-

Posts

1,496 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by motdaeng

-

i’m not entirely sure why you’re asking for proof. just a few points: do all shops and street vendors earning less than 10k per month ? are all shop's and seller's registered and paying taxes? do all thai people working in the entertainment and tourism industries pay their taxes? are illegal earnings and income from corruption and grey / side market activities subject to taxation? do all freelancers (facebook selling, etc) pay taxes? ... if you really believe that only a small portion of thais commit tax evasion and need proof of that, then i can’t help you ... i agree that there are foreigners who don’t have to pay taxes due to the DTA and exemptions, or because of low pensions. however, not all countries have such generous treaties like the US with thailand, some have no treaties at all. if these individuals receive pensions certain sum of pension, they could already be paying taxes. i think it would be wrong to look the whole situation from just one perspective. there are foreign tax residents who sustain their lives in thailand also through investments, rental income (apartments/houses), stock market etc which results in paying taxes! some other situation, someone like to buy a car, land, house, or has to pay medical expenses with earnings (no savings before 31.12.2023). in all these situations, taxes must be paid ... just a reminder, taxes are progressive, ranging from 5% to 35%, which can result in a nice tax payment ... a easy, nice little earn for the TRD! as we all know, this little change for the tax law aims to close a loophole (used primarily by thai's), and we foreigners were not the reason for the law change. however, in my opinion, this does not mean that we are exempt from complying with this law. in a few years, it will become clear which group of us foreigners acted with foresight ...

-

Latest carmaker to scale back its EV ambitions amid slowing sales

motdaeng replied to webfact's topic in Thailand News

we’ve missed you, our firefighter and old BMW driver… where have you been hiding all this time? -

Latest carmaker to scale back its EV ambitions amid slowing sales

motdaeng replied to webfact's topic in Thailand News

this reminds me of what was said about solar panels many years ago: not worth it, technology not mature, too expensive, loss of value, etc. electric vehicles will be part of our future mobility. there could be other solutions in the future, but for now, bev's are a good alternative to ice vehicles. i was surprised to see transport companies (in eu) investing in big electric trucks (40t) and successfully using them in short- and long-distance transport. these companies must think economically and long-term, yet they are still investing in ev mobility. skeptics should ask themselves why this is happening. bev's are not for everyone. bev's won’t save the world’s climate, and like ice vehicles, bev's have also disadvantages. however, bev's technology has much more potential compared to no much potential for improvment for ice . bev's make sense for many people (over 40 million worldwide and rising), so why don’t bev's skeptics get first hand information from experienced bev's owners or take a free test drive at one of the many dealers here in thailand... -

Latest carmaker to scale back its EV ambitions amid slowing sales

motdaeng replied to webfact's topic in Thailand News

luckily the uk is not the centre of the world ... and does not represent the world ev market ... on the other hand, thailand has a good charging infrastructure, cheap electric prices, big choice of bev in every price range ... in norway, 94 % of new cars sold in august have been bev ... it looks like a lot of people have a different mindset to the subject electric cars. the big difference is also, this people own an ev's and know what they are talking about, compare to most of the negative posters here ... -

Historian Urges Thaksin To Stop Pulling Strings Behind PM

motdaeng replied to webfact's topic in Thailand News

unfortunately it will be once again the downfall of the country, as it was in the past cause by toni the criminal ... -

Destination Thailand Visa Gains Popularity Among Expats

motdaeng replied to webfact's topic in Thailand News

why did YOU go to that digital nomads meeting? -

my personal opinion: many thais who should be paying taxes do not file tax returns, which is correct. however, a large portion of thais have little or nothing to declare. enforcing tax laws against this group would require a significant effort (manpower) from the TRD, which may is not justifiable. in contrast, enforcing the law on foreigners who are tax residents in thailand is much simpler and would generates more revenue per person for the TRD ...

-

it might be enforced rarely, but personally, i wouldn’t take it lightly if i committed tax evasion, even if i am only low-profile case. i prefer to follow the rules, and i’m confident it will pay off. the past 20 years in thailand confirms me that this is the right approach for the next 20 years ...

-

Investment for income stream for a Thai

motdaeng replied to gearbox's topic in Jobs, Economy, Banking, Business, Investments

since when is thailand in the west? -

Investment for income stream for a Thai

motdaeng replied to gearbox's topic in Jobs, Economy, Banking, Business, Investments

financially illiterate, generate steady 5%, a safe investment and that all in thailand? that would be nice but to be honest, impossible ... -

Reduce taxation by gifting.

motdaeng replied to phetphet's topic in Jobs, Economy, Banking, Business, Investments

i watched the video a few months ago, and neither of them convinced me ... the questions nor the answers. it was more of an embarrassing event, also with some false statements. i would not to suddenly start transferring money to my wife and declaring it as a "tax-free-gift" on the tax return ... but as always, up to you ... -

Lawsuit Challenges Paetongtarn’s PM Status Over Thavi Appointment

motdaeng replied to webfact's topic in Thailand News

she is the same evil and liar as her father... the apple doesn't fall far from the tree... no morals, only greedy for money and power... disgusting people ... -

.

