BKKKevin

Advanced Member-

Posts

544 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by BKKKevin

-

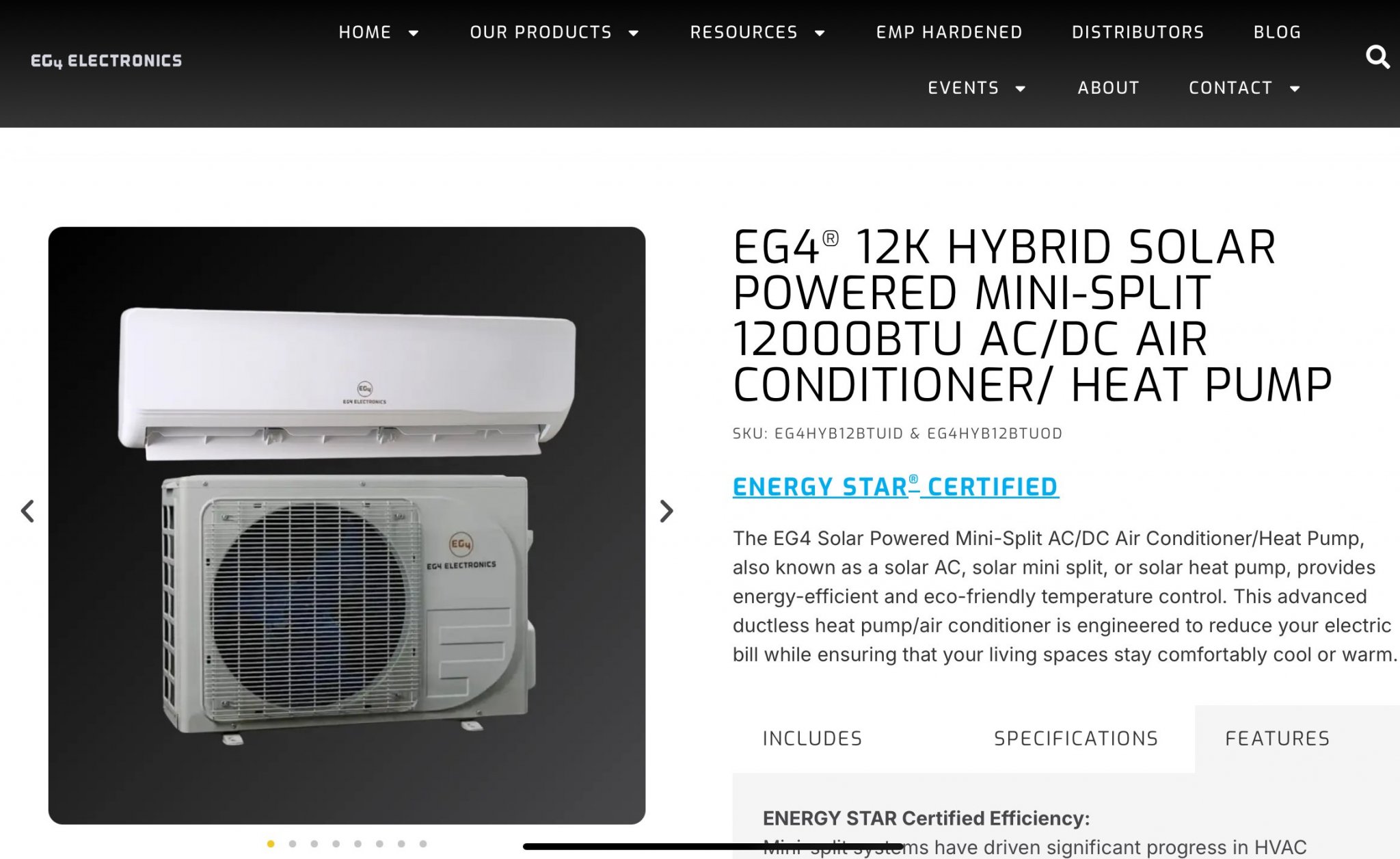

This is available in the US as a DIY kit… has anyone seen something similar here?… https://eg4electronics.com/categories/high-efficiency-appliances/eg4-12k-hybrid-solar-unit/

-

HOW TO: Remove Ugly Stickers from Indoor Unit of AC? Need HELP!

