samtam

Advanced Member-

Posts

3,379 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by samtam

-

Finance Tax Break Bonanza: Thais to Benefit from New Foreign Income Rule

samtam replied to webfact's topic in Thailand News

Yes, seems to be the same as the announcement in May. Sorry, my second link was a repeat of the first, so what is the substantive difference (apart from text, date etc) between: 19 May https://www.bangkokpost.com/business/general/3028760/department-to-amend-tax-on-foreign-income-remittance and 5 August https://www.bangkokpost.com/business/general/3081357/law-exempting-tax-on-foreign-income-in-the-offing -

Finance Tax Break Bonanza: Thais to Benefit from New Foreign Income Rule

samtam replied to webfact's topic in Thailand News

Can someone tell me the difference between this article from Bangkok Post on 19 May 2025: https://www.bangkokpost.com/business/general/3028760/department-to-amend-tax-on-foreign-income-remittance and this article from Bangkok Post on 5 August 2025: https://www.bangkokpost.com/business/general/3028760/department-to-amend-tax-on-foreign-income-remittance apart from the obvious 3 month time lapse? -

I misread your statement as three quarters of an hour, and I assumed the "safe side" meant getting a night in a good hotel, food etc plus another EUR600.

-

USA Ghislaine Maxwell’s Staggering Demands for Congressional Testimony

samtam replied to webfact's topic in World News

@Andycoops @BLMFem Is it legal for 16 year old girls to be working in a spa, (at Mar-a-Largo)? More specifically, what was their job? Handing out towels, giving massages? @Liverpool LouThese were literally Trump's own words at Turnberry, https://www.foxnews.com/us/jeffrey-epstein-stole-virginia-giuffre-other-employees-from-mar-a-lago-spa-trump and on board Air Force One: https://www.youtube.com/watch?v=CZ-umQ115Vk&ab_channel=AssociatedPress @CallumWK Virginia Giuffre did not successfully sue Prince Andrew. The case was settled for an undisclosed sum, out of court, under seal. No verifiable settlement figure has or can be released about how much was paid by Prince Andrew. https://en.wikipedia.org/wiki/Virginia_Giuffre_v._Prince_Andrew -

USA Ghislaine Maxwell’s Staggering Demands for Congressional Testimony

samtam replied to webfact's topic in World News

@HappyExpat57 "A child predator making demands?....." Not sure which one you're referring to. @bamnutsak Perhaps this one? @JAG Whilst your points about Prince Andrew are spot on, he has admitted no liability, and despite wild claims about the amount of payout to Virginia Giuffre, the amount was secret, and the "millions" claimed by some are probably greatly exaggerated; her death and Will might shed some light, but I expect that is protected information too. Trump is also a convicted felon, but that didn't stop him becoming POTUS. Her sentence is 20 years. She's 63. -

I always have a print out of my savings account, (also like yours, only used for the THB800K IMM monies), each page of which is signed by the bank, (Krungsri). I thought IMM required 1) bank letter and 2) signed printed copy of savings transactions 3) passbook etc. (I go to CW too, and these are the documents my gofer asks me to provide.)

-

UK Trump to Be Hosted by King Charles at Windsor: Unprecedented Second State Visit

samtam replied to webfact's topic in World News

The Crown was hardly historical. Unfortunately so many people believe it's what actually happened. -

UK Trump to Be Hosted by King Charles at Windsor: Unprecedented Second State Visit

samtam replied to webfact's topic in World News

There's nothing wrong with the grandeur of Windsor Castle; the State Rooms are as magnificent or even more grand than those at Buckingham Palace. The only loyalty he respects demands is towards him. It's a one way street. Prime Ministers are not accorded State Visits, (as in the case of Canada, King Charles III is Head of State, and of 14 other realms, including New Zealand and Australia). It is only fitting that Trudeau would be given a dinner hosted by the then Prime Minister; it wasn't a State Dinner, which is only for heads of state. -

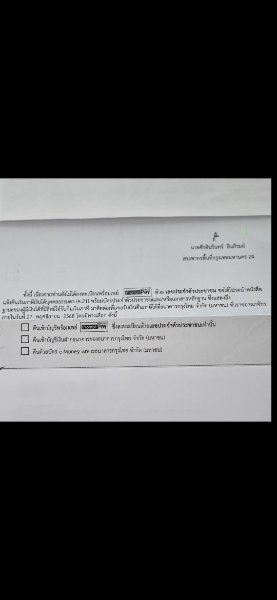

As previously mentioned, my letter, not cheque (check) states these 3 options to receive the funds; it turns out 3 is not available, and 1 and 2 are open to interpretation, in as much as "identify by national ID" is not specified. I showed both my passport and my Thai Pink ID card, but that was of no interest: It would be wonderfully simple if they just sent me a cheque, (or even credited my account through Prompt Pay), but that does not seem to be an option they are offering.

-

Yes, I think opening an account with Krung Thai is the only solution, and I imagine that is a joy unto itself, (potentially with documentation that is verging on the too hard); I don't know whether they would accept Yellow Book, Passport, Pink ID etc. Getting a proof of address from IMM is really self-defeating, as it costs more than the WHT.