-

Destination Thailand Visa Gains Popularity Among Expats

motdaeng replied to webfact's topic in Thailand News

it's getting better and better... thailand, here we come for cooking (no more temples as an excuse) ... -

media and several sources, including a few embassies, have reported that the tax law has been adjusted and now also affects foreigners. expat associations are organizing information events on the topic, and so on. while a large portion of expats are aware of the changes, many are likely to ignore or downplay the new situation ... i am sure, that expats with transfering a substantial taxable amounts into thailand (several million thb per year) have already taken steps in response to the new tax situation. they don't have the mindset of doing nothing and waiting, assuming that nothing will happen anyway ...

-

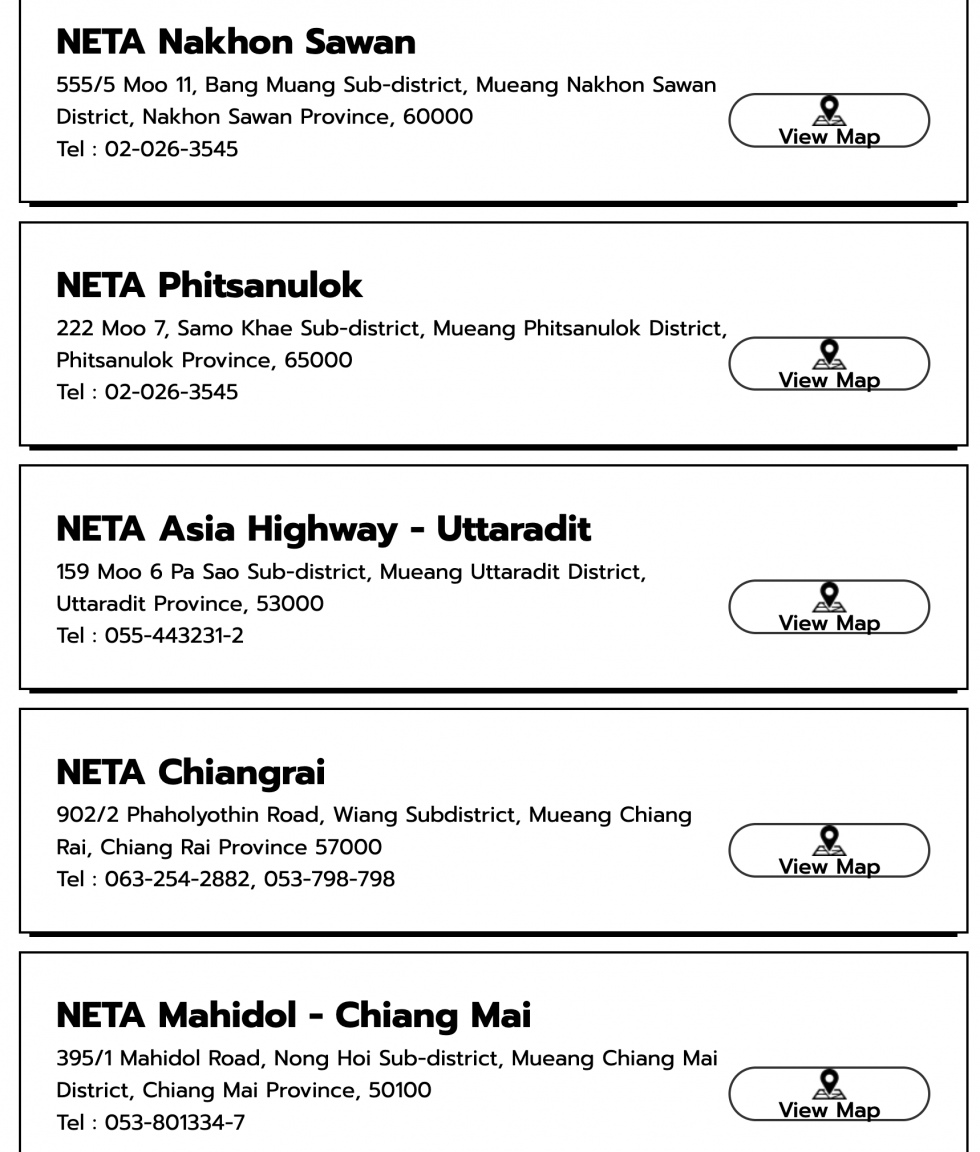

there are not so many as byd, mg, changan etc , but have a look at: https://www.neta.co.th/en/dealer_network eg. 5 neta dealer in the north:

-

i don't own a neta v, but i'll try to answer your question, some neta v owner may correct my post: the average consumption is about 12 kwh per 100 km, depending on driving style etc. ptt charging station prices vary, 7-9 baht per kwh. cost for 350 km driving: 3.50 x 12 x 8 = 336 baht (assuming 8 baht per kwh at a ptt station) 3.50 x 12 x 4 = 168 baht (assuming 4 baht per kwh for a home charger)

-

byd offered free charging for a reason: the company recently cut prices significantly on some models, and customers who had purchased their cars at higher prices were unhappy and complained. in response, byd provided free charging for a limited time as a form of compensation ...

-

it's not just you; he does that with other members too ... (i get it also ...) it seems, expatoilworker still hasn't found a new hobby involving his favorite subjects: fire and explosions ...