-

Posts

10,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

You have made some unnecessary restrictions but are on the right track. only talking about TRD Money generated in a year you are not tax resident is not assessable income whenever it is remitted, so you only need to be non resident in the year you sell your house and make the capital gain, SO ONLY 1 year as a nonresident is required. if you are a nonresident you have no assessable income irrespective of when or how it was generated All the above is predicated on the current rules not changing. of course if the rules change the above avoidance strategies may not apply.

-

The current Thai rules are clear 1) the capital gain has been realised this year and you are tax resident in Thailand, the funds are kept outside Thailand 2) given that the rules do not change, you remit them to Thailand in any year. There is no time that can pass where you are a tax resident in Thailand and those funds magically change state from assessable to non-assessable. until 1/1/204 the magic time was 1 year now there is no limit Thai rules can change, they may restore the magic, I don’t think they will but they could.

-

You are basing your argument on a set of rules that haven’t been written yet. There is no standard set of tax rules every country has their on rules. Many are similar none are exactly the same. It is totally pointless to argue that under some unpublished rules that some capital gain will or will not be taxed and that under the same set of mythical rules certain conditions will apply. You don’t know, you can’t know. with all taxation rules the devil is in the details and since there are no details there is nothing to pontificate on.

-

From making the capital gain in your home country (independent of if you have a home country CGT liability or not) until remitted to Thailand (if you ever do) they remain a capital gain and so assessable for Thai tax according to the TRD. The TRD who is the only relevant body for this discussion, always considers them assessable This is only true if you are a Thai tax resident in the year the gain occurs and you are Thai tax resident in the year the money is remitted Thai world wide taxation would make changes that haven’t been decided yet so it is pointless to speculate until the rules are clear, however it is extremely unlikely that your idea about the likely effect is true Your introduction of the term savings is rather unhelpful, as the TRD has no interest the the term the remittance to Thailand is either assessable income, non-assessable money or a mixture of both

-

The best dummy ticket for proof of return

sometimewoodworker replied to Cameroni's topic in Thailand Travel Forum

Since it is a genuine booking you can go through the airline portal to Amadeus, Sabre, or Travelport. depending on the system the temporary ticket seller uses, give you family name, travel date and booking reference then printout the ticket if wanted. Since those 4 pieces of information are all that are required to confirm a ticket and you have a genuine ticket booked logos and QR codes are just eye candy -

The best dummy ticket for proof of return

sometimewoodworker replied to Cameroni's topic in Thailand Travel Forum

Who gets physical tickets to day? With your name and the 6 character booking reference they are as real as any other ticket until the time passes then they get cancelled -

The best dummy ticket for proof of return

sometimewoodworker replied to Cameroni's topic in Thailand Travel Forum

You specify the date that you need the ticket and pay then the details are sent to you on the date you specify -

I agree that 2017 is safe as is anything prior 2024 This is semantics and the terms are irrelevant as far as the TRD is concerned. The TRD is interested in if the funds are assessable or are not assessable when remitted into Thailand. So wanting to term them savings is just unnecessary confusing the issue. Once the funds are remitted and you decide if they are assessable or not and paid tax or not as required you are free to call them anything you like. Again what you decide to call the funds does not have any effect on if they are or are not assessable, you can call them tears of a unicorn if you want and as far as the DTC is concerned they always remain capital gains until remitted to Thailand. However the tax rules on capital gains are virtually always covered by a DTA/DTC the U.K. DTC says they are taxable in Thailand This would mean that if you were only tax resident in Thailand you would be exempt from CGT in the U.K. but required to pay in Thailand. you need to read the DTA/DTC applicable to you as Sherrings says https://sherrings.com/capital-gains-personal-income-tax-thailand.html Correct but you are rather unlikely to totally escape CGT

-

Seems stable is wonderful, until it isn’t! Our supply is usually okay as is our water supply, but we had a 5 day power cut a year ago and a 4~6 week water cutoff, the power cut was the most noticeable, we didn’t notice the water was cut until the neighbours asked how we were doing with no water for 2 weeks, we hadn’t noticed as our system has about 2 months storage

-

The best dummy ticket for proof of return

sometimewoodworker replied to Cameroni's topic in Thailand Travel Forum

The airline requiring you to show an outward or return ticket while checking in is very dependent on the airline (LCC’s are more likely to ask) and the airport you are travelling from. In some airports you will never be asked, in others you will often be asked, and in others you will always be asked -

