Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

When do they increase the Elite visa prices?

Mike Teavee replied to timoti's topic in Thai Visas, Residency, and Work Permits

I consider this every extension renewal time & My thinking is, I keep 800K in the bank all year around & if I get the 5 year visa I would immediately free up 200K. I don’t need the money but if I did then it’s a good way of freeing up some cash until my Pensions start in 2.5 years at which point I could either move to the income method or top up to 800K or (most likely) spend 400K & get an extra 15 years. My main reason for not getting one isn’t so much the cost, more the I don’t want to get off of the Non-IMM O “Treadmill” & find at some point in the future the rules change & existing holders are Grandfathered in (E.G Increase in money in the bank, compulsory health insurance etc…) -

Agree 100% but you can’t blame a young guy for not including Health Insurance in that. I honestly did not even think about Private Health Insurance ( Except for the tax I paid on my BUPA insurance from 26) until I was 53 Even working in Singapore my company gave me Health Insurance so it was only when I retired that it came on my radar (& even then only because they were making it compulsory for Non-IMM OA holders, I’m No -IMM O). Call me Stupid (you wouldn’t be the 1st) but I bought my 1st Health Insurance at 54 & at that time it was very Alien to me…

-

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

You clearly don’t have a clue about Health Care in the UK. It’s “Free” (won’t go into how it’s funded or how I had to pay additional tax for it as my company gave me Private Health Insurance as a “Benefit in Kind”, never used it but thanks for taking the 40% tax from me for having it) So none of us (myself included) thought about it until we came to not live there. Is your Country that much different (Not that I would comment on your countries Health provisos as, I wouldn’t have a clue)

-

Am thinking maybe I should take a more "Grown Up" (None of us wants to think about our deaths) approach to what happens when I die... So would appreciate any recommendations for a Thai Lawyer (Pattaya) who can help me put a Will together for my Thai Assets...

-

What Movies or TV shows are you watching (2023)

Mike Teavee replied to CharlieH's topic in Entertainment

Season 2 of Before We Die has dropped… https://m.imdb.com/title/tt13125694/ -

I find Mister Prakan https://misterprakan.com/th/health/main?lg=en to be a good site for comparing different Health Insurance Polices/providers. Can purchase the policy through them (I did & found their service very good, E.g. When I needed the Covid Insurance certificate for the Thailand Pass to return to Thailand they emailed it me within minutes of asking) or through another Broker, chances are the prices will be the same.

-

I'm pretty sure that by "Visa Account" he meant the money in the bank to support his Extension (to his permission to stay in Thailand, not the one he's added to his house) As an aside I have heard that some banks will allow your partner to be a "Silent" Joint Account holder on your "Extension" account, their name does not appear in the paperwork for Immigration but they are added to the account as a signatory so can withdraw money.

-

I decided to get Health Insurance around the time they made it mandatory for the Non-IMM OA holders as I felt that there was a high risk of them applying it to Non-IMM O holders at that time. Figured it would be sensible to get on the ladder "Early" so took the (Pacific Cross "Visa Friendly") policy out the day before my 55th birthday & this year (day before my 57th) the renewal was <30,600 for $100K cover (excluding out-patient & has a 100K deductible). I keep 2 years spends (updated a few times per year depending on dividend income/fx rates) in the bank anyway so am sort of also self-insured should something bad happen & the Insurance doesn't pay out. End of the day we all have our own levels of risk, for me the risk in being forced to get Health Insurance later in life (as happened to the Non-IMM OA holders) was the nudge I needed to get Health Insurance whilst I could. Edit: I appreciate this doesn't answer the OP question so for that I would just say that as with any long term savings, you're always already too late so best start catching up now.

-

I'm using a (10 year old) MacBook Pro which cost me the same as my previous laptop (Alienware) & the one before that (an 18" HP Media thing that doubled as a TV) - Neither of which lasted longer than 18 months. However, I am noticing that the screen is getting dimmer at the corners & am obviously have a problem between the Graphics card & Windows (use BootCamp with Win10) as it refuses to boot if I don't disable it (MacOS works fine though)... So am thinking of having a change. I spent my career in IT Dev/Architecture so am used to buying the most expensive/powerful machine that would enable me to run a bunch of VM Servers/Clients but now I'm retired I only use it for Internet Browsing & Word/Excel/Powerpoint/Visio (still help mates out putting presentations/pitches together). So after very cursory research, I came up with this https://www.asus.com/th/laptops/for-home/vivobook/asus-vivobook-14-s413/ S413EA-EB341WS : INDIE BLACK Operating System: Windows 11 Home CPU: Intel® Core™ i3-1115G4 Processor RAM: 8GB DDR4 on board Storage: 512GB SSD Display: 14.0-inch FHD Anti-glare display Keyboard: Backlit Chiclet Keyboard Office: Office Home and Student 2021 price : 15,990.- Baht Which looks like it would do the job (though Instinctively I would like a faster processor & more RAM) and for < 16K it looks like a good deal to me (+ I did have an Asus Chromebook for 3-4 years & loved it so am happy with the brand). Apologies I haven't read the full thread so don't know if this has already been mentioned but somebody was recommending getting a Mac & somebody pointed out that the OP needed MS Office - OP, You do know that you can get MS Office for MAC https://msofficestore.us/product-category/ms-office/mac-microsoft-office/?gad=1&gclid=Cj0KCQjw1_SkBhDwARIsANbGpFsLCwolm1Dm0egj5DfiB31iZ2A1y1CI_4ttrSDa6t6g2caYXerfIFwaAqmSEALw_wcB

