-

Posts

29,143 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pib

-

No shortage of different answers coming from BoI regarding address reporting. Maybe BoI has very recently changed their policy due to feedback they are getting, maybe a case of different BoI employees being on different pages, etc. Maybe time to ask BoI again to see if this weeks answer is different from previous weeks.

-

Retirement Visa Annual @Changwattana

Pib replied to Finlaco's topic in Thai Visas, Residency, and Work Permits

You can renew up to 45 days early at CW. You do not lose any time off your extension by renewing early. I did 14 retirement and marriage extensions at CW thru 2022....I typically applied for renewal 40 to 45 days before as I like to get things done and out of the way....plus, it would give me plenty of time to resolve any unexpected event. -

Paperwork-wise and not having to get the wife involved a retirement extension is easier....not to imply paperwork required for a marriage extension is hard (as it's not) especially if married in Thailand. If your marriage occurred outside Thailand then you'll need to go thru the process to get it registered in Thailand then it will be easy for ensuing years. If the annual income requirement is a major factor, the marriage extension income requirements are a lot less than a retirement extension. Each person's situation and opinion will be different regarding whether a retirement or marriage extension best suits them. Kinda like buying a car where budget, options, design, annual upkeep, etc., all come into play and people's choice will vary.

-

Typically it would occur during the approx 30 days under consideration period. But regarding visits immigration can do them anytime they want....even for a "retirement" extension which a "few" AN posters have posted about over the last few months. Now I don't think any of these were CW visits but done by other immigration offices and may have been random in nature. Personally...just my opinion....but I think whether a marriage extension visit occurs or not is based on your application....like maybe how many years you have been married (i..e, recently or long time married), whether its your first marriage extension or not, just your whole record of applications, etc. As mentioned earlier I had a marriage extension in 2020, 21, and 22 on top of 11 retirement extensions....I've never had a home visit by CW.

-

At CW just the husband needs to go for the 2nd visit; wife not needed. They typically have you sign a form or two, the IO does one last quick review of your application, and then the IO stamps the 12 month approval into your passport. Typically takes 30 to 60 minutes with 90% of that being queue time. This is done at the L32 counter if I remember right....it's a cubicle with one immigration officer with one or two helpers at the end of the main L section. IMO at CW they just let your package pretty lay around for 30 days after the "under consideration" stamp is issued or maybe certain packages they might run some extra checks on or do a home visit before you come back on approx 30 days for the final stamp. As mentioned earlier I did three marriage extensions at CW in 2020, 2021, and 2022....no home visits for any of them. One year this 2nd visit L32 counter immigration officer noticed my photo on the application was the same as I used the previous year and made me go downstairs to get a new photo....brought the new photo back....about 15 minutes I had my marriage extension 12 month stamp.

-

Pay in THB!!!! Because paying in USD incurs a charge from the local Thai bank the hospital uses to interface with the card network. Typically that charge is approx 5.9%. And if your card-issuing bank/company normally applies a foreign transaction fee of say 1 to 3% (or more) you might still be charged that fee also simply because the transaction occurred in a foreign country and not because of any currency conversion. Like when you you pay at many Thai stores with a card unless you tell them to "charge in Thai Baht" they may accomplish the transaction in USD (or whatever currency you home country card uses). HomePro is bad about defaulting to charging USD vs THB. Have you noticed at many stores like Lotus, Big C, whatever, etc., although these stores do not default to charging USD you may notice they tear often off a small slip and discard it and give you the rest of the receipt. That small receipt they discarded (or maybe they give it to you also...some do with me), that small slip reflects the currency exchange fee which right now in Thailand is typically 5.9% if they charge you in USD/your home country currency. Or said another way it costing you 5.9% more after all the currency exchange/fee dust settles when paying in USD vs THB. Summary: Pay in THB!!!

