UKresonant

Advanced Member-

Posts

1,419 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by UKresonant

-

Expat Tax Twists in Thailand: Navigating the New Landscape in 2024

UKresonant replied to webfact's topic in Thailand News

If you have not declared your tax residency already to your debit card provider (bank), a non-tourist pattern of spending, in a particular country, may prompt them to ask for you to clarify. (Depending what jurisdiction your bank is located). -

Expat Tax Twists in Thailand: Navigating the New Landscape in 2024

UKresonant replied to webfact's topic in Thailand News

That's what Dad does, just has to watch for variance on the Dec/Jan Trip. Belt and braces as always from previous years money so far, and pre Jan 2024 funds ongoing, so absolutely no chance of liability to tax over there. -

Expat Tax Twists in Thailand: Navigating the New Landscape in 2024

UKresonant replied to webfact's topic in Thailand News

If you spend less than 180 days cumulatively in the calendar year your not tax resident in Thailand. Then years in to the future it would only be if your bringing in assessable income generated from a year you were over the 179 days in Thailand. (After 2023) -

Expat Tax Twists in Thailand: Navigating the New Landscape in 2024

UKresonant replied to webfact's topic in Thailand News

So it would probably be covered by the pre-2024 dis-regard, if you still have the paper work. (The interest on such savings has to be considered, if Thai Tax resident after Jan 2024, and later remitted to Thailand) Assuming the tax situation is probably as understood time now, if you asked the same question in 2034 it would depend on whether you were Thai tax resident when youn earned the income, if you were, it would be potentially taxable, if you brought it in to Thailand, at any time in the future. (read the English translations of RD 162/2566, see if it explains ) So from now on the interest on the savings will likely become Thai taxable as soon as you exceed the 179days in Thailand that year, whenever you bring it into Thailand from now on... -

