OJAS

Advanced Member-

Posts

8,718 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by OJAS

-

On the basis of section G it would appear that this refund would take the form of a GBP cheque which HMRC would then despatch to the beneficiary widow by snail mail. Another shining example of HMRC being really at the cutting edge of secure electronic technology, is it (not)?!! More seriously, though, is the note stating that "it’s sometimes not possible to cash British pound payments overseas" - which, I suspect, could be problematical here in Thailand. Would be nice, I think, if HMRC could proactively tell our widows how they would be able to receive their refunds instead.

-

Whilst this is, indeed, the case provided that the amounts involved do not total more than the UK personal allowance (currently £12,570) as already said, it would appear that her widow's pensions might, however, be deemed assessable income for Thailand taxation purposes, because of Article 19(2) of the UK/Thailand Double Taxation Agreement, which states: (2) (a) Any pension paid by the Contracting State or a political subdivision or a local authority thereof to any individual in respect of services of a governmental nature rendered to that State or subdivision or local authority thereof shall be taxable only in that State. (b) However, such pension shall be taxable only in the other contracting State if the recipient is a national of and a resident of that State. But, given your subsequent statement that the amounts involved won't exceed the current UK personal allowance, she might not, in practice, have to pay any tax in Thailand either because of the various allowances and exemptions currently in force. That all said, things could, of course, change at both UK and Thailand ends between now and when your wife claims her widow's pensions!

-

This sounds to me like a temporary tax code provided by the Scottish Police pension providers for the widow and HMRC to use. This would be consistent with what MyCSP told me in connection with my Civil Service pension in January. That said, what, if anything, might then happen in the longer term remains a mystery.

-

I strongly suspect that only DWP will be able to answer your questions definitively. I suggest that you contact their International Pensions Centre through the enquiry form linked below: https://secure.dwp.gov.uk/contact-the-international-pension-centre/contact-form

-

Applied for UK State Pension today - 20 minutes and done!

OJAS replied to simon43's topic in UK & Europe Topics and Events

A distinct improvement on the rigmarole I had to go through 10 years ago, when I was required to submit my original birth certificate which then went AWOL! -

Likely for copyright reasons: https://www.bbc.com/mediacentre/bbcstudios/2005/bbc-studios-to-make-podcasts-available-to-international-audiences-via-bbc-dot-com-and-the-bbc-app It will, however, still be possible to listen to the World Service and Radio 4 from abroad via the following link instead: https://www.bbc.com/audio and scroll to bottom. It may also be possible to continue listening to remaining BBC stations from abroad (should one be so inclined) with a VPN - but that remains to be seen, I suspect.

-

Complain message: ATTN: Thai Govt.

OJAS replied to muranp's topic in Thai Visas, Residency, and Work Permits

Indeed, he would run the risk of getting banged up in the Bangkok Hilton (or local equivalent)! -

Complain message: ATTN: Thai Govt.

OJAS replied to muranp's topic in Thai Visas, Residency, and Work Permits

And, while you're about it, are you also planning to send an email to all relevant authorities and media outlets back in your home country bitterly complaining about a number of negative measures which your home country government may have seen fit to impose on its expats living in Thailand in recent years (of which there are quite a fair few in the case of us Brits, for instance, believe you me!)? -

London suggestions for a 10-year-old

OJAS replied to brewsterbudgen's topic in UK & Europe Topics and Events

Or Brighton or Bournemouth who both have home EPL fixtures on 2, 12 & 26 April? -

But that would have been no guarantee that, had he won the 2019 Election, Corbyn would not have changed his mind following his first meeting with DWP's Sir Humphrey Appleton. I cannot think of a single politician of any political persuasion who pledged to unfreeze pensions while in opposition but then not had a "remarkable" change of heart once in government.

