Etaoin Shrdlu

Advanced Member-

Posts

2,436 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Etaoin Shrdlu

-

Check your existing medical insurance cover to see if it would respond to a claim for treatment in the US. If not, or if it would only provide benefits based upon Thai "usual and customary" levels, you should consider looking into travel insurance that provides medical benefits at a more appropriate level.

-

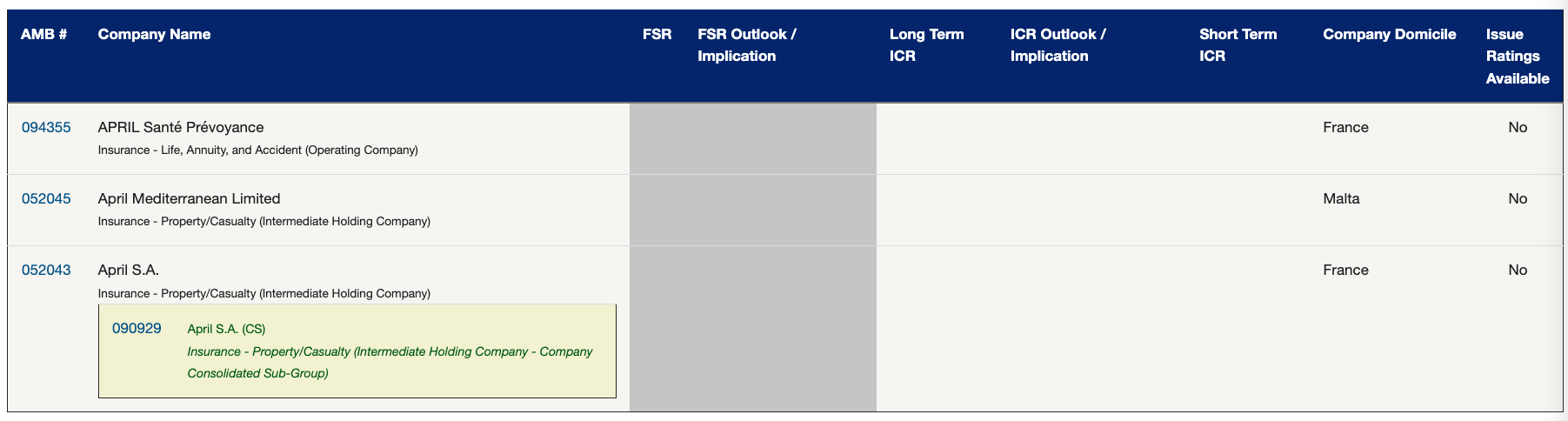

April's own website describes them as a leading wholesale insurance broker: https://fr.april-international.com/en/about-april-international-care I was able to find information from AM Best regarding three companies that are probably part of the April group. Searches for "April International" did not retrieve any results, but "April" did. Two of them appear to be holding companies, but April Sante Prevoyance looks like an operating company. Bloomberg's description of the company is: "APRIL - Sante Prevoyance SA provides insurance services. The Company designs, manages, and sells life, health, hospitalization, and accidental death insurance policies for families, seniors, entrepreneurs and self employed. APRIL - Sante Prevoyance conducts business in France." To me, this is a description of an insurance intermediary more than an insurance company. Perhaps it is a managing general agent that has some underwriting and claims-paying authority, but I don't think this describes an insurance company. There may be another entity within the April Group that is actually an insurance company, but I'm not able to find information about it using AM Best or internet searches. It would also be a bit unusual within the insurance industry for a major insurance broker to own an insurance company and place its clients' business with it due to potential conflicts of interest. I think April is an insurance intermediary and may act as a managing general agent for an insurance company or companies, but I am not sure at all that it is an insurance company. If there is a bona fide insurance company within the April Group it seems to be hidden quite well.

-

Both AA and April International are insurance brokers. Part of the delay may well be attributable to having to pass documents and other communications through two brokers before they get to the insurer. You might want to ask AA to get on the phone with April and find out what is causing the delay. Or perhaps call April yourself? Phone calls convey more urgency than emails. Might also be a good idea to find out the name and contact details of the insurance company that actually pays claims under the policy you have and ask AA to call them.

-

When did you sell the building and did you have capital gains on the sale? If you are Thai residents under the Revenue Department's definition, have capital gains, and bring the funds into Thailand in the same year, you may owe Thai income tax on the gains. But I'm not a tax expert, so you might wish to get proper advice.