-

With Bangkok Bank you can do yourself with a Pin number from an ATM if you don't know yours (It's a 4 digit number that was used to set-up mobile banking not the 6 digit pin you use with it). I couldn't remember mine (wasn't sure if I ever knew it as the girl in the Bank set it up for me when I opened the account) but had no problem resetting it at an ATM and getting the App to work on my new phone.

-

Website for temporary flight reservation

Mike Teavee replied to thecyclist's topic in Thai Visas, Residency, and Work Permits

Which Airport were you flying from because I've flown with SIA from Changi & not been asked for an onward ticket (though I was PPS at the time) but have been asked by them for an onward flight when travelling back from Manchester (UK), at that time I showed them my Singapore Employment Pass & all was OK. Completely different story for a Mate of mine who was travelling back with Emirates from Birmingham & had to buy a return ticket from Singapore even though he had an EP to show he worked there. Edit: Just remembered, I have been asked by Silk Air (SIA's budget carrier) for an onward ticket when flying to Davao, at that time I was coming back via Kalibo/Boracay on (I think) Tiger (Could have been Air Asia) so was able to show them the return ticket albeit with a different airline & from a different airport in the Philippines. Have also been asked by Scoot (Another SIA Budget carrier) for a return ticket when travelling to KL But at that time I'd quit my job & was leaving Singapore so showed them my Exit letter from IRAS (Singapore Tax Authority) & they couldn't really stop me from leaving. -

What Movies or TV shows are you watching (2023)

Mike Teavee replied to CharlieH's topic in Entertainment

Season 3 of The Witcher has just dropped (on Netflix) -

Requirements for a Retired expat to buy a vehicle

Mike Teavee replied to dingdongrb's topic in Thailand Motor Discussion

When I got my CoR I was asked what it was for (to get a Tax Identification Number) & was told that I could only use it for that purpose, if I needed one for another purpose (e.g. Buying a Car) then I would have to get a new one. As an aside, it seems a CoR is needed to open a bank account (at least in Pattaya / Bangkok) nowadays -

Possible return to the UK, without any money.

Mike Teavee replied to Terry2905's topic in UK & Europe Topics and Events

As has been mentioned, click on @Shannoblic name on one of his posts or his highlighted name in this Post) and you'll see a screen that looks like... Click on the "Message" option & you'll get a screen that looks like... His name will already be populated so just give your message a Subject, type out your message & hit send in the bottom right hand corner... -

How to get my tax refund?

Mike Teavee replied to Lorry's topic in Jobs, Economy, Banking, Business, Investments

Cardless Withdrawals are great but what if you need cash & are somewhere that doesn't have one of your Bank's ATMs (My closest Bangkok Bank one is a 20 minute walk from where I live & I've never been able to find one in Terminal 21, Pattaya) or need to buy something online (assuming you don't have a Thai Credit Card). For the sake of 3-400b pa it makes sense to me to keep the card. Re: Reclaiming Tax, I gave up on mine after:- Visiting the office 3 times (3rd time sent to a different office) Completing a form detailing my pension by answering "Not Applicable" a dozen times as I'm too young to draw my pension Providing photocopies of every page of my 2 bank books & passport. The final straw came when they asked me for photocopies of every statement of my overseas accounts, it would probably cost me more in photocopying/paper than the 4,331b they owe me in withholding tax. -

Website for temporary flight reservation

Mike Teavee replied to thecyclist's topic in Thai Visas, Residency, and Work Permits

Fully Flexible/Refundable tickets are more expensive than a restricted ticket so it does cost you when you purchase the ticket but I get some guys want the flexibility so are willing to pay more. -

