-

Posts

2,051 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by oldcpu

-

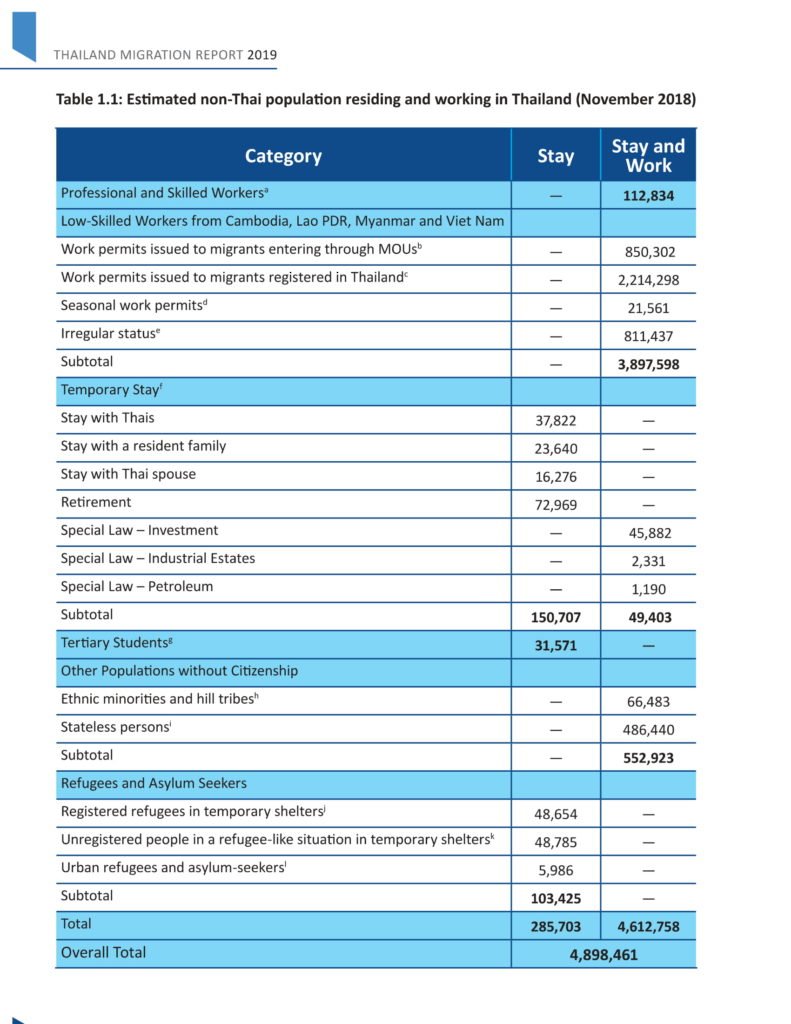

As noted - I do not know the exact number of expatriates who may be affected by Thailand's recent (from 2023) P.161 and P.162. I do believe there is a lot of speculation on this topic (including from myself) where I suspect many of us (including myself) could be wrong on occasion, as we attempt to obtain a better assessment. From a 2019 Asean now post according to figures released by the United Nations,citing Thailand's Immigration Bureau, Thailand's expatriate population is considerably smaller than previous vague estimates. According to the figures in the 2019 Thailand Migration report, there are just 150,707 expatriates residing in Thailand, of those 72,969 are retirees. I do not believe most of us know the actual figures here. Plus the data I found was IMMEDIATELY prior to the COVID years - and not after the COVID years. I have thou made an effort to assess if there have been any studies done on related aspects to this topic, and I note from a 2019 Asean now post according to figures released by the United Nations, citing Thailand's Immigration Bureau, Thailand's expatriate population is considerably smaller than previous vague estimates. This references a 2019 Thailand Migration report (just prior to COVID), so one can probably only speculate if the numbers are similar today. Many expatriates from poor countries LEFT Thailand when COVID hit, only to come back later. Here is a link to the PDF of the Thailand Migration Report 2019: According to that report, the number of expats living in Thailand would be 312,944 individuals in November 2018, where among them, 162,237 individuals (51.8%) are categorized as workers. And the other 48.2%? MANY stay with Thai, or stay with a resident family, or stay with a Thai spouse. The number of those who are retirees was ONLY 72,969. One then, for that 72,969 expatriate retirees, needs to consider aspects where I do not believe either of us have any statistics. How many of them only live from pension check to pension check? And how many keep foreign bank accounts (that have MUCH higher interest than what can be offered in Thailand) and so in effect NEVER bring in current year income into Thailand. Further, the DTA of the countries (in which income/pension) comes from for those 72,969 expatriate retirees needs to be considered. Typically those countries are Japan, India, UK, USA, Korea, France, China, Taiwan, Russia. Other countries with moderate numbers of expatriate (retirees) include Netherlands, Germany, Norway and Sweden. And there are further countries with retiree expatriates where the numbers are even MUCH smaller. So using the year 2019 figures, ... if ONLY 72,96 retirees how many may be knowing avoiding tax? Do they live from pay check to pay check ? , or do these retirees keep substantial funds OUTSIDE of Thailand, where interest rates are higher for savings (and hence they NEVER bring into Thailand current year income)? Further, what do the DTA say about their pensions? Are they ALREADY taxed by the country from which they get their pension (and excluded from Thai double taxation due to the DTA)? Many retirees also need to consider "interest" and "capital gains" in regards to their DTAs ... and due to the effort needed to look at each DTA for each country I did NOT look at such. My experience thou, with expat retirees, is that those with such non-Thailand interest and capital gains, also have substantial bank accounts from outside of Thailand where they can show they did NOT bring in current year income into Thailand. I looked at the most common countries (based on the noted statistics) in regards to pensions, and I am confident the MAJORITY (but not all) are well protected by their DTA. Lets look at some of these countries, where I looked at the DTA (AND I MAY HAVE THIS WRONG - SO IF YOU ARE FROM ONE OF THESE COUNTRIES - DON'T RELY ON WHAT I ASSESSED AS I FIND THE DTA LANGUAGE CONFUSING However don't blindly reject such either. Do your own research and don't simply pull numbers out of a hat. Japan DTA - Any pension paid by Japan in respect of services rendered to Japan, shall only be taxable in Japan (except Thai citizens can be taxed in Thailand for Japanese pensions). Its unclear to me how this applies to business pensions as the use of the word "contracting state" is ambiguous. India DTA - pensions and similar