-

Posts

2,122 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by oldcpu

-

Yes .. I regularly backup. It's also about the inconvenience of having to not only change phones ( if phone lost) but also be without a wise card while replacing a phone. Good to read you also have a physical card. Of course no approach is perfect. The physical cards can also be hacked in a crowded space by someone with a special electronic device moving the device close to where a physical card is located on one's person. To help protect against that, my wallet is lined with thin metal to block such scanners. Sometimes it seems one can't be too careful.

-

About 3 years old? Galalaxy A53 5G. It's not about the age of the phone. And I still receive the latest security updates from Samsung. So your assumption not correct. It's about not having all one's information on one single device. No amount of software security will prevent physical loss of one's phone. Multiple phones is also not a good solution as there are other considerations. And as already pointed out on this thread, one can make payments with a physical debit card that one can not make with a virtual card on one's phone. I recommend any one who can get such a physical debit card - do get one. And don't be sidetracked by claims that a virtual card is equivalent in functionality for everything. A virtual card has limitations.

-

Bank Savings Interest Rates 2023

oldcpu replied to kiko11's topic in Jobs, Economy, Banking, Business, Investments

To the best of my knowledge there is no such thing as a 12-month tourist visa. Further, also from what I have read, one can not get 1-year extensions (on one's permission to stay in Thailand) year after year after year on ANY tourist visa. So what you typed is wrong. A tourist visa, for allowing one a permission to stay in Thailand, is NOT as good as a Type-O non-immigrant visa. Yes - I grant that. I have friends (who keep 800k THB in a Thai bank) who always go with an agent to avoid dealing with immigration. Some like the idea to pay an agent for that. Safer? How is that? You edited your post and removed the risk comment. Let me go back in history - there was a time in the 1997 to 1999 timeframe when one could stay visa-exempt in Thailand and never leave the country. One just had to pay an immigration officer outside of 'office hours' and they would handle getting one's passport stamped as if one left the country and returned. Well - eventually that was stopped (immigration officers disciplined) , and those with the particular exit/re-entry stamp in their passport could be in trouble if spotted, ... so I recall reading of some who deliberately reported their passports lost, so to get new passports and not see these 'tell-tale" stamps that were in the old passports. So lets now consider "safer" and "risk" . My view is there is more risk that the time could come that agents will find it more and more difficult to lubricate the acceptance (ie bribe an official) of one's extension (when one does not have the funds in Thailand) .. MUCH more risky than having the 800k in one's bank. So safer to pay an agent to likely bribe a Thai immigration official (than stability of a Thai bank) ? .... I don't think so. Now - don't get me wrong. For those who don't have the funds, and who have no choice (if they wish to remain in Thailand) who have to go for an agent - then I say sure ! Go for an agent. All the power to them. But for those who adopt that approach - just to make a few extra thousand Thai baht ? IMHO those going to make the extra thousand are putting at risk those who don't have the money, for if too many adopt such an approach, I believe the risk of a crackdown increases. Sure - its a dog eat dog world - but sometimes one can get bit. So while I support most of those who use agents, we have very different views here. -

Downsides? You may have to maintain a postal mailing address outside of Thailand to obtain and keep your Wise card (at least it used to be that way). I've been living in Thailand since 2019 and just prior to COVID in early 2020 my Wise card expired. Wise would not send a replacement to Thailand. Instead they sent such to a German address I maintain (an address of a friend) who passed the card to another friend and hand delivered the replacement card to me in Feb 2020. I've had to work around this (not deliver card to Thailand) one other time. Wise transfer times can vary, dependent on the currencies involved and the amount being transferred. Further for transfering large very sums of money I find Wise can be more expensive than a bank's swift transfer and currency exchange. Also Wise can be used to transfer money into Thailand, but it can not be used to transfer money out of Thailand. Also, one does not get 'frequent flyer' or other 'points' for using a Wise card. Having typed all the above, I find the Wise card very useful for traveling in different countries in South East Asia, Europe, and in Canada. I believe the amount I save using the Wise card (with its superior exchange rate) is better than trying to build up flyer points on a different card with horrible exchange rates.