-

It can have an impact especially during the approx 30 days "under consideration" period where at the end of that approx 30 days you are to go back to immigration to get the final approval stamp that gives the 1 year extension. Heck, even if you are on a retirement extension you need to be in county 30 to 45 days before it expires to submit for renewal. Yes, whether a retirement or marriage extension there are time frames you need to be in country...and those times are say plus or minus 30-45 days of the annual renewal. But a marriage extension has much lower income requirements....only Bt400K two months before the application date and it should stay at Bt400K until you get the final approval which means maintaining Bt400K for around 3 months....outside of those 3 months you can take the balance to zero if desired. That's sure a lot less than a retirement extension Bt800K for 5 months (2 before and 3 months after the approval and then if desired dropping to no less than Bt400K of 7 months...but being sure to top back up to Bt800K 2 months before applying for renewal. Seems most people just leave it at Bt800K or above to avoid messing up on the deposit timing. And if using the monthly income method it's Bt40K/month vs the Bt65K/month for a retirement extension. And let's not forget a marriage extension does not require medical insurance even if your underlying visa is a OA visa...that can be a biggie for many people who have a OA visa especially when the Thai insurance cost "A LOT" due to age and actually provides little coverage due to high deductible and uncovered preconditions. Yeap, there are times you need to be in-country each year to allow for extension processing time.

-

All depends on your foreign credit card. If it charges a foreign transaction of say 1 to 3% which is typical then you might be better off paying with cash. Keep in mind that foreign transaction fee is "not" levied by hospital but by your "card-issuing" bank/company and they determine what foreign transaction fee (if any) they will apply. Even the typical 1% Visa/Mastercard fee is absorbed by my card-issuing banks/companies. Actually that Visa/Mastercard 1% fee is passed to your bans versus you directly; but it's up to your bank if they absorb or pass that fee along to you. Most of my credit card banks/companies absorb that fee and do not charge any additional fee....therefore, I have no foreign transaction fee cards. So, I get to leave most of my money in the U.S., greatly reduces my need to transfer money to Thailand which costs money to transfers, and I earn cash back on my card purchases. Personally, I use my no foreign transaction fee U.S. credit cards that pay 1.5% to2% cash back to pay all my hospital bills, groceries I buy at Lotus/Big C, fuel for the SUV, just any where I can pay with my credit card. Just like lunch today....I grabbed some fast food at Burger King...paid that approx Bt200 bill with one of above mentioned credit cards....no foreign transaction fee and I'll get 2% cash back. And I use my no foreign transaction fee U.S. debit cards (no cash back) to do period counter withdrawals at Thai banks. The full Visa/Mastercard exchange rate with no fees slightly beats even a Wise transfer since Wise charges fees for transfer although their exchange rate might be a tad higher. A person needs to look at exchange rate "and" associated fees versus just exchange rate only. Yea, for about 15 years now I've been using my no foreign transaction fee U.S. credit and debit cards. Whether a person should use their credit/debit cards depends greatly on what foreign transaction fee the cards may charge, any cash back earned, etc.

-

Yes...you need to be available if at all possible. Typically they don't give much advance notice based on posts I've read. If not available when they call then I guess you need to negotiate a different day if they absolutely want to see you and/or the wife at your home and maybe talk to a few neighbors to confirm you really live there. Immigration realizes people work and may be far away when (if) immigration wants to do a home visit.

-

You have a defacto partnership and not a registered marriage. You would need to register your foriegn marriage with the local amphur office which requires legalization via your home country Embassy and Thai Ministry of foriegn affairs. But without a marriage certificate you can do none of that.

-

Hope the teething ends soon...but at best I figure they may end up offering mail-in reporting to Chamchuri Sq. The BoI SMART visa has been around for around 4 years now and 365 address reporting is only allowed at Chamchuri Sq via in-person/designated person or by mail-in. When exiting/reentering Thailand the 365 address reporting date resets just like how 1 year visa 90 day address reporting works.

-

LTR assets held in ltd company + cash?

