-

Posts

10,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

Do tell the makers of the most desirable products like Porsche, Lamborghini, Rolls Royce, Bentley, Ferrari, Lexus, Alfa Romeo, Louis Vuitton, Chanel, Prada, Hermès, Fendi, Céline, Dior, Patek Philippe, Rolex, Audemars Piguet, Breitling, Cartier, etc that because they have small market share they are unimportant. -

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

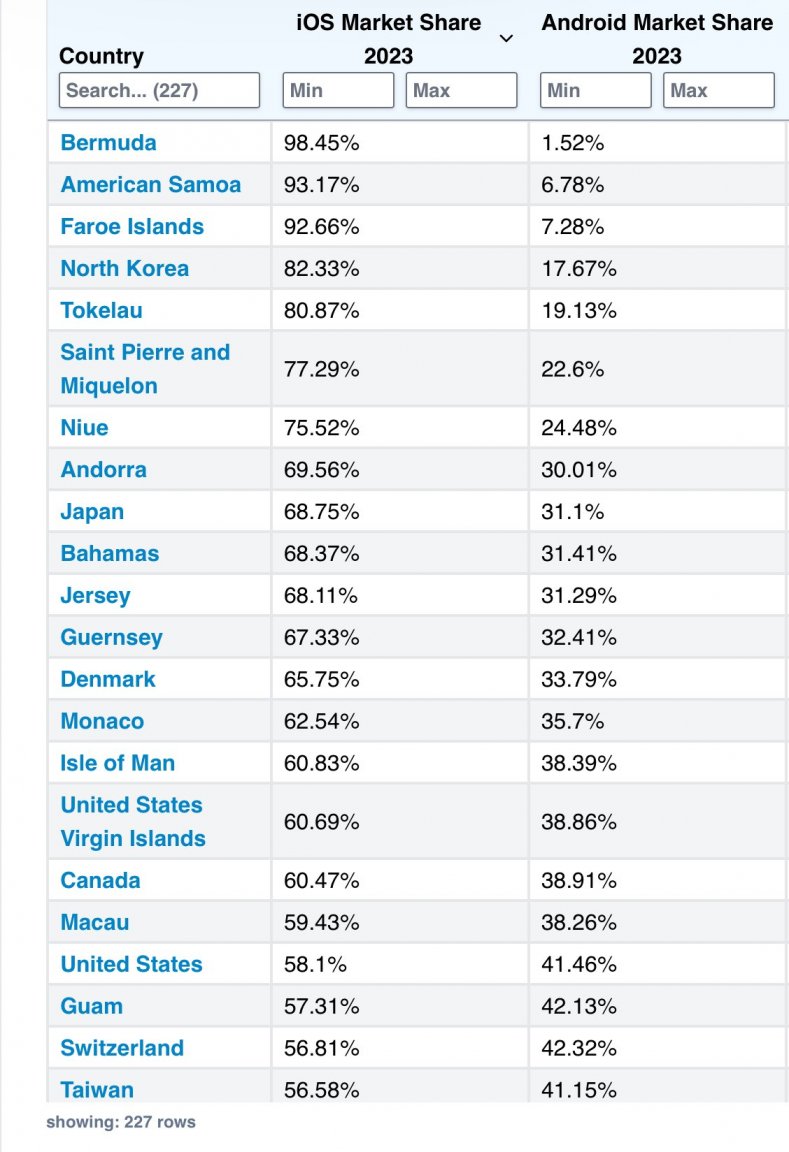

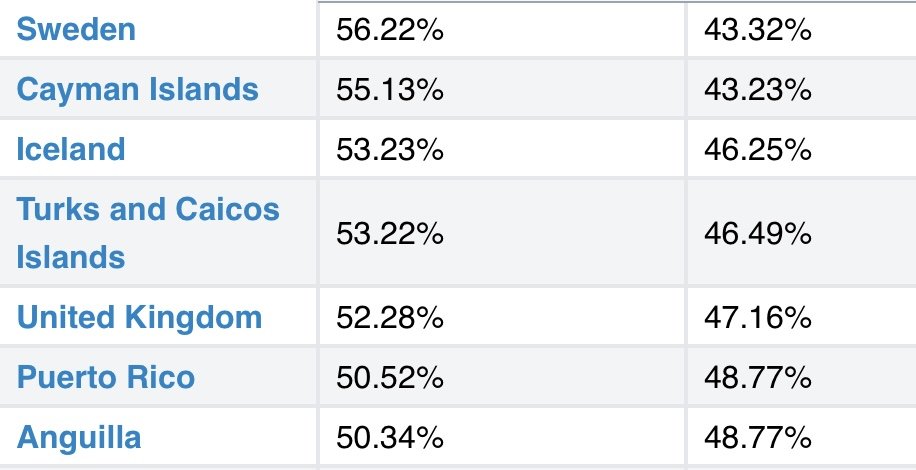

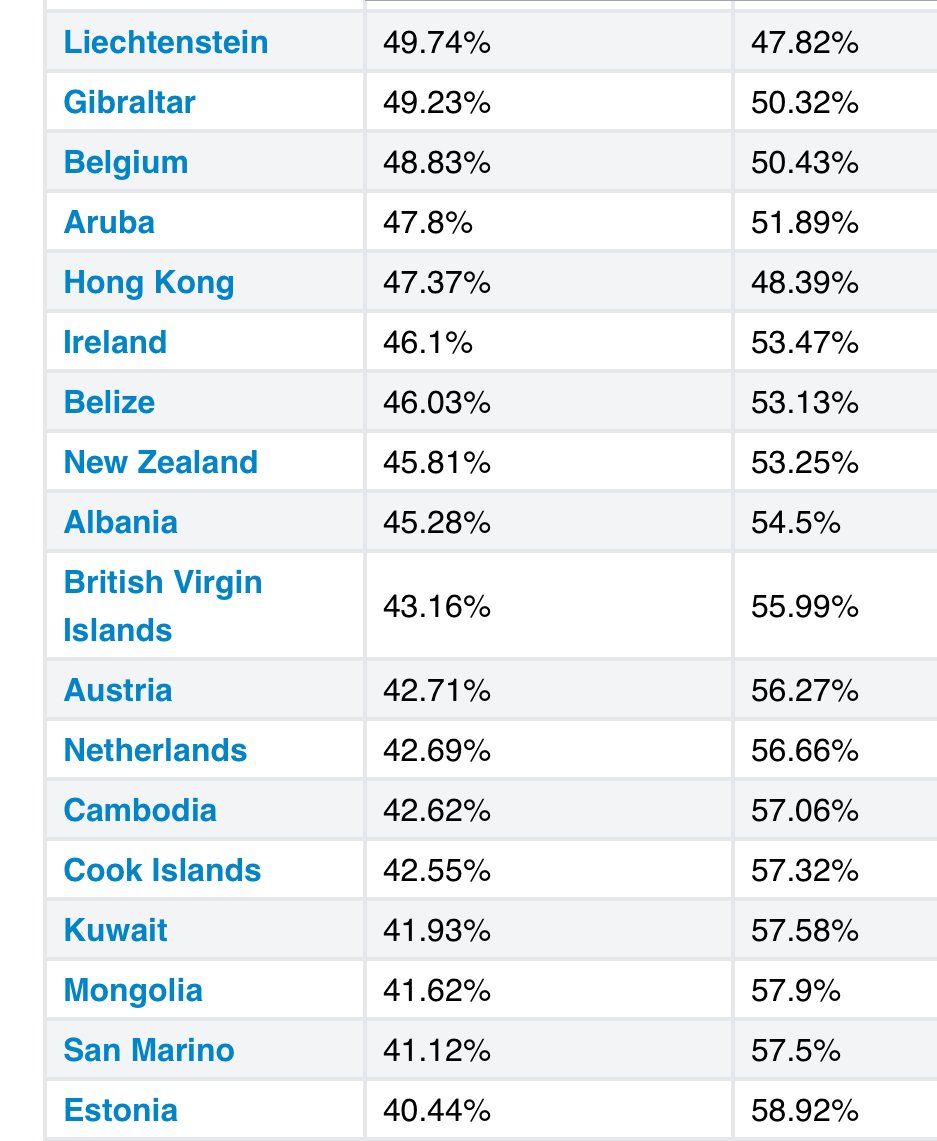

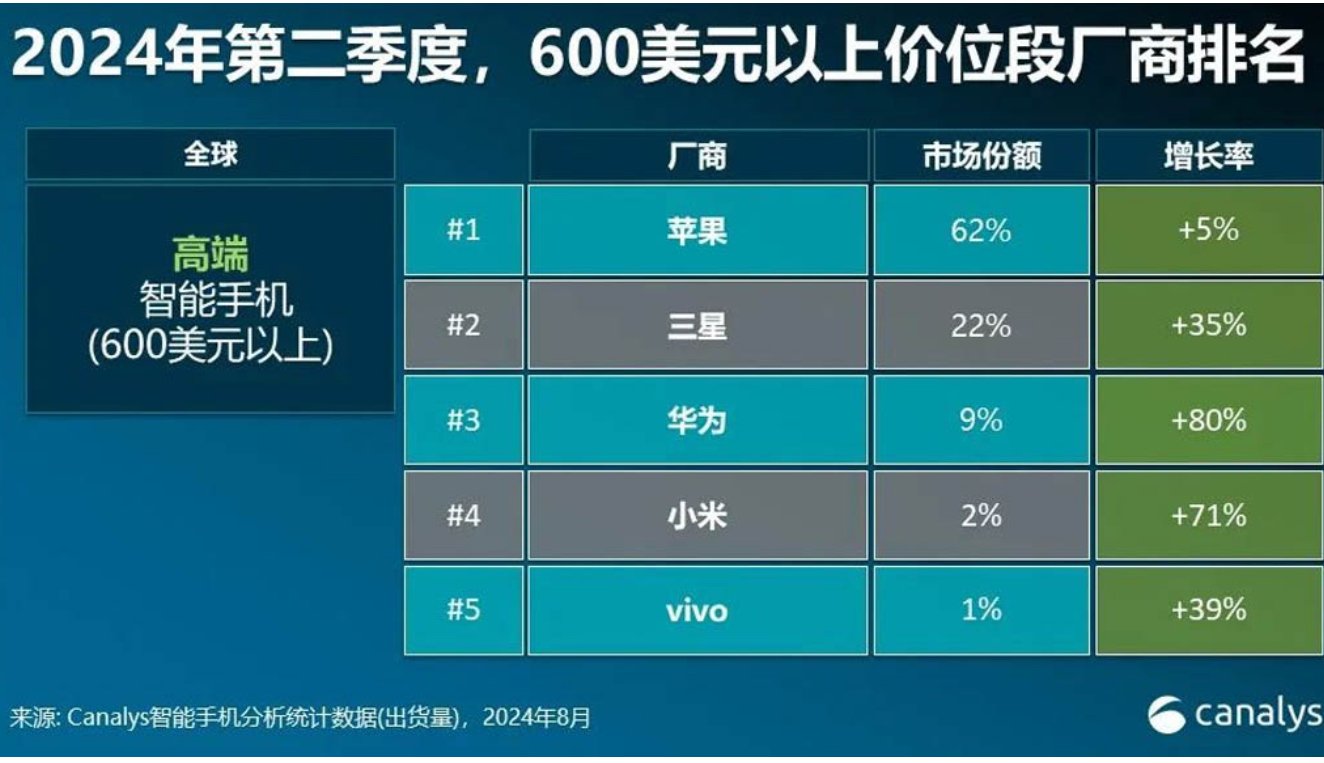

You really should extract your head out of a place designed for solid waste elimination there are 29 countries over 50% market share with another 18 over 40% as @Paradise Pete said world wide Apple is at 62% virtually 3 times the nex contender even in the Chinese market they are 1.7 times the Chinese maker so sure your cheap android phones are selling more. Do please let us know the actual profit made by the android phone makers are any of them making more than 5%? -