The best dummy ticket for proof of return

sometimewoodworker replied to Cameroni's topic in Thailand Travel Forum

You clearly don’t understand the way those places function. They don’t use dummy tickets. They use real reservations with real airlines, with the correct entry in the database so it can be checked online if required, however they are subsequently cancelled usually between 24 and 48 hours after being issued, so since you should only need the ticket to checkin for your flight and once they have checked you in you no longer have a use for it. -

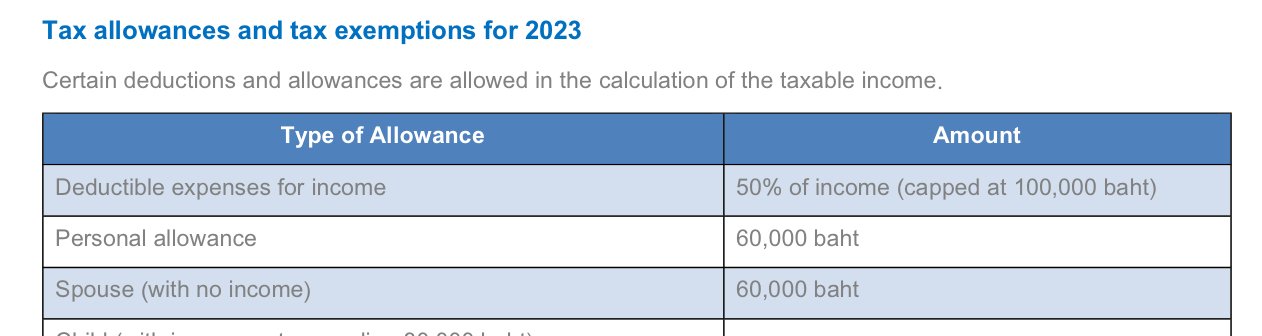

You are misinterpreting the 100k, it is understandable as it has been miss worded by many posters You have up to 100k Deductions for Expenses that is not limited to pensions but is allowed against all income. You get the maximum 100k deduction as long as your assessable income is over 200k Of course if you have no assessable income you don’t get the deduction but then it doesn’t matter as you won’t be paying anything anyway.

-

While the tax rate for descendants and ascendants is correctly given at 5% you miss the point that it is only changed after 20 million. Under 20 million gifts with the correct paperwork are tax free so as long as you complete the correct documentation you can ignore all the small transactions. However for the gift to be tax free it must be transferred directly to the recipient. To avoid Thai taxes on the money it needs to come directly from overseas to your wife’s account and she can not give any of the money to you