Pib replied to richchris's topic in Thai Visas, Residency, and Work Permits

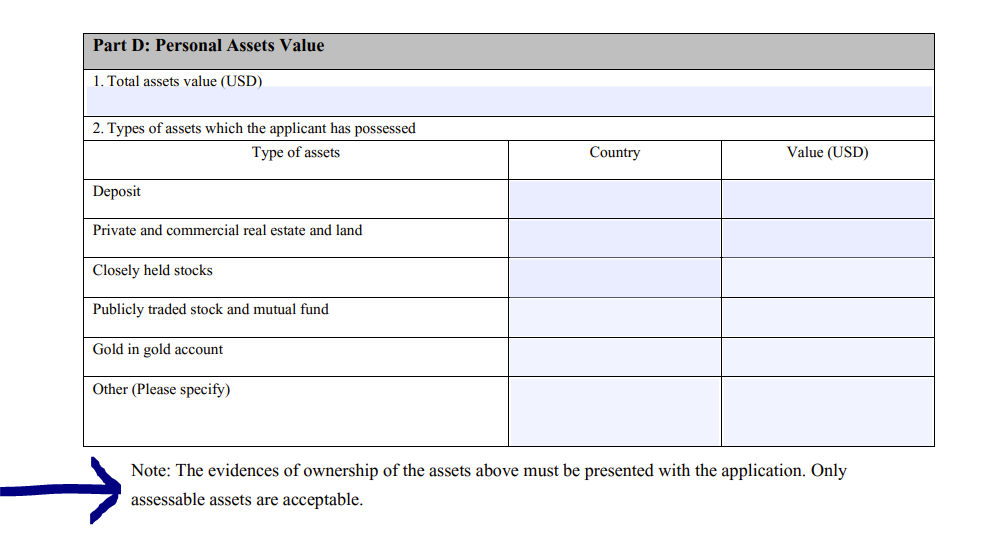

Probably best to ask BoI using the Contact from/email at the BoI LTR website....over the last few months they have been answering with hours or a day or two. My last couple of Contact/emails got answered within minutes to hours. But from looking at the paper version of the LTR WGC application it would seem your LTD companies could be used as long as you can show clear ownership and whatever docs BoI would require to prove the assets value. From BoI LTR website https://ltr.boi.go.th/documents/Wealthy-Global-Citizen.pdf -

As discussed/posted over the last few days currently it must be done at Bangkok Chamchuri Sq in-person or my a designated person. Review the posts starting from last Thursday/24 Aug like the posts from Ben Zioner and Pib who quoted BoI email responses regarding the reporting requirement. I really, really surprised BoI is not allowing reporting by mail to Chamchuri Sq like they allow for SMART visas. Remember, squeaky wheel gets the oil....contact/ping BoI LTR about the issue...see what they tell you.

-

My guess is BoI and HQ Immigration have a memorandum of understanding with each other as to how immigration will support BoI type visas. As BoI type visas are typically "complicated and unique" in requirements (a lot different than a type 1 Year non immigrant visa) I expect HQ Immigration feels every local immigration office would not be able (nor want to) to properly participate in the care & feeding of BoI type visas like LTR visas UNLESS the immigration offices received additional manpower which BoI would have to fund. Now I can understand that to a degree. But with the address reporting I just don't see why they couldn't offer "mail-in" reporting to Chamchuri Sq immigration especially since they already allow it for BoI SMART visas. But who knows, maybe Chamchuri Sq immigration is resisting mail-in reporting for LTR visas...playing a game of wanting additional manpower....I don't know.