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

You may like to try to convince yourself but you are wrong. apple has very few models compared to the hundreds of android ones however even in Thailand the market share is over 33% and rising, in the USA it’s over 58% and rising in the U.K. over 52% and rising while android is falling in all 3 Take all the high net worth countries, the top being Bermuda at over 98%, few of them are under 50%. So you can try to convince yourself and others of the fable of Apple having a small market share, they don’t! -

Can't Come In Without A Boarding Pass!

sometimewoodworker replied to Pui's topic in Suvarnabhumi Airport Forum

It came in when the TM6 was stopped -

Nothing unusual about that, many/all, countries will issue 2 passports if you have a good reason. Many frequently travers will have one with an embassy getting visas and be flying on the other. That the vast majority of people don’t know this is because they fly so infrequently they have never had a reason to have a second passport. FWIW, I have flown domestically 4 or 5 times this year, I have always used either my pink card or Thai driving licence. It has been the same in virtually every hotel as well.

-

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

Well no it isn’t really more. Apple basically charges exactly the same, just that the exchange rate has tanked and they don’t adjust prices that quickly, also there is the difference in VAT (Thailand) and state taxes (USA) go back a couple of months and your $89 = ฿3,270 so where is the joke? The closeness to China is irrelevant. -

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

You may want a cheap new phone, personally I used a Samsung Hero until I needed a phone with Apple CarPlay, when I transitioned to an SE 2 You may have the skill to do that with a hairdryer, but get it wrong and you will damage the Touch ID sensor and then if you want to use Touch ID you are out of luck unless you want to pay Apple (the only ones who can do the job) upwards of 12,000 for a replacement screen & home button DAMHIKT 😪 -

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

@Paradise Pete is absolutely correct the cost from Apple is ฿ 3,290 it will have a guarantee and be genuine and though they won’t damage anything if they do fixing is free you can get an independent to do it for you for less, the battery will have a shorter lifespan. while @NotEinstein did a replacement on an iPhone 6 (I could also do one on one of those) because the screen is not hot melt glued) I doubt he would do a glued one, I certainly would not. -

Reduce taxation by gifting.

sometimewoodworker replied to phetphet's topic in Jobs, Economy, Banking, Business, Investments

Rather nicely put. 45 years ago HMRC presented me with an estimated tax bill of a reasonably large number of thousands of pounds. Reading the notice closely I found that unless I filed a dispute within a few weeks the estimate would become my tax bill with no appeal possible. I filed a tax return with zero tax owed, sorted. It is unlikely that the TRD acts much differently. It is always the taxpayers duty to prove that the tax they pay, or don’t pay, is accurate and can be supported by proof. Tax authorities are quite reasonable if you show that you are following or trying to follow the regulations and will often overlook small differences or missing receipts or documents . They are Jekyll and Hyde if they feel you are trying to pull a fast one. -

Since the transactions will be looked at by the TRD that would be an extremely risky course of action. However the report of an “independent” mechanic detailing all the requirements to bring the car to a saleable condition could easily drop the market value by a very significant amount. Nudge nudge wink wink

-

@Lorry The legislation is being drafted. It will not be implemented in 2026. The British chamber of commerce along with the American chamber of commerce are, or will be, lobbying on the exact details. 2027 is the earliest possible date due to the fact that it isn’t yet drafted and after drafting it must go through parliament etc. Until implementation of WW taxation, sending otherwise assessable income as gifts in the correct way with the correct documentation is legitimate tax avoidance and depending on your available funds to transfer can save millions. In 2024, 2025 & 2026 sending to one family recipient could avoid up to 21 million in tax, more if you have more than 1 person to receive and have enough to give. Personally I will be saving more in tax and hassle than I have spent on advice and legal fees, also the WW changes will have little effect and the gift route will still be effective for my personal circumstances.