-

Called at the Chonburi Taxation office

oldcpu replied to Delight's topic in Jobs, Economy, Banking, Business, Investments

If you have not already been provided a different Thai TIN, then providing your pink-ID # (with a caveat that it has not yet been activated for online tax submission) is NOT providing a fake TIN. Its the truth - which was confirmed to me by a Phuket RD official (when he assessed I did not 'qualify' for a separate Thai TIN nor any Thai TIN (yet) for that matter ) - but he also advised my pink-ID # for online tax submissions could be my TIN only after it was activated. Its the absolute best information you have at present time. -

If all foreigners who reside in Thailand > 180 days are to be assigned tax IDs, then the local provincial RD offices need to be educated on this. Because that is not their view. Their view is more complex. Some of us, who reside in Thailand greater than 180 days applied for Thai TIN and we were refused a Thai TIN. I am one of those. So perhaps it is more accurate to add some qualifications on that statement that all tax resident foreigners will get a Thai TIN, because currently that is not the view of some provincial RD offices. These offices claim its more complex than such blanket statements. Yes .. this could change, but then let's make that clear too ..ie a blanket tax ID is not required for all at present ( albeit tax ID is definitely required for some to many) and not make non verified statements that this will definitely change. Rather qualify such statements with the facts. That is what the Thai RD try to do. I think we all ( who reside > 180 days) need to both wait and see, while also evaluating our own situation relative to the need to get a tax ID as news becomes more clear.

-

I had something similar to fill in earlier this year wity two different Canadian financial institutions. I simply replied with the truth in the form that they had me fill out (which they accepted), which was my Pink-ID # (same number is on the Yellow Book) might become my Tax-ID, with the written caveat that my Thai TIN is not yet activated (there is lots of room in the form to succinctly add that detail). I confirmed that information PRIOR with a phone chat with the Thailand Revenue Department (Phuket branch) who noted I did not qualify for a Thai TIN (despite my spending >180 days/year in Thailand as I was not bringing money into Thailand and because I had no Thai income). The RD official advised that my Pink-ID # "might" become my 'online Thai tax-ID' ONLY AFTER it was activated as such. But the Phuket branch RD official advised I did not qualify for such a Thai TIN to be activated at present time. This is all 100% legal and it is the truth. The two Canadian financial institutions were more than happy to receive that information.

-

My take on this is as follows: if one needs to file an income tax return, one DOES NOT file for income earned IN THE CURRENT (ONGOING) TAX YEAR, but rather one files for income in the PREVIOUS tax year. PREVIOUS ! Ergo this applies to when/if one TYPICALLY files a tax return (which if an annual return and if filed on time, this is ALWAYS filed for the previous tax year). ie ... taxation is exempt for any nominal tax return (if filed). But I am no taxation expert. I am fortunate to have the financial luxury to wait a few years to see all of these taxation changes 'play out' before I bring any more money into Thailand.

-

Different currency accounts

oldcpu replied to Deserted's topic in Jobs, Economy, Banking, Business, Investments

I can't speak for SCB, but in Phuket for Krungsri and for Bangkok Bank, I had to do so at my local branch in Phuket. -

I too am on an LTR but I think we will need to wait and see. I have read and re-read translations of the LTR Royal Decree many times, and it states (for Wealthy Pensioners and Wealthy Global Citizens) that their foreign assessable income is tax exempt. It does not state such foreign income is not assessable. Does that make a difference in regards to having to file a Thai tax return (and thus obtain a Thai tax ID)? I don't know. I appreciate your view that to file a tax return when zero money is legally owed reads to be "paperwork for nothing" ... but there are countries (Canada in particular) that DO want want such paperwork for nothing - so if Thailand does eventually demand tax returns for nothing, they won't be alone. Given I already attempted to get a Thai tax ID (and was denied such as I don't bring in any more money into Thailand at the present time), my intent - as an LTR visa holder - is to wait a couple of years (and NOT bring money into Thailand), and see how any potential tax submission requirement for LTR visa holders may play out. TIT and one never really knows. I do hope your sense is correct that no tax return will be required for the noted LTR visa holders, who have no Thai income. .... ie a sense that such LTR visa holders will NOT have to file a Thai tax return for assessable foreign income brought into Thailand. Its clear (from the Royal Decree) there is no tax due for noted LTR visa holders foreign assessable income brought into Thailand - but for me it is not so clear that there is no requirement for a tax return. .

