-

Posts

17,712 -

Joined

-

Last visited

-

Days Won

16

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Danderman123

-

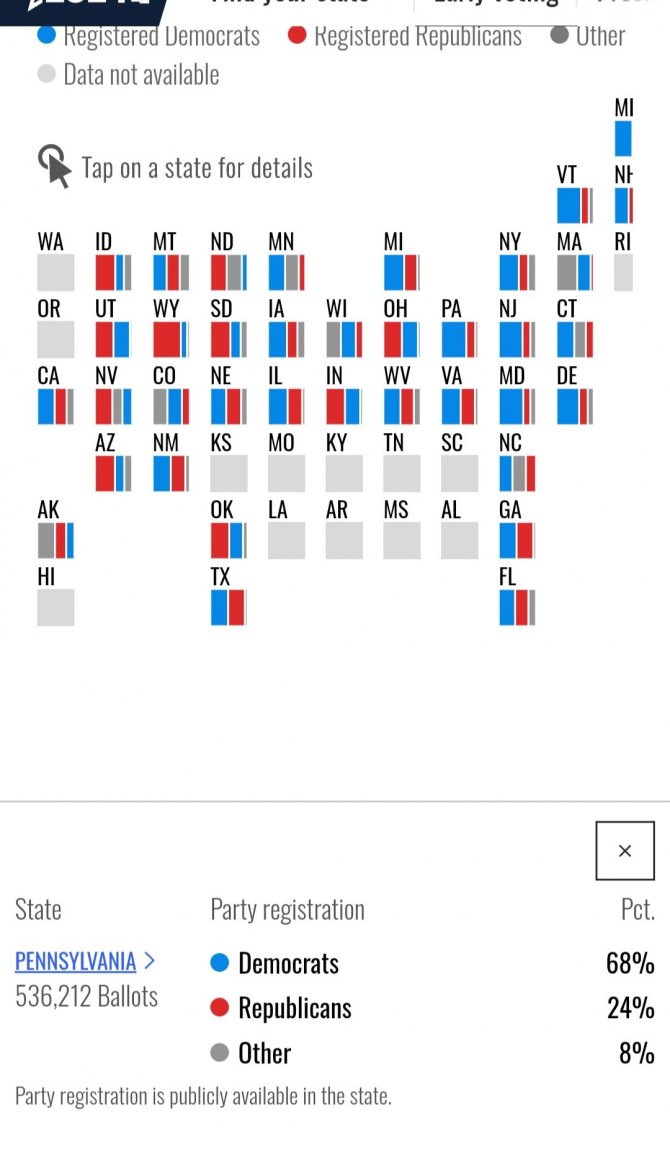

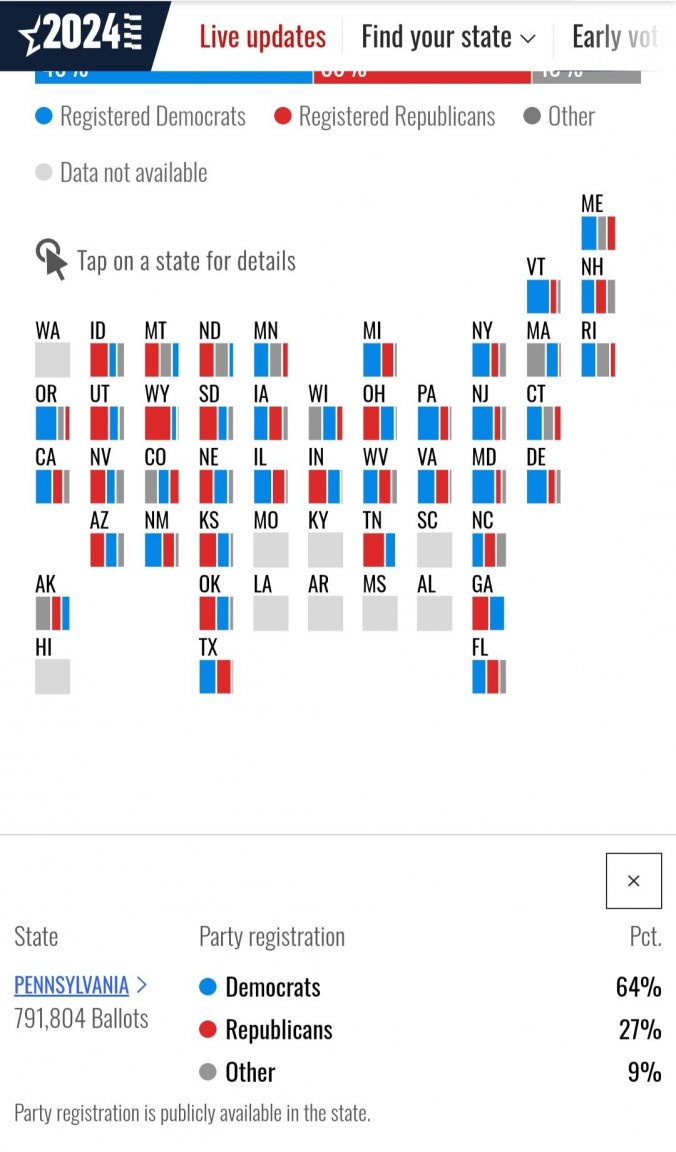

As expected, Republican pollsters are flooding the zone with bad polls, and their acolytes are flooding the board with bad polls. You will notice that the Trumpers don't post anything about early voting. You know, actual data about actual votes: https://www.nbcnews.com/politics/2024-elections/early-vote Spoiler alert: the Republicans aren't turning out for Trump.

-

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Trump preparing for his post election employment?

Danderman123 replied to Thailand's topic in Political Soapbox

-

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Trump preparing for his post election employment?

Danderman123 replied to Thailand's topic in Political Soapbox

Trump couldn't really work at McDonald's, since he is a convicted felon. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Wall street very convinced ,its gonna be Trump

Danderman123 replied to riclag's topic in Political Soapbox

Lower taxes for the middle class, higher taxes for billionaires (I know that gives you a sad). Probably let in as many illegals as Trump, based on current rates. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Wall street very convinced ,its gonna be Trump

Danderman123 replied to riclag's topic in Political Soapbox

Joe Biden may have his unsteady moments, but he follows the advice of his staff. Ronald Reagan followed the advice of Nancy (which why his second term was better than his first). Trump doesn't follow anyone's advice. -

- 55 replies

-

- 11

-

-

-

-

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Wall street very convinced ,its gonna be Trump

Danderman123 replied to riclag's topic in Political Soapbox

You are the one that wants to give an Alzheimer's sufferer the nuclear codes. Let's hope he doesn't shoot any missiles at your country. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

A vote for Trump is a vote for Putin / Orban / Kim Jong Un

Danderman123 replied to Jingthing's topic in Political Soapbox

You seem ignorant of history. Tell us how Hitler honored the Molotov-Ribbentrop treaty. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Trump ahead in all battleground states - ALL OF THEM!

Danderman123 replied to theblether's topic in Political Soapbox

When Trump lies, his hands go into accordion mode. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Foreign Election Interference in the US 2024 Election!

Danderman123 replied to Hanaguma's topic in Political Soapbox

If it were Trump being protected by the barricade, you would have a different opinion. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Israel Hamas War the Widening Middle East Conflict