remuneration paid to a resident of Thailand shall only be taxable in Thailand, except for Government Service in India, where government service pensions from India are only taxable in India (unless one a citizen of Thailand). Business pensions from India shall only be taxable in India. UK DTA - UK pensions to former UK government workers (or to those whose company supported the UK government) are only taxed in the UK. I suspect other non-government pensions are also taxable in the UK (and possibly in Thailand), but in a quick surf of the DTA I am not clear. There is a substantial UK expatriate community on Asean Now and I suspect they all know the details. USA DTA - Para-20 - USA Government service pensions are only taxable in USA. Social security and other public pensions to a resident of Thailand, are only taxable in USA. Annuities paid to Thai residents are taxed only in Thailand. Again, there is a substantial US citizen expatriate community on Asian Now and I suspect they all know the details. Korea DTA - Article-18 (pensions) - pensions of past employment in Korea and paid to a resident of Thailand may be taxed in Korea. But I suspect if NOT a pension for government service it may also be taxed in Thailand (where Korea tax has priority ? ) . If a pension for Korean government service it may only be taxed in Korea. < I also found this DTA very confusing > France DTA - Article-18 (private pensions) - Pensions for past employment in France and paid to residents of Thailand may only be taxed in France. China DTA - pensions for Chinese government service are only taxed in China. Other Chinese pensions are taxed in Thailand, although China may also tax such (I assume they get second priority). I also found this unclear. Taiwan (Taipei) DTA : Article-18: Pensions for past employment in Taiwan (Taipei) are only taxable in Tapei. Russia DTA : Pensions paid by Russian government to a Russian citizen who was employed by the Russian government are only taxable by Russia. Pensions paid to a resident of Thailand are only taxable in Thailand, not withstanding that pensions derived by a resident of Thailand may also be taxed in Russia if the pensions originate from Russia. Netherlands DTA : Pensions for government service in Netherlands (or for a business in connection with the government) may only be taxed in Netherlands. Pensions for past employment in Netherlands to a resident of Thailand are only taxable in Thailand. However it can also be taxed in Netherlands if used as a deduction for Netherlands income. Germany DTA: Pensions derived by a resident of Thailand may be taxed in Germany ONLY if such is used as a deduction for German income. Notwithstanding that, pensions from a Government authority (for Government service ?? ) shall be exempt from tax in Thailand. I found the German DTA a bit confusing as it left me wondering if pensions from a German company are taxable by a resident in Thailand? Norway DTA: Pensions paid to a resident of Thailand shall only be taxable in Thailand, except that pensions paid to a Norwegian Government employee (or from company supporting the Norwegian government) shall only be taxable in Norway. Sweden DTA: Pensions paid by Sweden for services rendered to Sweden (as government employee or employee of business supporting the Swedish government) are only taxable in Sweden. I could see no reference to non-government employment/business-support pensions so its not clear to me where they are taxed. Again, I found the DTA confusing. Canada DTA - pensions and other similar remuneration for past employment arising in Canada and paid to a resident of Thailand, shall be taxable only in Canada. Again - TO EMPHASIZE, this is only my own quick look to try to assess a statement that large number of expatriates in Thailand were knowingly avoiding paying tax (which I don't believe). I STRONGLY RECOMMEND every expatriate look at the DTA associated with the country from which the expatriate derives their income and make their own assessment. My quick look could be wrong. However my look did convince me that the vast majority of expatriates to Thailand are NOT knowingly avoiding paying Thailand taxation - simply on the numbers from the 2019 immigration document AND from the content that I could understand in the DTAs. Obviously I would be interested to learn otherwise - but lets do such pointing at actual studies and actual DTAs and not numbers pulled out of the thin air.

