within that cap mentioned, and still are Tax free 25% capped. (total of all pensions)

-

2 hours ago, Yumthai said:

The way I see it: many foreigners live in Thailand for years getting yearly extensions of stay without actually meeting the financial requirements.

Likewise, there will be many foreigners stating (if ever asked) that all the money they remit in Thailand are savings prior 1 Jan 2024, gift/inheritance or already taxed income without actually getting proper documentation.

Thailand is unable to discern a genuine foreign document from an edited one.

Thailand has 0 power to enforce its tax law offshore and certainly can't require any docs from third-parties abroad.

I'm hoping they would accept if checked, the payment advice slip from the pension, that payment on the receiving bank statement, and the net amount being SWIFT transferred to Thailand. and hopefully show them sample proof verification via online banking? the P60 is mainly a A4 print now.

Legalization, letter from Embassy, and all that guff would just would be totally impractical or even available perhaps.

(If RD recognise items for Tax, would it not be reasonable that Immigration then recognise it?)

-

1

1

-

-

5 hours ago, Ben Zioner said:

Dunno what you mean by "pretty well off". LTR, with an 80000 USD pension plus health cover requirement. It is for anyone who had a middle management career and retired at the "normal age", as defined by their pension funds. That's my case and there are probably 50 Million of other people in that situation in Europe alone.

For many years, until only months ago the UK pension system had a total fund value cap of $1.34M life time allowance, with a 25% Tax free lump sum from that of circa $335k. Before they ran into punitive Tax on any Excess. The total cap is gone (for now), but the Tax free lump sum is still frozen at the $335k. The "plus healthcare" outside the UK perhaps not, would have to be a separate privately paid provision in most cases, as would be a sustainable pension above circa $53k p.a..

The UK state pension could add $15k to the $53k, still falls short.

The UK state pension is below the provision in many similar countries and relies on the fact of Free healthcare, but that is generally only whilst still in the UK.

Falls short a bit.

Sympathy 😢

-

2 hours ago, 4MyEgo said:

As he has mentioned that he is an Australian, Australia and Thailand has a Double Taxation Agreement (DTA), and if he states that he is a resident of Australia and pays taxes in Australia, i.e. lodges a tax return annually, then Thailand cannot touch him, so to speak, but if he doesn't lodge a tax return in Australia as a resident, then the Thai Revenue department can ask the Australian Taxation Office, as they have an agreement to communicate with each other, and they will have him for breakfast.

He can think he's a tourist and argue his case in front of a Thai Judge, we all know what the outcome of that would be, 180 days, go straight to jail, do not collect $200 (Monopoly) LoL.

I would certainly not want to rely on the tie breaker in article 4, as a principle reason for not filing, if you know you have remitted (especially) non pension , non-pre-taxed income . Very thin ice. UK HMRC or equivl. may not issue a "letter of confirmation" then your hung out to dry. Just have to file.....

All of my pensions are pre-taxed in the UK in any case.

-

1

1

-

-

1 hour ago, samtam said:

Number 1....Oh, so that's now a complete reversal of what I understood from this Opus Magnum.

Number 2....It is an income derived from dividends in shares, which are assessed, but deemed not taxable, under the tax laws of Hong Kong:

cf: https://taxsummaries.pwc.com/hong-kong-sar/corporate/income-determination

Income pre 1 January 2024 is now apparently exempt, but income derived after 1 January 2024 is not exempt...(subject to being utilised within Thailand, by means of ATM withdrawal or HK issued Credit Card usage).

Is that correct?

If the dividends are distributed, whilst you are tax resident in Thailand, from 2024, they are Thai tax assesable whenever you remit them to Thailand.

Dividends and interest tend to be taxed where you are (tax) resident, said a credible YouTube channel, rather than where they arise.

(I would have the same situation with tax free in UK, Individual savings account, dividends. (As part of my UK end re-shuffle they will all trail to the account paying UK end essentials.) Dividends and gains taxable as just any other income in Thailand. So they will be a static income and growth portfolios if I'm in Thailand for a while.

