lannarebirth

-

Posts

18,698 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by lannarebirth

-

-

Someone has leaked the info that the US unemployment figures this week will be 10.3%

and the DJIA will respond to this by falling 1000 + in one day

must have been AlexLah. right?

WOW my source was right..........10.2%

They actually knocked off 0.1% to make the figures look " less bad "

so the markets could rally another 200 points for zorro's sake

I don't know why you guys are playing grab ass on this thing. It makes you both look stupid. Although stupid and making money is the better kind.

Anyhow, highest UE rates since 1983 I read. That worked out pretty well, in the end:

-

I use it as a supplement for feeding my porcine friend, the "Empress of Mae Ann". She likes her slop and she gives two thumbs up on rice bran, "lum". Want me to bring you a bag to judge if it's adequate for your needs?

Sawasdee Khrup, Khun LannaRebirth,

That's very kind of you to offer !

But we imagine that it is not very finely ground, and we cannot swallow anything really solid of any size (thanks to evidently permanent changes in my human's throat as a result of radiation).

If you care to say a few words about the texture, hardness, size, that would be most appreciated.

We visited a friend in Mae Rim the other day who now has a 70+ kilo wild boar in his menagerie; unfortunately his lady-mate died of "twisted stomach" recently. The wild boar was very impressive ! He was wary of us at first, but soon he ate some greens from my human's hands.

best, ~o:37;

It has a dust like texture. I would say very fine. In the rice milling process they schuck the husks first, abrade the bran off which has to be blown through the pipe as it's so fine. It often is left to fall to the floor and swept up and sold, but one can affix a bag to the output tube and catch it as it comes out. Why don't you buy some of that health store rice bran and I'll bring you some of this "lum" and then you can compare. What do you think?

-

Sawasdee Khrup, Khun UG, and Khun LannaRebirth,

@Khun UG, Thanks. Please Sir to kindly note the footnotes in the message and check them out at your own very leisure of time.

@Khun LannaRebirth, Thanks. We guess that you are using the rice bran as part of your mixture for feeding your canine friends ?

best, ~o:37;

I use it as a supplement for feeding my porcine friend, the "Empress of Mae Ann". She likes her slop and she gives two thumbs up on rice bran, "lum". Want me to bring you a bag to judge if it's adequate for your needs?

-

I'm not sure if it's the same quality, but I buy rice bran "lum" at the rice mill for about 80 baht for an about 20 kg sackful. Maybe there is further processing for human consumption? I don't know.

-

Its funny how CaptainARK wont go near the gold thread.

The Captain/Harmonica got banned

I noticed right after he went off the other night on some long post

about posting trades. He was tearing into one member in particular.

Who knows why but it was a odd post as usual

Ignore my last post, I'm not sure what I was talking about.

As far as posting trades is concerned it just doesn't work. Not even on an actual securities trading forum, which this isn't even close to being. Almost nobody trades what I trade or for the same reasons I trade it. What could they possibly get from me posting a trade I'm in for 5 minutes, and didn't know a minute before i got in that i would. Should I tell them afterwards? I don't think so. It's an exercise in futility.

-

Interesting update on India's purchase

I was surprised to find that India paid for their 6.7B in gold in SDR's

It poses the question.......

Did India want to hold the dollars or did the IMF not want dollars?

wrong question. the correct questions [and answers] are:

-what is India's source of the SDRs which are used to pay for the gold?

-can the Reserve Bank of India print SDRs? yes/no

-can SDRs be bought at vegetable markets in Delhi or fish markets in Mumbai? yes/no

-is it correct that SDRs can only be acquired from the IMF against payment of the appropriate currency amounts? yes/no

-does India have to use 44% US-Dollars to pay for the gold? yes/no

What is your point ?

India dumped fiat for gold. Not much else to be said.

I think the point is that the IMF dumped Gold in lieu of coming up with real cash.

-

Good article.

Even though I could pay cash, I am thinking about borrowing 40 grand to buy some bullion. I see limited downside at this point. I could even handle a temporary slide down to 800.

If I was looking to buy I think this is a nice pullback to do so in both Gold & Silver.

Could launch. Good Luck.

-

1200 SPX possible but gonna be tough with so many gaps open below.

Actually, only one gap remaining at 980. I was looking at Nasdaq 100 which has 3.