-

As long as Thailand continues to respect the DTA for the worldwide income for a number of us (where we have already, consistent with the DTA of our income source countries PAID income tax), then even if the LTR tax exempt status (per Royal Decree) were to be cancelled, it would have minimal effect on us. Frankly, IMHO, the risk of taxation on expatriates to Thailand is MUCH more likely to affect the expatriates who live from pay check to pay check, than it is to affect the more wealthy expatriates. The more wealthy know how to manage their tax strategies and are not likely to run away at such taxation concerns without first investigating their options. So I would argue its those who are borderline (paycheck to paycheck) who are more likely to depart due to taxation, than it is for those who have the wealth to come up with alternatives permitting them to spend a good portion of their time in Thailand - and FURTHER, currently we are seeing just that. More and more expatriates are flocking to Phuket (where these new comers ARE wealthier) in comparison to those departing. Ergo the title/premise of this thread is flawed. Having typed that, from a selfish perspective of one who lives in Phuket, I would be happy to see the numbers decrease like the topic title suggests, ... but I from what I can see day to day - such is not happening. More wealthy are coming to Phuket.

-

And to get back on point ... claims "of 10,000, 30,000, 50,000 expats who have knowingly committed tax evasion" by bringing foreign income into Thailand then such is HIGHLY UNLIKELY the case. There is NO evidence to suggest such. Rather if one looks at the total # of expats from the different countries where the expatriates come from ... If one considers which countries where most expatriates who bring money into Thailand come from (as opposed to the largest population of expatriates who are likely trying to send money out of Thailand (ie Myanmar, Laos, Cambodia) , and if one looks at the DTA's from those countries where money is likely brought into Thailand, and if one examines the DTAs - then it I believe the speculation "of 10,000, 30,000, 50,000 expats who have knowingly committed tax evasion" is an exaggeration and inaccurate. It does not help if we exaggerate. .

-

You are incorrect. You need to read more carefully. Look above where I specifically stated: The remaining countries with the largest #s of expatriates, all have DTAs with Thailand. And so before stating that they may be avoiding tax, one really needs to check the details of their DTAs. What part of that do you not understand?

-

No - I don't need to change any more than claims "of 10,000, 30,000, 50,000 expats who have knowingly committed tax evasion" when such is HIGHLY UNLIKELY the case. Further DTAs CAN provide immunity from Thai tax in some cases. Not all cases. Which is why I noted DTAs must be examined. I was clear there. Further, case in point: My Canadian pension can ONLY be taxed in Canada. FULL STOP. This is in accordance with the Canada-Thai DTA. The DTA does for that pension provide immunity from Thai taxation. It is NOT wrong. Perhaps, you did not mean to say what you did , but if you didn't then maybe you need to change the wording of your statement.

