david_je

-

Posts

515 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by david_je

-

-

On 7/4/2022 at 10:34 AM, kidneyw said:

I went there four weeks ago on appointment. This was my second booster, my first being Pfizer. This appointment stipulated Pfizer, but when I got there I was given the option of Moderna, which I took. There were also walk ins that day.

And was the requirement four months after the Pfizer booster, or six months? Thanks.

-

14 hours ago, userabcd said:

Better to call ahead to find out if Moderna will be still be available, to avoid a wasted trip.

My wife was there towards the end of last week and they told her that Moderna (door 1) vaccine was ending on the 2nd July 2022.

Pfizer vaccine will still be available and given until the end of July 2022.

15 hours ago, unblocktheplanet said:These look like the numbers. But I haven't tried them yet. Hoping to go t;mow Mon July 3 in afternoon. Hope it isn't a wasted trip, though I want to get a gander at the new stattion.

Bang Sue Vaccination Centre

02 201-6600 โฆษณา

02 201 6600 ซื้อภาพข่าว

02 201 6096If you wouldn't mind letting us know what you find out, including. timing of Moderna as second booster (4 or 6 months) and for how long Moderna will be available there, would appreciate it.

Thanks.

-

Would someone who has gotten it recently at Bang Sue confirm that you can get Moderna as a second booster four months after your first booster, which was Pfizer?

Is there a phone number there? I could not find online.

Thanks.

-

18 minutes ago, Sheryl said:

I do it several times a year, and also Botox

Mouth lines, it is usually best to do volume filler high on the cheeks and to the side, this lifts things up.

You do fillers several times a year? They are so short-lasting?

What brand and type have you found best for mouth lines and lifting and adding volume to cheeks?

Thank you, Sheryl.

-

Please share any notable aspects including choice of doctor, results, brand of filler, Korean fillers vs U.S.-made, etc. I am most interested in smoothing out brow and mouth lines and adding volume around cheeks.

There have been past posts on this, but could not find anything more recent. I am in Bangkok.

Thank you.

-

If anyone here has used cannabis in any form and found it helpful for chronic daily migraines, pls let me know? Or know where I can seek such expert advice/treatment for this. Thanks.

-

Foreigner, hoping to get Moderna as second booster in mid-July. Does anyone where in Bangkok I can get free? Would like to get into queue now.

Thanks.

-

Thank you for replies to my message on being repeatedly rejected in online application. I did it in person at CW the other day, and was told that it was because I had just had a new Non-O visa and the TM47 info was not yet in system. I should be able to do 90-days online the next time.

-

1

1

-

-

1 hour ago, DrJack54 said:

So, you were able to register on the new online system. Obtain password etc and then it stated pending and subsequent rejection.

Any reason given?

Yes, registered and submitted fine. No reason given for rejection. If anyone knows of way to find out why rejected, pls let me know.

Thanks.

-

2 hours ago, ubonjoe said:

1. You can do your 90 day report up to 7 days after the report date that is includes the report date in the count when doing it in person.

It does apply to online reports. By mail they must be received at least 7 days before the report date.

2. You will only need your passport and a completed TM47 form to the report in person.

1.The Immigration website rules, below, make no mention of 7-days after for online or 7-days before for postal. Can you advise where it is stated? And just to be absolutely certain, it is treated as customary/"legal" to do it 7 days after and is without a fine or a notice attached to receipt or my record, correct?

2.So no need to photocopy any pages of passport or any other documents, and only show the passport?

Thank you for your help.

How to Notification

1. The foreigner makes the notification in person, or authorizes another person to make the notification (The notification must be made within 15 days before or after 7 days the period of 90 days expires)

2. The foreigner makes the notification by registered mail (Thailand Post only and send the mail before the renewal date 15 days to Immigration Office in local area where the foreigner resides)

3. The foreigner makes the notification via internet by terms and conditions of service. Check the website : www.immigration.go.th => Online Services

-

My multiple attempts online have been rejected for unknown reasons. My notification due date is May 16, so I am past the 15-days-before requirement for postal, and only choice is to do in person.

The Immigration website says 90-day reporting has been moved from MTT to CW as of April 18. Can I ask anyone who has done in-person:

1. Does the rule below from Immigration website mean I can go anytime between now and May 23? That means for in-person reporting, there is a grace period of 7 days that does not apply to online or postal?

