Bvor

Member-

Posts

397 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Bvor

-

anyone got a 60 day visa exempt yet?

Bvor replied to kwilco's topic in Thai Visas, Residency, and Work Permits

please substantiate with link to official rule/regulation - what was source of visa agents "assertion"? -

anyone got a 60 day visa exempt yet?

Bvor replied to kwilco's topic in Thai Visas, Residency, and Work Permits

Yeah, amazing thailand. -

anyone got a 60 day visa exempt yet?

Bvor replied to kwilco's topic in Thai Visas, Residency, and Work Permits

Bangkok Post reports that the PM said he will sign off on Monday so until he does that and an announcement is gazetted it will still be 30 days. Been reported that Gazette announcements are done daily so maybe 60 days can still be effected 15/7 "sometime" but more likely a day or two later......TIT style. -

anyone got a 60 day visa exempt yet?

Bvor replied to kwilco's topic in Thai Visas, Residency, and Work Permits

The silence is deafening! -

Thailand to tax residents’ foreign income irrespective of remittance

Bvor replied to snoop1130's topic in Thailand News

hmm, hope more case law can be more considerate where appropriate. EG. I'm "gifting" to help a poor family for kids education and 24/7 homecare for bedridden vegetative "gf" father - not for any tax avoidance reasons. I dare not register marriage/defacto cos Centrelink will reduce my OAP. Best I not do 180> days in LOS - "gf" can always accompany me back to Oz for 1 or 2 of my swings per year. -