-

Yep. Different rules. I went to Krung Thai with the letter, my passport, my Pink ID and my Krungsri account passbook on which I have Prompt Pay. They would not pay out. They said I had to go to Krungsri to register my account with my TIN. Went to Krungsri next door, (who initially wanted me to go back to Krung Thai). Anyway, they said as my Prompt Pay with them was registered with my phone number, they could not accept my TIN. My account ID is my passport, so not sure whether that clashes. Anyway, obviously a system designed in a vacuum to reality. I suppose the only option left is to open a Krung Thai account. Or just bin the refund letter. I am past caring.

-

Well, I went to my branch on Tuesday to get mine sorted out. It seems I opened the Krungsri app on my old phone, (in 2020, although I never remember doing so, or ever using it*), and didn't delete it, so when I tried to open it on my new(ish) phone it stated I already had the app, even tough it never showed in my apps list. Anyway, now sorted. So I have the Krungsri app, plus I have a Krungsri Biz app (for a joint account), so I couldn't add the sole account to that. *I'm only a spring chicken 68 year old, although memory seems to be a failing; what happens after I turn 70 is anyone's guess. The only issue I have with the Krungsri app is I cannot read a transaction list for say 6-12 months, (as is possible with online banking). Maybe something I haven't yet mastered, and reluctant to eff around with it, as apart from anything else, it has my IMM 800K dosh in it, which I don't want affected. You will be able to use the Biz app even after 70, despite their blurb and what they say. My partner is 71 and it worked perfectly; others too have reported successful opening of Biz app even though they are 70+.

-

"....while physical passports will STILL EXIST..."

-

They do indeed have good benefits, but the sugar level is high.

-

Bangkok bank .face scan.

samtam replied to harry94's topic in Jobs, Economy, Banking, Business, Investments

Well, I stand corrected. It is clearly working as intended then. Perhaps he misunderstood what he was being told. -

Bangkok bank .face scan.

samtam replied to harry94's topic in Jobs, Economy, Banking, Business, Investments

Many things IT related with banks, (and anything else for that matter) seem to be way beyond programmers. But we can all rest easy at night that banks, the Revenue, Immigration are all now fully integrated. Allegedly. [Regarding the new Thailand Digital Arrival Card (TDAC), a friend recently arrived for a visit and had it all prepared and wanted to show it to the IMM officer (at Chiang Mai airport), and said person was not remotely interested. So I'm glad that has proved to be a worthwhile investment in keeping Thailand safe, or whatever it was intended to do.] -

If you have a Krungsri Online account, (and view it on your pc), you should get an email and SMS with OTP instructing you how to change. However, as I noted, if there are slight variations in your account, it will require more work. Call 1572 and press "0" then "3" and you will get through to the Biz Online team. Once you change to Biz Online you can view both through pc & app.

-

@anchadian Thanks. @Felt35 Thanks. My issue seems a bit more complicated, and as yet unresolved. Since I already have a Krungsri Biz Online (which has me as the "Control", but another named party, effectively a joint account), Krungsri 1572 have told me I need to close the existing Krungsri Biz Online and open a new one with only my name, (by going into a branch etc etc). The jury's still out whether that is the case, as I am waiting to hear back from my relationship manager. I did express a little dismay (!) that what should be simple issues have not been considered before this plan was hatched. The phone banking guy said "yes", there were IT issues that still needed to be sorted out. Quelle surprise!

-

Bangkok bank .face scan.

samtam replied to harry94's topic in Jobs, Economy, Banking, Business, Investments

Just curious, but why can't you take a photo with glasses, if you normally wear them? I do with another (UK) banking app. (Same with passport photo, ID card etc.) -

Thanks. I have been in touch with Krungsri. The sole account will transfer with the OTP to a new Krungsri Biz Online (KBOL), same account number. I will have to choose a new password. (So effectively the only thing changing is the access, via Krungsri Biz Online app) and no longer Krungsri Online (banking). The complication comes as there are 2 of us, and one has received the OTP, the other (me) has not. But as I have another Krungsri Biz Online, it may be that my sole account gets added to it, although in that existing KBOL I am listed as the Administrative Control (ler), so that may mean I have to open another KBOL with only my name. I am not doing anything until Krungsri have clarified, and then I will go into the branch and do the update, (aka account name type change). It would appear with no account number change, there will be no transfer of funds from one account to another. It is merely the access, through KBOL, (Krungsri Biz Online app).

-

Grateful if you can report how you got on. I have Krungsri Biz Online for my "joint" account, but I will need another for my sole account, in which I keep my THB800K IMM money. My fear is that the transfer from that sole Mee Tae Dai savings to a new Krungsri Biz On line might involve a clearing issue, whereby the funds are in the clearing system, (and therefore the IMM requirement of not dipping below THB800K). But if it's a straightforward (555) renaming, of same account number and the funds do not move out from MTD to another account, then I need to spend a couple of hours dealing with one of their geniuses in the branch.