Kenny202

Advanced Member-

Posts

5,499 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Kenny202

-

Is it possible to copy and print a small identity photo?

Kenny202 replied to Kenny202's topic in General Topics

Come to think of it I have a Google Pixel phone takes amazing portraits. I'll take a couple of photos myself and give it to the missus to take to the photo place in case they can't copy the original one. -

Is it possible to copy and print a small identity photo?

Kenny202 replied to Kenny202's topic in General Topics

Thanks for the replies guys but not everyone lives in Pattaya lol. Not looking for a location. I am in the North East. Just asking generally if a photo shop can do this. I assume if one can they all can -

Is it possible to copy and print a small identity photo?

Kenny202 replied to Kenny202's topic in General Topics

I don't want to sit for photos, I don't have time. Was hoping they could print a set from the one small photo I have -

I need to put in an application tomorrow with a small photo attached, about 6x4 cm. Photos are not for passport or anything. Need to be decent but not critical. Is it possible to get one of these small photo shops to copy my last original photo and make another set of prints? I have one small photo left from the last set I got professionally done.

-

Parental visa financial requirements 400k

Kenny202 replied to Kenny202's topic in Thai Visas, Residency, and Work Permits

The thing is though, I will be applying for my extension 30-45 days before my current stay until date. Is the money supposed to be in the bank only on the the day of new extension application, the stay until date or date you receive approval back? (usually 1-2 weeks after stay until date) -

Parental visa financial requirements 400k

Kenny202 replied to Kenny202's topic in Thai Visas, Residency, and Work Permits

Marriage or parent visa? -

Going to apply for re extension of my parental visa early July (45 days before due / stay until date expires).....stay until date mid August. I believe for a parental extension the 400k only needs to be in the bank the day of application, but my IO requires 2 months before applying, no problem. What I am concerned about is that the balance may not still be 400k on the day the actual extension renews in August, and when I pick it up after it has been approved (after under consideration period) a week or two after expiry date. Will balance under 400k the day my extension expires or when I pick up the new extension be a problem? In 6 years I have never been asked to show bank balance when picking up the (new) approved extension. I have enough money to top it up, but my money is invested back home and bit of a hassle to transfer a smaller amount.... particularly when the only reason I would need extra is for the extension.