-

I am unable to find a Standard and Poor rating for Kiatnakin. They carry a rating of "A" from TRIS (Thai Rating and Information Service) which provides credit analysis and ratings for Thai companies. TRIS is 49% owned by Standard and Poor, so it is quite possible that TRIS follows similar methodologies as S&P. Having said that, I suspect that TRIS uses different metrics to assign ratings and a TRIS "A" rating may not be equal to a S&P rating of "A". For one thing, Thai firms will, on balance, be smaller than foreign firms and the metrics would possibly have go be scaled down to reflect that. TRIS ratings may be a valid basis to compare Thai firms with each other, but possibly not to compare Thai firms holding TRIS ratings with foreign firms holding S&P ratings. But I will happily defer to someone with more insight into this topic.

-

Government-owned banks would presumably carry the same credit rating as Thailand itself, which is BBB+ per Standard and Poor. Bangkok Bank and Bank of Ayutthaya also carry a S&P rating of BBB+. SCB and Kasikorn were downgraded last year to BBB. Krungthai is BBB-. Krungsri was rated BBB+ back in April 2020, but I don't know if this has changed in the meantime. An S&P rating of BBB- is considered the lowest "investment grade" rating. https://www.theasianbanker.com/press-releases/four-thai-banks-downgraded-as-structural-issues-persist;-outlooks-stable Rating agencies are not infallible, but at least there is an attempt to provide a systematic estimate of creditworthiness. These ratings reflect the banks' financial strength and have little or no bearing on whether they are consumer-friendly.

-

RD was certainly ubiquitous at one point, so in that sense it was mainstream and it is still around today, especially in dentists' offices. But politically, it was quite far to the right and its foreign language editions' content was suspected of having been influenced by the CIA. I always considered it dumbed-down propaganda for right-wing nationalist types, so I'm usually a bit skeptical about anything it says.

-

1. class insurance motorbike older than 5 years?

Etaoin Shrdlu replied to Hummin's topic in Motorcycles in Thailand

I think that in order to remain legal, you'll need to buy a new Por Ror Bor cover when your current one expires. -

1. class insurance motorbike older than 5 years?

Etaoin Shrdlu replied to Hummin's topic in Motorcycles in Thailand

The compulsory Por Ror Bor scheme is separate from the voluntary coverage you get when you purchase a proper auto or motorcycle policy. It is possible to purchase the Por Ror Bor cover along with the voluntary policy, but the voluntary coverages do not obviate the need to purchase and pay for the Por Ror Bor sticker as a separate item. -

International Health Insurance VUMI

Etaoin Shrdlu replied to HampiK's topic in Insurance in Thailand

That makes sense. I would then expect Groupama to issue medical insurance policies and Chubb to issue personal accident and travel policies based upon the information above. -

International Health Insurance VUMI

Etaoin Shrdlu replied to HampiK's topic in Insurance in Thailand

Chubb used to be somewhat of a niche insurer in the US. They used to specialize in insurance for high net worth individuals that had things like art collections, expensive automobiles and expensive homes. They also were a player in things like professional indemnity covers and other somewhat specialized property and casualty insurance lines for companies. They tended to charge slightly higher premiums than mainstream insurers, but were very good about paying claims. Kind of the Tiffany's of the insurance world. About seven or eight years ago, Chubb was purchased by ACE globally and I think, like all corporate mergers, the corporate culture of the acquiring company prevailed. I think Chubb has probably lost much of the allure that it may have had. It isn't surprising that ACE chose to use the Chubb name instead of its own and I think the Chubb of yore is gone. In my mind, Chubb was not associated with health insurance, but things may have changed after the ACE merger. Chubb's local office struggled a bit back in the day due to its high underwriting standards and higher premiums. I think it remains a small player in the Thai market. -

First of all, I think it is useful to understand the difference between an insurance broker and an insurance company. For example, April and Luma are insurance brokers and if you use them to obtain insurance, your policy could be issued by any of a number of insurance companies they use. Your experience with claims will be a reflection of the insurance company's claims-paying attitude and ability and not April's or Luma's. On the other side, Cigna, Chubb and LMG are insurance companies, so comments regarding claims experience with these companies are relevant. In general, it is usually best to obtain medical insurance from a multinational insurance company's operation domiciled in the US, UK, EU or even Singapore rather than from their Thailand-based local venture. There are several reasons for this including better consumer protection and a stronger regulatory environment. Many offshore insurers use community rating for their products while few, if any, Thai insurers do. Community rating helps prevent large premium increases when one has a claim. This is something you should ask about when getting health insurance. Insurance brokers based in Thailand and licensed by the OIC are prohibited from offering policies from insurers located outside of Thailand, but some will do so. In such cases, the policyholder is usually asked to pay the premium directly to the insurer offshore in order to avoid an auditable paper trail going through the local broker.

