Pattaya57

Advanced Member-

Posts

2,769 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pattaya57

-

TM30 Options Help Request

Pattaya57 replied to tomdfc's topic in Thai Visas, Residency, and Work Permits

No way would I be posting my Passport for a TM30 (I've read it takes 2 to 4 weeks to get a postal TM30 receipt back) -

Right, so you're 21 and already built up and sold a very successful car dent repair business to make you wealthy. At 21 you'd barely of finished your apprenticeship If you are 21 and fit then this whole thread doesnt make sense. Why would anyone give you a strange look when sitting with a 20 year old...just doesn't add up

-

Why so surprised you get funny looks. You are looking for teenagers but you posted elsewhere you are 52 and 116 Kg trying to lose some weight. On this thread you say you're 21 and fit, so I guess honesty is not one of your strong points Also, the last example above sounds like you were trying to upskirt a lady, so why wouldn't the mother hurry away from the old, fat sex tourist

-

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

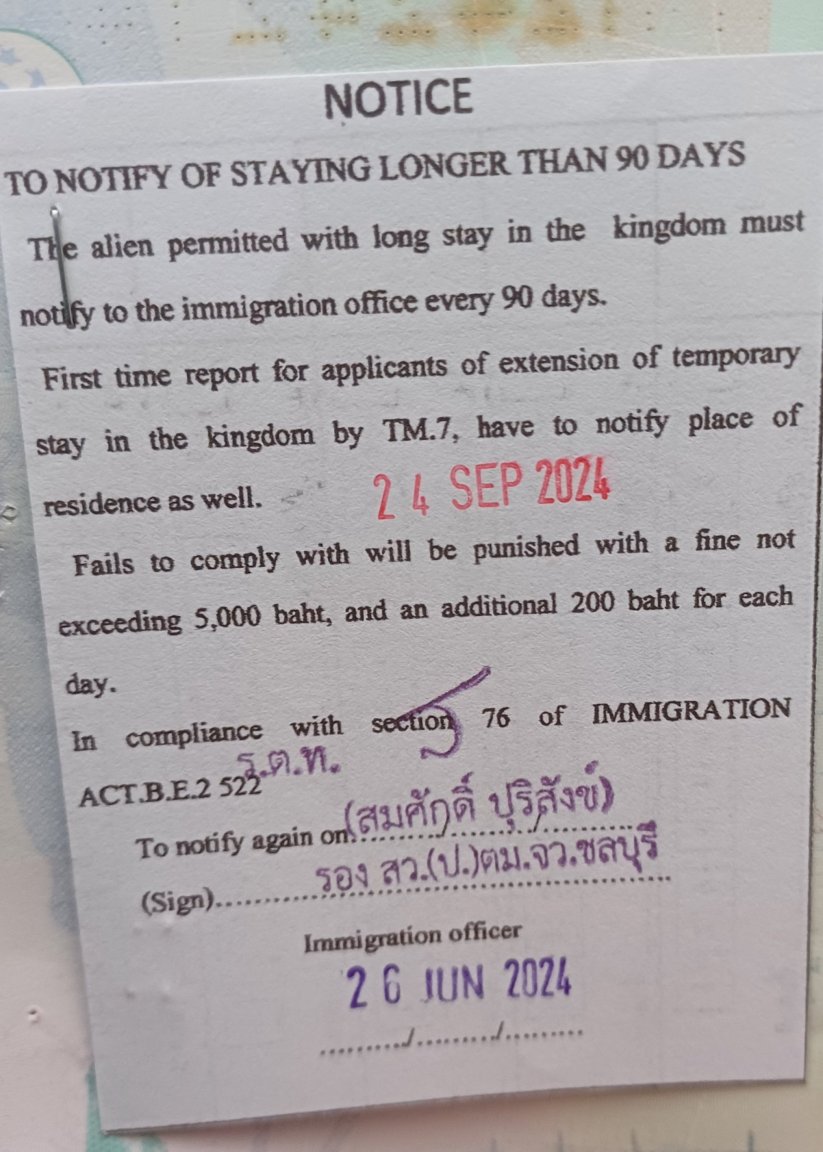

Just to clarify the 90 day report date, I googled many other forums and all say your first 90 day report is required 90 days after issuance of the first 12 month extension. This is exactly what Jomtien did with me which is why I'm to report 24 Sep after an extension stamp of 26 June (not 14 July which is the last day of my 90 day non-imm O). -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