Swedish Man Arrested on Samui Island for 75 Days of Overstaying

Mike Teavee replied to webfact's topic in Koh Samui News

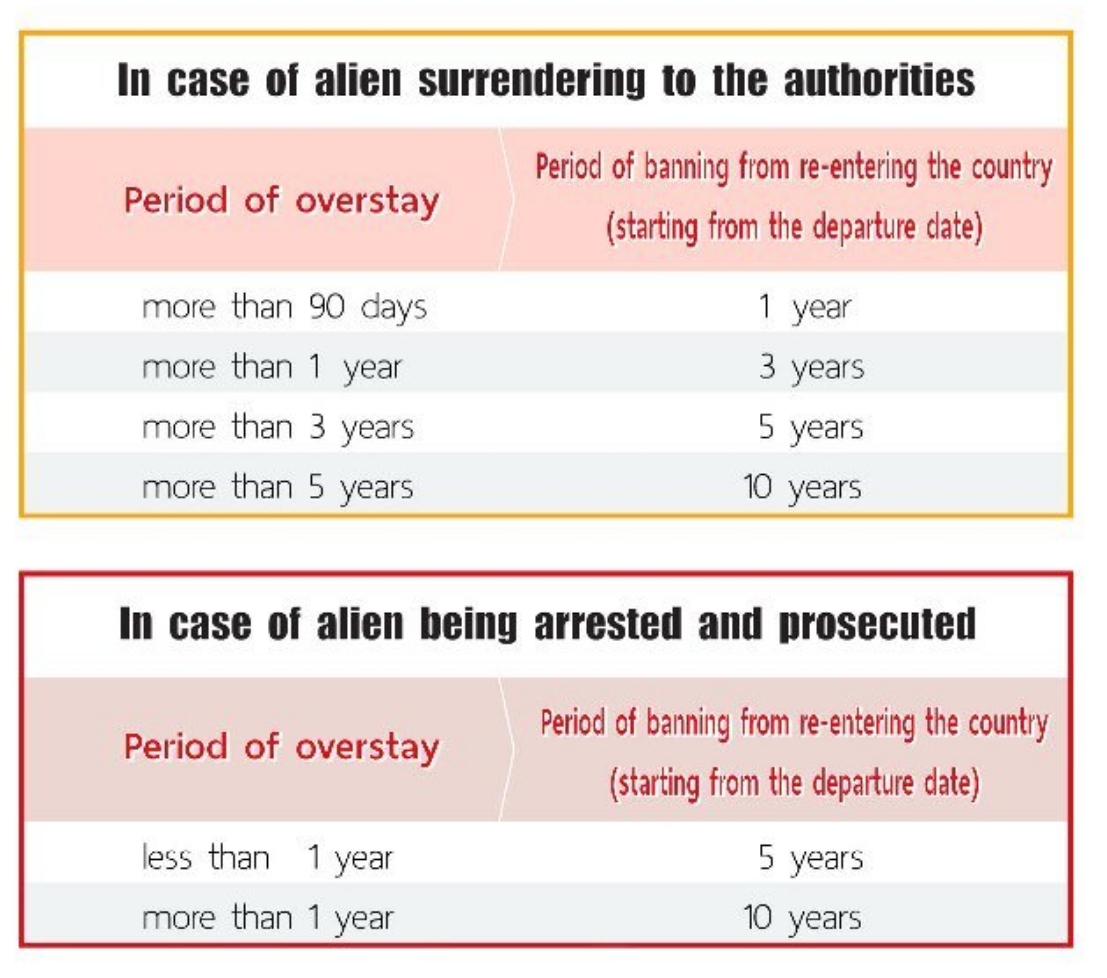

For getting arrested (i.e. not going into immigration to sort it out voluntarily) you get a 5 year ban for any overstay less than 1 year & a 10 year ban for over 1 year overstay. -

Possible return to the UK, without any money.

Mike Teavee replied to Terry2905's topic in UK & Europe Topics and Events

As he’s too young to get a Pension & doesn’t have any other income I’m assuming he’ll get housing benefit so council will be paying. -

I plan on doing it on my next trip (either October or May depending on whether my parents visit us in Oct/Nov), will be getting my extension in September & wasn't going to bother getting the stamp transferred as I thought most people just travelled with 2 passports until they're next extension. If it is going to be a problem for travelling outside of Thailand during that period then I'll probably get it done at Jomtien IO as I tend to use the Fast Track Channel as BKK & don't recall seeing an Immigration Desk 3 whilst going through.

-

Website for temporary flight reservation

Mike Teavee replied to thecyclist's topic in Thai Visas, Residency, and Work Permits

https://onwardticket.com/ -

No it's an Imperial measurement & equates to 14lbs or approx. 6.35 KG

-

Possible return to the UK, without any money.

Mike Teavee replied to Terry2905's topic in UK & Europe Topics and Events

Is your Pension frozen in Laos Simon? I know it is in Thailand & it's not in Philippines but have no idea when it comes to Laos, Cambodia, Vietnam, Indonesia etc... -

What Movies or TV shows are you watching (2023)

Mike Teavee replied to CharlieH's topic in Entertainment

Another vote for Black Mirror but for me the best Episode of Season 1 was the 1st one especially as Rory Kinnear came across as a lot like David Cameron at that time.