-

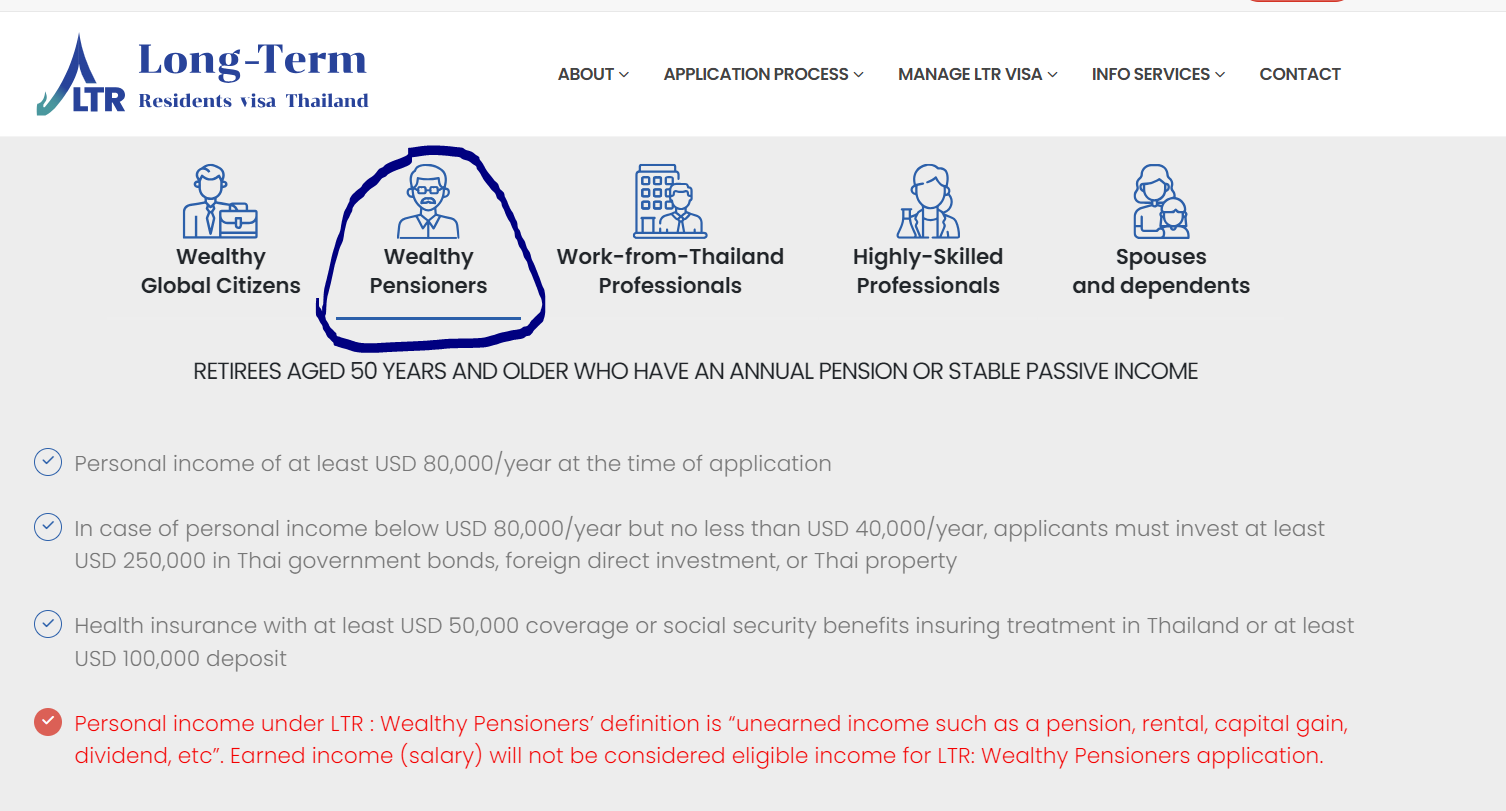

@Christophe Depoire The 1M$ is for a LTR Global Citizen visa...and yea, it has other big dollar investment requirements. However, there are different types of LTR visas like the LTR Pensioner visa (must be at least 50 years old which you are) that do "not" require 1M$ on assets. It's basically geared towards having annual pension/passive/fixed income (earned income of wages/salary not accepted) of at least $80K....."OR" at least $40K but less than $80K income with a $250K investment in property, Thai govt bonds, or foreign direct investment. The health insurance requirement is $50K (foreign or Thai) "OR" you can self-insure with a $100K equivalent in a bank acct (foreign or Thai) for at least 12 months. And all LTR visas authorize a Work Permit...even the Pensioner visa, whereas, with an OX visa a work permit is not authorized. A key thing to note is you do not have to have any deposits in Thai bank accts (but it's OK if you do) and your insurance policy can be foreign or Thai. Or said another way a person can get a LTR Pensioner visa without having one baht deposited in Thailand and can use a foreign insurance policy; with an OX visa you must have a Bt3M in a Thai bank and must have a Thai insurance policy. Also, with an OX visa if you staying in Thailand over 1 year there is the requirement for annual review at your local Thai immigration office to ensure you are still complying with the OX requirements. Actually the requirement just says the annual review is required at the local office....I'm not sure how it would work if you are not in