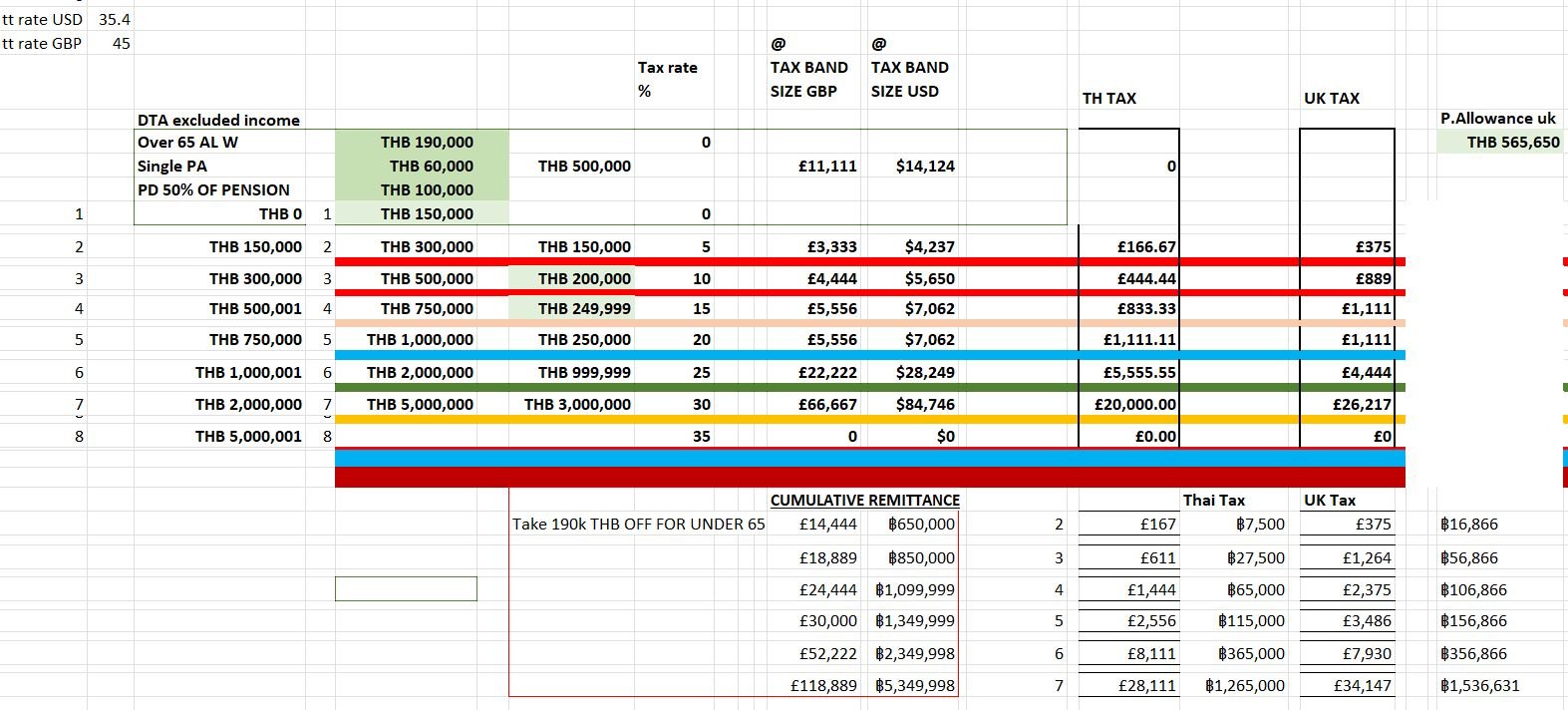

I think in a lot of cases it is the translation of the other things translating against the personal income tax at the Thai end that is the shock to the system perhaps. Also the differential caused due to the UK having a separate £3k allowance for capital gains. (or it will be in a few weeks if not held at £6k due to election year.)

-

So do you think it is reasonable that we can truly pick what we remit, I am indeed hoping that is the case. I'm trying to organise so that I have good records available later should I become tax resident in Thailand E.G. a. All pre-taxed at source UK Pensions, paid to one UK bank account. b. All non taxed investment dividends and interest to another account With the intention of only including items from "a" to be considered for transfer to Thailand, with associated paper trail, proof of taxation etc However could it get complicated, and they could deem that they consider the items at "b" to be the remittance, though I would not wish to include them as they would be needed for expenditure in the UK and never be remitted to Thailand? It was the Norwegian answer link earlier on page 222 that raised my doubts, of course this was someone trying to detach from Norway's tax system and obtain a Thai Certificate of Residence to use against the Norwegian Tax. (Not a Scenario I would anticipate with the UK) https://www.rd.go.th/fileadmin/download/nation/Norwegian_answer.pdf But I'm hoping that Pension Payslip. P60 end of year tax certs, remittance to UK Bank and assoc. statement, amount remitted to Thai bank. Only items in the conversation? and all is well.

-

Yes best to avoid any interest being added to the account after 1st Jan 2024. As this years interest will compromise the pre-2024's purity (assuming you shall be Thai tax resident for 2024 that is). If it does get credited to the amount I will transfer it back out to another account before it compounds.

-

Thailand in Crisis: Population plummets by 500k in 4 Years

UKresonant replied to webfact's topic in Thailand News

A shallow population deline is probably a good thing. So getting it back to a shallow decline, rather than a steep decline is what may be useful. Much better than a lot of the net zero BS, which frequently sounds like sales pitches from interested factions, rather than than long term analysis. Population decline does not fit to well on certain spreadsheets though. -

Thailand in Crisis: Population plummets by 500k in 4 Years

UKresonant replied to webfact's topic in Thailand News

TAT should do a recount perhaps..... -

METV current requirements London

UKresonant replied to Greenwich Boy's topic in Thai Visas, Residency, and Work Permits

For. Travel history we just scan the stamps in the passport and edit it as one JPG on the PC,. If it is just Thai that's fine but if no stamps on some destinations, list with stamp pics and convert to JPG for upload.... -

I'm hoping they would accept if checked, the payment advice slip from the pension, that payment on the receiving bank statement, and the net amount being SWIFT transferred to Thailand. and hopefully show them sample proof verification via online banking? the P60 is mainly a A4 print now. Legalization, letter from Embassy, and all that guff would just would be totally impractical or even available perhaps. (If RD recognise items for Tax, would it not be reasonable that Immigration then recognise it?)

-

For many years, until only months ago the UK pension system had a total fund value cap of $1.34M life time allowance, with a 25% Tax free lump sum from that of circa $335k. Before they ran into punitive Tax on any Excess. The total cap is gone (for now), but the Tax free lump sum is still frozen at the $335k. The "plus healthcare" outside the UK perhaps not, would have to be a separate privately paid provision in most cases, as would be a sustainable pension above circa $53k p.a.. The UK state pension could add $15k to the $53k, still falls short. The UK state pension is below the provision in many similar countries and relies on the fact of Free healthcare, but that is generally only whilst still in the UK. Falls short a bit. Sympathy 😢

-

I would certainly not want to rely on the tie breaker in article 4, as a principle reason for not filing, if you know you have remitted (especially) non pension , non-pre-taxed income . Very thin ice. UK HMRC or equivl. may not issue a "letter of confirmation" then your hung out to dry. Just have to file..... All of my pensions are pre-taxed in the UK in any case.

-

If the dividends are distributed, whilst you are tax resident in Thailand, from 2024, they are Thai tax assesable whenever you remit them to Thailand. Dividends and interest tend to be taxed where you are (tax) resident, said a credible YouTube channel, rather than where they arise. (I would have the same situation with tax free in UK, Individual savings account, dividends. (As part of my UK end re-shuffle they will all trail to the account paying UK end essentials.) Dividends and gains taxable as just any other income in Thailand. So they will be a static income and growth portfolios if I'm in Thailand for a while.

