-

Posts

29,077 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pib

-

Obtaining FETs from your bank

Pib replied to Moonlover's topic in Jobs, Economy, Banking, Business, Investments

Typically Thai banks do not charge a fee for a FET document when the transfer is 3 months or less old. If older than 3 months then a small fee of approx Bt100 per FET may apply. -

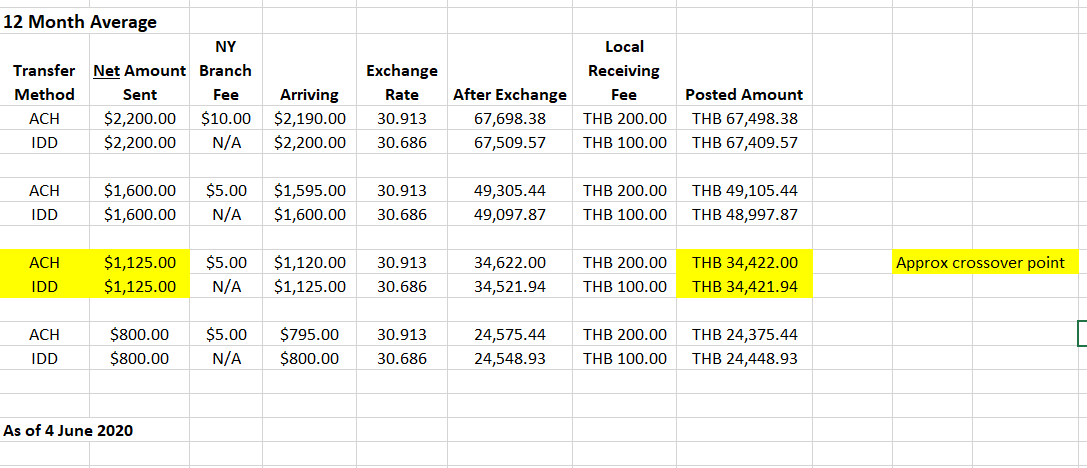

Found the spreadsheet where I use to track IDD vs ACH method exchange rates, amount posting to a person's acct, etc., based on some typical payment amounts. Below is a 12 month average reflecting 12 monthly payments from 3 Jul 2019 to 3 Jun 2020. ACH exchange rate was based on the Bangkok Bank TT Buying Rate in effect for the 3rd day of month at the 0830am opening rate which is what incoming ACH/SWIFT transfers are typically based on. IDD exchange rate is based on my wife's SSA payments made via IDD.