Thailand to tax residents’ foreign income irrespective of remittance

Bvor replied to snoop1130's topic in Thailand News

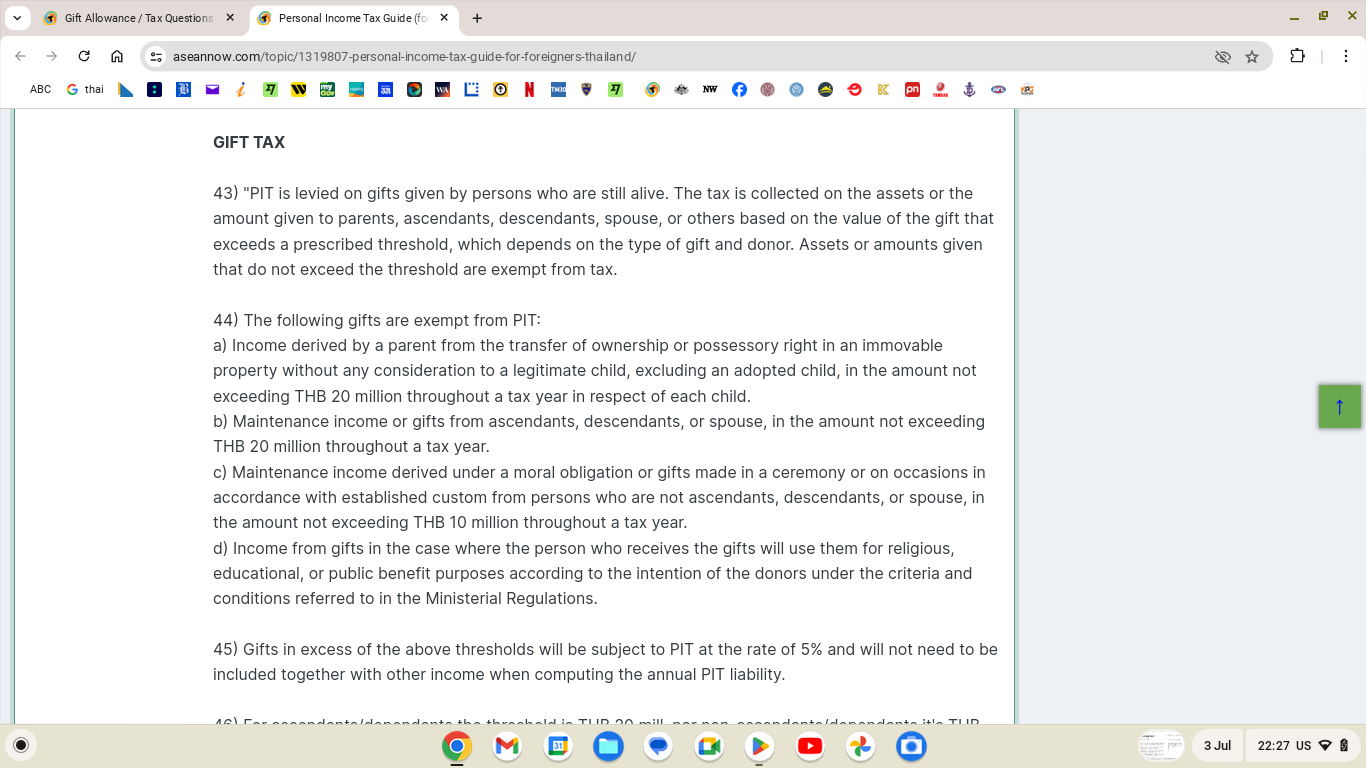

I don't think I need to as not relevant to my query in context of long-time girlfriend. Just found on another thread re Gifting and Tax an interesting reference to this issue - see attached 44(c) which maybe can be applied to long-term girlfriend not registered as spouse. -

Thailand to tax residents’ foreign income irrespective of remittance

Bvor replied to snoop1130's topic in Thailand News

Are gifting allowances only applicable to direct Thai family members thereby excluding all other Thai persons eg long-term girlfriend? -

60 day visa exemption for select countries

Bvor replied to wmlc's topic in Thai Visas, Residency, and Work Permits

Does "good authority" know when "begin on July 15" will be "officially announced"? -

Australian OAP Taxation Issues.

Bvor replied to Will27's topic in Australia & Oceania Topics and Events

That's all very well for the DTA/OAP bizzo but what's your take and or anybody elses take on my SAPTO tax met in Oz query. -

Australian OAP Taxation Issues.

