NoDisplayName

Advanced Member-

Posts

3,720 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by NoDisplayName

-

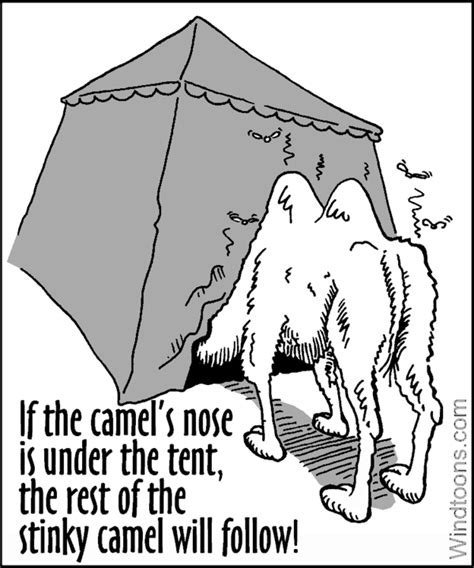

It all comes down to whether you as the donor are receiving benefit from the gifted funds. However, it's all a gray area and very much up to interpretation. Clear cut examples are easy. If you gift money that is used for daily living expenses for both of you, that should be disallowed. If you gift money used for daily living expenses for your wife's mother, allowed. Houses and cars are..........complicated. I would say if the house and/or car is put in her name, then it should be allowed, regardless of whether you incidentally live/drive within. Others argue the opposite. The system is primed for corruption as ,in my opinion, that was the original intent. The laws are written by wealthy politicians to protect their wealth and that of their wealthy acquaintances. No need for a 20 million baht gift clause in a nation composed mainly of subsistence farmers. Same reason capital gains on stock and mutual fund sales are tax free, and why Thai mutual funds (holding foreign funds that pay dividends) don't pay dividends. We'll have to wait until someone gets flagged for an audit and has to document their gifts.

-

Apply for SocSec Benefits Online?

NoDisplayName replied to NoDisplayName's topic in US & Canada Topics and Events

Not necessarily. I know others have done that, but unclear why. Could be they were naturalized citizens or green card holders, or who knows what else. I imagine gov.gov has records of my SS "contributions", and my passport renewals, and my DD214. The online sites claiming it's possible to apply online from overseas don't mention certified passports. Maybe Manilla has to do a review for anyone living outside CONUS, and they will schedule an interview if required. -

How to import a small wood working machine from China

NoDisplayName replied to Abunai's topic in General Topics

Same item available thru AliBaba. I believe some of those sellers quote delivery with customs included. Contact the seller. https://www.alibaba.com/product-detail/Woodworking-Electric-Bench-Scroll-Saw-18_1600773234706.html?spm=a2700.galleryofferlist.normal_offer.d_title.582713a0hdP7Ku Or find the same item on Shopee, made in the same factory by the same workers with the same components, but a different label slapped on it. https://shopee.co.th/Total-แท่นเลื่อยฉลุไฟฟ้า-16-นิ้ว-85-วัตต์-รุ่น-TS88501-(-Scroll-Saw-)-เลื่อยไฟฟ้า-i.21230588.23886159568?sp_atk=f3438209-62c6-4d3d-abbe-0ae6c7c21e9f&xptdk=f3438209-62c6-4d3d-abbe-0ae6c7c21e9f -

Hahaha! Silly man. First rule of Rules-Based International Order: Treaties are for other countries to follow. "We're an empire now, and when we act, we create our own reality. And while you're studying that reality -- judiciously, as you will -- we'll act again, creating other new realities, which you can study too, and that's how things will sort out. We're history's actors . . . and you, all of you, will be left to just study what we do."

-

"His mother was a hamster and his father smells of elderberries"

-

Read back thousands of pages? I don't think so. Some have spoken of potential need to obtain a "tax clearance certificate." Some fear-mongers have claimed it will be needed at immigration for extensions. None that I am aware of have actually procured this holy writ of unobtainium. You could be the game-changer! Time is running out, only 3 weeks left. File and get your "TCC" quickly, quickly.

-

But we have had several executions by drone strike ordered by presidential authority without a trial.