-

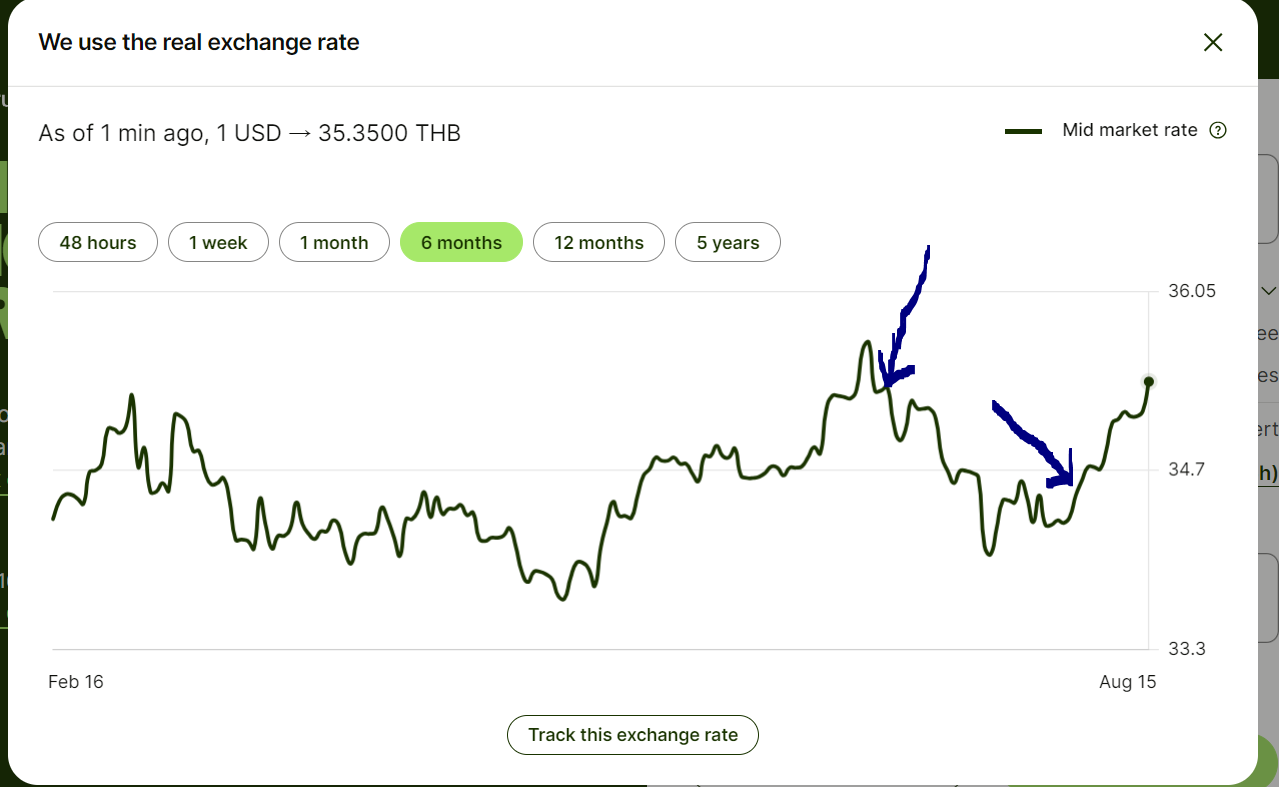

Paul039, To be honest with you, as soon as you started talking a Bt100 fee (i.e., the BAHTNET receiving fee) and Citibank I knew you were using the IDD method, but I wanted to see if you knew as many people remain confused about the ACH and IDD direct deposit methods. Citibank Global is involved with IDD because they are the contactor bank used by the U.S. Treasury for IDD payments to Thailand and some other countries. The exchange rate used for IDD payments is not published anywhere...a person must calculate it based on using the "net" amount of their payment (e.g., gross amount of your SSA payment minus all deductions like tax, Medicare, etc.)....it's critical to know the "net" amount being paid. And the IDD rate is "not" the local Citibank bank exchange rate as the IDD exchange rate is determined upstream by the US Treasury/it's contractor bank "before" your payment arrives Thailand. "Several business days before" you receive your payment the US Treasury or it's contractor bank will accomplish the exchange on their end (i.e.., the dollars converted to baht, round-up the baht to pay you, etc.) and then it's transferred/paid to you typically on the 3rd of each month. With IDD there are no fees applied "except" the possibility of a receiving bank fee....no Citibank fees, no other fees except the possibly of a receiving bank fee. An IDD payment flows through the SWIFT system and the last leg of that transfer to a Thailand bank flows through the Bank of Thailand "BAHTNET" system which interfaces with the SWIFT system. Thai banks typically use the transaction code of BTN for a payment via the BAHTNET system. Thai banks charge a receiving fee for BAHTNET transfers....that receiving fee is Bt100. Citibank uses BAHTNET for the last leg of the transfer to your Bangkok Bank acct or whatever Thai bank a person has his IDD payment go to. Exchange rates whether you track exchange rates via XE, Wise, your Thai bank exchange rates vary from day to day, week to week, month to month....even during the day they can change multiple times. Like if I use the Wise exchange rate trend chart shown at bottom their exchange rate was 35.31 and 34.465 on 3 Jul and 3 Aug, respectively....that's a pretty healthy drop of 2.4% over one month. The IDD exchange rates used for 3 Jul and 3 Aug payments were 35.195 and 33.789, respectively....a very healthy drop of 4%. BUT KEEP IN MIND these Wise and IDD rates are really several days apart since the Wise rate is real time and the IDD rate is based on an exchange rate occurring several business days (how many unknown) before the actual payment date on the 3rd of each month. Sometimes the IDD rate being determined several days before an actual payment works to a person's advantage (like when rates are peaking) or can work to your disadvantage (like with rates are dropping)....exchange rates are volatile. Now you might be thinking right now that the IDD 3 Jul exchange rate was durn close to the Wise 3 Jul exchange rate, however, the IDD rate was quite a bit below the Wise rate for the 3 Aug payment. Why? Well, keeping in mind what I said earlier that the IDD rate is determined "several business days" before the actual payment when you look at below Wise trend chart where I have entered some blue arrows pointing to the Wise rates for 3 Jul and 3 Aug you will see the rates a few business days before were quite different....the trend rate a few days before 3 Jul was significantly higher and the trend rate a few days before 3 Aug was significantly lower. Unless you can compare exchange rates on the same date and time then it makes if hard to compare. So, where you were saying you were use to seeing around a Bt1,000 difference in what you "expected" to receive and figured it was fee being applied somewhere along the way, I expect that is because you were using some exchange rate like XE, Wise, etc., for your reference....but it's incorrect to use such a rate. Instead, you must