There's just no convincing you is there. You must update passbook same day as bank letter, nope mine was 6 days apart, you must do 90 day report 14 July, nope they gave me a logical 90 date report date 90 days after I just provided them with more details than that of a 90 day report. Be happy they are actually applying common sense -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

Rules change, that's the point of my thread to show the current rules, not what people perceive them to be after years of posts 😉 -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

Why, the Pic I posted clearly says 90 day report required 24 Sep (I got a separate financial report appointment I posted earlier which is also due 24 Sep) -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

Oh I almost forgot, this forum pretty much says 90 day reporting has nothing to do with getting an extension, however Jomtien stapled a notice into my passport telling me to do a 90 day report on 24 Sep, so 90 days from extension application/stamp date (my actual 90 days in country will be on 14 July) Also has the fine gone up? I thought it was 2000 baht fine for not reporting but this says 5000 baht + 200 baht for each day not reporting -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

Just to finish the process, they said pick-up Passport after 2pm but I got there at 1:30 and it was ready. I just waved my blue ticket number at desk 8 and they pointed to the only female IO there so thats who you see to pick up your passport. Still no queues so decided to get multiple re-entry permit as well. Cost 3800 baht, took 15 minutes and needed: - TM8 Re-entry application + photo - copy of passport ID page - copy of Retirement extension - copy of non-imm O entry stamp - copy of TM30 No idea why they needed a TM30 for a re-entry permit but it seems to be this all powerful document you must include with everything 😆 -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