-

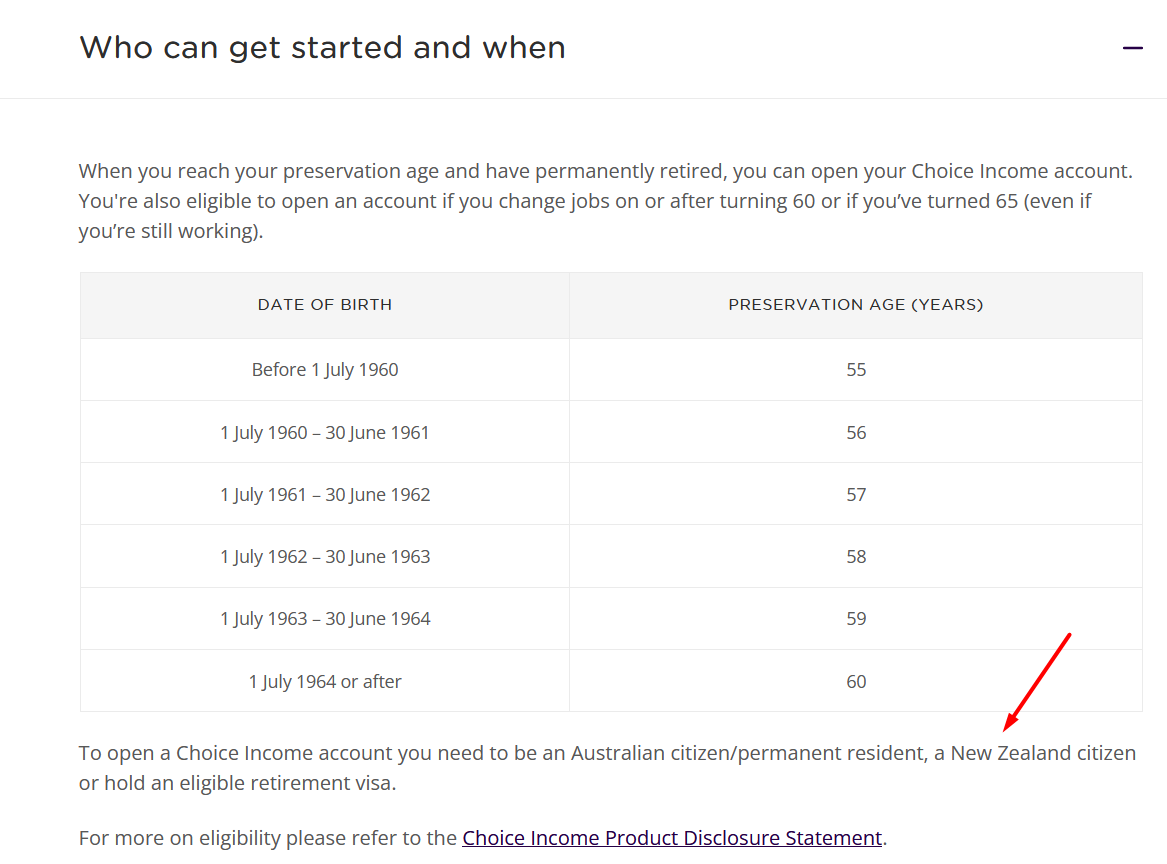

Well there is another thing I found...no mention of it on their paper application...only online application. I thought maybe it had something to do with money laundering laws or something. I seem to remember seeing it somewhere though for Australian Super when I googled it. I actually sent it to someone else who asked me about it. Here it is here, not sure if this is online or just their blurb. It is actually from Australian Super

-

I actually posted an enquiry on the ATO forum. Very simple question. Can a non resident for tax purposes convert a super account to a pension stream and if so does that person need to be physically in Australia to apply. At first a consultant replied and said they would find out. Came back later and said I need to submit my enquiry by written mail aka too hard basket. I am with Colonial and even they couldn't give me a straight answer but there online app does state you need to be a resident for tax purposes and later in the application says you need to be in Australia when lodging the application and at the time the super company accepts it. I could have probably completed the application (I can use my sons address) I wasn't worried so much about the Super company as much as the tax issues and possible future fines and back payments. I still don't know if it is a n ATO requirement or super company requirement and seemingly neither do they

-

Help with parental visa

Kenny202 replied to Kenny202's topic in Thai Visas, Residency, and Work Permits

I would have thought so too, there's a ton of work, particularly the first one. I told him to check it wasn't just a hand holding exercise but he says it's the whole deal -

Help with parental visa

Kenny202 replied to Kenny202's topic in Thai Visas, Residency, and Work Permits

Just wondering, and I suspect the guy short on funds....an agent has quoted him a pretty reasonable price for the 1 year parental extension and 15k to do the non O visa transfer (15k). In my experience the first parental extension is the time consuming part. Would he be able to do the Non O application himself fairly easily and save the 15k? Or does he have to show the 400k in the bank at the non O transfer stage as well as the parent visa stage? When I did my first one year OA visa (retirement) in my home country....You could basically extend it out to nearly 2 years by leaving the country and returning within the first year..do a trip in / out right at the end of your first 12 months and it started from scratch with another 12 months. Is the Non O the same or only 3 months? -

Help with parental visa

Kenny202 replied to Kenny202's topic in Thai Visas, Residency, and Work Permits

You're right actually. His first entry was by air, 2nd one by land. Would he be likely to be allowed in again on a visa free 30 days land or air crossing?? That would be three (2 with 90 day extensions) back to back without any period of time in between -

Help with parental visa

Kenny202 replied to Kenny202's topic in Thai Visas, Residency, and Work Permits

Excellent info thanks 😊 -

Help with parental visa

Kenny202 replied to Kenny202's topic in Thai Visas, Residency, and Work Permits

He was legally married to the mother. He was doing a 6 month stint working back home, long story short came back for a surprise visit and you can imagine some of the surprises he got. His name is on the birth certificate and they were legally married when the kids were born. They were divorced not long after he came back and he has been taking care of the kids in Thailand last 5 months or so. He also now has sole custody. Waiting on the papers from the court. The kids are Thai nationals, he hasn't done citizenship for them back home yet. Mother around but not sure where. Yes children living with him now and for the last 5 months. I understand now why he needs to leave the country again. I thought he could just extend his tourist visa or whatever he is on now. Does the first parental visa on a non O work like retirement does (or used to). Where as long as you leave the country in the first year and return the 12 months starts from scratch again? So effectively the first extension you can stretch out nearly 2 years? He must have come in on visa exempt and extended an extra 60 days? (total 90 days). He's done that twice back to back. How many time would he be allowed to do that? He reckons immigration told him he can do that 3 times before they will pull him up. I found that a bit hard to believe Thanks for your help -