calculate the IDD rate used based on your "net" payment from SSA....there are no fees applied along the way other than the Thai bank BAHTNET Bt100 receiving fee. It's not like the ACH method where Bangkok Bank NY branch takes a $5 or $10 fee and then the receiving Bangkok Bank applies another 0.25% (Bt200 min, Bt500 max) fee. And it's not like the Wise method where Wise fees occur. So, assuming you know the "net", repeat, net dollar amount of your SSA monthly payment use the IDD rate of 35.195 for the 3 Jul payment and 33.789 for your 3 Aug payment. Then substract the Bt100 BAHTNET receiving fee. Using that info should come within a few stang of the monthly payment "posting" to your Bangkok Bank acct. Keep in mind the Bt100 fee is not reflected on your Thai bank statement/passbook/account as it's applied before posting to your acct. However, you can see the fee if your are signed up for the Bangkok Bank "free" SMS Remittance Alert for foreign incoming payment which will show the amount being received, any fees, and exchange rate used (except no exchange rate reflected for incoming payment already converted to baht like IDD payments). In closing, my wife has received her SSA pension payment via IDD since 2019 and for the first 12 months I tracked it monthly to determine how the IDD method compared to the ACH method in terms of exchange rate, fees, total baht hitting a person's Thai bank acct after all the "exchange rate and fee" dust settled. At that time if a person was receiving approx $1,125 or below it was better "purely from most money posting to your acct" to use IDD and if above $1,125 it was better to use the ACH method. Of course IDD and ACH have other pros and cons like with IDD the payment can go to any Thai bank, to a joint acct, an unrestricted acct, can have a debit card, can do online outward transfers, etc., where an ACH payment can only go to Bangkok Bank, only to a acct in your name, it's a restricted acct, no debit card allowed, online outward transfers not allowed. But ACH transfers get your FTT international transfer bank coding where IDD transfers get your BTN local transfer bank coding. Up to each individual as to whether IDD or ACH best meets their needs and desires. Wise Trend Exchange Rate Chart with Arrows Pointing to 3 Jul and 3 Aug rates....quite a bit of change occurring around & between those dates.

-

Actually the 90 day reporting server and a floor fan was plugged into the same power strip. When leaving work last Friday the janitor turned off the entire power strip instead of just turning of the fan and it was just noticed this morning. To prevent reoccurrence the server will now be plugged directly into a wall socket.

-

It wouldn't surprise me in the least that TPC suspends on or before 15 Sep 2023 the implementation of their new & improved (i.e., higher priced) memberships package for a full year. Thai govt agencies/enterprises have a solid record of delaying (or flip flopping) at the last minute implementation of new rules/polices that get a lot of public/media attention. I'm sure TPC is getting a lot of non-flattering mail & feedback about how they are handling cancellation of current packages and implementation of new packages. Implementation that has no-to scant details on the new packages along with many people surely feeling they are being rushed into making a decision of whether to upgrade or not.

-

A marriage extension is a good route to go....only Bt400K two months before application required....and after getting the final approval 12 month stamp you can take the deposit balance to zero if desired....not needing to plus back up to Bt400K until two months before applying again. And no insurance requirement. I went the marriage extension route for 3 years starting in 2019 when the govt started requiring medical insurance for those on a retirement extension with an underlying OA visa (I had been on OA retirement extensions for around a dozen years). I'm now on a LTR Pension visa.

