-

Posts

10,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

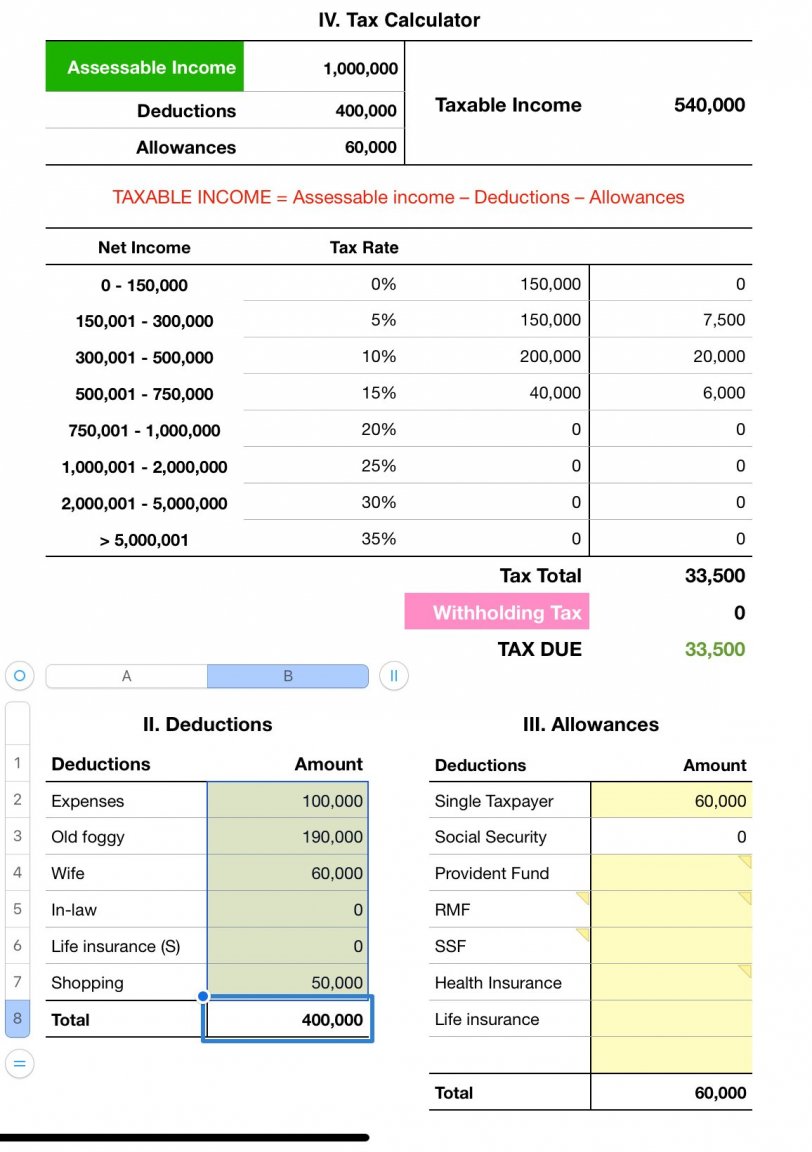

Tax Return 2025

sometimewoodworker replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

If you owe no Thai tax you don’t need to file a Thai tax return. I have virtually no knowledge, or interest in having much knowledge, about USA taxes or the USA/Thai DTA -

