Nemises

Advanced Member-

Posts

2,757 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Nemises

-

As at Dec 2022: Jobseeker asset test The combined worth of an applicant’s assets are considered when assessing their eligibility, and if that rises to exceed certain limits the recipient’s payment will be cut off. Assets for an eligible single JobSeeker recipient can not exceed $280,000 for homeowners, or $504,500 for non-homeowners. For eligible recipients in a couple, combined assets can not exceed $419,000 for homeowners, or $643,500 for non-homeowners.

-

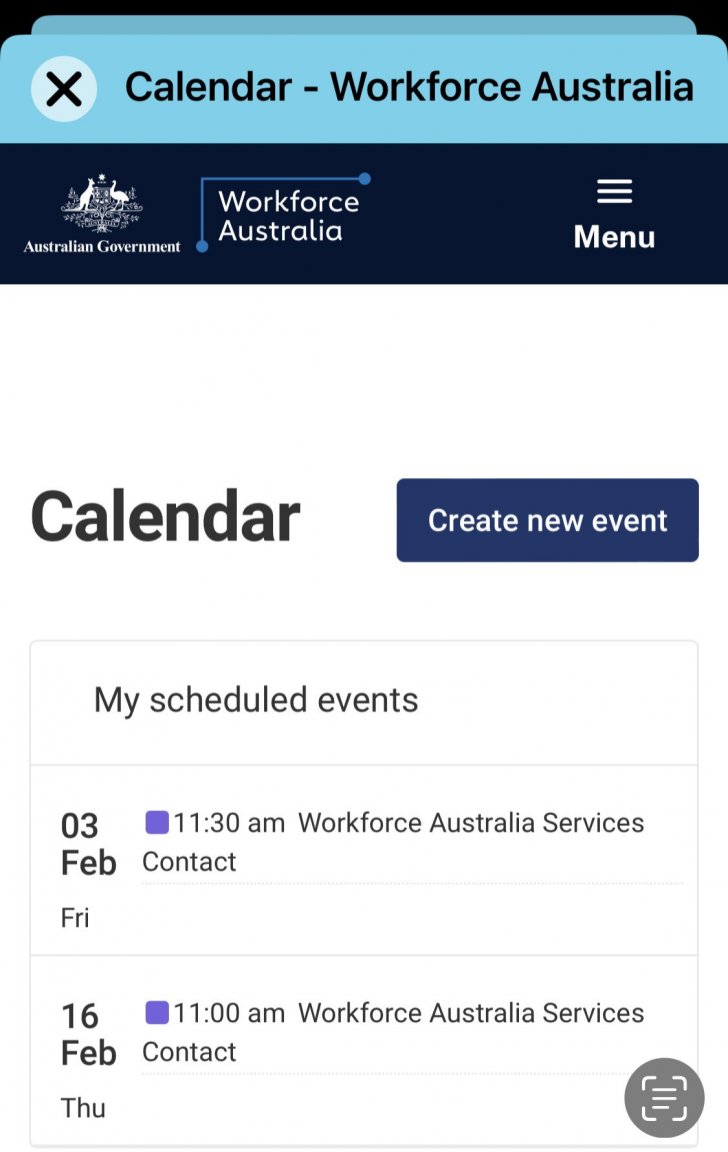

Here’s a screenshot from my MyGov app earlier this year confirming their requirement for me to report in person to their office every 2 weeks in order to receive the dole. As showing, not only did they instruct me on what date I needed to go there, but also at what time. Perhaps their wanting to see me in person every 2 weeks had something to do with me having just arrived back in the country after having lived overseas for many years…

-

Well, I started off on the dole but because they wanted me to attend their office every 2 weeks I had to think of another benefit because my house sits are sometimes far from my local Centrelink office. Enter the carer’s pension for an elderly relative! It pays $1,200 per fortnight. I bank $1,000 and the $200 pays the grocery bill. I also get free car rego, and heavily subsidised pharmaceuticals when needed.

-

Yes, able to look for work. No, never refused it. I protest their requirement to report to them every 2 weeks - to no avail. The report involves me telling them I’m still looking for work, the guy them marks me as having attended on his computer and he says “see you again in 2 weeks”. In and out in 2 minutes. An absolute joke.

-

I didn’t sell anything, I left my stuff and car in storage and now doing my 2 years (rent-free!) in Aus and saving $A2k a month from welfare benefits whilst here. Back to Thailand next year with the extra $A52k welfare savings - plus pension for life. Thai GF visits me here every 6 months. So, in my situation, obviously not feeling sick about returning to live in Australia for those 2 years.