-

@4MyEgo The retirement extension rule is Bt800K two months before applying and 3 months after with a minimum of Bt400K for the remaining months. If you plan to switch to doing a retirement extension you'll need to always maintain Bt400K to Bt800K in a Thai bank anyway. Now if you plan to always use an agent to get around above requirement then you'll always being paying an agent fee and also have the possibly of the agent-obtained extension causing issues later on...but it seems most people never have an agent issues.

-

Feasibility Study Expedited for Government Spaceport Project

Pib replied to webfact's topic in Thailand News

No new decisions are really being made as the study has been underway for several years. It's more of just reviving people's memories of the ongoing study and give the govt a fresh pat on the back for the study. -

It's not a loss...it's not like Bt75K is being stolen, a fee, being thrown out the window, etc., ...it's just a lower exchange rate. Are you saying if the exchange rate was higher you would not have any issue in transferring the funds and wouldn't consider using an agent? Now what is a fee/loss is the fee you pay an agent. Yes, I know it arguable about earning higher interest in a person's home country, etc., which might offset the agent fee.

-

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

My "guess" is the only reason they reviewed your bank book more than one year back is simply because the bank book reflected years and years of balances....and it's easy/quick to visually review....just flip thru the bankbook pages....plus, you probably appeared to the IO as a honest person not trying to game the system. I guess if your bankbook say only reflected at least one year's worth of balances that would have been fine....but that's just my guess. Rationale behind that guess is partially due to them only being interested in the latest one year insurance coverage versus 4 years worth. Thanks for your crossfeed....your crossfeed has been the most detailed I can remember about the OX visa. They are rarely talked on AseanNow probably because very few people have them as putting a Bt3M deposit into a Thai bank is a bridge too far for most. -

Feasibility Study Expedited for Government Spaceport Project

Pib replied to webfact's topic in Thailand News

TAT will soon be projecting millions of space aliens visiting Thailand each year. A 60 day visa called "First Contact" is already planned.- 71 replies

-

- 22

-

-

-

-

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

@howerde Thanks. Your experience syncs with other OX holder posts (although few posts) I've read over the years where an OX holder typically gets a Deer-in-the-Headlights" type response when visiting their servicing immigration office although the MFA and HQ Immigration websites seem pretty clear about the OX annual re-exam/review process. And am I assuming right you have not had went thru an actual reexam/review process yet? But if you have did immigration basically just check to ensure you still had the required funds deposited and still had insurance.....and did they only look back only 1 year to confirm the required funds and insurance? -

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

@howerde How do you handle the OX annual examination of qualifications requirement as quoted below from the Ministry of Foriegn Affairs and Bangkok Immigration websites? From MFA website: Foreigners must report, in person, to the immigration officer every 1 year for the examination of the qualifications and supporting documents. From Bangkok Immigration website: Note: After obtaining a visa, you must come back for a qualifying examination every 1 year at the local immigration office. -

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

Although BoI has not published the rules relating to the the 5 year extension personally I expect it to be similar/basically a repeat of the initial application regarding income/investment/health insurance requirements without any fee. And below is a late June 2023 BoI response when asked about the mid term/2nd 5 year process where they say the extension process will be similar to the initial application. I expect since a person learned how to ride the LTR bicycle application process on the initial application then the extension application will be less challenging/worrisome. -

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

Yeap....that's a possibility based on current LTR required docs/procedures which focuses on 1 or 2 years of income proof. However, I expect BoI could ways ask for additional years of income proof. -