Tax Return 2025

sometimewoodworker replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

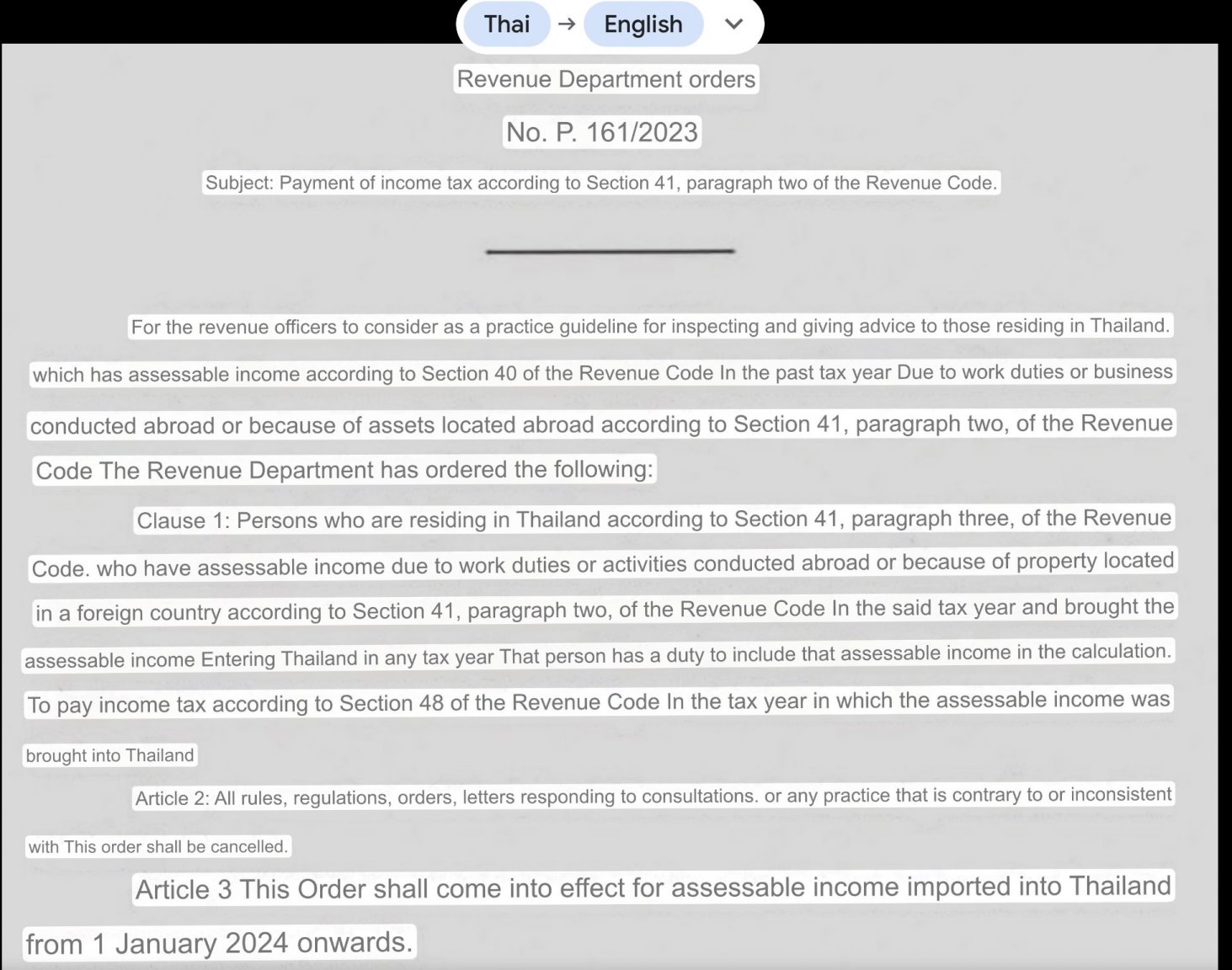

I can see nothing that supports your highlighted statement. Because you can find nothing contradicting a statement does not make the statement true. the TRD P161 does not, of course the various DTAs/DTCs effect the status of the assessability of the remitted funds -

Tax Return 2025

sometimewoodworker replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

One of the big 4 is offering a ฿17,000 + vat fixed price, many other tax preparers offer lower and higher prices, as has been mentioned you are likely, if you have a Thai speaker with you, to get the TRD to help for free. I filed a tax return a few years ago with TRD and translator for free and got a bit over a ฿300 refund. The TRD assistance is unlikely to be so good if you are trying to use a DTA reduction in tax due. -

if you consider the gift to be like income (of course it isn’t exactly but it maybe easier to understand if thought of like income) a gift can be property or some other item as well as cash. There are 2 allowances before tax is due; gifts to ascendants, descendants, or spouses, the allowance is ฿20 million per year per recipient. Then the tax is 5% For gifts to others, the allowance is ฿10 million per year per recipient. Then the tax is 5% The gift tax must be paid by the receiver of the gift This is the essence, however there is paperwork required that I’m not going to get into. The person making the gift gets no tax benefit by making the gift if the funds or items are in Thailand. I will not go into making a gift from overseas as there are people here who strongly disagree with professional advice.

