-

Posts

10,579 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

I have never seen any reports for anything but Teak. There maybe other timbers that are covered but I’ve only ever seen the reports about Teak. They are usually infested with termites as you can see, though the termites live in the cracks and don’t, or can’t, eat the heart wood. There are several species used. The wood is extremely dense with some having a very marked difference in colour between the hardwood and surface layers. It is very similar to old English oak where you will find woodworms cannot eat the heartwood even after a few hundred years of trying. I decided that its not worth the time and effort to convert the house posts into usable material.

-

There is no license to possess hardwood per se, there are licenses required to be involved in Teak

-

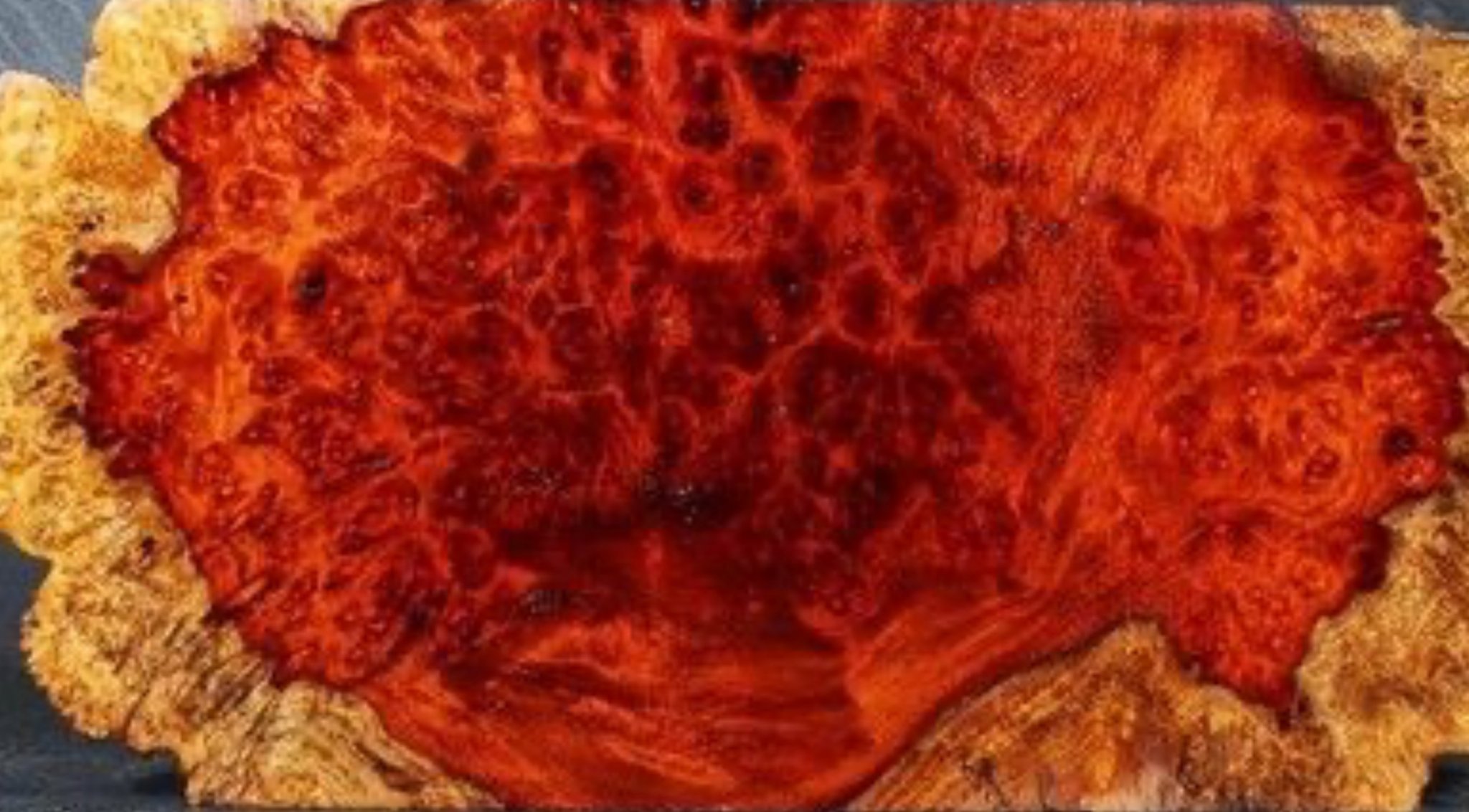

For that I would ask a super yacht joiner or a private jumbo airplane outfitter or someone who is outfitting really high end apartments or houses that are in the hundreds of millions and the ฿150,000 per sheet is not even at the high end of prices. for reasonably simple face veneer prices this is an example of the process. as to what you can get try a pattern like this (1-4" T x 2-5" W x 3-12" L $60.00) sizes to outfit a room like this then multiply the face veneer prices by a factor of 10 too 100 as you will be exhausting the available world supply.

