Etaoin Shrdlu

Advanced Member-

Posts

2,466 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Etaoin Shrdlu

-

I think he pentagon leases space at Utapao from a contractor, so technically this allows both the US and Thailand to state that there are no US military bases in the country. Then there is JUSMAGTHAI, which has been here since 1953. I think the US considers it an overseas military base of some description. Others with more detailed or correct info, please comment.

-

I suspect that AA World is an insurance broker. WR Life is also an insurance broker according to their website. There are other threads discussing WR LIfe and the possible location and financial status of the insurance company actually providing the coverage under the policies they issue. So far, this remains an unanswered question as far a I can tell. Perhaps someone could ask AA World to provide information as to the identity and financial status of whichever insurance company WR Life the insurance broker places their clients' business with.

-

Lowering the amount of insurance should probably come second to finding a deductible and premium trade-off that works for you. Find a deductible that you can handle, and if you can, use some of the premium savings to get higher limits. Better to have high limits for catastrophic accidents or illnesses because that's what one really needs cover for.

-

What probably matters more than trying to find the theoretical actuarial sweet spot in terms of optimizing premiums and deductibles would be to choose a deductible and premium level that fits best within your financial situation.

-

We give our dog dry kibble mixed with a bit of canned dog food. He's nine years now, so I get the kibble formulated for older dogs. I get different brands of canned food just to mix things up. Whenever I see Snickers or Mars Bars candies, I'm reminded that Mars also makes Pedigree and Royal Canin dog foods. Somehow that seems to say something.

-

Stark warning over Republicans’ ‘dehumanizing’ rhetoric on crime

Etaoin Shrdlu replied to onthedarkside's topic in World News

Looks like there's a one-man crime wave involving sexual assault, illegal retention of classified documents, falsifying business records, inciting insurrection and illegal attempts to overturn an election. So perhaps you're right and crime is up. -

Stark warning over Republicans’ ‘dehumanizing’ rhetoric on crime

Etaoin Shrdlu replied to onthedarkside's topic in World News

From the article: “Joe Biden and the defund-the-police Democrats have turned our once-great cities into cesspools of bloodshed and crime,” Trump said" This certainly seems to be Trump saying that crime is up. -

