-

Posts

3,156 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TroubleandGrumpy

-

He has lived in Thailand for over 20 years and is a Thai Citizen - he is the owner of the legal company and he knows exactly what he is talking about. Planning and preparing is not changing anyhting - it just means looking into the matter and thinking about the 'what ifs'. Apples and Oranges are both fruit that grow on trees. Up to you which one/s if any, you eat - I eat both.

-

Agreed - preparing for what could happen is always a wise move and is never time wasted, even if that time was wasted.. Learning how to plan and prepare is an exercise that can come in handy one day. Right now I am doing two things myself. One is waiting for the Thai RD to provide clarifications and details, and maybe even following Malaysia's lead by postponing implementation for a few years, to give plenty of time to cover all the issues and release detailed advice. The other one is to bring in more this year than planned (not a tax resident in 2023), and then bring in the absolute minimum in 2024. Meanwhile I will watch as things develop - and I will not be asking the Thai RD for advice ???? Concurrently, I am continuing to check out the 'Retirement Visas' on offer from neighbouring countries. And let me tell you, with the recent clampdown announced on TM30s being in Passports, it is ridiculous how Thailand treats its 'invited guests' compared to most of the others. Seriously, Thailand has a very similar 'command and control' system over its foreign guests, that China and Vietnam do.

-

I always wear a helmet and gloves and shows when riding a bike in Thailand. If you dont want to know what the new Thai Govt law/rules are regarding what is an acceptable helmet, then that is your choice, but dont preach to me and others here about how we should live our life. I was watching a video yesterday from an online lawyer, and he said that it would be wise for everybody to be aware of how these coming changes might be going to affect them. He warned that even Al Capone found out the hard way that you dont mess with the Tax Dept - and ignorance of the law/rules is no defence if you are nailed by a Tax Dept. But in the end it is up to you.

-

That is what I figured - and one of the many reasons I am trying to figure this all out and decide what course of action to take. Still locked into Plan A at the minute = bring in extra this year - bring in minimum in 2024 - see how things pan out in 2025. Plan B - move to another retiree friendly country nearby (Malaysia and Philippines look good). Plan C - go back to Australia (much earlier than planned).

-

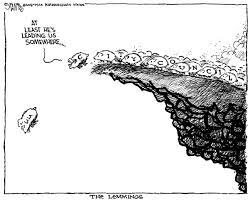

That is so very true mate - and it is so obvious to anyone that knows how things work in any Tax Dept, and how things work in Thailand. In Malaysia they recognised the disaster that was approaching when then did the same thing back in 2021. So they delayed the implementation for 5 years, and made exemptions for personal income tax returns. Hopefully there will be anough complaints and blowback (Companies, Thais and Expats), that the Thai Govt will also make qualified exemptions for personal income taxes, and also delay the full implementation. But as you have said before, they are desperate for taxes - the cupboard has been stripped bare, tourism is not charging back, funds are leaving the country at record levels, and exports are continuing to stall, and they have a 500 Billion Baht vote bribe that they have to pay for. Like you, I dont think they care who gets caught in their new 'tax net' - they are so desperate they are charging ahead like that bull you mentioned. Hopefully, sanity will prevail - Expats are not the main targets, but we could so easily get caught up in this new net.

-

Ditto. I have lived in 4 properties in Thailand (all rentals) - and only 1 of them I would even think about buying for all the normal reasons, but mainly because of the neighbours and dogs (very noisy). The only 'good' place was in an upmarketed gated community in Chiang Mai. PS - dont forget that unlike in the west where you can sell your place while staying there, in Thailand it usually has to be vacant - which means renting somewhere while waiting for the property to sell - unless you really really trust your agent and lawyer.

-

Exactly. Exactly what is a Mutual Fund to the Thai RD - does that definition include Mutual Funds overseas. If I do have to lodge a tax return, how will I prove to Somchai that my Mutual Fund (Super) in Australia has already applied a 15% tax to all the earnings in the Super Fund. Will Thailand view the Super Fund 'earnings' as taxable. Obviously the only way to get those answers will be if/when Thai RD releases all the clarifications and details. But at least I have a good grasp on what the questions are that I will need to ask. The thought of throwing everything over to a Thai lawyer/accountant, with no idea how things might affect my finances, is not my idea of a good strategy.

-

No mate. Unless you stay 180 or more days total in Thailand in any tax year (Jan to Dec), then you are not a tax resident and you are not required to lodge a tax return. I should have specified - my answer is for tax residents only. My point being it would be very unwise to not lodge a tax return if you might have taxable income, because in the future the Thai RD can backdate their 'audit' and severely nail anyone for not loding a return, plus they can apply severe penalties to any money they determine is owing.

