mran66

Advanced Member-

Posts

1,248 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by mran66

-

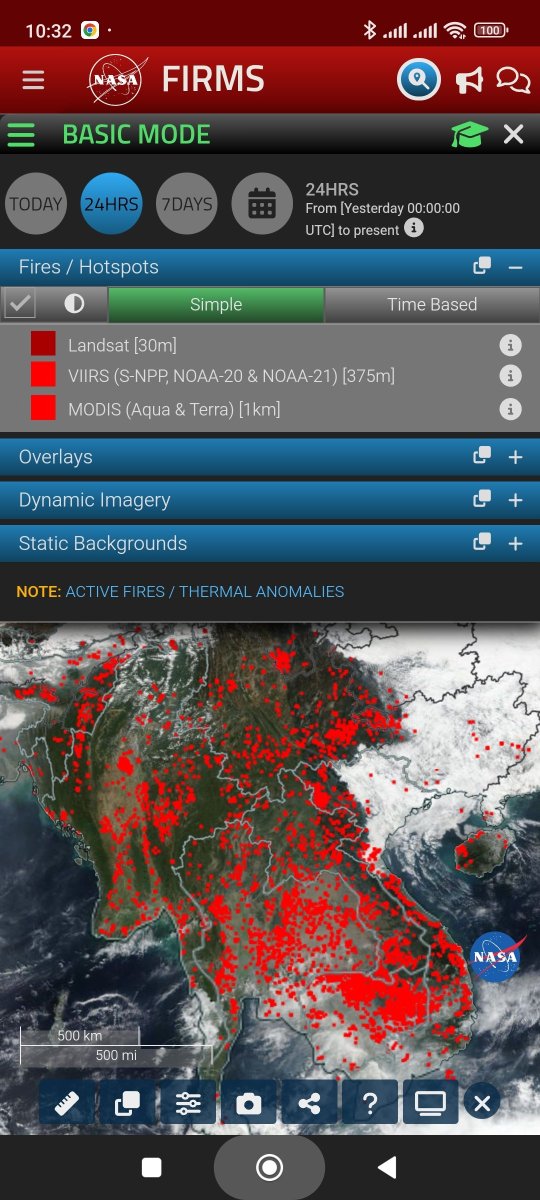

Bangkok's Air Crisis Escalates: Fourth Worst Globally for Pollution

mran66 replied to snoop1130's topic in Bangkok News

In all honesty all the neighboring countries are equally guilty. That's why the situation is favourable to all of them to fingerpoint the others and just hide their heads to sand without doing anything than talk ASEAN proving it's worth in the matter also pretty well. -

Bangkok's Air Crisis Escalates: Fourth Worst Globally for Pollution

mran66 replied to snoop1130's topic in Bangkok News

... And working good not only regarding air quality. Widely used with great success whenever/wherever problems requiring some concrete action appear. Often the method is used in combination with blaming/fingerpointing someone else than the culprits themselves, amplifying the perceived impact of the method -

Thailand Introduces Online TM6 as Tourism Fee Faces Delays

mran66 replied to webfact's topic in Thailand News

That's what I was wondering also yesterday when saw this news. Now they are planning to ask foreigners to fill two separate online forms to enter the country, the ETA and the TM.6. Hard to see much other reason that employing themselves and some externals to get envelopes to create useless things -

Toddler in critical condition after falling into water container

mran66 replied to webfact's topic in Isaan News

"His great-grandmother, who had been caring for him, recalled how he loved playing with water despite her warnings." Amazing explanation.... 11 month old not taking notice of warnings, what a stubborn child! Certainly he understood what grand grand mama was talking about. Not. -

Thaksin’s Medical Leave Under Scrutiny: Protests Demand Reimprisonment

mran66 replied to webfact's topic in Thailand News

Bug guys sure won't say or do anything - with the exception of retroactive complete pardon to make the whole complaint void -

Pitbull mauls monk to death in gruesome Nonthaburi temple attack

mran66 replied to webfact's topic in Bangkok News

Guess he will now be reborn as pitbull and go out for rampage revenge against all pitbulls. -

Thaksin to Discuss Global Path for Thai Models with Naomi Campbell

mran66 replied to webfact's topic in Thailand News

Lots of more or less beautify thai ladies and non-binaries on the catwalks already, both the traditional agogo's as well as on the post modern catwalks of onlyfans and the likes. -

PM Paetongtarn Shinawatra Reassures Safety of Chinese Tourists

mran66 replied to webfact's topic in Thailand News

...wiping problems under carpet like an ostrich hiding his head. Kidnappings widely reported in media are just rumors. Delivering a speech made by AI makes any problems disappear -

I got the Thai tax ID some years ago as an US bank insisted I need to give one to them. Once I got it, I gave it to krungsri to avoid the withholding tax. I've never filed a tax return here as no taxable income (always sent matured capitalized income from overseas), neither bothered to file to claim back the small tax held from bank interest Also transferred enough in late 2023 to have couple or years without need to transfer more and to have some time to see how the tax thingy will really go. One thing is for sure: I will not pay any substantial tax to thailand (99.x% of my overseas income is not taxed anywhere so it would be HEAVILY taxed here if assessed taxable in Thailand). If tax laws remain as today, just need to stay out of the country traveling for half a year every couple of years so that can send tax free that year by being non resident. If worldwide taxation would come some day, then probably need to set up a more permanent residence to some other country so that can split time under 180 days a year as continuous traveling for 180 days a year is probably too much for extended time Now, if this LTR would work out, would save some hassle as it would fix all tax issues at one go.