Stark warning over Republicans’ ‘dehumanizing’ rhetoric on crime

Etaoin Shrdlu replied to onthedarkside's topic in World News

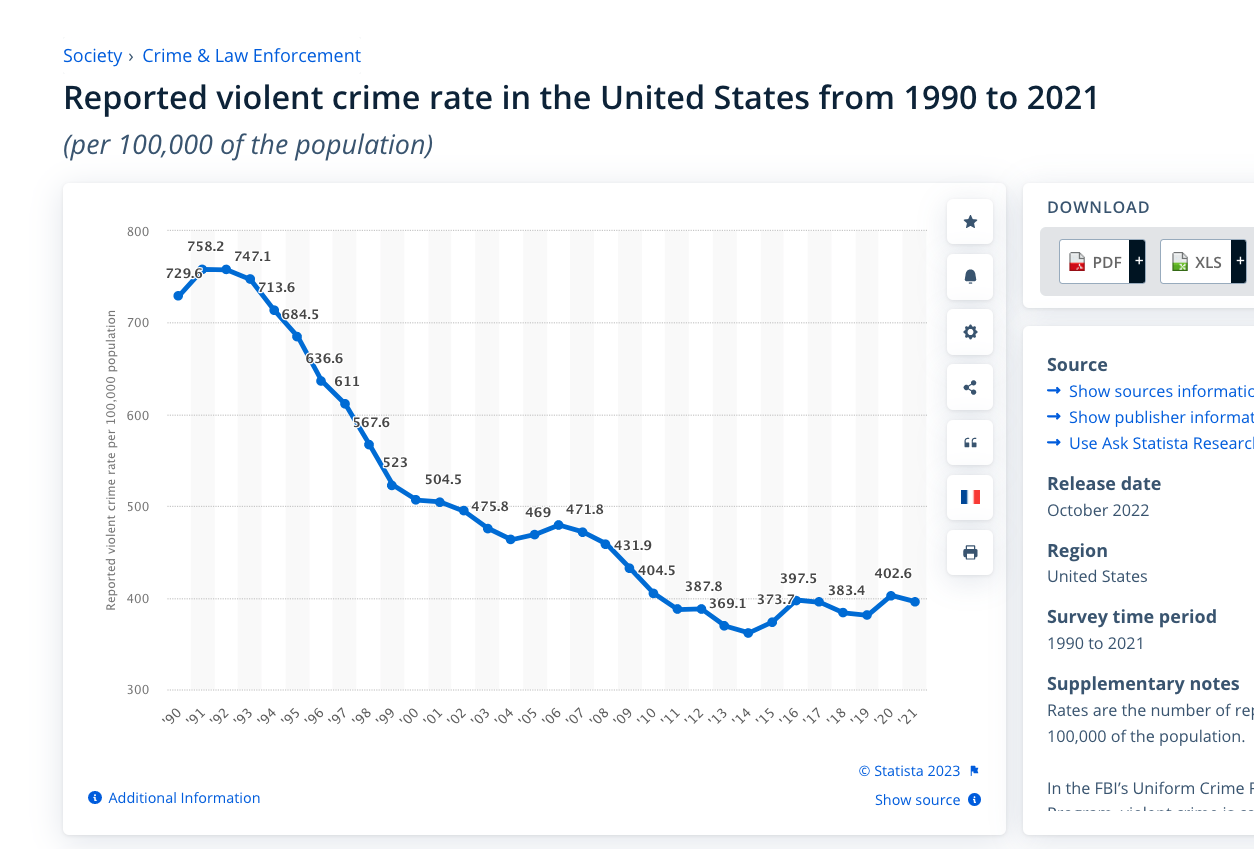

Not much evidence that violent crime is up in any meaningful way. More lies and disinformation from the Republican Party. -

To US Expats in Thailand only. It's about your wallet.

Etaoin Shrdlu replied to swissie's topic in ASEAN NOW Community Pub

I remember when I got well over three Swiss francs for a dollar when I lived in Switzerland in the early 1970s. After a couple of years I was getting well under three. On the other hand, when I moved to Thailand in the 1980s, I got about 25 baht to the dollar. Today I get 33 and for several years I got more than 40. But yes, the long-term trajectory for the dollar against the baht is probably downward. Those just scraping by with modest US dollar income here will feel the pinch over time. I don't know about the relative purchasing power of the baht and dollar over this timeframe, so raw exchange rates may not tell the whole story. The near-term threat to the dollar is the republicans' intransigence on lifting the debt ceiling. If the US defaults on its debt, the effect on the dollar will be swift and severe. This is of more concern, but congress has played chicken with this before. -

It is fairly common for symptoms of depression to be worse in the morning and gradually subside during the day. If low mood is keeping you from doing what you enjoy, you might want to consider getting screened for depression.

-

It has also become more difficult to find Nexgard Spectra for our dog. Expensive as well. Bought a box of three from the only merchant on Shopee that is selling it. Not sure if it is working as well as it should, so may visit the vet to see about alternatives. Frontline seems to be readily available, but I think it is only in liquid form that needs to be applied to the back of the dog's neck. I prefer the Nexgard Spectra chews that I can mix into his food.