-

Replacement Apple batteries, oem or generic?

sometimewoodworker replied to up2you2's topic in Apple Products

It very much depends on the life you expect to get from the phone. The genuine Apple sourced batteries are excellent value for money and you can be sure the replacement will be perfect. You can get batteries of various qualities from independent suppliers, they will be cheaper, they will not have the same life time as an apple battery, Apple does not supply batteries to anyone neither do its suppliers. So if you want 2 and more years then get it through Apple care, if you want a cheaper battery that will need replacement long before the Apple only then use a good independent. -

True I disagree see P161 modified by P162. That may work, but isn’t the only safe way and being not tax resident does not mean that you are exempt from paying tax (it should but it doesn’t because This Is Thailand) If tax resident you are already in the system however, if the TRD will ever bother is completely different. those who file are more likely to be questioned, but more likely is still not very likely. Just hope that the TRD never gets the budget to multiply is staff and computer resources by large factors

-

Because there are so many different sources of income being remitted, different tax rules in home countries, different allowances available in Thailand, different dependents along with over 60 DTAs that may be applicable, that there is almost a different set of rules for each person Really! Because it is true add all the income sources, multiply by all the countries with DTSs, multiply by all the various Thai allowances, multiply by all the different domestic situations and the possible permutations are in the hundreds of thousands if not millions. So almost everyone has a different answer. You either do it all yourself or if you don’t want to then you can pay an expert , not bother and be liable to penalties if audited or totally OK or paying more tax than the minimum you are liable to.

-

That maybe true and a bigger pump will probably work, however your current pump may be sufficient with correctly sized pipe. The vast majority of Thai plumbing is done with ½” pipe and multiple 90o bends Many houses that complain (or don’t bother complaining) will have much better supply pressure and flow if they used 1½ “ pipe until just before the outlets and as few bends as possible The reason why ½” pipe and multiple 90o bends is a bad choice and 1½ “ pipe until just before the outlets and as few bends as possible work is friction losses in the pipe a 5 meter run of ½” pipe and multiple 90o bends compared to the same in 1½ “ pipe with few bends will have 80 x friction loss, and higher, than the larger bore pipe. You can overcome this by using a bigger pump and keep using small pipe & that is what most do. as to your situation if you don’t want to replace any pipe the bigger 250 will probably be plenty. if you are up for replacing pipe then any runs of ½” that are replaced with 1½ “ pipe will help, the more that is replaced the better. If you are going to replace any pipe you may find that your current 150 is big enough.

-

I did My students rather strongly disagree. But then they were paying and continued doing so for years. However I didn’t accept everyone who applied, I suspect that you might not have qualified for my assistance. No thank you. It has been sufficiently explained, explored and talked over in the forum messages. however PLONK.

-

This is your interpretation. I too use Udon immigration. They do not hate the marriage extension. It is quite possible that they hate those who do not have all the correct papers organised. the IOs may well reflect the applicant’s feelings. My wife has been complimented on the fact that we were so well sorted out. I have had everything organised and signed, they just needed to put the stamp over our signatures. There is occasionally an extra document added in but that is the same for any application not exclusively the marriage extension.

-

I can, and did, explain it to you, however I cannot understand it for you. Personally I paid for the advice I received so it was their job to explain it to me. It is possible that you require an explanation tailored to you. There is ample information in the threads for most to tease out the meaning, if it is opaque to you then you need someone else to explain it. I have found in my professional experience that my desire to teach and explain, some times at great length, is related is reasonably closely related to the compensation I receive (be it financial or otherwise)

-

And exactly how much tax, as a percentage, of overseas income remitted to Thailand are they paying? If it’s not zero the they are probably fools or have poor advice. If they have Thai income they should be paying a maximum of 17% or once again are probably fools or have poor advice. there is the letter of the law and there is the way it is applied, you should be well aware that the 2 are different. Can the application change? Of course it can. Will it? Probably not. On the subject of gifts, talk to people who actually know the practice and the way it is applied. I know both and am confident enough that I will be able to defend my decisions should I ever be audited. NB I do not bet unless it has no risk.