-

Romantic Stunt Gone Wrong: Man Steals Truck to Impress his Crush

mran66 replied to webfact's topic in Southern Thailand News

Must indeed be on drugs to believe that can impress someone with a pickup. -

In this video at 27:00 he talks about misconceptions and states "crypto holdings and capital gains can be used used as proof of income" as misconception. Statement is somewhat vague as it could be interpreted to mean that capital gains could not be used as proof of income, though I assume he actually means crypto gains, not any capital gains as BOI web page clearly states "unearned or passive income includes, but are not limited to pension, rental, realized capital gain, dividend, and interest payments" i.e capital gains can be used. Did not see crypto mentioned in BOI pages though maybe it is somewhere there. Thus, I assume capital gains are OK as long as they are not from crypto trading(?)

-

Well, exempt on overseas income is clearly listed as benefit and that is also my only reason to apply it instead of continue on non-O renewals Having said that, it is anyone's guess how rules are applied with current system since 1jan24 as no experience yet, not to speak about possible law changes in the future. Can only assume that no tax on overseas income in any situation.

-

Thailand Sets Sights on Nuclear Power Integration by 2037

mran66 replied to webfact's topic in Thailand News

Still floating around without engines. Probably sunk soon. -

Thailand Sets Sights on Nuclear Power Integration by 2037

mran66 replied to webfact's topic in Thailand News

Part of thaksins plan for thai investment on technology, thai developed fusion reactor? -

Thailand Sets Sights on Nuclear Power Integration by 2037

mran66 replied to webfact's topic in Thailand News

At least one coup will happen before that, possibly with some parliamentary govt changes so things can change many times before anything happens. Luckily in this case. -

Okay, thanks. Just noticed that passport validity date is also a consideration - my passport expires in November 9th, and was planning to renew it during summer when visiting home country. However, LTR says requirement is passport valid for 6mo at the time of visa issuance (not at time of application). Thus, I might need to get a new passport via embassy (and pay their ridiculous delivery fee...) if the application process incl making the appointment to get the stamp takes time. Insurance renewal on April 12, so really have only 3 weeks between 100% set of docs and the 6mo deadline. Is the appointment usually soon after getting the application approved, or takes weeks from approval? Any idea if I can file the initial application with my current passport, and then get a new passport during the application process so that when appear for the stamp I would have new blank passport (possibly with transferred non-O on it), OR is it better just to get new passport from embassy first, transfer my visa to it, and just file the application with that new passport?

-

Was just reading the application process steps on their webpage, and it seems there is actually a specific step to add additional or updated info like insurance docs and entry stamps prior to final approval by BOI staff. Does not make much of a difference to me whether I apply now or April (retirement visa due in November), but seems I could actually file the application and get the 20day processing started earlier, and update the insurance and latest entry stamp (if any) in April as per the std process

-

The logic (or lack of it) makes me wonder if they have a forum where they review the visa system holistically covering all options, or is it rather different govt departments competing against each other with their own visas. I would guess the LTR, DTV and other affordably priced visas are created by departments who genuinely try to attract certain type of people to reside (= spend or bring money) in/to Thailand, and the new options obviously are working for many people to whom Elite was the only officially available one in the past (language school visas used to circumvent the rules though). So Elite really has become the the last resort visa to get cash from marginal foreigner segments who do not qualify for others, yet for whatever reason want to stay here. Pricing the Elite more affordably might actually be financially better for the sellers of Elite. However, if you do not qualify for LTR or DTV, retirement or the likes, Elite even with its current pricing is not a bad deal for certain groups as long as tax rules remain as they are even with tax on income brought in (as long as no global taxation) as the cost is very small compared to tax savings for certain group of people. You spend some 20k USD to get the visa, and might be able to save 10, 100, 1000 or even more times in taxes in your home country by becoming tax resident here. I recall I was considering getting the Elite before turning 50 for couple of years for the very reason, however at the time you could still manage to stay enough in Thailand by traveling in/out the country without any visa or tourist visa, so did not at the end as was traveling quite a bit anyway.

-

BTW would you happen to know it the "10 mo remaining" insurance criteria is a hard core one? I've had same health insurance for many years but the renewal is in early April, thus only 3mo left before next renewal. Wondering if this is a showstopper for application until I renew, or long history with same insurance would be acceptable even with only 3mo left