- The foreigner makes the notification in person, or authorizes another person to make the notification (The notification must be made within 15 days before or after 7 days the period of 90 days expires)

2.For in-person, are the required documents the same as the list of multiple photocopies as for postal, or only TM47 and show passport similar to online?

Thank you.

-

On 5/4/2022 at 10:11 AM, ubonjoe said:

The old site has been shutdown for some time now. I did that post in early March.

1. I just use the Soi number since it does non have a name in my case. Same for house number.

2. Yes

If you don't tick the box you have to complete info after it. It means the info you entered when doing registration to use the site and get the password.

3. You need to put your full name instead of leaving it blank. Many offices will not accept the application it does not have your full name on it. I have completed all the boxes on the 2 reports I have had approved on the new online site. For building name I put home since that is what I used on the old site and the mobile app.

I did as you suggested (except did not fill in mobile number), but still rejected. I will try again with a little tweak, but it is now too late to do by mail (my reporting due date May 16 and instructions say it must be received 15 days before that) and I will have no choice but to make the long trip to CW?

-

On 5/1/2022 at 7:39 PM, BangkokAlan said:

There aren't any specific supermarkets serving those countries uniquely but the Central Food Halls at Central Chidlom and Central Ladprao have vast Asia ranges and if you like Korean food there is a Korean supermarket on Ratchada Road near Esplanade mall. Don Donki in Ekamia also has a lot of Asian ranges not sure the coverage on the you have asked but I do believe they have Japanese and China products. Most international supermarkets cater for Japanese ranges and there is a Japanese Supermarket in Sukhumvit 33/1 and a few more dotted around Bangkok but Suk 31 is the one the Japanese housewives visit.

Thanks for that. I will try them.

-

1

1

-

-

On 3/4/2022 at 4:53 PM, ubonjoe said:

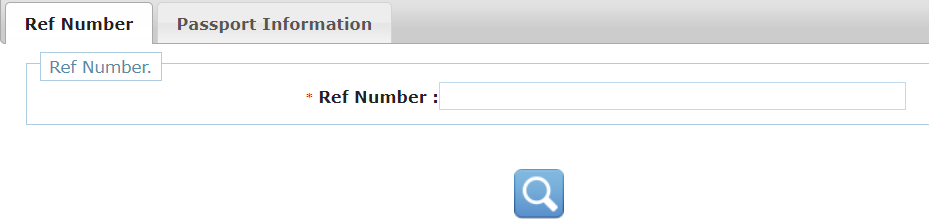

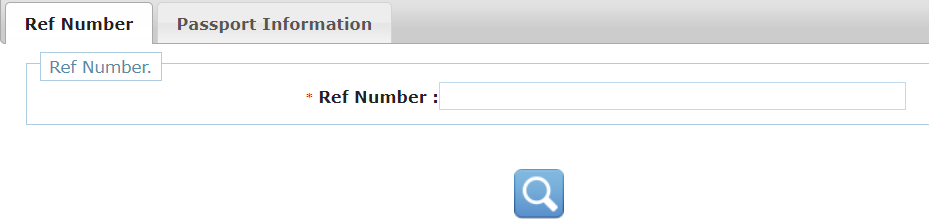

Try going to this page on the old reporting site (with no VPN on) https://extranet.immigration.go.th/fn90online/online/tm47/TM47Action.do?cmd=acceptTerm

And then selecting check the status button and then enter the reference number for the report.

It will show the TM47 form in a different format than the one on the new site and at the bottom it may show the reason it was rejected.

It will show the TM47 form in a different format than the one on the new site and at the bottom it may show the reason it was rejected.

I got the same rejection notice today. The link you provided above only takes me to what appears to be the new site, so can't determine reason for rejection. I rechecked accuracy of info I inputted.

However, wondering on application:

1. For "address no", I had put only number of soi, without name of soi, which I put in the "soi/road" field. Should I put both number and name of soi in "address no" field and name of main road in "soi/road" field?

2. Should the box "Use Login info" be checked? What does that mean?

3. I only filled out the mandatory (*) fields. Is that okay?

Thank you.