-

I'm not saying that at all. You just want to hear it. This is the disconnect. I'm actually gifting money to the wifi. Not evading tax, not laundering, not filtering. I could remit non-assessable money into my/her account and gift without tax, but then I have transfer fees and foreign exchange fees, twice, as she'd send it back out to invest. If I gift offshore, we save the transfer and forex fees. She can invest in US ETF's, non-dividend payers that appreciate 8-10%/year. Foreign investors pay tax on dividends, but NOT on capital gains. She can invest for higher returns, tax-free in the US, and only pay tax on remitted capital gains as ordinary income, which would likely be below her TEDA at that time anyway. I want a bigly sum sitting there, as the transfer of my brokerage account to her requires IRS documents that take up to a year to process.

-

Not positive, but expect if that 200K is your only income, you are probably entitled to a refund of a significant portion of the 20K baht withholding tax. I'm no taxspert, but that's below your TEDA, at least 60K personal allowance and 150K taxed at 0%, so you'll likely get it all back. Let us know what happens.

-

Why would you do that? Why would you file when your ASSESSABLE remittances are zero? Why would you declare NON assessable funds, when there is no provision on the tax forms to deduct them? Why would you declare NON assessable funds at all, when WE self-determine whether remittances must be declared? If you couldn't file online, you could have simply said "I only brought in savings, no salary or pension" and not given any numbers at all.

-

Ukrainian forces lose access to Maxar satellite

NoDisplayName replied to simple1's topic in Political Soapbox

By "put on their big boy pants" you mean telling the US to stuff their sanctions, and would you please stop blowing up our natural gas lines? We'd really like to MEGA, but cutting us off from a reliable provider of clean, efficient, low-cost energy has certainly made that difficult. Hard to be an industrial powerhouse when you're freezing your eier off. -

Ukrainian forces lose access to Maxar satellite

NoDisplayName replied to simple1's topic in Political Soapbox

No, that was not the goal. Minsk and Minsk-2 would have kept the Donbass and the other new Russian territories as part of a Ukranian federal republic with limited autonomy. Putin practically begged the western powers to implement Minsk, but ethnic cleansing had to continue. Zelensky, Macron, Merkel and Poroshenko all admitted Minsk was a stalling tactic used to flood Ukraine with game changing wunder waffles. And now they think Putin is going to sign Minsk-3 allowing NATO (western european) troops in as peacekeepers.... -

Ukrainian forces lose access to Maxar satellite

NoDisplayName replied to simple1's topic in Political Soapbox

Could all have been avoided by implementing the Minsk agreements. Or heck, just avoid the whole damn thing by not regime-changing the legitimately-elected government. If NATO hadn't gotten greedy, Crimea would still be part of Ukraine, and the Soviets would still be paying the lease on Sevastopol. -

Incorrect. The limit of gifting spouses is 20 million baht per year. She can save up all her 20M gifts for a decade, and bring in 200M in one swell foop as non-taxable gifts. The 20M limit is on gifts received per year, NOT on gifts already gifted remitted into Thailand. Yes, they may be in a passbook savings account, but they are still qualified gifts. Remitting more than 20M probably is reportable, but not taxable. The gifts are remitted over a decade, not received in one year. Same as when reporting carrying more than a designated amount of currency when flying. Reportable, not taxable. Perhaps look at them at an angle where they are not being laundered. I am gifting, solely for her benefit. I have no rights to the money gifted. It will likely stay in her account as long as I breath. I'm pretty sure that's both technically and ethically below-board. A quick review of the gifting rules should tell you that. You missed the part where my wifi asked whether gifting oversees was allowed. TRD did not "recommend" it over gifting in-country. They simply confirmed that the rules for gifting IN Thailand apply for gifts given outside, as well.

-

No, not yet. Tax policy is fluid now, no telling what changes are coming, or what might flag interest. If I follow a procedure that is unquestionably legal, no worries. I've got plenty of non-assessable funds and in-country savings to spend down that will cover all foreseeable expenses. Been there, done that. We both have Schwab accounts. I can pull cash by ACH from my other brokerage into my Schwab cash account. Then I have a standing order allowing my to send cash only, one way, to the wifi's account. Everything set up, all links tested. Good to go. Everything can be done online now without having to contact a representative.

-

They no say that. Wife asked if gift rules apply to funds received in an offshore account. TRD says yes, gift rules are not limited to Thai bank accounts only. There was talk on previous threads that gifts received offshore don't get gift tax exemption. That is untrue. I don't want to send direct to her Thai account, because I would be the remitter, in which case million baht deposits might draw attention. Sure, I could (try to) prove non-assessable funds, but I don't want to. They did not. We want to gift offshore so that remittances are her gift, NOT my funds deposited in her account and then declared as a gift.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png.8488ab72b8bb2e508209bfe3211b6e08.png)