Thailand. The OX visa seems to be geared towards those who come to live full time in Thailand versus just a few months each year. Now the multi-entry LTR visas are pretty much for a niche group just like the OX visa, but there are ways to qualify without needing on have even one baht deposited in Thailand and you can use a foreign insurance policy or self insurance which you can not do with an OX visa. So, you might want to check to see if you meet LTR Pensioner visa requirements...see below snapshot for the BoI LTR website for a LTR Pensioner visa.....each of the other LTR visa types has different requirements.

-

It's 80K USD per year which works out to an average of approx. 6.7K not 8K USD per month for an LTR Pensioner visa...and must be at least 50 years old. And yea, where the OP said $1M USD in assets is required only applies to the LTR Global Citizen visa which does not have the 50 years old requirement.

-

When I switched from an OA retirement extension to a marriage extension in mid 2020 due to the OA medical insurance requirement...and then renewed the marriage extension two more times in 2021 and 2022 before switching to a LTR visa I never had home visit from CW immigration. Since that period included the COVID pandemic maybe CW cut way back on home visits. Or maybe because I had 11 retirement extensions under my belt at the same address when switching to the marriage extension had an impact....or maybe because the wife and I have been married for decades was the reason....don't know. I just know I've never had a home visit from CW on my retirement or marriage extensions.

