-

Posts

5,461 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by rabas

-

Thaksin suffers heart valve disease and rarely has visitors : Chaichana

rabas replied to snoop1130's topic in Thailand News

Um, what is written just before those words? ... that you can't read the post, which is Thai. You can't understand Google's translation. You also can't understand the actual discussion which is in the video with the evidence. But then you reason it has no value because it was 5 months ago? That was the very day after Thaksin was allegedly taken to the 14th floor, in a location claimed to be without air conditioning. So it looked like he didn't arrive. -

Thaksin suffers heart valve disease and rarely has visitors : Chaichana

rabas replied to snoop1130's topic in Thailand News

You have two choices, it was an eye exam or the image released by Thaksin of him and Paetongtarn at the ophthalmologist in Dubai was faked by Thaksin. https://www.thaipbsworld.com/paetongtarn-in-dubai-to-meet-thaksin/ -

Thaksin suffers heart valve disease and rarely has visitors : Chaichana

rabas replied to snoop1130's topic in Thailand News

The poster's comment in Thai is not meaningless, just Google's translation. Or better, just listen to the video which contains all the factual evidence. So OK you can't, but at least accept that. The X post is only an intro comment to the video. It basically says "The reporter easily took the lift up to the 14 floor just before the hospital locked the lift's doors. That is, that was in the past, but now times have changed and one would not be able to do so." I.e., the hospital began locking the lift after the incident. The video talks about what the reporter saw, which was nothing to indicate Thaksin was there. No guards, nothing, as well as the lift being open to the general public, also unguarded. Further, the whole floor seemed to be air conditioned, cool and comfortable (contrary to police claims). The 3 nurses at the nurses' station had no fans or other means to stay cool without air conditioning. (according to the video) link to referenced video -

Thaksin suffers heart valve disease and rarely has visitors : Chaichana

rabas replied to snoop1130's topic in Thailand News

An eye exam, wasn't it? -

Thaksin suffers heart valve disease and rarely has visitors : Chaichana

rabas replied to snoop1130's topic in Thailand News

Except most Thai. Thai know things because they know how Thais communicate. Westerners not so much. A Thai lie is often not meant to deceive, just preserve the face of those who pretend to believe it. Nothing more. So if you have proof Thaksin ever went to the police hospital I would be interested. -

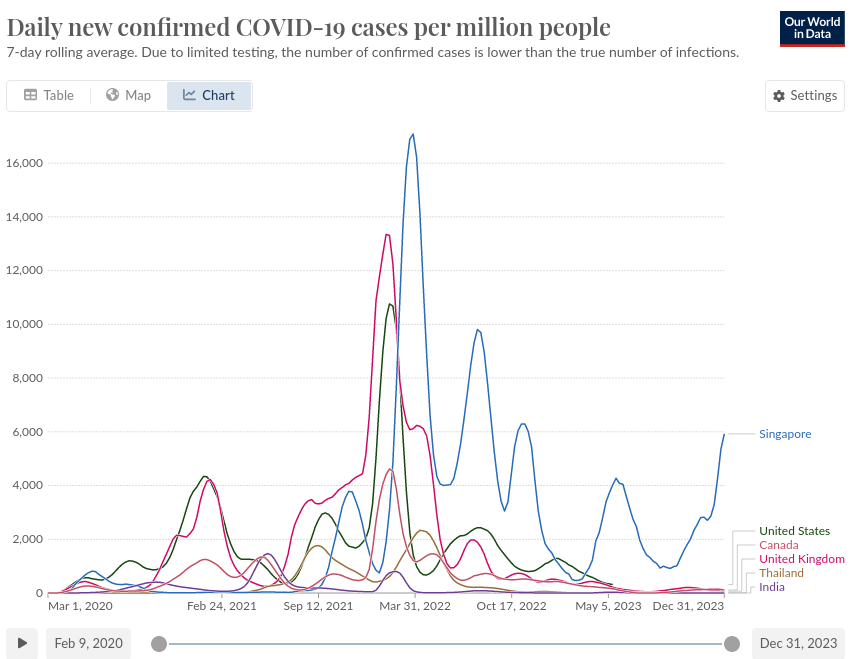

It's very possible that one brand/version/batch of a rapid test kit will not detect more recent strains of SARS-2-Cov, while PCR tests still work. This is in part because SARS-2 is a particularly infectious and rapidly mutating virus, possibly as a result of R&D programs studying such properties (as we now know). Rapid tests only look at viral surface proteins, mostly from the changeable spike. PCR test's deeper in viral RNA and sees parts that rarely change. ATK manufacturers adapt to newer strains but it's a bit like trying to board a moving train. So it's important to check the manufacturing date and try different brands. Here is a 2 minute video that explains clearly (from approved sources) Why a rapid test might not detect all COVID variants

-

Thank you. I see a broad variety on iherb.