-

I like projects. I never did like maintenance and upkeep. I hire other people to do those things. Here, I've started on a project that I can't define exactly, but I'm pretty sure I can't complete it before I die, as then I'd have to keep it up. Makes me happy.

-

begging all traders:

as some interested prior posters have asked, if at all possible that many traders posting numerous very informative posts for all of us to read and enrich our trading knowledge which we appreciate very much....

but is it possible at all if you can also post some of your trades, just some--not necessarily all, of your trades for all of us to follow and practise....

would you be willing to share with us your actual trade, pls?

it would be very helpful for those who are just beginning to trade....

it would be even more helpful for those who appear to trade on the other side of the ledger, for them to learn how you trade profitably?

can you pls help all of us out that way, rather than posting passages after passages of insights and all....

can you pls show your actual ability to trade profitably?

thx much everyone, particularly those who have been helping posting insightful trading info and page after page of analyses and very useful info....

and if possible--can you also show us how you draw your trendlines before the facts rather than after the facts.... for example, if you can draw your trendlines before the market opens for the particular trades.... rather than drawing the trendlines after the market close.... so we can learn from you and see how you can use trendlines to predict... before market opens.... thx much all

wishing everyone profitable trading.... cheers

Fine gold doubt you will get any answers here , except for a few they mostly bears bit grumpy about missing a little old 3500 pt rally. The top traders forum anywhere is hotcopper.com.au click on weekend charting and you will find 100's of posts from top chartists willing to share. Although be warned most are extremely bullish till 2nd quarter 2010 at the very least. Good luck

Maybe even 3rd quarter '10. Imagine there will be a $USD boom or bust in that timeframe. Volatility going to pickup for sure. 1200 SPX possible but gonna be tough with so many gaps open below.

-

flying you jinxed it

but we up 12 again only half time , im off to bed now

lanna was referring to this chart dow

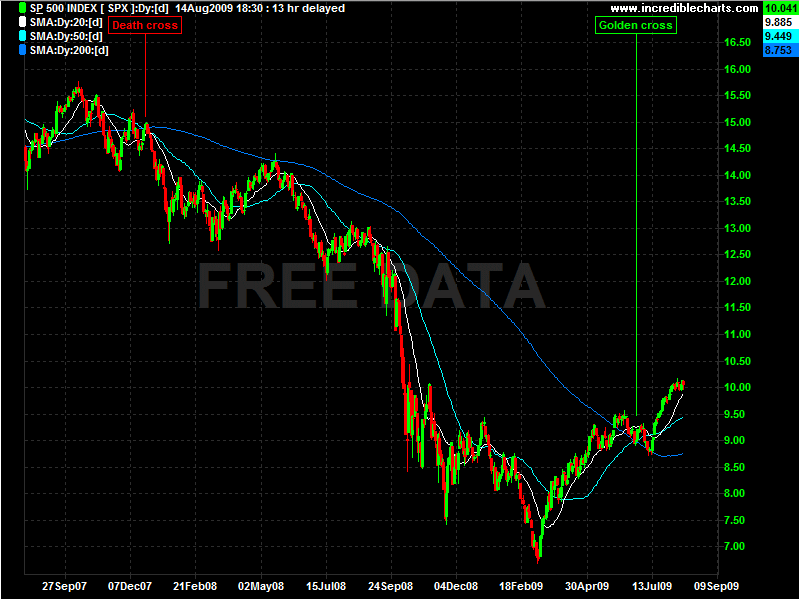

I never refer to the Dow, except for when I'm encouraging people not to watch it. I watch the S&P 500. I'm not a Bull or a Bear but I would note it's hitting downside targets more quickly than I would have thought, is not retracing much, and breadth stinks.