-

I think that my centre of vital interest will likely be the UK, with article 4 fiscal domicile. Non-resident non-O or tourist visa, unlikely to be in Thailand more than 90 / 150 days on a single trip, unless there was a specific need. Own nothing in Thailand, if the wife buys a property I had to sign it was nothing to do with me anyway. The only thing I have there is enough to maintain bank accounts. UK Ties 90 day tie likely will be there 92+ Most years. Valid at least 2 years anyway Accommodation tie aways available and use it every year hopefully. 99.8 % of Income originates from the UK. But don't wish to get to that level, that Article 4, fiscal domicile needs debating. Should I become tax resident in Thailand in the future. I would try and design things in initial years. 1. Not having to file. 2. Not filing, whilst ensuring I'm absolutely not due any tax to Thai RD, article 4 may also help, Thailand not cetre of vital (tax) interest, if questioned. Would have to make sure bank interest never exceeds 60k THB ( not difficult probably) 3. If I was there all year in the more distant future, UK sufficient ties not in place, yes would file in Thainland etc I have no tax assessable items for Thailand currently the one year I was perhaps Tax resident, was spent, and cannot still be mingled on the books. So I would be in the same situation as someone as a brand new arrival, despite having been every year since 1993 (except 21/22 Covid .) Just don't want any hassle! (Pray they never move to Global Tax, that would make things substantially problematic for me.....)

-

I suggest that you advise (not complain) to the issuing embassy (Ministry of foreign affairs) that their issued visa No ####### does not seem to be fulfilling its purpose expectation (including a picture of the stamp in your passport), and ask them to please clarify. Advise them by hard copy proof of delivery post on return to home country, if no e-mail response. "I now have a note in my passport saying my next entry must be on a non-immigrant visa". Very weird! The MFA may find that useful information as well, as you don't desire a continuous stay even for 60 days. issue of Visa's being MFA jurisdiction (two ministries out of sync?) Look on the bright side, your not tax resident 🙂

-

I think things feel safer, especially for those with simple financials, remitting tax deducted at source Pensions. But for those with more complex financials, there is more clarity, but some doubt still persists. I'm not continuously in Thailand normally, so as long as they keep the remittance basis not to bad. I've only had one year a while back, that I would have been Thai tax resident, and I had no major financial transactions that year (Globally). Reading the Norwegian Answer for example (earlier in the thread) https://www.rd.go.th/fileadmin/download/nation/Norwegian_answer.pdf * Scary word = Global Not Scary "Remittance" mentioned later in the text though.. (Posted Thursday at 05:24 AM Mike Lister And another, albeit from the Revenue itself: 2.1 Under Internal Regulations In Thailand In Thailand pension income is regarded as assessable income under Section 40 (1) of the Revenue Code. A resident of Thailand must declare his worldwide income on the basis that the income received from abroad in a tax year must be brought into Thailand within the same year, based on Section 41 paragraph 2 of the Revenue Code. [link above] *)

-

I think it's because our tax treaty is about 42 years old and has an absence of specific words, in the pensions area (except for Government pensions),🤨. Reading the UK revenue end information and community posts are sometimes like walking into a library with no bookshelves, though the librarian perhaps knows where most were most of the books are.😐 Hopefully the associated general procedure and tax detail 🧐 discussed (where known) is pretty universally useful, I don't mean to be hogging the lane 🤔

-

If the state pension exceeds the (£12570 frozen till 2028?)Personal allowance, because of the high inflation indexation in the past couple of years, the tax code is adjusted on other pensions to pay the tax ( actually if savings interest exceeds the allowance slightly the adjust the coding as well ). If no other pension(s), they will ask for it probably. I can say that Occupational Government pension (DB), Occupational (DB), Private (DC), Private (Occupational DC SIPP) pensions that I know of are all automatically taxed via UK PAYE deduction. Tax return only needed if you actually need to pay tax on some other event. State Pension issues an annual Pension letter advising the amount for the next April To April payment period (No P60) DB pensions issue Annual pay advice (unless a change in amount or tax adjustment) and P60 End of year Tax Cert. (Gov can down load monthly Payslip via PDF). DC monthly pay advice Paper or PDF on different providers, and P60 end of tax year Certs P60 is 6th April to 5th April.

-

Thanks for that info. I guess the English translation of POR 162/2566 lost a bit somewhere. From 2024 on A. Earned / derived whilst Thai Tax resident. B. Assessable in the future if that at "A" is remitted to Thailand. If they think that when you spend one year ever, tax resident, and then they will tax anything that is sent to Thailand for eternity, then yes I will try and circumvent that, or think what that very special year may be. I wonder if they will bring out a 90per 179 day ME Visa? I suppose two single entry 90 day ones would do. Would be interesting if you find where you read /;seen that. Sounds like more mines in the minefield, or it could be easy the ain't really fully unfurled their new colours yet perhaps. Smiley face or Smiley with sharp teeth