Danderman123 replied to Social Media's topic in The War in Israel

After yet more Gazans were killed by Israeli bombs, a neighbor asked "why is Israel attacking us?". However, if you ask that same person about Israel, they would say "Israel must be destroyed and the Jews driven into the sea." This was the case before October 7. There seems to be a disconnect between their worldview, and the consequences of their support for Hamas. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Trump preparing for his post election employment?

Danderman123 replied to Thailand's topic in Political Soapbox

Is he going to put this on his resume? -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Foreign Election Interference in the US 2024 Election!

Danderman123 replied to Hanaguma's topic in Political Soapbox

Thousands of people attacked the US Capitol at the urging of Donald Trump, with intent of stopping the certification of the Electoral vote. As a result, over police were injured, some severely, and some committed suicide soon afterwards. Some Trumpers were trampled by the crowd, and died. One woman tried to pass a barricade, and was shot. The Capitol was sacked and trashed. Trump says it was "a day of love". -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Foreign Election Interference in the US 2024 Election!

Danderman123 replied to Hanaguma's topic in Political Soapbox

Because you don't care if a jury found Trump liable for sexual assault. If the victim were your relative, you might feel differently. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Foreign Election Interference in the US 2024 Election!

Danderman123 replied to Hanaguma's topic in Political Soapbox

You are parsing words about one of the most tragic events in US history. -

For better or worse, the time for convincing voters is over, and we are in the GOTV phase of the election. That's why Elon's failures with his GOTV operations are significant. Early voting numbers are showing that the GOP effort to promote early voting are failing. More to the point, Trump's campaign is basing a lot of their hopes on young men, who are notorious for not voting. Conversely young women tend to support Harris, and they do vote.

-

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Trump ahead in all battleground states - ALL OF THEM!

Danderman123 replied to theblether's topic in Political Soapbox

Desperation is when you make dozens of fact free posts to soothe your anxiety. Meanwhile, the election nears, and the Dems advantage in early voting increases. -

.thumb.jpeg.435f0fb7221c5dd6500feca45095b936.jpeg)

Trump ahead in all battleground states - ALL OF THEM!

Danderman123 replied to theblether's topic in Political Soapbox

No. What are you on about?