-

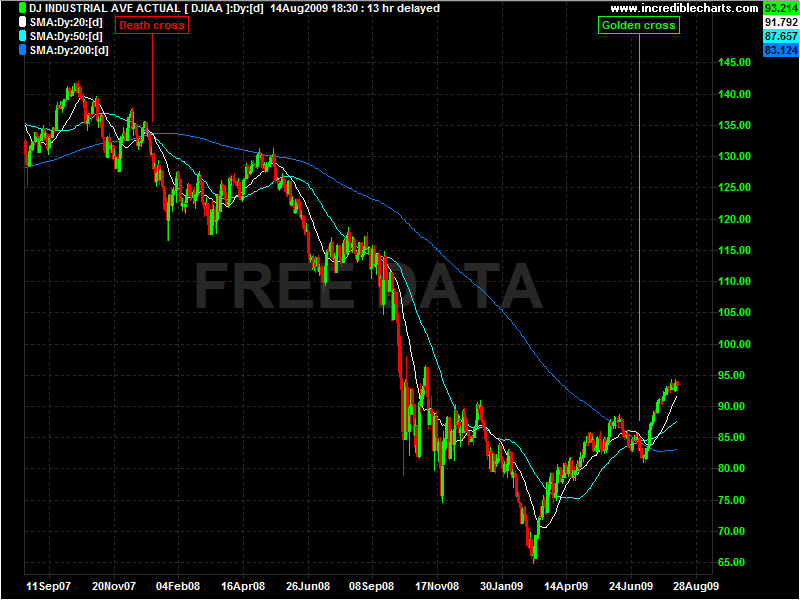

Guys Im no chartist Thats why Im a memeber of a chartists website where the experts live. We are at a milestone right now according the pros with a "Golden Cross" appearing on the dow chart. This week will be make or break time and if the charts are correct we could see some serious money start to flow back into the markets. If that's the case the last 6 months will look like beer money investment. Lets see what happens by next Friday night. The below is Cut n Paste.

the Dow and sp500 have both made a milestone this week by having the golden cross over. As I've read on finical sense the 50 day EMA line has crossed above the 200 day EMA line, signalling the end of the bear run. Is that possible in this negative environment?

So I checked that I'm on my charting system and sure enough that did occur on the 12/13th of August! Is this the point where scared investors finally tip their money in? Is this where long term investors are reluctant to sell?

"Long-term crossovers carry more weight than short-term events.

The Golden Cross represents a major shift from the bears to the bulls. It triggers when the 50-day average breaks above the 200-day average.

Conversely, the Death Cross restores bear power when the 50-day falls back beneath the 200-day.

The 200-day average becomes major resistance after the 50-day average

http://www.tradingday.com/c/tatuto/movinga...crossovers.html

OK, sorry, I thought that was you.

-

Dow up 100 or so.

looking like last weeks up 100 down 100 same day was a classic pump n dump tree shake . You cant beat the big boys . Anyone holding just use basic T/A, keep

it in the channel. Looking good last 10 months and If we can hold tonight the v could make history.

trillions waiting for a magic wand, nice n safe they will jump in hard at 12000. for the 15% p.a return for next few years

zzzzzzzzzzzzz boring, big bucks now

Refresh my memory if you would. Were you the one hailing the significance of he 50/200 crossover?

-

It's all good.

-

if he was gettin a share of the google ads money his posts would have been top earners. theyll be inviting him back to boost the numbers again. always entertainning. 'free water' became a cult classic.He didn't say Red Lion; he said Red Loin. I took that to be some place where your loins get red. Maybe some kinky place where you rub chili pepper on your crotch.

Now that's what I call 'hot action' !

Although as trainee riff-raff, I don't often visit the establishment, I would agree that at some point the free-publicity ought to be backed-up by a little sponsorship money for TV. Play the Game Basil !

how many times has red Lion been mentioned since he was banned for saying it once.

is it safe? not tonight or tommorow.

The hypocrisy is astonishing. How many threads have been run by Mikes,Pinkies,Piggy's, Charlies, Miguel's, Dukes^3, and on and on and on, including some right now.Who the hel_l cares?

-

I'm not sure I was dishy, but my mother always said I was handsome. Sometimes when I'm walking in the city late at night, random women (?) will add their confirmations to my mother's unsolicited view. I'm trying to not let it all go to my head.

-

I puta a little bowl of fried rice outside, away from the house. That seems to keep them happy.

-

Lemontree opposite Kad Suan Kaew. Not posh - no atmosphere - excellent Thai food.

If you find the Lemon Tree, walk past one door to Taiwan Restaurant. Best noodles in Chiang Mai, or maybe anywhere.