Converting from Non-IMM O to Non-IMM OX

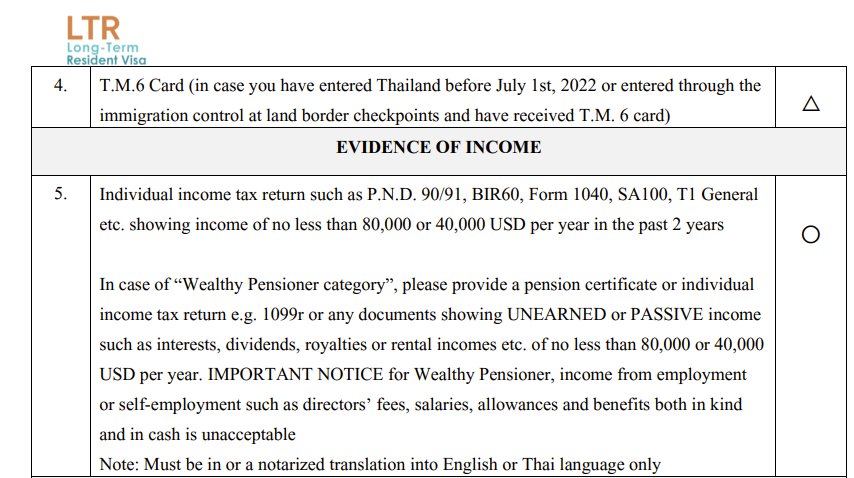

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

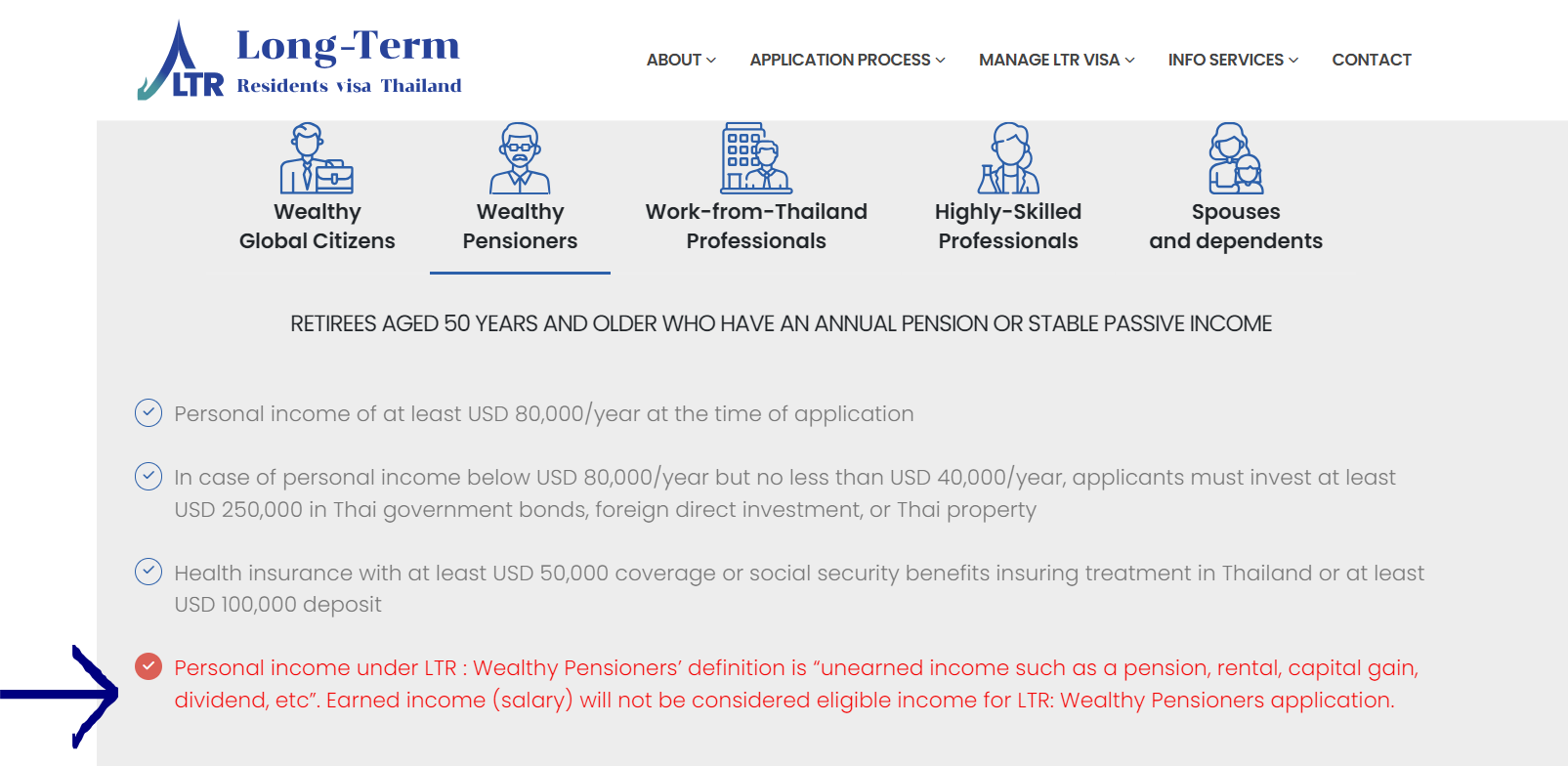

Many people buy/sell (trade) stocks continuously and each year a good portion of their total income is from Cap Gains. And many people also have investments in stocks/mutual funds that pay-out very significant Cap Gains/Dividends annually (assuming it's not a terrible stock market year) which they may just have automatically reinvested or they sell/withdraw all the Cap Gain/Dividends. But regardless of whether they have the Cap Gain reinvested automatically or actually have the gains paid into a bank acct it's still "unearned" income. -

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

As posted earlier, pretty much any income that is "not" from employment is considered unearned income. The BoI LTR website specifically mentions Cap Gains as unearned income. Whether earned or unearned income it would need to proved thru tax/bank/investment company/govt official documents....and yes, documents available from country to country would vary. Like for U.S. folks the Form 1040 Income Tax form, Form 1099R Distributions from Pensions/IRAs/Profit Sharing Plans, Form 1099B Proceeds for Broker/Barter Exchange, other types of govt/investment docs, etc. Personally maintained docs like spreadsheets wouldn't hack it. -