-

Called at the Chonburi Taxation office

oldcpu replied to Delight's topic in Jobs, Economy, Banking, Business, Investments

If you have a yellow book and a pink ID you could give them your pink ID number with the added caveat that it hasn't been activated yet as your tax ID. That is what I did for a couple Canadian financial institutions and that worked OK. Prior to doing that I applied for a tax ID and was refused. The Thai RD official advised me my pink ID # could be my tax ID only after it was activated. .. So what I provided to the Canadian financial institutions was accurate. -

I have (albeit not recently) gone for a one year extension of my permission to stay in Thailand on a Type-OA visa for reason of marriage) in Phuket. I believe what I encountered is also true for Type-O visas. The caution I have is if applying in Phuket do indeed apply as soon as possible, as my understanding is the final approval for a 1-year extension, for reason of marriage to a Thai citizen, is not done in Phuket province but rather the paperwork, collected by Phuket immigration is sent outside of the province for final approval. This takes extra time for you to get the final approval back (and IMHO it may be one reason why Phuket allows one to apply 45 days in advance). Good luck in your efforts.

-

Thanks the article toward the end states: " If the Revenue Code is amended to implement a worldwide income tax system, the Royal Decree governing LTR visa benefits would likely need to be revised to maintain these tax advantages." But it does not go into detail as to why the Royal Decree might need a revision in such a case. I note RD Notification regarding income tax (no.427) for the LTR visa income tax reduction and exemption confirms that LTR visa holders (Wealthy Pensioner , Wealthy Global citizen, or Work from Thailand professional) are eligible for tax reduction or exemption in accordance with the Royal Decree. Further Section-5 of the " Royal Decree issued under the Revenue Code governing reduction of tax rates and exemption of taxes (No. 743) B.E.2565(2022)" notes that income tax under Part-2 Chapter-3 in Title-2 of the Revenue code shall be exempted for a foreigner categorized as a Wealthy Global Citizen, Wealthy Pensioner, or Work-from-Thailand Professional under immigration law for assessable income under section 40 of the Revenue code derived in the previous year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand. My speculation would be only that if "Part-2 Chapter-3 in Title-2 of the Revenue code" is no longer the relevant reference would the Royal Decree need updating. Else I speculate an update would not be needed.

-

This is one of the documents BoI either put on your BoI website account for you to download (or send to you by email - I can't recall which) and you print this out and you take to the BoI office. It is 2 pages long. First page has the title : "Notification of qualification endorsement for Long-Term Resident Visa" and the second page a small table with your LTR visa applicant #, your name, passport number and a couple of other items, together with an official red BoI stamp.

-

Bank Savings Interest Rates 2023

oldcpu replied to kiko11's topic in Jobs, Economy, Banking, Business, Investments

By "retirement visa" I assume you mean a non-immigrant type-O for reason of retirement. In which case it DOES provide more benefits than someone on a 30-day visa exemption stamp. Most Thai banks will NOT allow one to open a new bank account on a 30 day visa exempt. Most Thai banks WILL allow one to open a Thai bank account on a non-immigrant type-O visa. For someone who hopes to spend years in Thailand, a Thai bank account is incredibly useful, not to mention necessary when go for 1-year extensions on their permission to stay. Speaking of extensions, one can NOT get a 1-year extension of one's permission to stay on a 30-day visa exemption stamp. One CAN obtain such on a 90-day type-O non-immigrant visa. So there ARE benefits of a type-O non-immigrant visa (for retirement purposes) over a 30-day visa exemption stamp, DESPITE what you posted. I urge caution for anyone on a Visa exempt thinking they can just waltz in to Thailand and open a bank account. .... Now reference the 800k THB (retirement) or 400k THB (marriage) in a Thai bank when on a Type-O for a 1 year extension on one's type-O visa's permission to stay in Thailand , unlike yourself, some do consider it the proper legal approach , and for them being fully legal is important to them. They don't think it strange to do things 100% legally, even if it may be more expensive than arguably walking on a thin legal fence when using an agent when one does not have the per-requisite funds. Don't get me wrong. I am not one to put down those who use an agent, but neither am I one to put down those who follow the letter of the Thailand law. One great thing about Thailand, IMHO, is it has many different visas and also for some visas different approaches to do such - which can suit the needs and approaches of different people. I believe this is a good thing, and not strange at all that some like to take a different approach. -