-

Trump appeals verdict finding him liable for sexual assault

Etaoin Shrdlu replied to onthedarkside's topic in World News

He must truly believe the old adage that there is no such thing as bad publicity. -

I think I completely missed the point about (not) having kids

Etaoin Shrdlu replied to Celsius's topic in Family and Children

I put off having a family until late in life. I'm 70 and have four kids ages 23, 22, 20 and 18. For a long time I put career and other considerations ahead of having a family, but my priorities changed in middle age, plus wife really wanted kids. I've been lucky in that my kids have turned out well, at least so far. No regrets. -

Our family dentist recommended a specific dental surgeon at NP International Dental Clinic for our daughter. She received her implant back in January and will have the crown fitted later this month when she returns from university in the US. I'll dig out the name of the dentist and will DM you. He also practices at Chula and another major hospital, if I recall correctly. https://www.facebook.com/np.idc/

-

Lots of motorbikes here don't keep pace with the normal flow of traffic. In a restricted area where it may not be possible to take evasive action left or right, this would seem to cause a greater hazard than on the open road. I suppose lane-splitting in such an area also poses a greater hazard. If all motorbikes traveled at the same speed as the rest of traffic and did not engage in lane-splitting, perhaps they would not be banned from underpasses and similar.

-

ACS is an insurance broker, not an insurance company. While they may sell this insurance product, the final say on claims may rest with the insurance company, in this case, with respect to medical claims, I believe the insurer is MGEN. MGEN carries a rating of A+ from Fitch Ratings, so they have good financial strength. I have no idea as to their claims-paying attitude. You might wish to do a search and see if there are any reviews of MGEN's claims handling.

-

Looking at the explanation of coverage provided by ACS, it appears that coverage applies only while outside of one's country of residence. If one is resident in Thailand for nine months of the year, it is possible that the insurance company would say that your country of residence is Thailand and deny coverage. At the very least, you should clarify this in advance.

-

Some banks make coin counting machines available to the public. Call the customer service numbers of a couple of banks and ask if one of their branches has a coin counting machine available near you.

-

This has been in the news for a couple of days now and it has been clearly stated in a number of articles that this tax would only have been applicable to Thai citizens and permanent residents. Tourists, and those on non-immigrant extensions of stay, including non-immigrant O, OA and B visas, would not be affected at all by this departure tax. It has also been clarified that the Revenue Department does not intend to impose this tax in any event. Yet so many have gone on and on about how this would affect tourism and those on temporary extensions of stay. For those of us who have been around for some time, we can remember when it was necessary to obtain a tax clearance certificate from the Revenue Department in order to leave the Kingdom if we had a work permit. I think this entailed paying a tax to the Revenue Department, but I don't recall the details. This requirement was waived about thirty years ago, but is technically still on the books. Nothing new, really.

-

Proper medical insurance from Thai insurers is only available on an annual basis. He may be able to obtain personal accident insurance that has some coverage for medical expenses arising from an accident, however the amount of insurance will not be very great and certainly not sufficient to address a catastrophic accident. There would be no cover for illness. Again, this would be an annual policy, but the cost would be significantly lower than medical insurance.

-

Has anyone else been affective by not receiving their SSI for May?

Etaoin Shrdlu replied to davidstipek's topic in Chiang Mai

I have my SS benefits send by direct deposit to Bangkok Bank. I am also representative payee for my daughter and her SS benefits are routed via Bangkok Bank's New York branch. Sometimes my benefits arrive a day before my daughter's. I think internal processing within Bangkok Bank may delay payment some months when coming via Bangkok Bank's New York branch. -

Not long ago I got a new TM17 to replace the one that was full. The immigration officers at Chaeng Wattana completed the form for me without me having to ask them to help. The photos needed for a TM17 need to be on proper photographic paper instead of the less durable paper that some photo places provide for visa applications.

-

Quite often one of the requirements of employer-provided group medical insurance is that all insured persons have to be employees of the company and the company is obligated to pay the premium. Once one leaves or retires, this is no longer the case, so many insurers will not cover former employees or retirees. But it never hurts to ask. If you have to go under a separate policy, even with the same insurer, you'll probably face all of the pre-existing exclusion issues. If your employer is covering you under the Thai social security scheme, I'd advise you to consider continuing the medical coverage portion by voluntarily paying the monthly premium after you leave the company. It is only a few hundred baht per month and is definitely worth it. You have a short window to make this election after you leave the company, so look into it sooner rather than later.