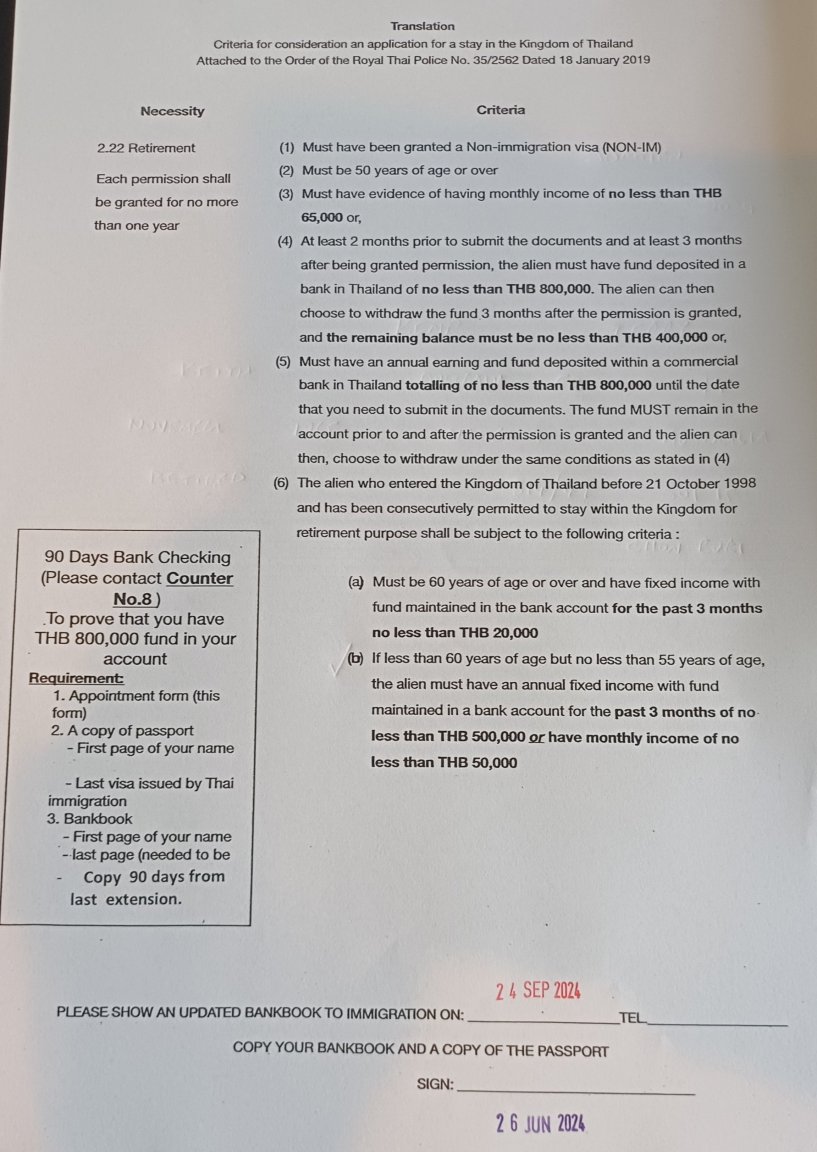

Haha I only just realised the IO gave me the return in 90 days form to prove I still have 800k in the bank, so it's 90 days from date of application, not 90 days from 12 month extension date -

Aussies to now enter China visa free

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

China said they were going to do something with Visa exempt and they quickly did it. Now if only Thailand could do the same China Embassy Statement "From 0:00 on July 1st, 2024 to 24:00 on December 31st, 2025 Beijing time, citizens holding ordinary passports of Australia traveling to China for business, tourism, family visit or transit purposes with the duration not exceeding 15 days, are eligible for visa-free entry from open sea, land, air ports of China." "Ordinary Passport Holders of New Zealand and Poland will also be applied to visa-free policies mentioned above." http://au.china-embassy.gov.cn/eng/lsfw_12/vc/202406/t20240626_11441694.htm -

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

I checked my Commonwealth Super defined benefit statement and it has three components, 1. Tax Free, 2. Taxable Taxed and 3. Taxable untaxed. At 60, the first 2 components are tax free, while the 3rd Component is Taxed at 10% less than my marginal tax rate. If I'm a non-resident that would be 30% marginal tax rate minus 10% = 20% tax on Component 3 only If resident, marginal tax rate would be 0% if assessible income < $18,200, 16% if between $18,200 and $45,000 and 30% if > $45,000, so component 3 tax rate would either be 0%, 6% or 20% Every person will have a different ratio, but mine is 1. Tax free - 18.2%, 2. Taxable Taxed - 25.8%, 3. Taxable Untaxed - 56.0% So as non-resident I would have 20% tax to pay on 56% of my pension, which is equivalent to 11.2% on my whole pension. Note this is same amount I'd pay as Resident with assessible income >$45,000 (but would also have to pay 2% Medicare) -

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

Please go away with comments like that -

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

Mine is Dept of Defence. I took pension 3 years ago but now remember there were 3 components. One was 18.2% tax free immediately at 55, one other was fully taxable until 60 when it became tax free and 3rd component had the 15% tax offset. I have some research to do. -

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

I also have a defined benefit Super pension which I have been getting since age 55. 18.2% of the pension is currently tax free but I pay tax on the rest. They told me it's zero tax when I turn 60 just like normal Super? -

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

Correct, if retired and over 60 taking a Super pension you are not taxed on that pension as a resident or non-resident. A lot of people will have other income that is taxed though so need to decide which status -

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

Oh I should add, unbelievably in the year you elect to be a non-resident the ATO still gives you a minimum $13,464 tax free + $395 for every month you're a resident in that year. So if you elect 10th October you will have $15,043 tax free threshold (instead of $18,200 for full tax year) I will be electing October for Non-resident status to use that $15k tax free threshold while the other 8 months Interest will be at only 10% instead of 18% or 32% (with medicare) -

I have a number of friends who would fight to the death to keep their 'Australian resident for tax' status, when clearly living retired in Thailand for 2-5 years in their Condo with a Thai wife and children in school is not in line with being an Aussie tax Resident. The main reason given was they wanted to keep the tax free threshold a resident gets, however this is not always the best choice. As an example, for someone that earns $45k bank interest in Australia here is resident tax vs non-resident tax (using the new 2024/25 tax rates of 16% between $18200 and $45000) Resident $18,200 - tax free $26,800 @ 16% = $4288 $45,000 @ 2% medicare = $900 Total Tax = $5188 Non-resident $45,000 @ 10% = $4500 Note 1: $36,400 bank interest has exactly the same $3640 tax as a resident or non-resident Note 2: a resident is taxed at 32% (with medicare) for every $ over $45k, vs only 10% for non-resident, so this becomes an even easier choice. I know other examples are better as resident, but I'm just pointing out that being a non-resident for tax is not always the bad thing that some people believe.