-

1 hour ago, TroubleandGrumpy said:

How it works in most countries is that being a tax resident is completely different from being a resident for purposes of social welfare and other Gover benefits, which is again completely different from being a Citizen. As a Citizen of Aust (and most countries) it does not take a lot to still be a tax resident when you are staying in other countries, no matter the length of time. You can be a tax resident of several countries - but the one that has 'precedent' is the one where you have most 'legal and social and financial' involvement - which for most Expats in Thailand who keep their money in their home country and also keep in contact with family/friuends there, means their home country would 'win' if the matter went to a Court - especially in their home country - especially if they are paying taxes (even if zero or very small) in their home country.

TH will have a great deal of trouble proving they have a greater involvement in my life - when technically and legally I am just a tourist here and could be made to leave at any time. Sure I am a tax resident after 180 days - but I am still a tax resident in Aust - and good luck Thailand trying to convince Aust ATO (their IRS) and CLink (Social Werlfare) and Politicians to pay over part of their age pension money sent to all ther Expats in Thailand, to the Thai Revenue Department in the form of income taxes. I heard there are about 30K Aussie Expats in Thailand and many of them are on the Pension - that is a big chunck of Australian tacxpayers money going to the Thai Govt. Two chances of that being alloowed - none and buckleys. IMO the same situation applies to most retired/married Expats recieving a Pension from their home country.

I think that my centre of vital interest will likely be the UK, with article 4 fiscal domicile.

Non-resident non-O or tourist visa, unlikely to be in Thailand more than 90 / 150 days on a single trip, unless there was a specific need.

Own nothing in Thailand, if the wife buys a property I had to sign it was nothing to do with me anyway.

The only thing I have there is enough to maintain bank accounts.

UK Ties

90 day tie likely will be there 92+ Most years. Valid at least 2 years anyway

Accommodation tie aways available and use it every year hopefully.

99.8 % of Income originates from the UK.

But don't wish to get to that level, that Article 4, fiscal domicile needs debating.

Should I become tax resident in Thailand in the future. I would try and design things in initial years.

1. Not having to file.

2. Not filing, whilst ensuring I'm absolutely not due any tax to Thai RD, article 4 may also help, Thailand not cetre of vital (tax) interest, if questioned.

Would have to make sure bank interest never exceeds 60k THB ( not difficult probably)

3. If I was there all year in the more distant future, UK sufficient ties not in place, yes would file in Thainland etc

I have no tax assessable items for Thailand currently the one year I was perhaps Tax resident, was spent, and cannot still be mingled on the books. So I would be in the same situation as someone as a brand new arrival, despite having been every year since 1993 (except 21/22 Covid .)

Just don't want any hassle!

(Pray they never move to Global Tax, that would make things substantially problematic for me.....)

-

1

1

-

-

- Popular Post

43 minutes ago, Orient Express said:I have an METV, valid for use until mid-April. I am 60+, European, but still with some work back home. I obtained the METV (eVisa) easily from my local embassy back in October.

I had a very unpleasant experience at Don Mueang recently, after returning from a few days in Laos. After a long time scrutinising my passport, the IO summoned a supervisor and I was taken aside and questioned. Actually, not questioned, but lectured to and told that I could not possibly be a tourist (too much time in Thailand …). I was eventually stamped in for 60 days, but told I couldn’t use my METV again to enter. It is valid until mid-April, and I had planned to go home to Europe for 3 weeks before then (for work reasons), and a further spell in Thailand with side-trips to Malaysia and Japan before returning to Europe at the end of May. That’s now all up in the air.

Instead, I now have a note in my passport saying my next entry must be on a non-immigrant visa. The IO also said I was not allowed to enter visa-exempt.

As a datapoint, my travel history is as follows:

On this visa: Entered start November, 4 weeks Thailand, 2 weeks Japan, 6 weeks Thailand, 4 days Laos

Previously in 2023: 2 trips to Thailand, total 11 weeks (first 45-day visa-exempt; second SETV)

2022: 3 trips to Thailand, total 22 weeks (first SETV, carried over from 2021; second SETV + extension, third 45-day visa exempt)

2021: 2 trips to Thailand, total 17 weeks (first 45-day visa exempt (inc 14 days quarantine) + extension; second SETV).