-

International Health Insurance VUMI

Etaoin Shrdlu replied to HampiK's topic in Insurance in Thailand

Groupama Gan Vie is carries an A+ rating from Fitch: https://www.fitchratings.com/entity/groupama-gan-vie-88772891 This is equivalent to a Standard and Poor rating of A+. https://www.moneyland.ch/en/rating-agencies As for Chubb European Group SE, they received an "AA" rating from Standard & Poor. https://www.chubb.com/uk-en/about-us-uk/europe-financial-information.html Both firms have very good ratings from professional rating agencies, so this should satisfy those who care about their insurance companies' financial strength. Basically it means that they will likely be around and have the financial ability to pay claims in the future. -

Yes, 1 million baht is not adequate to address an at-fault case where the other party's expensive vehicle is severely damaged or multiple vehicles are damaged. Typically the owner of an expensive vehicle will have first class insurance covering damage to the vehicle itself. In such cases, the insurance company covering the expensive car will repair the car and then subrogate against the at-faulty party's insurer for the cost to repair up to the limit of liability for property damage under the at-fault party's policy. Depending upon the insurance company's view on the chances of success and the amounts involved, they may then pursue the vehicle owner/driver for any remaining amount. If Somchai has few assets or the amount is not worth the cost and effort to pursue, the insurance company may do nothing. Since Thailand does not mandate any third party liability cover for vehicles, the result is lots of uninsured or underinsured accidents.

-

If you have travel insurance that doesn't exclude motorcycle risks and no other exclusion applies, you should be good. But you'll have to read and understand your policy in order to figure this one out. If the policy is tough reading, ask your insurance broker to help you. If you don't use a broker, you should consider doing so. Don't worry, you don't need to wear a helmet in order to have an accident. Many people don't wear helmets and have accidents. We read about it quite frequently on Asean Now and on Go Fund Me websites. But seriously, what is your question? The driver is likely to be a Thai, so he'll get treated a a government hospital at no expense to him. Don't worry about the mototaxi driver, but don't expect him to have adequate insurance to cover your medical bills. You're pretty much on your own here.

-

I think a printout from the Mor Phrom app will be ok. I also think they will probably be ok with a look at vaccination certificate on the app itself. I obtained the DDC MoH yellow Covid-19 booklet at MedPark Hospital when I received my booster back in March last year. Here's a link from Bumrungrad on how to obtain the certificate: https://www.bumrungrad.com/PDF-en/info_visit_00312_en

-

Travel insurance warning after Welshman's motorbike crash

Etaoin Shrdlu replied to webfact's topic in Thailand News

1) No, it is not available as part of the compulsory Por Ror Bor scheme. One must purchase voluntary motorcycle cover and usually add this on top of the standard policy cover. You could purchase the Por Ror Bor sticker as part of a voluntary policy and have both with the same insurer. 2) Most insurers will provide policies in both Thai and English, but the Thai language version will prevail. 3) The insurance company may offer several limits which you may select, but limits are usually not very high and I would not recommend anyone rely upon this exclusively. It isn't a substitute for proper medical insurance. It won't be enough for serious injuries. 4) Insurers may ask for a copy of your license when you insure your motorbike. 5) This is similar to personal accident cover and should operate regardless of fault. But beware of other exclusions that my void cover, such as riding under the influence of alcohol, no license, etc. -

I don't think anyone has made one that would work well enough to be certified as a medical device or be reliable enough to replace test strips in monitoring blood glucose levels for managing diabetes.

-

This thread kind of reminds me of some of the late Bernard Trink's recommendations for tinned foods, but his passion was Dinty Moore beef stew.

-

Procedure for one tooth using a 2.9 mm implant (Straumann, made in Switzerland) was 74,000 baht including both the implant and crown.