-

It certainly can. Obviously but irrelevant You don’t know my level of knowledge and understanding. if funds have been taxed in the origin country is only relevant in the possible tax relief if remitted to the person who earned or generated them you are fixated on the source of the funds. If you didn’t earn them it doesn’t matter

-

Posit The funds exist, they are not illegal in the origin country. They may have been taxed or not in the country of origin. The taxation or not outside Thailand is irrelevant. They may be assessable if remitted to a foreigner who earned them. The are not assessable if received by a Thai taxpayer as a gift The foreigner has received nothing so has no tax liability

-

Back up your statement with facts and quote the exact TRD position that supports your theory. The gifter has not remitted taxable funds to themselves, tax is due on remitted funds only (this may change), they have received no funds, the funds were not earned in Thailand, Q.E.D. They have no tax liability

-

Please explain, using current rules, exactly how there is any liability to the gifter if the funds do not touch their Thai accounts? The funds originate from overseas and do not touch the gifters accounts. the gifter has not received anything so there is nothing to assess! NB the gifter must receive no money at all from the giftee

-

I had assumed that the words Since the gift is remitted directly to the recipient there is no tax. It is not income! Implied that the transfer to the recipient was directly from overseas and so was not made in Thailand. To be absolutely clear the gift is directly sent to the recipient from overseas. Thus the gifter has received no assessable income in Thailand. Of course if the funds first go to the donor it maybe assessable income. The recipient has no income they have a gift so no tax liability.

-

From https://www.herrera-partners.com/2024/01/10/on-gift-tax-and-properties-in-thailand/#:~:text=Legal Concept of Gift,the receiver accepts such property.” “ Legal Concept of Gift Section 521 of Thai Civil and Commercial Code states that “A gift is a contract whereby a person. Called the donor, transfers gratuitously a property of his own to another person, called the receiver, and the receiver accepts such property.” As it is pointed out by the regulator, gifting is one of the legal actions clearly stated in Thai civil and commercial code. This legal action must consist at least 2 parties, the donor, and the receiver, to form a legal action. For example, a father gives a car to a daughter. In this circumstance, the father is the donor and the daughter is the receiver. The legal action cannot be completed with only one party. Section 523 of Thai Civil and Commercial Code stated that “A gift is valid only on delivery of the property given.” Moreover, the gift legal action will be valid when a gift is given to the receiver. As long as the receiver does not receive the property/asset, the legal action will not be considered as valid. The donor must also be alive while the receiver receives such property. Otherwise, if the donor is not alive while gifting, such legal action will be considered as inheritance. From section 521 and section 523 of Thai civil and commercial code, it shows the qualification of the gifting. We can examine the legal action of gift must contain all these elements. We do not need to point out that without one of these elements, the legal action will not be considered as gift. The donor must show the intention of gifting the property. The receiver must show the intention of receiving the property. The receiver must be existing in the gifting period. This legal action differs from the inheritance. In gifting circumstance, the properties will be transferred to the receiver while both parties are alive. On the other hand, the donor must die first in the inheritance circumstance. If a property is transferred by inheritance, the outcome of the action such as the form of the action or the taxation can be different from the gifting. Hence, it is important to examine the circumstance thoroughly to examine whether it is a gifting or inheritance. Thai Gift Tax Gift tax is a personal income taxation made from the property that is given or received from a legal action of gifting before the donor passes away. Because gifting is a legal action that does not need any compensations from the receiver or the donor, the Thai regulator consider that there are many circumstances that the gift is made with the aim to avoid the taxation emerged from selling or purchasing. Hence, gift tax is collected to prevent inheritance taxation avoidance. Although the gift tax is a taxation on gifting, not every gifting has to be taxed according to Thai Tax Law. The following is the criteria for gifting that will have to be taxed according to personal tax law. 5% of the exceeding value of 20 million Thai Baht in case the receiver is the spouse, parents, or descendants of the donor. 5% of the exceeding value of 10 million Thai Baht in case the receiver is other third party. If the value of the property is less than 10 million or 20 million Thai Baht, the receiver does not have to pay the personal income tax for the received property. In other words, gifting a property, which has a value not more than 10 million or 20 million Thai Baht, is not obliged to be taxed for 5% of the value of the property. Nonetheless, each circumstance is subjected to different tax regulation. Although the circumstance may not be taxed according to the gift tax regulation, it may be taxed by other sections of the law. Therefore, it is essential to examine case by case and consult Tax advisers in Thailand.”