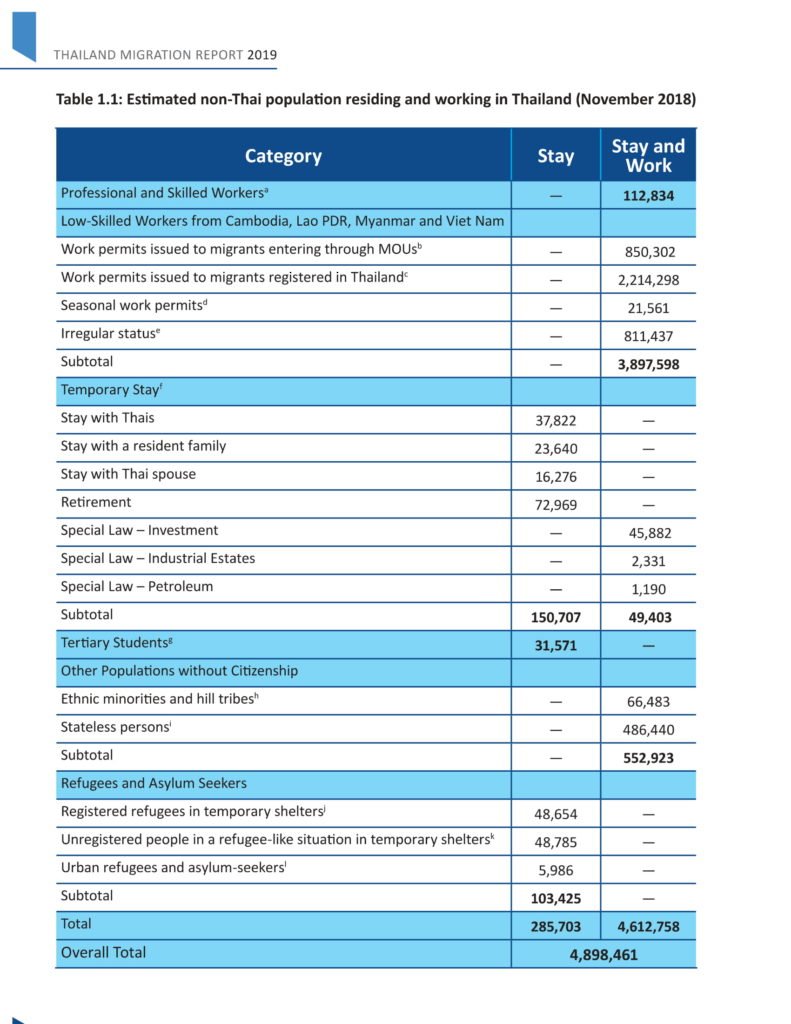

As noted - I do not know the exact number of expatriates who may be affected by Thailand's recent (from 2023) P.161 and P.162. I do believe there is a lot of speculation on this topic (including from myself) where I suspect many of us (including myself) could be wrong on occasion, as we attempt to obtain a better assessment. From a 2019 Asean now post according to figures released by the United Nations,citing Thailand's Immigration Bureau, Thailand's expatriate population is considerably smaller than previous vague estimates. According to the figures in the 2019 Thailand Migration report, there are just 150,707 expatriates residing in Thailand, of those 72,969 are retirees. I do not believe most of us know the actual figures here. Plus the data I found was IMMEDIATELY prior to the COVID years - and not after the COVID years. I have thou made an effort to assess if there have been any studies done on related aspects to this topic, and I note from a 2019 Asean now post according to figures released by the United Nations, citing Thailand's Immigration Bureau, Thailand's expatriate population is considerably smaller than previous vague estimates. This references a 2019 Thailand Migration report (just prior to COVID), so one can probably only speculate if the numbers are similar today. Many expatriates from poor countries LEFT Thailand when COVID hit, only to come back later. Here is a link to the PDF of the Thailand Migration Report 2019: According to that report, the number of expats living in Thailand would be 312,944 individuals in November 2018, where among them, 162,237 individuals (51.8%) are categorized as workers. And the other 48.2%? MANY stay with Thai, or stay with a resident family, or stay with a Thai spouse. The number of those who are retirees was ONLY 72,969. One then, for that 72,969 expatriate retirees, needs to consider aspects where I do not believe either of us have any statistics. How many of them only live from pension check to pension check? And how many keep foreign bank accounts (that have MUCH higher interest than what can be offered in Thailand) and so in effect NEVER bring in current year income into Thailand. Further, the DTA of the countries (in which income/pension) comes from for those 72,969 expatriate retirees needs to be considered. Typically those countries are Japan, India, UK, USA, Korea, France, China, Taiwan, Russia. Other countries with moderate numbers of expatriate (retirees) include Netherlands, Germany, Norway and Sweden. And there are further countries with retiree expatriates where the numbers are even MUCH smaller. So using the year 2019 figures, ... if ONLY 72,96 retirees how many may be knowing avoiding tax? Do they live from pay check to pay check ? , or do these retirees keep substantial funds OUTSIDE of Thailand, where interest rates are higher for savings (and hence they NEVER bring into Thailand current year income)? Further, what do the DTA say about their pensions? Are they ALREADY taxed by the country from which they get their pension (and excluded from Thai double taxation due to the DTA)? Many retirees also need to consider "interest" and "capital gains" in regards to their DTAs ... and due to the effort needed to look at each DTA for each country I did NOT look at such. My experience thou, with expat retirees, is that those with such non-Thailand interest and capital gains, also have substantial bank accounts from outside of Thailand where they can show they did NOT bring in current year income into Thailand. I looked at the most common countries (based on the noted statistics) in regards to pensions, and I am confident the MAJORITY (but not all) are well protected by their DTA. Lets look at some of these countries, where I looked at the DTA (AND I MAY HAVE THIS WRONG - SO IF YOU ARE FROM ONE OF THESE COUNTRIES - DON'T RELY ON WHAT I ASSESSED AS I FIND THE DTA LANGUAGE CONFUSING However don't blindly reject such either. Do your own research and don't simply pull numbers out of a hat. Japan DTA - Any pension paid by Japan in respect of services rendered to Japan, shall only be taxable in Japan (except Thai citizens can be taxed in Thailand for Japanese pensions). Its unclear to me how this applies to business pensions as the use of the word "contracting state" is ambiguous. India DTA - pensions and similar remuneration paid to a resident of