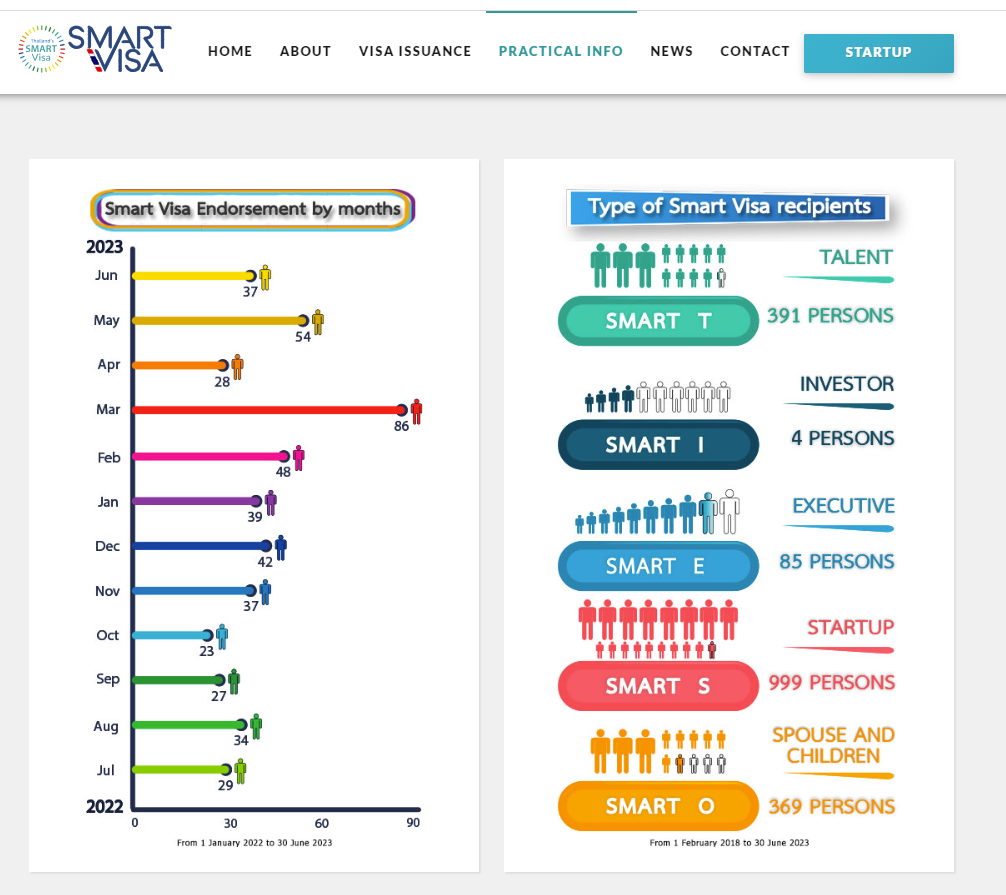

No. A person needs to be employed and/or ready to make an investment in Thailand. An "unemployed" Chinese is not employed and probably don't have big funds to invest in Thailand. On the average approx 30 SMART visa are approved per month. It's focused towards specific groups. https://smart-visa.boi.go.th/smart/index.html#qualifications https://smart-visa.boi.go.th/smart/pages/statistics.html

-

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

All should as they are "unearned/passive" income.....that is, income not derived from employment. Employment income is considered "earned" income. Also, see below snapshot from the BoI LTR website which talks earned and unearned income regarding a pensioner visa. -

Keep in mind the bar codes on the form contain specific info which may or may not be important to the "current year 7162 exercise." If you scan the two main bar codes you'll see one barcode contains your SSN "plus some additional numbers/letters"....and the other bar code only contains the additional numbers/letters that was also shown in the first bar code. I don't have a clue what the additional letters/numbers mean but I could tell from the sequence it's not date related. Probably a code generated specifically to a person's SSN record.....or maybe a code that only applies to the current year 7162 exercise with that code being different every year. I can only guess what that code represents and how important it may be to ensure your barcoded 7162 is accepted by Wilkes Barre. You might want to consider mailing back a 7162 which does "not" contain a bar code vs the bar coded form from last year....just download/complete a blank 7162 from the Manila FBU website and send that back. And if you still get a bar coded 7162 later on (like the 1st mailing finally showing up or getting the 2nd mailing) be sure to mail that back also. https://ph.usembassy.gov/services/social-security/

-

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