Bvor replied to Will27's topic in Australia & Oceania Topics and Events

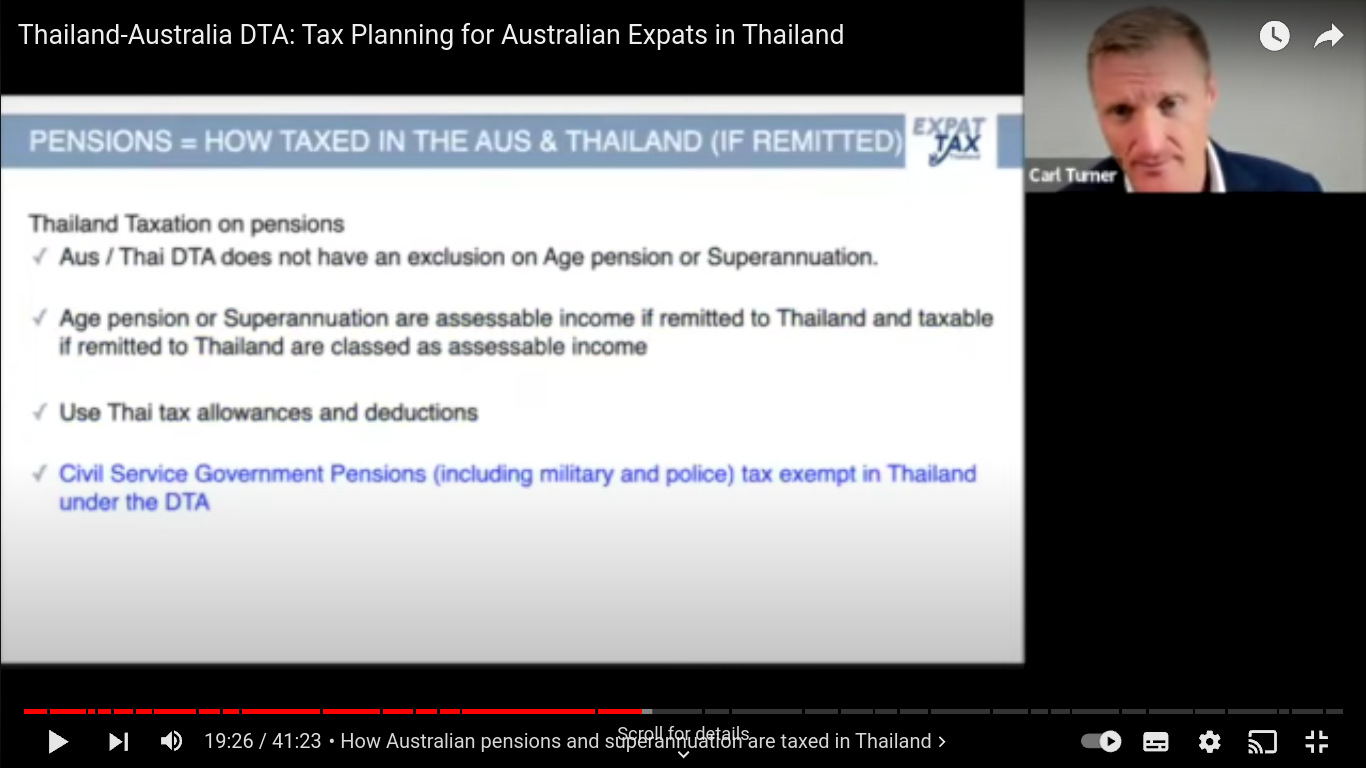

I sent him a query weeks ago, which he received but has not yet answered, whether the application of SAPTO is deemed to have paid the tax payable on my OAP - ie tax has been met in Australia - what is your take? It may be irrelevant to my intended <180 stays in LOS but I still would like clarification specific to my query as I may decide to go 180> sometime down the track . Attached is screen shot from youtube clip re DTA and OAP. -

Australian OAP Taxation Issues.

Bvor replied to Will27's topic in Australia & Oceania Topics and Events

I'm with you that change will eventually occur (calm down KH bashers) but it appears been sitting in the Khun Jones in tray for 2 years or so plus the time elapsed since libs first proposed them makes forecasting how much longer somewhat tedious - bit like some LOS proposed changes. -

yes and resulting in Thailand losing my >180 days spending which Oz will now gain......som nam naa!

-

yeah, whether or not the proposed 60 day visa exemption is available 4 times per year by air will be interesting albeit evisa's still available.

-

I don't want stays of 60+ days ............what suits me is 44 day stays 4 times a year so i am under LOS 180 day rule and will then also be over OZ 183 day rule. Where i am coming from is........... If the proposed 60 day visa exempts change comes to be and can be utilised 4 times a calender year for 44 day stays i will do. I am returning to OZ 20/6/2024 and will wait for more clarification of how BKK I/O interprets proposed 60 day visa exemptions per calender year before i do next LOS stay. I want to avoid LOS officialdom as much as possible but if LOS B/S insists i will do evisa tourist visas when in OZ.

-

cos 44 day stays (x4) is enough for me these days and proposed 60 day visa exempts (x4) will hopefully facilitate so i have zero interaction re visa's and thai "officialdom" whether it be in LOS or OZ in any shape or form. evisa will be plan B though.

-

yes i have........... LOS tax would be very minimal but not so the beauracratic BS. Done my research re OAP,visa's, tax tables, DTA's etc as it applies to me. I have a life in OZ as well as LOS. Cost of 4 airfares per year is ok with me. Been doin visa exempts/tourist visas for approx 20 years with my LOS/OZ swings. Its my intention to remain an OZ tax resident and not be a LOS tax resident. thx for your input cheers

-

up to me......🙏

-

have decided to do <180 days and not deal with LOS new taxes/TIN. have decided to do same. thx for your summaries albeit my SAPTO "tax paid?" question still not clarified however not relevant to me anymore with my intended LOS/OZ swings.

-

FYI Pattaya City Expats Club re income not subject to tax and DTA albeit no determination. The guest speaker then moved on to the Revenue’s suggestion that, from January 2025, tax residents’ worldwide income, whether remitted to Thailand or not, would be taxable. However, this plan needed the approval of Thailand’s parliament which had not yet even begun to consider the notion. Answering a series of member’s questions Mr Carden said 61 double-taxation treaties would be important in the hypothetical scenario – although the detail varied one agreement from another. Many issues would need to be addressed, for example whether income deemed to be tax-free in the home country would be considered tax-free here. The example given was UK premium bonds whose winnings are specifically exempt from taxation under UK law.

-

and maybe you are right, can only wait and see how things pan out. in my circumstances i'm ok to do 4 LOS stays <180 days per year and not be declared a LOS tax resident on some database. cheers

-

i tend to agree. however am interested in having some clarity on the reason why LOS won't tax the money i transfer to LOS ie tax already "covered" by SAPTO or other reason. its really a moot point for me now that i intend to stay under LOS 180 day rule so i should let it go.