All visas issued by my home embassy.

I am a genuine tourist, in the sense that I just like spending time in Thailand. I don’t have a relationship here, and I’m certainly not doing business or working here. I know that the retirement option is open to me (and may be the only solution now), but I am loathe to do this when I still intend to carry out some work (accounting) back home for a few years. So frustrating.

I’m interested in any positive ideas or feedback.

I suggest that you advise (not complain) to the issuing embassy (Ministry of foreign affairs) that their issued visa No ####### does not seem to be fulfilling its purpose expectation (including a picture of the stamp in your passport), and ask them to please clarify. Advise them by hard copy proof of delivery post on return to home country, if no e-mail response.

"I now have a note in my passport saying my next entry must be on a non-immigrant visa". Very weird! The MFA may find that useful information as well, as you don't desire a continuous stay even for 60 days. issue of Visa's being MFA jurisdiction (two ministries out of sync?)

Look on the bright side, your not tax resident 🙂

-

1

1

-

1

1

-

1

1

-

1

1

-

1

1

-

Just now, Mike Lister said:

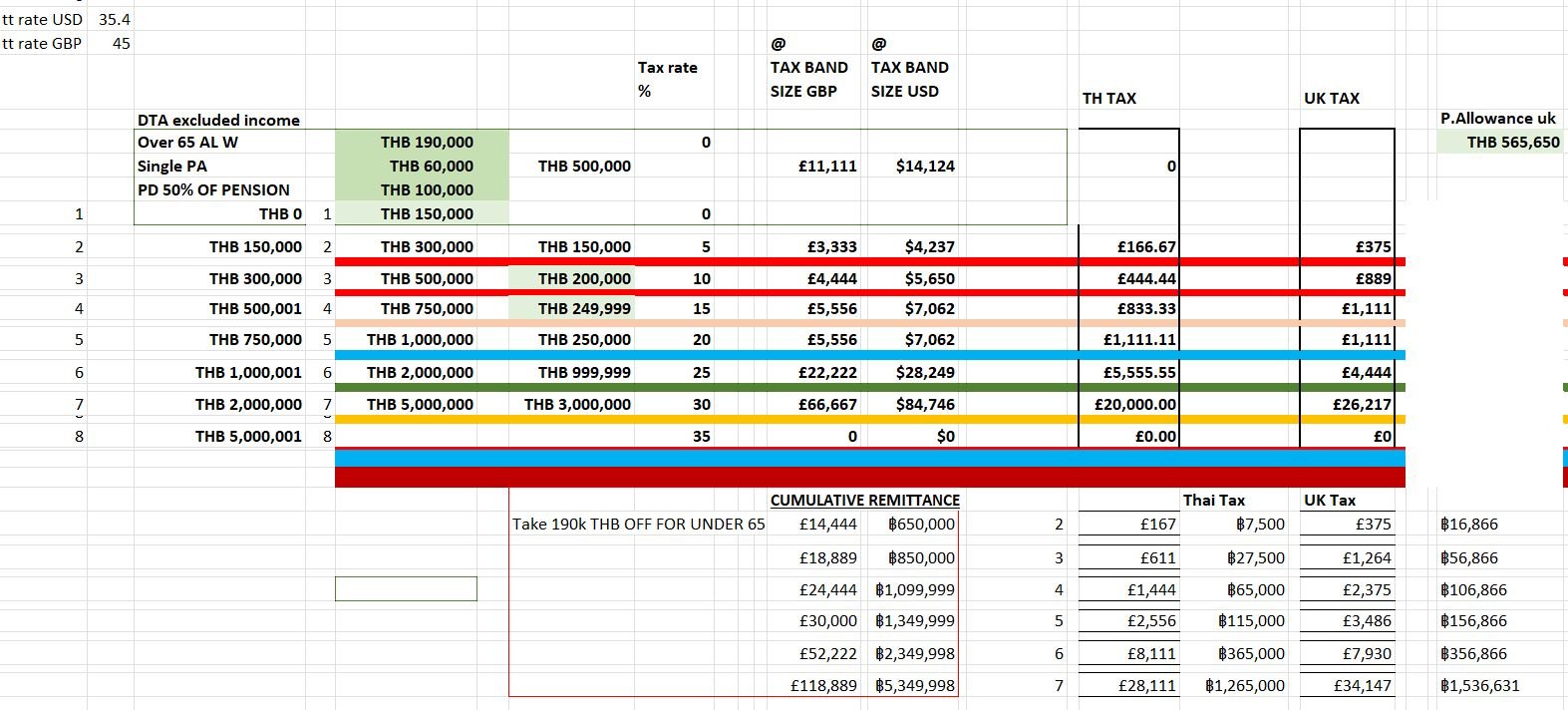

I wanted to satisfy myself that what I said earlier was true so I ran a quick back of the fag packet comparison. Below I compared, unscientifically, tax rates against Pounds and their Baht equivalents at 44. I assumed that the Personal Allowance and TEDA were similar, in the case of the Thai side, 350k + 150k zero rated. As you can see, the Thai tax rates are lower until they reach the range shaded in yellow and the UK has a 5% advantage, after which they diverge quite significantly once again.

The over 65 190k THB allowance certainly helps a lot (once I Qualify later), I'm simplifying it in my thoughts as up to 1 million Baht parity-ish, one to two million baht more in Thailand, over 2.2 m baht gradually becomes cheaper than U.K.

-

1

1

-

-

Just now, stat said:

Reading your great post another red flag for me was raised. If I do not have to file a tax report and most of the expats will not do in 2025 I am sure there will be no real "safety" even after 2025 how this will all play out. Are you 100% sure that one does not have to file? In other countries for example you have to file if you earn foreign income that has not been taxed no matter how neglible the amount. I am aware that this is not really an indication for Thailand but is shows there is the possibility burried somewhere deep in the thai RD laws and directives. Thanks!