-

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Today's Sydney Morning Herald: Christmas is coming early for many senior citizens, with significant changes to the pension from July 1. It’s an interesting change; the pension rates themselves are not changing, but the thresholds that determine how much pension is paid have been adjusted for inflation. The result is that many part-pensioners will now move to a full pension, and some people who are ineligible for a pension – because they are over the assets test cut-off point – will be eligible to start claiming a part-pension and all the concessions that go with it. The big news is that every couple who are part-pensioners now should get a $50-a-week increase in their pension, while singles will get $35 a week. These benefits are available only to part-pensioners because they are due to a change in the taper rates – not to an increase in the amount of pension payable. The assets test cut-off points will change too. The lower level at which the pension starts to reduce has gone up from $419,000 per couple ($280,000 for singles) to 451,500 and $301,750, respectively. The upper level at which eligibility for a pension cuts off moves from $954,000 for a homeowner couple to $986,500, and for singles the numbers go from $634,750 to $656,500. The new numbers also increase the amount pensioners can earn before their pension starts to reduce under the income test. For a couple, the income test cut-off point rises from $336 a fortnight to $360 a fortnight – for singles it increases from $190 a fortnight to $204 a fortnight. Deeming rates remain at generous levels: between 0.25 per cent and 2.25 per cent. The government promised a year ago that these would be frozen until July 1, 2024, but thresholds have been increased slightly in line with inflation, which will have a small benefit to all income-tested pensioners. An important thing to note is the way the tests intersect. Centrelink tests you on both the income test and the assets test, and then applies the one that gives you the least pension. But the tests tend to be out of kilter, which can lead to some anomalous results. For example, if you’re asset-tested, deeming is not relevant – it’s only used for the income test. Furthermore, the rule that a pensioner couple will start to lose their pension once income reaches $360 a fortnight does not affect an assets-tested pensioner. Think about Jack and Jill, who own their home and have $600,000 in total assessable assets, of which $550,000 are financial assets and subject to deeming. The couple is subject to the assets test, and their pension will rise from $530 a fortnight to $580 a fortnight each after June 30. Because they are assets tested, they can earn $36,000 a year with no adverse effect on their pension. Under the proposed adjusted deeming rules, their $550,000 in financial assets would be deemed to be earning $10,000 a year, which gives them space to earn an additional $26,000 a year with no effect on their pension. -

God doesn't exist. It's a man-made conscript to control the weak and gullible by fear.

-

Can you enlighten us as to where you will be moving to? Didn't think so...

-

Where will you move to?

-

Do you believe in God? Yes, I believe in God. I also believe in the Easter Bunny.

-

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

The person being cared-for doesn’t need a full time carer, and if they do need assistance with anything there are others close-by to help out. -

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

No link ..but plenty of photos! -

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

After 6 years of living in LoS arrived back to AU late last year (aged 65) with the intention of doing house sitting for “those 2 years” whilst obtaining the dole in the meantime. Immediately obtained the dole but the fortnightly reporting (in person) to C’Link was a big problem when not housesitting locally. Fortunately I qualified for the Carer’s pension, allowing me to ditch the dole thus enabling me to also travel to distant sits to live rent-free …and collect $1,200 per fortnight along the way! So life here is good with my bank balance heading north quickly. It got better when my beautiful Thai tilac (respectable, secure employment) successfully obtained an AU tourist visa - she arrives next week and intends to visit me every 6 months - in a new city each time! Can understand the 2 years “jail sentence” as not being possible for many, but so far, touch wood, it’s working perfectly for me. Renewed my NSW car rego today for free and the $2.50 ride-all-day on buses, trains, trams and ferries is brilliant. Loved going to the Sydney beaches over summer to swim in deep, refreshing clean oceans with cooling onshore breezes. Also loving the clean air quality … and of course the $3.30 bottles of red (Barossa Valley) wine from Aldi! ???? Enjoying catching up with family and friends and going to regular RL matches and the big horse racing carnivals. Expensive to eat out here and schooners are over $10, so lots of that cheap Aldi wine and home cooked meals. As much as I’m enjoying it here, it’s Thailand where I want to live, so upon reaching 67 next year the plan is to switch to the aged pension from the carer’s pension then immediately return to my TH tropical paradise and my tilac.. with the aged pension in the back pocket - thank you Australia ???? Anyone else want to update us on how they’re going, doing their 2 years “home detention”? -

The beauty of using an agent.

Nemises replied to JeffersLos's topic in Thai Visas, Residency, and Work Permits

You forgot to mention the 800,000 baht these people have sitting in some Thai bank doing SFA. I invested the 800k into my home country’s (blue chip) stock market 10 years ago and it’s now worth 2M baht. Feel sorry for those people not only going to an immigration office but also not getting a decent return on their 800k. Sad really. ???????????? -

Australian Tourist Visa Application

Nemises replied to David48's topic in Visas and migration to other countries

Hi forum, just wondering if anyone knows of a visa agent who can assist me (presently in AU for 2 years) get a tourist visa for my TGF (works [respectable, long term gov position] and lives in Khon Kaen). Any help appreciated. -

Australian Tourist Visa Application

Nemises replied to David48's topic in Visas and migration to other countries

Good to hear that. Any link/s I can show to the people who disagree with your answer? -

Australian Tourist Visa Application

Nemises replied to David48's topic in Visas and migration to other countries

Apologies if this has been asked before, but is it true that you must have been divorced for at least 6 months before being eligible to obtain a tourist visa for your TGF to visit Australia?