Got a mate here with kids (sole parent)... too young for retirement extension. Trying to clear something up for him, he seems confused. He entered the country initially from Australia on a tourist 30 day visa, extended another 60 days. Went out of the country to Laos and came back in again....same deal tourist visa / 60 day extension with just over a month to go. SO he's on his second 90 day stretch. If he does not do the parental visa this time, how many times can he come in on back to back 30 day tourist visas / 60 day extensions (90 days)? Next one will be his third one. He seems to have this weird idea all he will have to do is enter from another country (Cambodia walk in). What is the difference between getting a visa between land crossing or flight? Is one easier than the other? What is the limit these days on back to back border hop visas? I thought he would simply be able to extend the visa he has now but apparently the agent telling him he needs to once again leave the country, get a non o and come back in before they can start the 12 month parent visa. I myself a bit confused with O / Non O visas. And by the way. Is the tourist visa he's on now an O, Non O or just a tourist visa? Whats the difference? Appreciate any help, this bloke has no clue and he will end up locked out of the country and his kids stuck here.

-

My statements do have tax deductions shown but it is very obtuse with little explanation. I think something like tax / sundries or something like that. I know because was directed to it by the super consultant I was discussing it with online. The reason it would be impossible to get a full breakdown is it is recalculated every moment the earnings rise and fall

-

4 replies all saying the same rhetorical stuff that we already know? Really? Are you bored? I did write the OP in a misleading way where you thought, or it may have looked like I was talking about tax on interest I earned from money I withdrew from super and invested elsewhere. I didn't actually mean that. I spend the money I withdraw. I was talking about the money that is actually accruing interest IN super. My bad. I think they refer to it as earnings rather than interest. You do realize being a non resident for tax purposes has nothing to do with Super unless you withdraw it and invest it somewhere else, and even then you can tell the bank to with hold 10% of your interest earnings and you are completely covered / tax paid. The problem is quite a few banks wont accept investments from declared non residents...U bank for one. Normal tax on super earnings is 15% resident or non resident and with held by the Super company and paid to the ATO. You don't have to be a resident for tax purposes to convert to a pension stream.... you simply have to be in Australia when you apply and when the Super company approves the change. Super and pension streams have nothing to do with residents or non residents for tax purposes. A trip back to Oz would cover that should it be worthwhile. I have clarified that with super company and my accountant. The 32% non residents tax is worst case scenario...say for example I was earning money in another country. I am a registered non resident for tax purposes by the way and as far as I know there is no big can of worms? You mix captain obvious statements with clearly incorrect / misleading statements, and this could be misleading to others reading this post that may benefit / by seeking the same advice.

-

The processing of the online form not a problem. I am sure I could've completed it and converted to pension stream as fa as the Super company concerned. The only reason I noticed it was when it came up with a space for Australian address / State / Postcode and the warning referring you to the PDS saying ATO requires you to be in Australia at the time of applying. The guy from the super company was saying your choice to proceed but he reckons he got advice from "the team" to say it was sketchy tax wise. I don't think the Super company gives a rats. It is actually an ATO stipulation, not the Super companies requirement. I am just worried the ATO will know I wasn't in the country when applying and possibly down the track I will get hit for the 15% I saved and the super company didn't keep. They do know exactly where you are these days with links to everywhere and your passport details. If you think its not a problem let me know, still keen to do it

-

I went though the process of setting up a pension stream this week and hit an unexpected snag. One of the requirement of the pension stream / tax saving is that you have a residential address in Australia (easy... my sons address) and that you are IN Australia when you apply for the pension stream and receive the Super companies confirmation. Could all be done online in a day. Doesn't say you have to be living in Australia, just that you have to be in OZ when you apply. I could have actually completed the application and process and got the pension plan but the super company did advise the ATO may, and often do check. And very easy for them these days to check if you are in the country at any given time. Worst case scenario you get a tap on the shoulder in the future have to pay any back taxes owing (15% that you saved on tax) plus a fine. Anybody else run into this or have a work around?

-

The 32% on withdrawals Superannuation completely false. Have clarified all that with accountant and super company. The Super company with holds 15% on earnings so no more to pay on withdrawal or at any time. No tax return is necessary as far as super goes. As gearbox said you can save the 15% with holding by moving to a pension stream. 32% as a non resident is worst case scenario if you have money invested with a bank etc and you haven't declared yourself as a non resident or haven't instructed the financial institution to with hold mandatory non residents flat rate 10% tax.