Thailand shall only be taxable in Thailand, except for Government Service in India, where government service pensions from India are only taxable in India (unless one a citizen of Thailand). Business pensions from India shall only be taxable in India. UK DTA - UK pensions to former UK government workers (or to those whose company supported the UK government) are only taxed in the UK. I suspect other non-government pensions are also taxable in the UK (and possibly in Thailand), but in a quick surf of the DTA I am not clear. There is a substantial UK expatriate community on Asean Now and I suspect they all know the details. USA DTA - Para-20 - USA Government service pensions are only taxable in USA. Social security and other public pensions to a resident of Thailand, are only taxable in USA. Annuities paid to Thai residents are taxed only in Thailand. Again, there is a substantial US citizen expatriate community on Asian Now and I suspect they all know the details. Korea DTA - Article-18 (pensions) - pensions of past employment in Korea and paid to a resident of Thailand may be taxed in Korea. But I suspect if NOT a pension for government service it may also be taxed in Thailand (where Korea tax has priority ? ) . If a pension for Korean government service it may only be taxed in Korea. < I also found this DTA very confusing > France DTA - Article-18 (private pensions) - Pensions for past employment in France and paid to residents of Thailand may only be taxed in France. China DTA - pensions for Chinese government service are only taxed in China. Other Chinese pensions are taxed in Thailand, although China may also tax such (I assume they get second priority). I also found this unclear. Taiwan (Taipei) DTA : Article-18: Pensions for past employment in Taiwan (Taipei) are only taxable in Tapei. Russia DTA : Pensions paid by Russian government to a Russian citizen who was employed by the Russian government are only taxable by Russia. Pensions paid to a resident of Thailand are only taxable in Thailand, not withstanding that pensions derived by a resident of Thailand may also be taxed in Russia if the pensions originate from Russia. Netherlands DTA : Pensions for government service in Netherlands (or for a business in connection with the government) may only be taxed in Netherlands. Pensions for past employment in Netherlands to a resident of Thailand are only taxable in Thailand. However it can also be taxed in Netherlands if used as a deduction for Netherlands income. Germany DTA: Pensions derived by a resident of Thailand may be taxed in Germany ONLY if such is used as a deduction for German income. Notwithstanding that, pensions from a Government authority (for Government service ?? ) shall be exempt from tax in Thailand. I found the German DTA a bit confusing as it left me wondering if pensions from a German company are taxable by a resident in Thailand? Norway DTA: Pensions paid to a resident of Thailand shall only be taxable in Thailand, except that pensions paid to a Norwegian Government employee (or from company supporting the Norwegian government) shall only be taxable in Norway. Sweden DTA: Pensions paid by Sweden for services rendered to Sweden (as government employee or employee of business supporting the Swedish government) are only taxable in Sweden. I could see no reference to non-government employment/business-support pensions so its not clear to me where they are taxed. Again, I found the DTA confusing. Canada DTA - pensions and other similar remuneration for past employment arising in Canada and paid to a resident of Thailand, shall be taxable only in Canada. Again - TO EMPHASIZE, this is only my own quick look to try to assess a statement that large number of expatriates in Thailand were knowingly avoiding paying tax (which I don't believe). I STRONGLY RECOMMEND every expatriate look at the DTA associated with the country from which the expatriate derives their income and make their own assessment. My quick look could be wrong. However my look did convince me that the vast majority of expatriates to Thailand are NOT knowingly avoiding paying Thailand taxation - simply on the numbers from the 2019 immigration document AND from the content that I could understand in the DTAs. Obviously I would be interested to learn otherwise - but lets do such pointing at actual studies and actual DTAs and not numbers pulled out of the thin air.

