-

Posts

10,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

The Hidden Dangers of Parasites in Stored Salmon

sometimewoodworker replied to snoop1130's topic in Thailand News

However you have missed the point that virtually no salmon you can buy has not been frozen and since the vast majority of parasites are killed by the freezing process your chances of getting infected by salmon tapeworm are virtually zero. so yes raw unfrozen salmon is far from safe but since you can’t eat it you are safe -

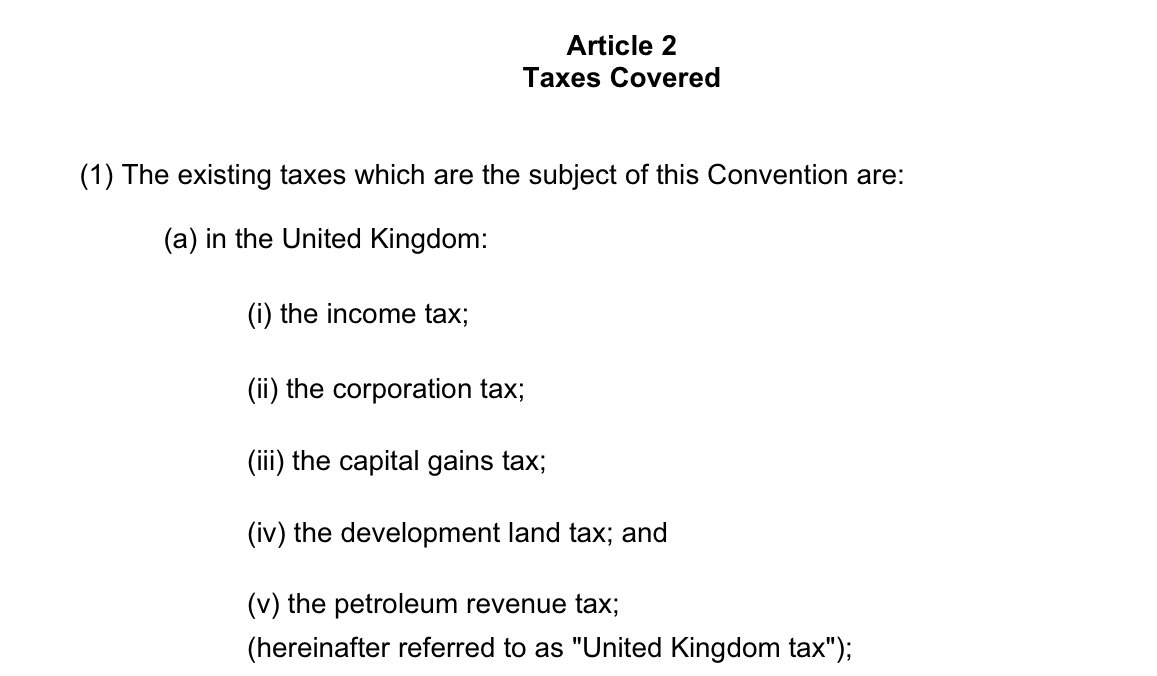

Your pensions were always assessable in Thailand when remitted to Thailand. So the completion of P85 makes no difference to the TRD. All it means is that you have no U.K. tax paid to offset the Thai tax that will be due. By a very rough calculation you will be receiving around ฿800,000 this will mean that you will almost certainly have a Thai tax liability of upwards of £450. these numbers are extremely tentative and would require much more information to be remotely accurate you need to provide exact figures to an accountant for this.

-

Thank you for the explanation. Personally I have had no requirement for an NT code as my pensions, state and private, are both paid without taxation into my U.K. account and I complete an HMRC return annually. I don’t have a tax code, I do have a unique Taxpayer Reference that may possibly contain a tax code.

-

The first is a question that is impossible to answer as it has been asked you haven’t given enough information. the second one that is given a question mark but is not. It is a winge. There is nothing that that suggests that that your bank deposit for your visa or extension should be exempt from tax and no reason for it to be exempt. However if you want it to be exempt then do not live in Thailand for more than 180 days in the year that you bring in the money. if you do your homework you can reduce or possibly eliminate your tax liability

-

Last time I looked a loan is a contract between 2 parties, nobody is forcing you to agree to the contract. There is a free market (with upper limits on interest) so if the loan is a profitable one there will be another lender, if nobody is offering a loan with a better interest rate then it is clear that the rate is suitable. If people are financially irresponsible it is not the lender’s job to lend at a low rate or educate them.