-

If one looks at lists as to the % of the nationalities that make up the most expatriates in Thailand (lets look at the top 10 or so), EVERY ONE comes with a country with a DTA ... I note: - Myanmar - DTA - Cambodia - DTA - Laos - DTA - China - DTA - Great Britain & Northern Ireland - DTA - Japan - DTA - India - DTA - USA - DTA - Netherlands - DTA - Germany - DTA - France - DTA - Russia - DTA My speculation is that most of those from Myanmar, Cambodia and Laos are likely working in Thailand, so they do not fall under the consideration of this discussions of expats bringing in money to Thailand. One might also speculate that applies to China, although clearly there is a lot of Chinese money brought into Thailand. The remaining countries with the largest #s of expatriates, all have DTAs with Thailand. And so before stating that they may be avoiding tax, one really needs to check the details of their DTAs. . It is possible, thou, that many are not filing tax returns when some of them should be (filing tax returns) even if they owe no tax.

-

What I typed in response to Chiang Mai applies. I suspect most have aleady paid tax and are protected by a DTA. And further many likely have savings outside of Thailand, yielding higher interest than what Thai banks can provide, and hence they can financially prove they are not in effect bringing in current year income. Neither of us have the actual proof here - so this is speculation - at best, IMHO.

-

I believe that is an incorrect generalization to which I have a different view. I suspect most of those who are you are considering, may have ALREADY paid tax on the income, and are covered by a DTA between the country where their income sourced, and Thailand. Further, I also suspect many of those have savings in excess of their annual income OUTSIDE of Thailand, and hence they can make a valid financial case that the money they brought in is NOT current year income (which would be especially relevant for those where the DTA did not cover their income). so I dare say your 10,000, 30,000, 50,000 figure is simply not correct. On this - unless either of can point to a definitive statistic that is not questionable, I think we will need to agree to disagree. .

-

Further, when I stated " I have the luxury of this 'wait and see' approach as prior to 1-Jan-2024, I brought enough money into Thailand to pay for my living here for a few years. " I should have noted that the money brought in was savings, that I could prove I have had for more than a decade, and NOT money remitted in the year of earnings. Regardless, I suspect others also made that careful distinction where in the end-2023 'rush' they brought into Thailand savings from previous years - and not year 2023 income - although I suspect given P.162 it makes no difference.

-

I think those expats with an LTR visa (such as myself) would beg to differ.

-

Have you read a translation of the Revenue Department Order p161 and the subsequent clarification in Revenue Department Order p162? Please correct me if I am wrong, but based on what I quoted - I suspect you did not (as my understanding is that P162 contradicts what you just posted). I do hope the is no taxation re my being on the LTR-WP visa, ... however my main puzzlement is in regards to the need to file ... or not to file ... a tax return.

-

good advice - but when I asked the Phuket RD official, he had no clue as to what an LTR visa was. He had never heard of such. He stated he would find out and contact my wife (and myself). He never did. Maybe next year, I will 'bang on his (the local RD office) door' again - but its pretty clear to me (albeit based on this one local tax (RD) official) that even the RD officials do not yet know the answer.

-

My wish / hope (?) for the future is that the definition as to what is 'assessable' income, and what is not 'assessable income' becomes more clear in the future. I do not believe that definition is as clear as some may believe it to be. I am on an LTR visa (Wealthy Pensioner) and I have been watching the threads with interest to assess how much of this might impact me. The Royal Decree for the LTR visa (hopefully a correct translation) states that that Income tax (under part-2 of chapter-3 in title-2 of the Revenue code) is exempted for foreigners on LTR categorized as a Wealthy Global Citizen, Wealthy Pensioner, or Work-from Thailand Professional for assessable income under section 40 of the Revenue Code, derived in the previous tax year, from employment, or from business, or from a property situated abroad, and brought into Thailand. My current interpretation (which could be wrong) is it means assessable income brought into Thailand for those LTR visa holders will be tax exempt. But it does NOT state the foreign income is not assessable (but it is tax exempt). For me that suggests that a Thai Tax return may be required (even thou no tax due) if I bring income (earned from after 1-Jan-2024) into Thailand. There are those on the LTR visa who disagree with my interpretation of the Royal Decree translation to English and who claim that this means no Thai Tax return required for the noted LTR visa categories. They claim the LTR means the foreign income is not assessable. I do NOT know if their assessment is correct. Nor do I know if mine is correct. For all I know they may be correct. Given this uncertainty in my mind (as I do not know what interpretation is correct) I have decided NOT to bring any money into Thailand for a few years, until this is clear. By such an approach, the best I understand from a Thailand RD official (in Phuket) is that I do not need a TIN nor file a tax return, as long as I bring no money into Thailand. I have the luxury of this 'wait and see' approach as prior to 1-Jan-2024, I brought enough money into Thailand to pay for my living here for a few years. My pension comes from Canada (where the DTA says my pension is taxed in Canada) and also my pension from Germany (where the DTA says my pension is NOT taxed in Germany) and also my pension from a European government organization (where there is no DTA - although I worked in Germany at the time for this European government organisation) ... where these may or may not be relevant given my LTR visa status. I believe some see the need to file, or the need not to file, a Thailand tax return as being crystal clear, ... but I for one, at present time, do not see this as crystal clear. So I am watching this all with interest. My hope is that this thread remains civil. There is nothing (IMHO) to be gained by not being civil in our discussions.