I think things feel safer, especially for those with simple financials, remitting tax deducted at source Pensions.

But for those with more complex financials, there is more clarity, but some doubt still persists. I'm not continuously in Thailand normally, so as long as they keep the remittance basis not to bad. I've only had one year a while back, that I would have been Thai tax resident, and I had no major financial transactions that year (Globally).

Reading the Norwegian Answer for example (earlier in the thread)

https://www.rd.go.th/fileadmin/download/nation/Norwegian_answer.pdf *

Scary word = Global

Not Scary "Remittance" mentioned later in the text though..

And another, albeit from the Revenue itself:

2.1 Under Internal Regulations

In Thailand

In Thailand pension income is regarded as assessable income under Section

40 (1) of the Revenue Code. A resident of Thailand must declare his worldwide income on the basis that the income received from abroad in a tax year must be brought into Thailand within the same year, based on Section 41 paragraph 2 of the Revenue Code.[link above] *)

-

1

1

-

-

6 hours ago, Yumthai said:

Is this thread related to only UK residents in Thailand? Sometimes I'm wondering.

I think it's because our tax treaty is about 42 years old and has an absence of specific words, in the pensions area (except for Government pensions),🤨. Reading the UK revenue end information and community posts are sometimes like walking into a library with no bookshelves, though the librarian perhaps knows where most were most of the books are.😐

Hopefully the associated general procedure and tax detail 🧐 discussed (where known) is pretty universally useful, I don't mean to be hogging the lane 🤔

-

2

2

-

-

- Popular Post

- Popular Post

Just now, Mike Lister said:One potentially open issue is that the UK State Pension falls into this category. Since it is currently below the level of the Personal Allowance and some resident expats don't need to file a UK tax return, how do they demonstrate that UK tax was paid on the pension or do they not even need to? (That pension will have been subject to the UK tax process and taxed in the 0% tax band). I'm going to guess this is a non-issue?

If the state pension exceeds the (£12570 frozen till 2028?)Personal allowance, because of the high inflation indexation in the past couple of years, the tax code is adjusted on other pensions to pay the tax ( actually if savings interest exceeds the allowance slightly the adjust the coding as well ). If no other pension(s), they will ask for it probably.