-

As long as Thailand continues to respect the DTA for the worldwide income for a number of us (where we have already, consistent with the DTA of our income source countries PAID income tax), then even if the LTR tax exempt status (per Royal Decree) were to be cancelled, it would have minimal effect on us. Frankly, IMHO, the risk of taxation on expatriates to Thailand is MUCH more likely to affect the expatriates who live from pay check to pay check, than it is to affect the more wealthy expatriates. The more wealthy know how to manage their tax strategies and are not likely to run away at such taxation concerns without first investigating their options. So I would argue its those who are borderline (paycheck to paycheck) who are more likely to depart due to taxation, than it is for those who have the wealth to come up with alternatives permitting them to spend a good portion of their time in Thailand - and FURTHER, currently we are seeing just that. More and more expatriates are flocking to Phuket (where these new comers ARE wealthier) in comparison to those departing. Ergo the title/premise of this thread is flawed. Having typed that, from a selfish perspective of one who lives in Phuket, I would be happy to see the numbers decrease like the topic title suggests, ... but I from what I can see day to day - such is not happening. More wealthy are coming to Phuket.

-

And to get back on point ... claims "of 10,000, 30,000, 50,000 expats who have knowingly committed tax evasion" by bringing foreign income into Thailand then such is HIGHLY UNLIKELY the case. There is NO evidence to suggest such. Rather if one looks at the total # of expats from the different countries where the expatriates come from ... If one considers which countries where most expatriates who bring money into Thailand come from (as opposed to the largest population of expatriates who are likely trying to send money out of Thailand (ie Myanmar, Laos, Cambodia) , and if one looks at the DTA's from those countries where money is likely brought into Thailand, and if one examines the DTAs - then it I believe the speculation "of 10,000, 30,000, 50,000 expats who have knowingly committed tax evasion" is an exaggeration and inaccurate. It does not help if we exaggerate. .