-

Usually don’t have the flexibility required if the under floor is not completely stable

-

That maybe what you think, however I would be extremely surprised if you can find anything closer than Bangkok, I have looked in an area about 150 Km north and south of Khon Kaen and they are the only company that has that material. You can probably get the shipment from KK for a reasonable price. If you know exactly what to look for it is possible that if you go to all the suppliers in the Chang Mai area you might find a supplier. However there are so many variables in the manufacturing process of plywood, all of them will effect the price and you can specify materials that will change the cost per 20mm sheet between about 400 per sheet to upwards of 150,000 and you will probably need to buy a quality that will make your eyes water A standard sheet is 1220mm x 2440mm Again a nice idea, unfortunately it won’t work. The only thing that will prevent formaldehyde exposure is to not use products that contain it in the construction

-

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

Again no mystery, just plain economic reality and little to do with greed. The card company charges a variable fee that can go as high as 4% (it depends on a number of factors but 4% it possible). But of course that is just one of the associated costs there are paperwork, accounting and record keeping costs involved. Once you analyse everything it is quite possible that overall the business makes little to no extra profit specially since they have to average out the expenses Whilst that maybe a requirement, there is nothing I see in the provided link that supports your statement. -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

The reason is really simple, while you pay the amount on the bill (unless they are asking or 5% extra) the merchant does not get the amount you pay they are charged a fee for the transaction. In most countries the merchant must eat that cost and are prohibited from passing it on to you, the situation in Thailand is not so clear cut, while merchant agreements may say that they cannot pass the cost+profit on to the customers the actual situation is that many do. So why should you expect to pay less for your items than someone using cash? There are many situations where they will give you an effective Credit/Debit card discount, as it makes business sense, others like your car dealer, where the fees to the merchant are so big, they will pass them on or refuse a card transaction. -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

Some cards do that. It depends on the agreement between the air miles provider and the credit card provider. You will have to find a bank who has an arrangement with an airline and will allow you to get a secured card that gives miles. If you find one then it is a good choice. -

That is a reasonable idea, there are some things you need to do before doing that you will first need to level the floor, while I’m not there I can be sure that it is not flat now, then since the floor is creaking you will need a minimum of 20mm ply (you could use USB but you need to know where to buy it) I know a supplier in Khon Kaen and you will pay 1,200+ per sheet for good plywood, again you have to know where to go as the majority of places have cheap Chinese plywood. You can never get a bargain on plywood, if its lower than 1,400 unless you know the suppliers, the reasons will include; little glue, high formaldehyde levels in the product, micron thin surface veneers, veneers overlapping, veneer voids, short time in the veneer press, low temperature in the press, etc don't make the mistake of using outdoor ply inside as the formaldehyde levels will be stratospheric, also don’t believe that your builder has any knowledge of any of the information above, they will almost always consider that they have a bargain when they pay 600 Baht for a sheet of cheap c*r*a*p, that will do an adequate job for a year or two, while giving people formaldehyde exposure.

-

I bought some glue today to repair a plastic PVC chair

sometimewoodworker replied to steven100's topic in DIY Forum

It lasts even longer if you put it in the freezer, but beware of humidity. -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

While it is certainly possible to add another authorised user for some, if not most, credit card account holders, and that for some that is useful, it doesn’t help the OP’s requirements. -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

Succinctly put, and it is not just foreigners but it also applies to Thai citizens though of course it’s not a work permit that is required for them but a job with a history. -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

That is absolutely correct. No job (Thai or foreigner) no unsecured credit card. The only possible exception is if you have quite a few million in the bank . -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

So far you seem to be the only one as everyone else has secured cards despite what @SAFETY FIRST is claiming his very substantial investment IS securing his card also unless you got yours in the last year nobody has mentioned that they got one When was it issued. what did you have to show to get it -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

So a secured CC 😉😉😉 555555 -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

No I didn’t, I said that years ago the requirements were different It is absolutely about time. 2008 is in the past when requirements were significantly less strict. There have been many who have tried to get an unsecured credit card, nobody has posted success without either an very large bank deposit and certainly nobody who is just sending in the the 65k per month, you claim that you were sending in 6 million per year, today that would attract a significant Thai tax burden that few would want And I have a red bridge in a cool area of west coast USA that you can buy with your imaginary millions. for those who have large income the rules are flexible, for the 99% if the population who don’t have those kinds of funds, none of them are getting an unsecured credit card and FWIW you supposed unsecured credit card requires 10 million of term Kasikorn securities to start. -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

As I said I have not heard any reports of anyone getting an unsecured credit card without having a job in Thailand. Have you had a credit card issued in Thailand in the last year or so. If so I would be very interested to have an update on the availability of unsecured credit cards without employment. -

Getting a credit card

sometimewoodworker replied to MarkT63's topic in Jobs, Economy, Banking, Business, Investments

There is no way that, unless you have a job in Thailand, that you will get anything but a secured deposit credit card, though the SCB requirements are rather more than most at 200% of the limit Kungsri is at 110% though that is only certain for a Thai national (SWMBO has one) Secured deposit credit cards are a standard option in Thailand irrespective of nationality. In the past regulations were less strict so the job requirement was not enforced strictly. -

There are not 2 positives. That is an American 120V half phase system where to get 200+V you need 3 wires (the 2 half phase (I know that they are technically 1/3 phase) and for 120V (often 110) you need 2 Thailand has single phase 220~230V and 3 phase 380+V So you need 1 line and 1 neutral (preferably 1 earth) because this is Thailand any colour will be used. So you need to test to be sure. Typical colours for neutral are white or blue, typically colours for line are red, brown, black. But see above never trust before testing, of course there is the problem that your LED could be 12V. Typically, 220v LEDs will have a bridge rectifier in the fitting so it will not matter which cable is line or neutral

-

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

In general iPhones are supported for double the time that android ones are so something like eight year while the typical android is not more than 4. So as long as it does what you want you are likely to get 3 to 5 years out of a 5 year old secondhand iPhone while the android of the same age may just get 1 year before the banking apps no longer work