-

Sorry to awake the thread. I'm looking for Melatonin to help my wife sleep better. I haven't used it for many years but from comments here I though it would be readily available on Lazada and Shopee. I was surprised to find none except for one hoax brand selling a 'natural' form that claims only 1.05 micrograms per capsule. Should be 1 to 10 milligrams. Shopee search find nothing. So have they stopped selling Melatonin OTC in Thailand? This is the fake brand on Lazada, some versions mention vitamin B i then listing details. Thai for 1.05 micrograms 1.05 ไมโครกรัม is in the first bullet.

-

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

Unfortunately, truth is not negotiable. Surely they both knew something was a foot but perhaps Israel didn't know when. Iran is quite genius at using it's various proxy forces in the region, which they've been building for a very long time. Iran was also a major factor in the Oct 7 attack. Wiki: 2023 Israel–Hamas war : Iran proxy warfare The IRGC reportedly worked with Hamas to plan the 7 October attack and gave the green light to launch the assault on a meeting in Beirut on 2 October. In the weeks leading up to the attack, some 500 fighters from Hamas and Palestinian Islamic Jihad received training in Iran, under the guidance of the IRGC Quds Force. Iranian officials publicly boasted for years about their role in arming militants in Gaza, and a 2020 US State Department report said Iran funnels $100 million a year to Hamas. -

My guess is that nothing will happen that didn't already happen years ago when you brought taxable income in from abroad in the same year you earned it. Except now every year is the 'same' year. Perhaps now we know the Thai meaning of 'same same'. Q: Is next year the same as the current (i.e., same) year? A: Yes, same same.

-

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

No, I believe you were putting words in my mouth to dodge my point, and are now doing it again. Do you understand that many Gaza casualties are because Hamas use of human shields? -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

I 'believe' your unintelligible answer/question proves you know Hamas use of human shields is why casualties are so high. Always have. -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

Nor will they ignore the deaths of Palestinians who aren't Hamas. Do you understand yet? Yes. Then they will put 2 and 2 together to realize they are related. Just like cause and effect. As most everyone already knows. -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

In a rapidly changing world, only this thread remains unchanged, stable like bed rock, the Rock of Gibraltar. Days go by and I know what was, is, and will be said without looking. Time becomes confused. Is it weeks ago or now? But all is not without reason. The fundamentally unchangeable reason is that without warning Hamas committed the worst most horrific terrorist attack on innocent people the world has ever seen. That can never be acceptable. From there perhaps we can all fix problems on all sides. But one must first accept such attacks are not unacceptable to humans. One team continues to excuse and/or ignore it. They refuse to take it into account in their reasoning. When that changes maybe the thread world will change. -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

Don't know, didn't discuss it. -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

The subject of my initial post was fact checking another poster's factually false comparison between bombing in Iraq vs Gaza. The next post was yet another poster who misunderstood everything blaming me for the first posters mistakes. Now you. -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

Don't ask me, I am not the one who brought up the comparison. Talk to Placeholder. I was just fact checking false claims. Hmm. Any false claims in your post? What about military purposely fighting civilians, is that accurate? ... Is the military really fighting the civilians right to exist? Maybe you mean the terrorists right to terrorize. ... Maybe there are some human shields? -

Bangkok woman’s unexpected fall in lift shaft sparks high-rise rescue

rabas replied to webfact's topic in Bangkok News

That explains it. The reporters are suffering TicFace-TocBook disease. No cure. -

Jeffrey Epstein: US court releases list of people connected to financier

rabas replied to CharlieH's topic in World News

Before the thread gets too long, it may be good to verify facts so here are the full document releases in easily searchable pdf format. There was a second release today so there are two .pdf files. I searched both rabus and my real name, whew! It only took 2 seconds. https://s3.documentcloud.org/documents/24253540/epstein-documents-943-https://s3.documentcloud.org/documents/24254004/epstein-2nd-batch.pdf In addition to names, you can also see what was said. -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

Other than that Mrs. Lincoln, how was the play? But your deflection is correct, I misremembered the most intense tank battle, which was in the Gulf war. But the Iraq invasion was by land and also relied on tanks thus my point about bombs was correct. Other than that, you missed the entire post's meaning. -

Netanyahu rejects claims accusing Israel of genocide in Gaza

rabas replied to CharlieH's topic in The War in Israel

OK all is clear. I assumed it was likely the WSJ and its authors. There is far to much reporting like that nowadays. I tried the Wayback machine but all their archived copies were unreadable. archive.is finally worked. "And I notice you've left uncommented on the massive destruction wreaked on Gaza." Not so useful without discussing reasons and perspective. How do you prevent such things? Certainly not by ignoring parts of the story. That's often what causes them.