-

Really you should read more. https://sherrings.com/gift-tax-law-in-thailand.html while they do not specifically use the words you like, it is implicit. Since the gift is remitted directly to the recipient there is no tax. It is not income! Since the gifter has not remitted the money to himself there is no tax. If the money is given to the gifter it is no longer a genuine gift and is liable to tax The person giving the gift must document the gift, there must be no conditions to the gift. The giftee must be able to do anything they want with the money, there can be no restrictions on the use if the gift

-

Grounding from a wall socket/receptacle/outlet: Is it safe?

sometimewoodworker replied to GammaGlobulin's topic in DIY Forum

Don’t try to explain. Tell him what you want, that if he wants the job he does it your way and watch to see that he does what you want. -

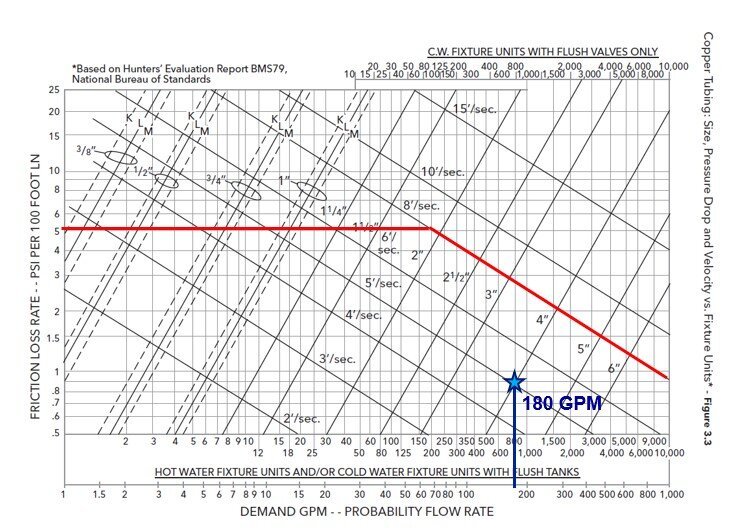

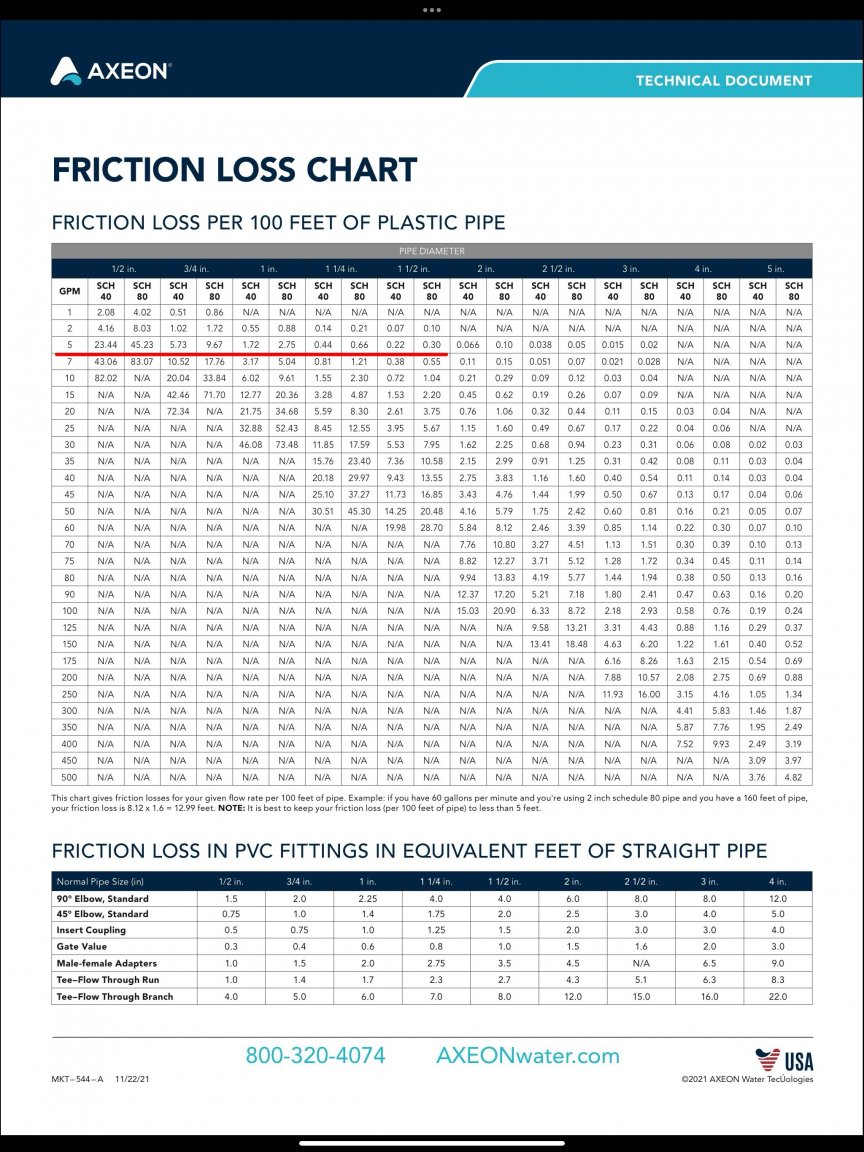

There are huge differences in friction losses as you drop down from 1½” once you go to a higher flow rates the friction losses get bigger and bigger.

-

Grounding from a wall socket/receptacle/outlet: Is it safe?

sometimewoodworker replied to GammaGlobulin's topic in DIY Forum

@Crossy has stated that his Ufer Ground (if he connects it) is better than his ground rod. as you already have grounding adding a building steel connection may be a good idea, in the USA many states require it. I am competent to work on my house, I won’t tell you what to do with yours . -

Tax Return 2025

sometimewoodworker replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