-

-

-

That's why I dont really agree with the premise of deflation. The stock market's up, commodity markets are up, property markets are rising. I think that is inflation. The problem is it isnt real inflation (too much demand). And as I see it Bernanke et al will go on trashing cash until he has convinced people that he has created inflation at which point they will spend. So the medium term outlook is for inflation and ZIRP implying negative interest rates. As rates go increasingly negative then asset prices rise but how far can you take it. What sort of bank lends without a theoretical profit? And when rates go up we are all stuffed.

Someone started a thread in the Chiang mai forum abboutland prices. Going only from my own observations I stated that during this recent economic downturn not only had I not seen (maybe others have) prices declining, that I saw firmness and even price increases. I had no explanation for why this should be happening, as indeed sales turnover is less. I sqid it felt like there was a defacto currency devaluation going on and it was manifesting itself in asset price appreciation. I said that was probably an absurd notion, not to be taken seriously, but maybe not.

-

I know that many went short yesterday, Why traders bet against an up trending dow is beyond me. Media always provide the spark I guess

That is hard to believe. If so, you need to trade with a smarter group.

Going short yesterday would mean that they were betting that after 4 down days in a row there would e a fifth. Low statistical odds. Going short yesterday would mean that reaching the 50 day ma where most were looking to buy back in they thought they should sell. Going short before the most awaited bit of economic data in weeks. Hmmm

most buy at the top of a rally, you know that as well as i do. Same would apply in a short. Agree with your odds but to the average punter it didnt look real good. I think the longest up trend in the recent rise was 11 days straight and yes you could see the dumping on 4th and 5th day. Trade with a smarter group? hmmm... a little bit of sarcasm I detect

My trading is brilliant on display page by page, thanks for the suggestion however my group is doing quite well

My trading is brilliant on display page by page, thanks for the suggestion however my group is doing quite well

I wasn't being sarcastic, really. I just find it hard to believe that anyone thought yesterday was a good day to initiate a short position.

-

I know that many went short yesterday, Why traders bet against an up trending dow is beyond me. Media always provide the spark I guess

That is hard to believe. If so, you need to trade with a smarter group.

Going short yesterday would mean that they were betting that after 4 down days in a row there would e a fifth. Low statistical odds. Going short yesterday would mean that reaching the 50 day ma where most were looking to buy back in they thought they should sell. Going short before the most awaited bit of economic data in weeks. Hmmm

-

One other thing. The thread title is "Investors". I don't consider IB an investment brokerage as much as a traders brokerage. The platform is not that easy to use for a novice and their charting sucks. There is no "hand holding" and there is no market research or insight to be gained there. Still, I think it's quite good for trading. I do not trade forex except occasionally in the futures market, so I have no idea how good they are for that. Options, futures shares trading excellent IMO.

How badly does the charting suck? They must have charts; exactly what is it that you don't like about them? Just how little market research is there? I'm assuming they have balance sheets and things like that, P/E, P/B ratios and such. Another question: have any of you switched brokerages online? Maybe I'm a Luddite, but I'm a bit skittish about transfering large amounts of money from one company to another in cyberspace. Like maybe they don't call it space for nothing. Also I'm considering keeping my E*Trade account and opening an IB account for foreign trading, splitting the money between the two. Later, if I love IB, I might go with them exclusively. Any thoughts on that? Thanks.

Well, if you're not used to Tradestation or Esignal charts you'd probably find it adequate. You can do studies, trendlines, fibs, etc.. Can't program but you can do simulated trading in Real Time.

There is no research at IB of any stock or whatever. You can use Yahoo or another similar site though.

I have never had a problem wiring money either into or out of IB. I did have a problem opening an account once having to do with supplying an inordinate amount of proof to show I live where I told them I live.

For newcomers the IB platform can be a bit twitchy. Hit the wrong button and you bought something, Not paying attention? You just doubled down rather than sold out your order. I recommend some time on the simulator.

Oh, here's what a basic IB chart looks like, but you can modify in any number of ways:

Politics And Thailand's Wealth Gap

in General Topics

Posted

I wouldn't say so, but I guess some would. He's just a songwriter you know, but to think he didn't change his times , for example the civil rights movement, is I think incorrect. Take a look at this:

http://www.youtube.com/watch?v=oUpfMFOoYpA

Anybody comes up with something like that in Thailand and they're a dead man. hel_l, you couldn't even say it in America now. They'd just laugh at you.