I can say that Occupational Government pension (DB), Occupational (DB), Private (DC), Private (Occupational DC SIPP) pensions that I know of are all automatically taxed via UK PAYE deduction. Tax return only needed if you actually need to pay tax on some other event.

State Pension issues an annual Pension letter advising the amount for the next April To April payment period (No P60)

DB pensions issue Annual pay advice (unless a change in amount or tax adjustment) and P60 End of year Tax Cert. (Gov can down load monthly Payslip via PDF).

DC monthly pay advice Paper or PDF on different providers, and P60 end of tax year Certs

P60 is 6th April to 5th April.

-

1

1

-

1

1

-

1

1

-

7 hours ago, Phulublub said:

Anyone thinking of dodging a bullet by having one year when they are not Thai tax resident needs to be careful. I have read (but cannot now find the source) that if you were tax resident, spend a year not tax resident and remit funds dirign that year, but then subsequently become tax resident again, the money transferred during your non-tax resident year will be Assessable Income in the year you return.

I suspect this is to stop people doing exactly as is being suggested to try and circumvent the law..

PH

Thanks for that info.

I guess the English translation of POR 162/2566 lost a bit somewhere.

From 2024 on

A. Earned / derived whilst Thai Tax resident.

B. Assessable in the future if that at "A" is remitted to Thailand.

If they think that when you spend one year ever, tax resident, and then they will tax anything that is sent to Thailand for eternity, then yes I will try and circumvent that, or think what that very special year may be.

I wonder if they will bring out a 90per 179 day ME Visa? I suppose two single entry 90 day ones would do.

Would be interesting if you find where you read /;seen that.

Sounds like more mines in the minefield, or it could be easy the ain't really fully unfurled their new colours yet perhaps. Smiley face or Smiley with sharp teeth

-

1

1

-

-

Just now, Mike Lister said:

We could do with some examples to show the effect of the tax, both taxed in the UK versus taxed in Thailand (for those pensions that are transportable). Any volunteers, a cpa sort of person would be good. :))

not quite what you asked for, may be of some use? (consider as a draft)

-

Just now, ukrules said:

You know I heard that the term "Government Pensions" is not clearly defined in the treaty.

Some say it's only pensions paid to people who worked for the government, others say it's both pensions paid to government workers and the 'state pension' - who's right on this?

Government could be National or Local authority...

https://www.gov.uk/hmrc-internal-manuals/international-manual/intm343040

Part C.1: UK State Pension or Incapacity Benefit...

"If there is no ‘other income’ article, you cannot claim exemption under the treaty from UK Income Tax on your State Pension".

Part 😄 Application for relief at source from UK Income Tax (Thailand = No)

(Relief at source may be available in cases where HMRC is able to exercise its discretion to issue a notice...????)

Where we cannot agree to allow relief at source or cannot arrange it, you can claim repayment of part or all of the UK tax taken off, as appropriate. (Big Maybe, could be double tax for months, until sorted, if possible)

P34 note (R/H Column)

4. Treaty does not include an article dealing with DT-Company Non-Government pensions. Also, no relief for State Pension or ‘trivial commutation lump sum’.

https://assets.publishing.service.gov.uk/media/5b05425fed915d1317445ed2/DT_Digest_April_2018.pdf

-

Just now, JimGant said:

If not, kick back, have a beer, and don't worry about filing a Thai tax return.

That is the choice under consideration, to have the Beer in the UK or Thailand 😋

-

1

1

-

-

Just now, Mike Lister said:

Prior to 31 December 2023, any funds that were remitted to Thailand, in the year they were earned, were potentially taxable here. This meant that a person could earn income, save it in a bank account for one year and then remit it the following year, free of Thai tax.

The change to the tax law that took place last last year did away with the above and said that anything earned and remitted AFTER 1 January 2024, regardless of when it was earned or remitted, was potentially taxable in Thailand.

Better?

With the assumption of being Thai Tax Resident at both events....