-

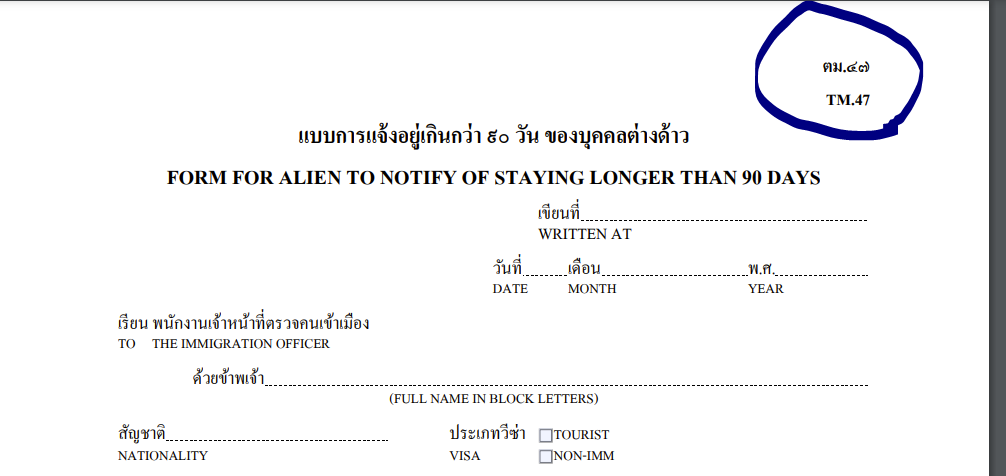

@mudcat I think you will find out at least for the address reporting it must be done at the person's "servicing/assigned" immigration office which is the Chamchuri Sq immigration office for various BoI visas such as LTR and SMART visas. The TM47 form for 90 day address reporting uses the same format (see image at bottom) of leaving the specific immigration office blank....just a case of a generic form being used vs having a separate form for the 100 or so immigration offices in Thailand. And if a person tries to do a 90 day report at any immigration office other than his servicing immigration he will be told to go to his servicing immigration office. When I was still on a Non OA visa I was personally told that right to my face two times back when I tried at two different immigration offices close to me (Nanthaburi and Nakhon Pathom offices) vs my servicing/assigned immigration office of CW since I live in Bangkok. One of these times was back in in late 2011 during the Big Flood when much of the country was flooded to include Bangkok and I tried to report at the Nakorn Pathom office who turned me away...told me no-can-accept a 90 day report from me....told me to mail-in my report to CW.....and of course mail service was severely impact due to the flooding....but I did mail it in and got new 90 day receipt back in about a month. And the Nanthaburi office (which is only 10 minutes from my Bangkok home...much closer than CW in north Bangkok) simply said no....I must report to CW since I live in Bangkok. One downside of BoI type visas is it locks you into accomplishing certain visa management related activities only at the Chamchuri Sq office like the address reporting at this point in time. Buy hey, same thing applies of being locked into a certain office if having a 1 year type visa where you get locked into using your servicing immigration office. And sometimes I wonder if a person needed a certificate of residence like to renew their drivers license or buy/sell a vehicle if they could get such at their "closest" immigration office or would that closest immigration office refer the person to their servicing immigration.....I don't know. For me it's not a biggie since I live in Bangkok and can get to Chamchuri Sq within 30 minutes...but if I didn't live in/close to Bangkok getting locked into having to only use the Chamchuri Sq immigration office could be painful. Hopefully more LTR holders will raise this 365 day address reporting issue to BoI for resolution....a better/easier way for LTR holders such as at least allowing a mail-in option like BoI allows for the SMART visa. Squeaky wheel gets the oil.

-

Yea...ditto for me. So many different types of Thai bank accts paying interest at different times. Regular savings accts which usually pay in Jun and Dec......fixed savings accts that may pay monthly/quarterly/semiannually/ annually..... hybrid accts like the Krungsri MTD acct which is kinda a regular & fixed acct mixed together.

-

The problem with passbook entries is unless they are updated frequently which ensures "every" balance change/transaction is reflected in your passbook, then some transactions could have caused your balance to drop below whatever the minimum deposit requirement is required for your extension of stay....and that transaction/balance would not be reflected in a consolidated (a.k.a., summary) balance update to your passbook as a consolidated balance update just shows your current balance. There could have been numerous transactions/balance changes in the period covered by that summary/consolidated balance update to your passbook. It seems most Immigration offices want to see a balance update to the passbook at least once a month. If no monthly update then the immigration officer may want to ensure you maintained the required extension of stay balance throughout the required months of the extension period and a 12 month statement will provide that information as such statements will reflect "all" (each and every one) transactions/balance changes. Even if it's a fixed savings account where you don't/can't add additional deposits and the fixed acct might only pay interest once a year the immigration officer knows a "statement" will always reflect "all" transactions/balance changes even in the unlikely event there were no changes.....just as they know passbooks might not reflect all transactions/balance changes. If you can get at less one monthly passbook update to your passbook generally that good enough for most immigration offices....they will usually accept the passbook. Otherwise, don't be surprised if the immigration office requires a 12 month statement. If it was me I would just get a 12 month statement just before an annual extension of stay since they are cheap to get but keep in mind that at some Thai banks it may take up to a week to get a 12 month statement (like at Bangkok Bank) while some others can produce an annual statement in minutes....the kind of statement that comes on bank letterhead paper, has a bank stamp/signature. The immigration office may not accept a 12 month statement you print from your online ibanking/mbanking account as such a statement could be photoshopped (altered). And as more Thai banks are slowly transitioning to "passbook-less" accounts I expect in the not-so-distance future immigration offices will always want a statement due to passbooks not always showing all transactions and more applicants not even having passbooks.

-

Yea. When a person exits Thailand whatever previous TM6 a person had is OBE'ed/killed off....no longer applicable. The TM6 is like a booger immigration just can't seem to shake off their finger since it's still being used for land entries but not air entries. Plus, some people haven't left Thailand for many years (like me) who still have their TM6 when it was required even for air entry. So, since there is still a good possibility a person may have a TM6 immigration will frequently ask for it. Kinda like "If you Got 'Em, then Smoke "Em."