You claim to know how Thailand works! And you expect the TRD to contact you via immigration!!! if they are going to contact you it will come from them unless they can get a “requirement for tax clearance” added to the extension requirements. -

That is probably the only part that you can. it is certainly possible and easy enough to do. There are fittings available from any size to any size pipe in all the big box stores. Any plumber can do it, but will probably say “no point” “too much money” Use the same size pipe as the pump (probably a 1” one) despite what Thai (and some foreign) logic says less pipe friction is always better. Our system uses 32mm pipe and with just about a ½ to ¾ bar pressure without the pump we still have enough for a shower, admittedly it is vey week but it is a shower.

-

Grounding from a wall socket/receptacle/outlet: Is it safe?

sometimewoodworker replied to GammaGlobulin's topic in DIY Forum

Did you read up on Ufer Grounding? -

Grounding from a wall socket/receptacle/outlet: Is it safe?

sometimewoodworker replied to GammaGlobulin's topic in DIY Forum

It doesn’t, you would find it cheaper to buy a new one. I can show you a picture of a 10,000 baht induction hob he repaired, but of course it proves nothing. Inexpensive appliances are usually not worth repairing more expensive ones are. -

Grounding from a wall socket/receptacle/outlet: Is it safe?

sometimewoodworker replied to GammaGlobulin's topic in DIY Forum

It should be 2 meters long -

Grounding from a wall socket/receptacle/outlet: Is it safe?

sometimewoodworker replied to GammaGlobulin's topic in DIY Forum

Yes joining all of them together. Correct grounding is better and safer than random unconnected grounds house grounding is a thing and being required, see Ufer grounding