BKKKevin replied to GammaGlobulin's topic in DIY Forum

WD 40 or generic spray oil from MrDiy… peel off the outer plastic layer and spray the paper backing to saturate it… Let sit overnight… Rub off with fingers or soft cloth saturated with the spray oil… Dont use any abrasive cloth or sponge as it could scuff the plastic… -

Maybe something more traditional like pink or baby blue?…

-

Essential Expat Guide: How to Buy a Motorcycle in Thailand

BKKKevin replied to CharlieH's topic in Motorcycles in Thailand

In my neighborhood it “up to you”… -

Thailand to tax residents’ foreign income irrespective of remittance

BKKKevin replied to snoop1130's topic in Thailand News

At a minimum we should be allowed to visit a National Park at the Thai rate… -

world wide income taxation update

BKKKevin replied to Presnock's topic in Jobs, Economy, Banking, Business, Investments

Another acorn has fallen from the tree... -

Chinese Man Arrested in Thailand After 14 Years on the Run

BKKKevin replied to webfact's topic in Bangkok News

14 years!… Kudos for the crack detective work!… -

Trump Backs Elon Musk's Plan to Slash Government Spending

BKKKevin replied to Social Media's topic in World News

Without EV tariffs Tesla would be worth about as much as X… -

Reduce taxation by gifting.

BKKKevin replied to phetphet's topic in Jobs, Economy, Banking, Business, Investments

Curious?… If I were to have an expensive medical procedure of say 300k+ baht and decided to charge that on my home country credit card so I could get 3% cash back and pay in installments would that be evasion of accessible income tax?… -

This is the way I just did the IDD transfer to my Thai Bank account… It was simple and took little time… Some specifics to note: You must have your Thai address on file with the SSA before submitting the SSA1099 form - I just logged in to my online SSA account and updated it there. I just mailed the SSA1099 form via ThaiPost (With tracking) SSA will send you a confirmation letter of address change to your Thai address and tell you when to expect your first transfer Your monthly payment date will change to the 3rd - Mine shows up on the fourth as a BahtNet transfer You will be required to complied Form 7162 annually (They will mail this to you at your Thai address in the spring of each year)… If they don’t receive the form they will suspend payments until it’s received so keep your address current with them If you have a Medicare advantage plan they may inform your insurance carrier. Some have reported that their bank will not complete their portion of the SSA1099 - ask them to give you a proof of account letter or make a copy of bank book showing your name and account number and make a note that your bank would not complete a form not generated by them

-

Reduce taxation by gifting.

BKKKevin replied to phetphet's topic in Jobs, Economy, Banking, Business, Investments

Another method of reducing your accessible income is to pay your rent via transfer from your Wise account… 😉 -

A Visit to the Tax Office

BKKKevin replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

I was thinking more of a Mia Noi being deductible... 😉 -

A Visit to the Tax Office

BKKKevin replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

So I now seem to have a clear understanding of savings & domicile… Can we now discuss what the meaning of wife is?… and is their a limit on the number of minor wives for deduction?… Can one prorate for short time arrangements? -

Harris-Walz southern Georgia bus tour highly successful

BKKKevin replied to Gecko123's topic in Political Soapbox

-

I have applied to the SSA to have my social security direct deposited to my Bangkok Bank account thru the IID system… This gives me a clean easily provable stream of incoming cash that I can say is not taxable due to treaty obligations… Then it’s my understanding that one get a 60k personal deduction, a 190k 65yo+ deduction and the first 150k has a tax rate of zero… That’s 410,000 I can transfer from my personal US account with no tax due… Anything above that I plan on transferring to my Thai partners bank account as Thai tax law allows for a lifetime 10 million baht gift tax exemption… As to whether I will be required to file a tax return here… I don’t see this happening any time soon… NO Thai government entity is capable of administering the setup of a tax ID and processing a tax return for several hundred thousand expats from 50 different countries… Just look at how well the administrate the online 90 day reporting…

-

The link just leads to a request for you phone number so a sales person can call you…