-

You have a rather misguided trust in a stamp. Also it is an assay office not an assessment office. Nobody buying gold will trust a a stamp, if they do they will shortly be buying gold covered lead. Your impression is wrong as a general rule, it maybe true for some countries and maybe regulated,, for example

-

In Thailand standard gold is 23 karat. The Sovereign is made of 22 karat gold, consisting of 11/12 gold and 1/12 copper, giving a gold content of 0.9167. The coin has a standard weight of 7.98805 grams and given that the fineness is 0.9167, the gold content is 7.323 grams or 0.2354 (Troy) ounces. So you will have to find a gold shop that will buy sovereigns, no shop will buy them without testing. I would very much doubt that you will get more than the scrap value from the majority of shops and that will be quite a bit less than a buyer who will buy them to resell as sovereigns.

-

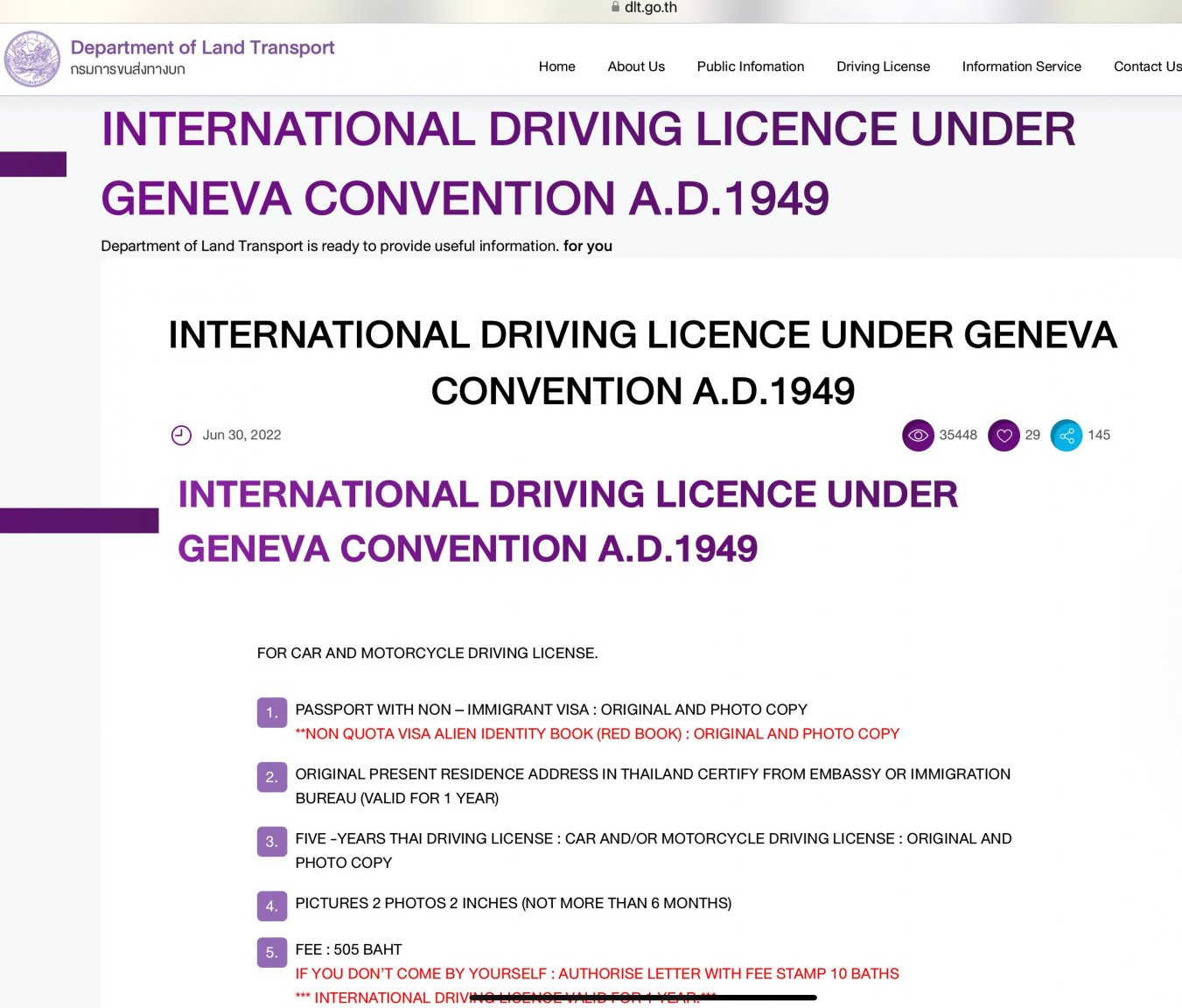

International Driving Permit

sometimewoodworker replied to daeumtnaot's topic in Thailand Motor Discussion

They will also usually accept a pink card and yellow book -

International Driving Permit

sometimewoodworker replied to daeumtnaot's topic in Thailand Motor Discussion

-

An account with commingled funds is a vey difficult one to justify the source of funds. if you are audited the Tax authorities will always assume that the origin of the funds are the kind that makes you owe the most tax. It is then up to you to prove that the tax authorities assumptions are wrong and you cannot do that. This is why you should have separate accounts where there is no commingling

-

It is illegal or at least strictly against PWA regulations (not to mention dangerous to health) to install a pump without a storage tank