-

Big Thailand visa changes from June 1

Pattaya57 replied to snoop1130's topic in Thai Visas, Residency, and Work Permits

I'm really surprised how slow this has been to implement. All through covid they'd announce 60 day extensions for covid just before it was to expire and then implement in 2 days, same with the 45 day visa exempt, temporary rules announced and implemented in 2-3 days -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

Well in fairness there are also lots of posts saying you can't use a fixed term account, which is obviously not true. I also remember reading on TV maybe 5 years ago that you must update bank book on day of application (or day before depending on office), so maybe it was required but not so strict anymore? (I was going to go on 21 June because of what I read on here to make it same day or day prior update but I got the flu and couldn't do it) -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

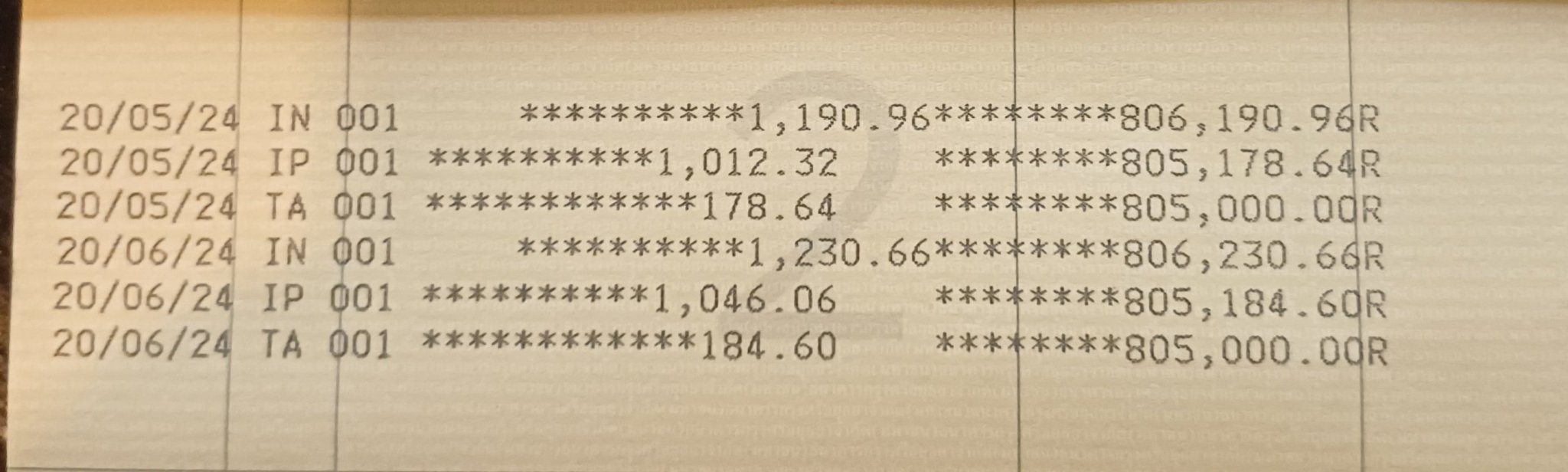

No doubt they were because you made it so. Doesn't mean Jomtien immigration is currently requiring it though? They accepted this after initial deposit on 20 April (just interest and tax transactions up to 20 June) -

DiY Retiement Extension - Jomtien

Pattaya57 replied to Pattaya57's topic in Thai Visas, Residency, and Work Permits

Thread is about rules at Jomtien though. No need to update passbook on day of application or day of Bank letter issuance or I would have been rejected and fixed term deposits with limited activity could never be used -

Big Thailand visa changes from June 1

Pattaya57 replied to snoop1130's topic in Thai Visas, Residency, and Work Permits

Yep, thread could probably lose the "Breaking News" banner 😆