-

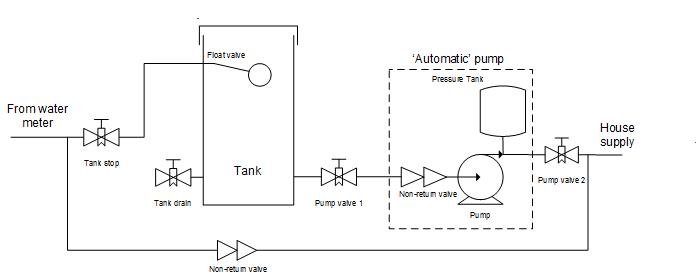

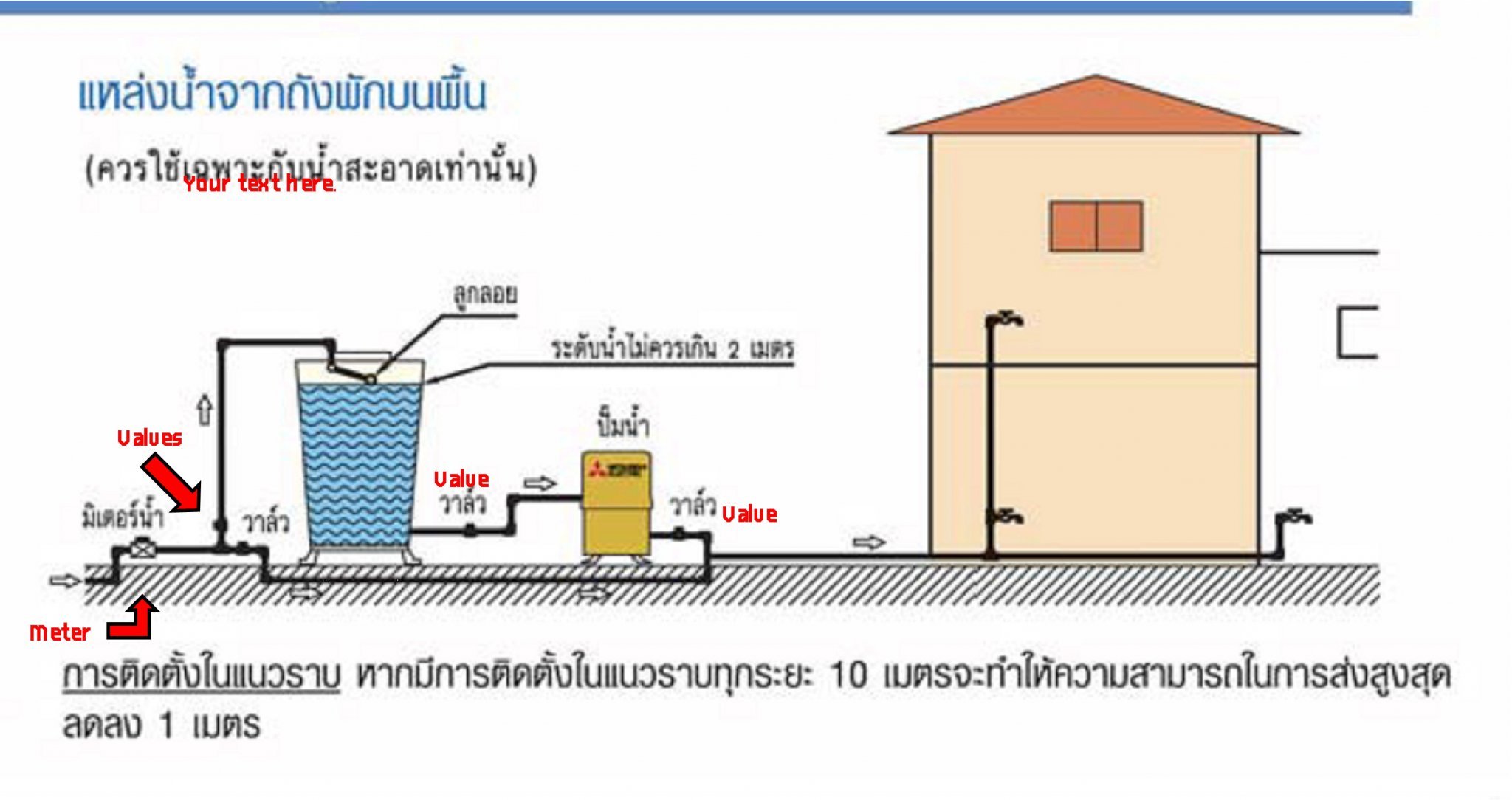

As @eyz4eva has good flow on some taps and the electrical supply here is often cut, not adding the bypass is a mistake. It is very probably small supply lines that have low pressure/flow and the pump will cure that.

-

You have found my plagiarism I confess I liberated the diagram without giving due credit to the master. It of course is your original

-

It is likely a semantics situation as well a what looks to be wording that is much more restricted on the picture above that reads ”50% of pension income up to 100K” that is the only reference to what I think all other sites like Sherrings term as an expense allowance. They do not list an allowance for pensions Deductions for Expenses Deduction against Category 1 Income (salaries, wages, pension income) 50% of assessable income but not more than 100,000 Baht

-

The PWA regulations do not permit you to have a pump that sucks from the water supply, which you seem to suggest you want to do. you need to have a storage tank that fills from the mains then you can pump from that tank. The 370W pump is likely to be enough and if you don’t have a supply problem the 1000L tank is likely to be big enough. @Crosby will likely be along with more information if needed.

-

While I don’t disagree that there may well be standard deductions I have only seen the one listed above, also the person I spoke to today did not know of any deduction specifically for pension income and given his position I would expect him to know. I remember that a deduction has been mentioned in some of the posts however I have not seen an authoritative link giving that information and would like to see some support for that.