-

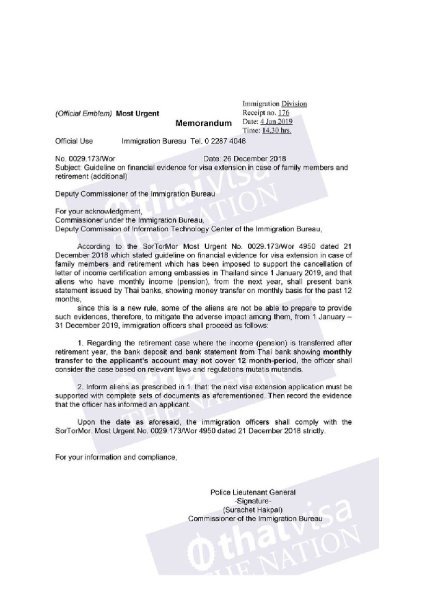

The sequence of events was as follows: (1) 8 October 2018 - British Embassy announced cessation of income confirmation service wef 1 January 2019: https://www.gov.uk/government/news/british-embassy-bangkok-to-stop-certification-of-income-letters (2) 21 December 2018 - Immigration Bureau published amendment to Police Order 138/2557 announcing revised financial criteria for retirement and marriage extensions in the light of certain embassies' decisions to cease their income confirmation services (downloadable via item 18 under the "Permission to stay, extension of stay, re-entry permit and other immigration matters" heading in the "Laws, regulations, Police Orders, etc. related to visas, immigration matters, and work permits" pinned thread). (3) 26 December 2018 - Leniency memorandum published. The major problematical issue was the nearly 3-month delay between (1) and (2). Despite assurances being received from various quarters that those who no longer had an income confirmation service available to them would instead be able to prove income through minimum monthly transfers to a Thai bank a/c, the Immigration Bureau, for reasons best known only to themselves, chose to adopt an extremely leisurely attitude to formalising these revised arrangements - which was the cause of much stress and uncertainty amongst those directly affected (myself included) at the time.

-

If you are talking about a 90-day non-O visa conversion in between a 60-day visa exemption entry and a fresh annual extension of stay for retirement, the financial requirement will be 800k in a Thai bank a/c period - see item 7 in the link below. Highly unlikely that there will be any question after 1 April of the 65k monthly income alternative referred to in item 6 being possible since this would be dependent on the Canadian Embassy being prepared to issue the necessary letter of guarantee. https://www.immigration.go.th/wp-content/uploads/2022/02/9.FOR-RETIREMENT-PURPOSES-50-YEARS-OLD-NON-O.pdf

-

Yes, the Immigration Bureau did issue a memorandum urging leniency in the first year back in 2018 - English translation attached. However, whether individual offices actually took any notice of it was another matter - certainly mine (Rayong) did not, and it was only by pure luck and chance that I had already been making monthly 65k+ transfers for a full year prior to my next retirement extension application in any event.

-

Non-Imm-O: Marriage vs. Retirement based

OJAS replied to XGM's topic in Thai Visas, Residency, and Work Permits

Likewise if you were to find yourself in the same unfortunate position as the OP of this thread: -

Not sure that you won't, in the event, be faced with exactly the self-same situation once again this time next year, though, unfortunately. Maybe a good idea for you to follow the lead of @Pumpuynarak and @MartinL by lodging a formal complaint with HMRC, laying particular emphasis on the totally unsatisfactory need for you to have to contact them each year in order to get things sorted: https://www.gov.uk/complain-about-hmrc

-

I'm sure that quite a few of us would be most interested to hear of the address you used for emailing HMRC! Reverting to this 2023 comment, the link you quoted related to a consultation exercise launched by the Coalition Government in 2014, which, in the event, was subsequently booted into the long grass, thankfully. However, I must admit that I was, more recently, worried by the possibility of Rachel Reeves reviving this proposal as a means of offsetting the £22bn black hole she allegedly inherited from her Tory predecessors, but thankfully the 30 October Budget came and went with no specific announcement on this point as far as I can tell. That's not to say, of course, that she or her successors would not seek to revive it at some point in the future, despite the fact that we are, in practice, probably talking about a drop in the ocean when compared to the overall finances of UK plc.

-

Recently sold house in UK

OJAS replied to kevtheblue's topic in Jobs, Economy, Banking, Business, Investments

In that case, as far as the Thai taxation position is concerned you need to refer to Article 14 of the double taxation agreement between the UK and Thailand: https://assets.publishing.service.gov.uk/media/5a80bddc40f0b623026953eb/uk-thailand-dtc180281_-_in_force.pdf -

Recently sold house in UK

OJAS replied to kevtheblue's topic in Jobs, Economy, Banking, Business, Investments

https://www.gov.uk/tax-sell-home -

Recently sold house in UK

OJAS replied to kevtheblue's topic in Jobs, Economy, Banking, Business, Investments

In particular, he now only has until 22 Feb to make any CGT payment to HMRC if he hasn't already done so! https://www.tax.service.gov.uk/capital-gains-tax-uk-property/start/report-pay-capital-gains-tax-uk-property?_ga=2.31492087.898625034.1633235870-1552680673.1629876543