-

I suspect all that will happen at most is there will be a 'changing of the guard' ... where those thriving on the current tax breaks (and worried of the future) will depart ... and those where the taxation is not an issue will very very VERY quickly fill the place of each and every one of those who depart.

-

new Wise account details, bank says fraud

oldcpu replied to seajae's topic in Jobs, Economy, Banking, Business, Investments

I read elsewhere the money finally arrived - which is good news. I have not seen any behaviour change in money transfer timing with Wise. As I inferred in a previous post - the timing can be a bit inconsistent at times - but I suspect my situation is different. I do transfers to about a dozen different countries, ... and receive funds nominally from Canada, USA, Germany, and Australia. I typically maintain a small amount of money in different currencies in Wise, so its not often I have to transfer from a Bank account in country-A to a Bank account in country-B via Wise (without the money first being in Wise for weeks or longer). I simply try to ensure I do not keep too much money in my Wise account as I believe it not insured and further the interest is either none or the interest is very very low (for some currencies). I note thou, by having some money already in Wise, I can obtain access to funds much quicker, ... and transfer funds to different places in the world much quicker (if the funds originate from Wise account). If I first have to transfer the money into Wise it takes a lot longer. This is NOT an approach for many, but I guess my financial situation gives me the luxury to be able to do such. Unfortunately for those in Thailand who want a Wise debit card (which I find very useful when traveling around the world), I believe one needs a address from a small select group of countries so to obtain such. My hope is that if /when Thailand legally allows internet banking that the situation with Wise will improve in regards to Thailand usability. -

Out of curiosity, I took a closer (albeit not conclusive for me) look at the Canada - Thai DTA article-18 for Pensions. I note it states: So this is clear ...that CPP (Canada Pension Plan) and OAS (Old Age Security) are ONLY taxable in Canada (the Contracting State and the first mentioned state). I note thou, that an RRSP/RRIF is a registered savings plan that need not be for past employment. Rather it is a saving to assist in retirement, although one's annual contribution limit to an RRSP does have a ceiling based on one's income - and so - does that make an RRSP/RRIF a pension/similar remuneration for past employment? Para-2 of article-18 is very confusing to me: For me to understand para-2, I needed to assess who is the payer of an RRSP/RRIF ? Is it the individual himself who pays himself out of his Canada based RRSP/RRIF ? or is it the financial institution (in Canada) where the RRSP/RRIF money is kept. If it is the financial institution, then it is clear the income is deemed to arise in Canada - and tax payed to Canada. But if the payer is assessed to be the individual (who permanently resides in Thailand) then the the income would deem to arise in Thailand. I assume this (income deemed to arise in Thailand) is incorrect, and the payer of the funds out of RRSP/RRIF deemed to be the financial institution holding the RRIF/RRSP (and hence this is taxed in Canada) - although frankly, the wording here in article-18, leaves a LOT to be desired.