That's Bt50K for a 10 year LTR Pensioner visa includes a multi-reentry permit...that averages out to Bt5K per year. And you are authorized a work permit on a LTR visa...even a pensioner visa. And address reporting is once every 365 days. You only need to extend the LTR visa once at the 5 year midterm point which has zero fee as the initial Bt50K fee paid for the 1st 5 years and 2nd 5 years. And the great feeling of having a l....o....n.....g term visa without the "annual" reapplication process.....it's a good feeling....highly recommended. If you would get a Non-O/OA Retirement 1 year visa that would be Bt1.9K/year for the basic 1 year fee via plus another Bt3.8K/year fee for a multi-reentry permit for a total of Bt5.7K/year. If on an OA visa you can't get a work permit, but you can have a work permit on an O visa. And address reporting is once every 90 days. And of course you have the "annual" reapplication process/concern/worry/etc., which is one of the most popular reasons for posting on AseanNow. So, if you qualify for a LTR visa all it's benefits such as no annual renewal (just a mid term renewal), multi-reentry permit, work permit (if desired) and address reporting only once a year, then the joy of not needing to do (or worry about) an annual visa/extension can be yours. Edit: and if you qualify for a LTR Pensioner visa under the USD $80K passive/pension income provision you don't have to make any investment in Thailand, no in-Thailand bank deposit needed, etc...all you funds can stay in your home country if desired. But if you qualify under the USD $40K up to USD $80K passive/pension income provision then a USD $250K investment in Thailand such as property (like a condo), Thai govt bonds, or foreign direct investment is required. Sometimes people already have a condo in Thailand worth at least USD $250K which satisfies the investment requirement if going the USD $40K method....so, basically if they have the $40K income they will meet the income requirement for the LTR 10 year pensioner visa. -

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

The Thai govt don't think it's silly as your money in a Thai bank helps Thai banks fund loans, make investments, etc., which helps the Thai economy. Money in a foriegn bank does none of that. -

Converting from Non-IMM O to Non-IMM OX

Pib replied to Mike Teavee's topic in Thai Visas, Residency, and Work Permits

No....It does not mean you can get the visa within Thailand. Although the MFA fee is quoted in baht the fee at a Thai embassy would be based on the currency used in that foriegn country and the exchange rate used by the embassy in that country.