-

1

1

-

-

20 hours ago, ikke1959 said:

If that is true, the tax department will refund the paid tax in Belgium if it is more than you had to pay in Thailand?? As double taxes in tyhe whole world are not done.

Nope.

-

I'm starting to think the Thai RD may think it is odd were asking about tax on pensions.

Cashng in your RMF units appear to be exempt from tax

https://sherrings.com/rmf-ssf-salary-sacrificing-tax-allowances-thailand.html

Normally the Retirement Mutual Fund would be cashed in, and they would tax whatever income is produced from where you place the tax exempt lump sum.

Trying to find an example of similar in English for a Thai company pension .scheme.

So the.question being "do I need to pay tax on my pension?" Expected logical answer would perhaps be NO in the Thai pension context.(?)

-

Just now, JimGant said:

DTA's address income, not income remitted. Thus, Thai RD gives credit that foreigners have some brain power to claim remitted income is from last year. Whether it is or not, is neither here nor there, as RD doesn't have the resources to call people in for questioning. And for those with direct deposits into Thailand of their pensions? You'd think that would be easy pickings for RD. But apparently not, as they didn't waste resources hitting all the banks to see if Joe Farang's direct deposit was from Boeing (taxable) or Uncle Sam (not taxable).

OCCUPATIONAL MANDATORY (PROVIDENT FUND)

"Tax EEE tax policy is currently adopted in Thailand, i.e. contribution, investment and payout are all tax exempted, although such tax relief is subject to limit of...." from this 2009 publication https://www.ilo.org/wcmsp5/groups/public/---asia/---ro-bangkok/documents/publication/wcms_836733.pdf Trying to find a more recent reference....

-

Just now, JimGant said:

As I posted somewhere in this mess of threads, for Brits, their DTA does NOT define assessable income when it comes to private/State pensions. As such, how is one to know that his Brit private pension is assessable income for Thai tax purposes?

Could it be treated the same as Thai Pensions, Tax free at point of taking it, but then anything derived from it is taxable? (UK Article 24) would not like to test that though!

Maybe since the UK does not offer relief at the UK end (except Thai National & resident on Gov ones), they thought at the time the were always to get Tax credit relief under UK DTA 23 3). So assumed they did not need an article.

-

- Popular Post

- Popular Post

(Por 161/2566) For a resident of Thailand who Derives or Earns , whilst being a Resident of Thailand, foreign source assessable income from 1st Jan 2024 onward it's subject to tax when remitted to Thailand (Whenever).

Previously it became taxable when remitted in the preceding Tax Year (to the Tax Filing 1st Jan - 31st March), when derived or earned, whilst being a Resident of Thailand.

(Por 162/2566) don't apply 161/2566 for stuff prior to 1st Jan 2024!

So if UK Pensions are of no interest to them to be taxed, by those RD offices perhaps are they thinking they were not derived while tax resident? wording of DTA would suggest not. Or s it because UK does not give relief from UK Tax, and the tax yield after credit relief (UK DTA 23) or exemption (UK DTA 19) is hardly going to yield very much. But there seemed to be a lack of interest, in Thai RD taxing pensions, going back many years. Someone way back suggested it was UK DTA 24, in that Similar Thai Pensions are not taxed as when they are not Government pensions, they are the same except it is a 100% tax free lump sum, rather than a 25% Tax free, and an ongoing payment. Equal treatment?

Still a bit of a mystery. (No written exemption or firm explanation that I've ever been able to find).

Going forward, Dividends, CGT as Personal income tax will, bank interest etc will still surely be.

(this post is a bit delayed as I see there about 10 new post before I pushed the button)

p.s I think the tax code is very much written from the Thai National, Thai resident, thinking of going overseas, context. Also we perhaps have a pre conceived concept, of the some times over officious application of untidy tax laws they are tasked to enforce.

-

1

1

-

1

1

-

1

1

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Thai gov. to tax (remitted) income from abroad for tax residents starting 2024 - Part I

in Jobs, Economy, Banking, Business, Investments

Posted

As far as my own tax is concerned, I totally resemble that description! Totally spoiled!

But I had to be aware of Tax regimes only in relation to other subjects and duties.