-

I agree with what Rob Browder noted. Try to find an inexpensive translation service. In my case (for Canada) I gave them my 2020 and 2021 tax returns. But since I applied in Dec-2022/Jan-2023, BoI asked for my year 2022 tax return. I ended up giving them three tax return years. BoI also asked for proof of my pensions (one of which comes from Germany) ... However the financial records for that is in German language - and fortunately my pension income (without that pension) already exceeded the pre-requisite amount. So I sent BoI a revised PDF reply / upload of my income (without my German pension amount included) and I also followed it up with a phone call, noting I already exceeded the income amount (from other English language pension sources) and I did not need proof of my German pension to meet the required income level. Also - as I went a self health insurance route, I had to prove equivalent of $100k US$ in a bank account anywhere in the world. I did not use my large bank account(s) in Germany to prove such as I would have to have such translated to English from German language - so I was fortunately able to use an account in Thailand that had the necessary amount. If you do find a good translation service (for German to English) please advise as to the service you use - as in 3.5 years when my LTR comes up for renewal, I may decide to use a German financial source - in which case I may have to go for a translation.

-

Thai Tax Returns for Foreigners

oldcpu replied to Nickcage49's topic in Jobs, Economy, Banking, Business, Investments

There are two aspects here. 1. There is Thai RD Order 161 together with Thai RD Instruction 162. Together this states any assessable foreign income (from tax year 2024 or later tax year) brought into Thailand commencing 1-Jan-2024 (and later), is potentially subject to Thai tax. Nominally the understanding is that foreign income/savings in place BEFORE 1-Jan-2024, that is brought into Thailand is not affected/nor planned to be taxed even if brought into Thailand in subsequent years. These two Thai RD documents are in place now. < and for others reading this - if my understanding is wrong there please correct me > . 2. The Thai RD management are pushing to also tax foreign assessable income even if NOT bought into Thailand. However that has not happened yet. Edit: The above is for foreigners who are resident in Thailand 180 days or greater cumulative time in any taxation/calendar year. -

Thai Tax Returns for Foreigners

oldcpu replied to Nickcage49's topic in Jobs, Economy, Banking, Business, Investments

Some of us (perhaps not many) as soon as 161 and 162 came out, before the end of calendar/tax year 2023, brought a substantial amount of money into Thailand, such that we can live here for a number of years, until the tax situation clarifies. For those of us who had the luxury of doing such, we don't need to hit an ATM to bring money in from abroad. And we won't (for 2024 tax year ,... 2025 tax year ... 2026 tax year) bring any foreign savings nor income into Thailand - and we have no Thai income to speak of. Eventually, after a number of years, .. yes ...we will need to bring money into Thailand ... but that bridge can be crossed when the time comes - and the 'road more clear'. So that is "what we are going to live on". -

The Investing Year Ahead

oldcpu replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

I guess the key word there is "good". We have no control if a company with different funds decides to decides to change their fund manager. Which could be "good" or "bad". I have always had the view that the primary purpose of a fund is to make money for those running the fund, ... and to do so they need to convince investors to let them play with the investor's money. Having typed that - I have no opinion as to what approach is better in practice .... go with a fund manager? go with an index fund/ETF? or trade on one's own with one's own assessment ? or a mix? But I do read the occasional thread (such as this) to see if there is something I need to try to learn and attempt to drive good information spotted into my thick skull. 🙂 -

new Wise account details, bank says fraud

oldcpu replied to seajae's topic in Jobs, Economy, Banking, Business, Investments

I can't confidently speak for transfers from Australia to Wise but for transfers from : * a German bank to Wise sometimes for me takes close to 24 hours - and sometimes a LOT quicker - and on very rare occasions longer * a Canadian bank to Wise sometimes for me takes MORE than 24 hours - and sometimes a LOT quicker - and on very rare occasions longer. I typically try to transfer any money to Wise very long in advance, such that any Wise delay won't impact my plans. -

Thai Tax Returns for Foreigners

oldcpu replied to Nickcage49's topic in Jobs, Economy, Banking, Business, Investments

Originally the 'chat' had been that we could expect the new tax forms (and presumably explanatory notes) in Nov. I note the Thai language forms (for 2024 tax year) are available (best I can determine using Google translation): https://www.rd.go.th/65971.html However the English language (for 2024 tax year) are not yet available: https://www.rd.go.th/english/65308.html I tried using Google translate on the Thai version to gain some insight - but either there is no further insight, or the Google translation is poor, or my understanding of the translation is poor. so I agree its a wait and see until the English language version of the Thai tax forms shows up for the 2024 tax year.