-

Anyone know of any good ones? Looking for things like boxes of 2-in-1 milk tea, spices, etc.

Thanks.

-

On 4/15/2022 at 12:59 PM, Sheryl said:

5 - AA is the best for this IMO.

Dear Sheryl and all,

Would you pls advise whom to contact at AA for this and alternative policies?

Thanks.

-

5 hours ago, drtreelove said:

I recommend the bokashi fertilizer from Organic Totto. 25kg sack for 350 plus delivery.

I use this in combination with vermicompost from Biosurge Thailand, now merged with Best Garden State (on FB)

Organic Fertilizer Worm Winner Vermicompost from Thailand (biosurgethailand.com)

BGS has two or three COF blends (complete organic fertilizer). I would trust the quality, but they don't list the ingredients and I haven't used their COF products myself.

Also consider inoculation with beneficial soil micro-organisms from SV Biotech/ Grotech, they have a product called Mycortech Biostimulant. I haven't used it but its along the lines of other soil biology inoculants that I have used for soil improvment.

This new generation soil fertility enhancement plus mulching and good water management is the best way to go in my opinion, for optimum plant health, nutrient density, flowers, color, fragrance, taste and productivity .

Avoid outdated products and practices, high NPK, high salts chemical fertilizers that are still being promoted by ag shops, advisors and growers who are not up to date with modern best management practices.

Thank you very much for your advice. Will try those.

-

For a small garden with fruit trees, vegetables and flowers, some of them plotted. Preferably organic. An online search brought up a dizzying array of choices. Also need to perk up potted roses, if anything specific for that.

Thank you.

-

On 3/27/2022 at 8:10 AM, rimmae2 said:

I had the second Moderna vaccine at Medpark yesterday, 3 months after the first. From entering to leaving the hospital it was less than 15 minutes with no requirements to sit for 20 minutes post vaccination as was the case the previous 3 times. As always superbly organised.

These Moderna jabs at Medpark, etc., are free? I've had 3 Pfizer jabs, and following new U.S. CDC guidance, will be looking to get a 2nd booster in the next few months. Unsure what interval should be.

-

1

1

-

-

On 3/23/2022 at 5:37 PM, Thailand J said:

For a year or so I can't log in to my Vanguard Brokerage account from Thailand without a VPN.

I feel comfortable using a VPN because of the 2 factor authentication I set up. Who told you that you can't use a Thai number to receive the one time passcode? not true.

If you don't want to use a VPN, call them everytime to log in or switch to Schwab.

Is the Thai number you use the number registered with your account? Or how did you set it up? I also asked to change my US number to Thai number so I could receive codes, etc., but Vanguard customer service said you cannot register an overseas number. They also told me not to use a VPN to log on as that may cause problems.

Thanks.

-

1

1

-

-

1 hour ago, The Hammer2021 said:

Try a different browser

Tried Chrome, Edge, Firefox -- result the same. Thanks.

-

1 hour ago, mtls2005 said:

Posted already

https://investor.vanguard.com/security-center

You use your username and password then receive a separate one-time authorization code entered in the prompt.

Have you tried the app?

So the code is an added layer of protection. It doesn't help me since my problem is the system does not accept my username and password to begin with.

Thanks.

-

10 hours ago, Thailand J said:

I don't log into my Vanguard account as often as before. I am not worried as Vanguard sends me a one time passcode on my Thai phone number every time I attempt to log in.

You should really try Schwab international brokerage account, it can be opened with your Thai address and Thai phone number.

How did you set up having Vanguard send you passcode on Thai number? And did you do that because you had the very same log-in problem as I do? By passcode you mean the log-in password after inputting username? They told me that only way to fix my lockout was to phone them every time I wanted to log in and they reset password or security questions.

They've also told me previously they cannot register overseas numbers, must be U.S.

Thanks.

-

If you use a VPN to access Vanguard or other account, you'd have to trust the VPN company with your personal details, no?

Free COVID booster shots on offer for all at Bang Sue vaccination centre

in COVID-19 Coronavirus

Posted

I don't know what your shot schedule was, but are you able to confirm that Bang Sue will give you Moderna as a second booster four months (not six months) after your first booster (which in my case was Pfizer)? Thank you.