-

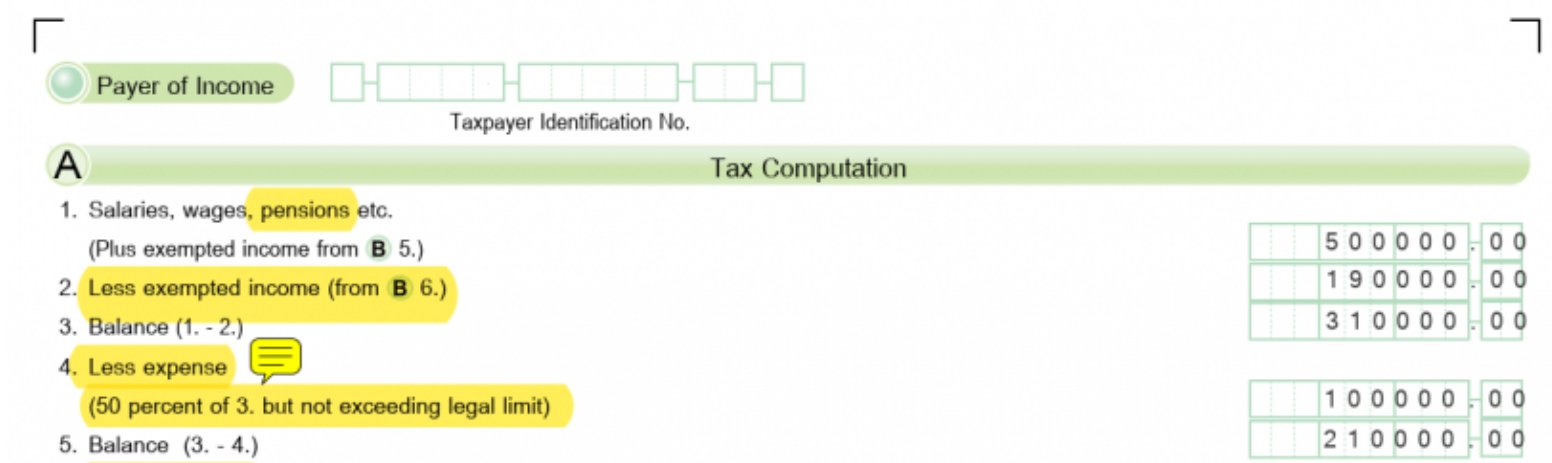

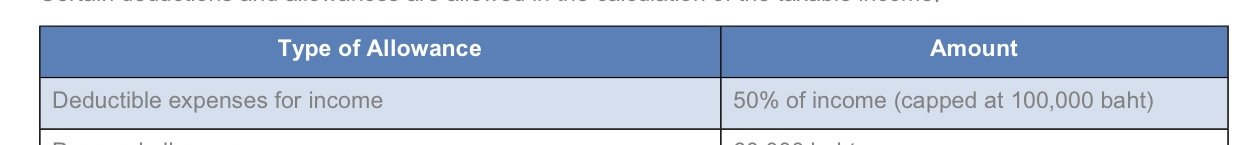

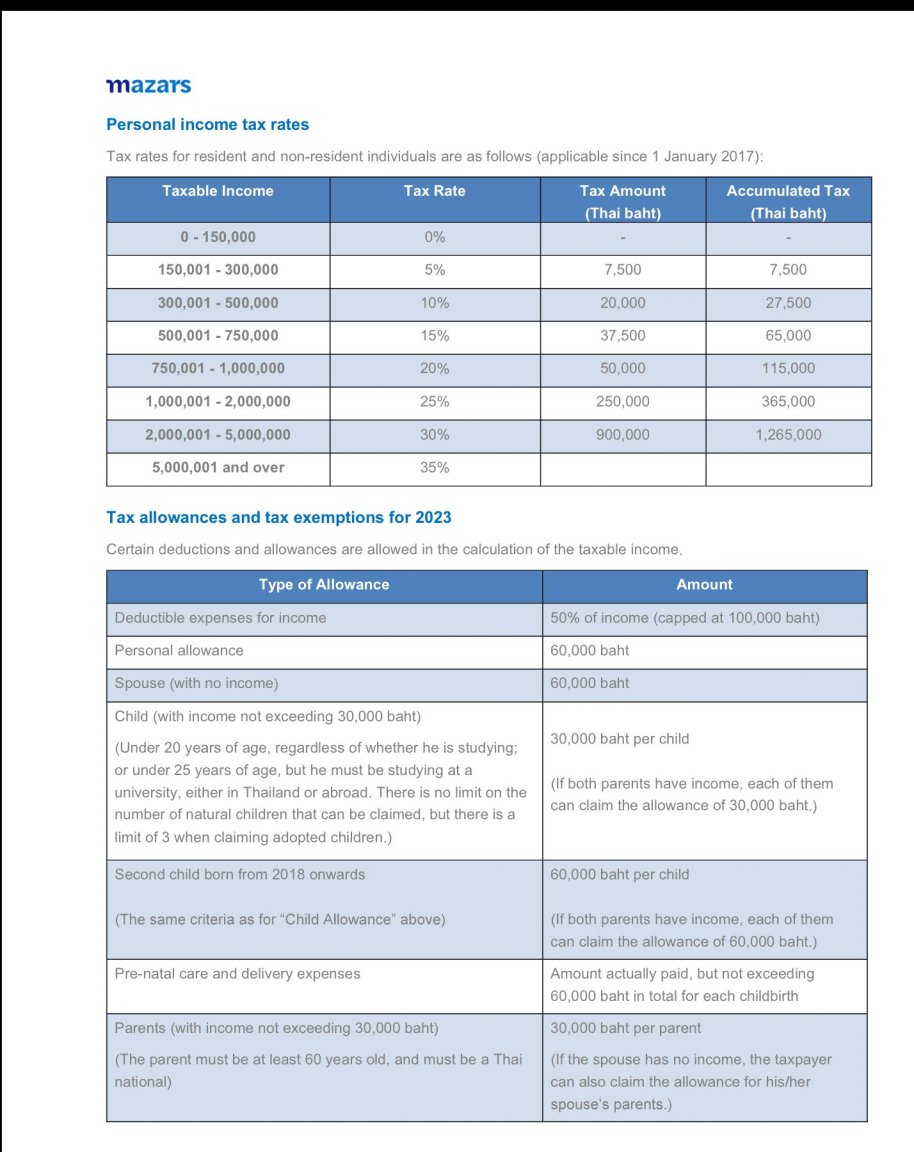

You are again defining the first of the Sherrings allowances as d) above while they only define it as Deduction against Category 1 Income (salaries, wages, pension income) 50% of assessable income but not more than 100,000 Baht Mazars also defines it as Deductible expenses for income 50% of income capped at 100,000 baht So your deduction is safe at ฿100,000 but miss termed. The definition given in the chart is wrong though the allowance exists and can be claimed by anyone with more than 200,000 of assessable income.

-

So do please explain your interpretation of This is the allowance that has wrongly been worded as an allowance specific to a pension. If you are so sure that there is an allowance specifically allowed against a pension only I would like to see an authoritative publication listing that. A tax director with Mazars knew of no such allowance and it is precisely his job to know of all allowance that can be claimed.