-

Yes that could be so. But it will not be clear until the Thai RD provide guidelines and details. It is only on that basis that it is wise to 'stay under radar' and not lodge a tax return. If the Thai RD guidelines and details (when they are provided), make it clear that we must do a tax return and that we must prove the money is not income, then to not lodge a tax return is very dangerous. If you break the tax laws and dont file a return, they can audit you for up to 7 or 10 years (not sure which). And their penalties can include veryu serious fines, interest of 1.5% on any amounts owing, jail terms, and then of course deportation. Dont mess with the Tax Office is my strong advice to anyone - anywhere in the world.

-

Unlike the Thai Immigration Police, the Thai RD staff are not expected to speak English. Certainly you can lodge a tax return in English or Thai, but according to my read of their 'guidelines' they can ask for any English documents to be translated into Thai and certified. Any subsequent 'appeal' against their decision, must be 100% in Thai - just like when you try to take any matter to a Thai Court.

-

And there we have it - totally guaranteed statement of fact from one who knows it all and understands everything about this matter. Thank you so much mate. Please put 1 Million Baht into an escrow account and send me the details - I will take that out only if the impossible happens and you are wrong. You know, I can recall a similar situation years ago when Expats were being fined and nailed for the TM30s, when the hotel had not reported them staying. This happened after the Junta decided to crack down on TM30 compliance - no rules were changed - they just enforeced them literally. After a few months the Thai Foreign Journalists Association organised a meeting which was attended by the Head of Immigration in Bangkok 1 Region and his minions. Their attitude was antagonistic and conforting - they were obviously told to attend. After quite a bit of 'toing and froing' the Head himself answered one question - 'Why must an Expat pay a fine when it is the Hotel that has not lodged the TM30 and he cannot?' His answer was "That is the Law" and he sat down. The event was recorded and the blowback in the media, including outside Thailand, was big. Not long after that they eased up the enforcement of that TM30 Law - which is still there. If you dont understand why I said the above - it is about interpretation and enforcement. I do hope you are right - but if you are wrong I will be 1 Million Baht richer - that should pay my taxes for a few years ????

-

Jacob - that is not the issue or concern. The issue/concern is the potential taxation of pensions and savings being brought into Thailand by Expats, when that money being brought into Thailand is listed as an International Transfer - was it income, was it savings, etetc etc - and how to 'prove' that to the satisfaction of the Thai RD if required. The complexity and problems are half the issue, and being required to pay income taxes on money that is not income (as such) is the othjer, and the third big problem is having to deal with the Thai RD.

-

Thanks mate. And you are right - I am the Grumpy one, and the Thai wife is Trouble ???? Like you I have dealt with many Tax Offices, through working with the Australian Tax Office (as an IT Supplier), and I have known many friends and colleagues who worked in the ATO. For those that do not know, in Australia the Fed Govt is very much like the USA Fed Govt. In the USA the vast majority are in Washington, and in Australia they are all in Canberra where I lived for 20+ years (for my sins). But unlike in USA, the State Govts in Aust are much much smaller - the Aust Fed Govt is way bigger than in USA or UK or anywhere I am aware of. When I say 'bigger', I mean their authority and control over how all Australians live and work. The Tax Office in Australia is omnipotent and controls all taxation in the country and internationally.

-

I and many many others agree with you Tom - it is a totally unacceptable situation that appears to be developing right in front of us, and we do not know when it will become clear what is going to happen. My Thai wife and I lived in Thailand for almost 5 years, then we lived in Australia for 5 years, and now we are back in Thailand. The plan was to live here for 10-15 years, and then (maybe) go back to Australia when very old (in 80s). This was all planned - the wife is Aust Citizen and I was forced to live there to 'qualify' for the Pension (living in Aust being one condition). Nowhere in all that planning both socially and financially was there any consideration for lodging tax returns and being obliged to pay income taxes in Thailand. Unlike some of the Exp[ats on here, my Thai Wife is adamant that I/we will not pay income taxes in Thailand, on the money I get as a Pension and from my life savings in Super. Hopefuly when all the dust/cloud clears that will not be the case, but every 'announcement' since this was first advised by the Thai RD, has not stated that retired/married Expats are not being targetted to pay income taxes in Thailand. We have two 'frontline' options, because only staying 179 days would be too difficult for me/us (we rent). First is to move to another country nearby, so we can easily visit for holidays now and then - Malaysia and Philippines look the best options at this time - maybe Indonesia (Bali). Seconds is to move back to Australia - maybe somewhere up north so it is a much shorter flight to get here and to other destinations we planned to visit in Asia using Thailand as our base (Singapore, Japan, Korea, China, Vietnam, Cambodia, Malaysia, Indonesia - I have no intention of ever returning to India).