-

Posts

1,491 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by motdaeng

-

Pension Tax Filing Report - Rejected

motdaeng replied to patrickl's topic in Jobs, Economy, Banking, Business, Investments

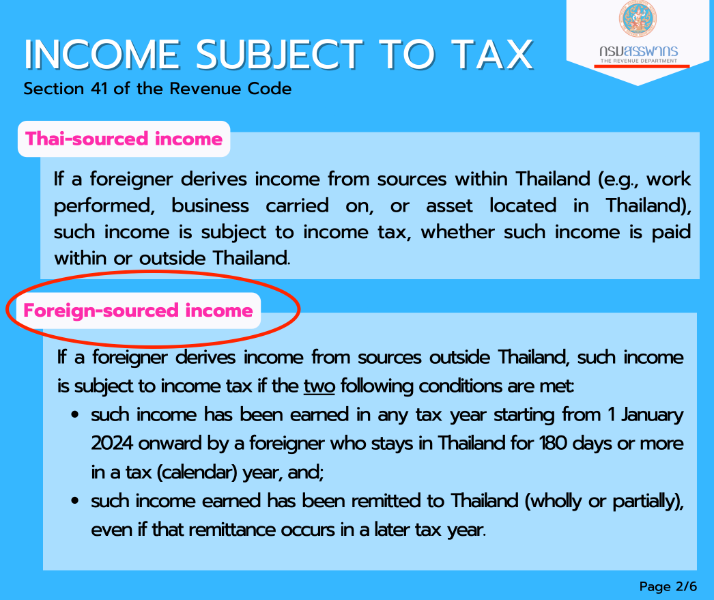

says who? do you have that in writing from the TRD? no, of course not! what we do have is an official document from the TRD that clearly explains who is required to file a tax return. that is a fact. everything else is simply not a fact!- 96 replies

-

- 12

-

-

-

-

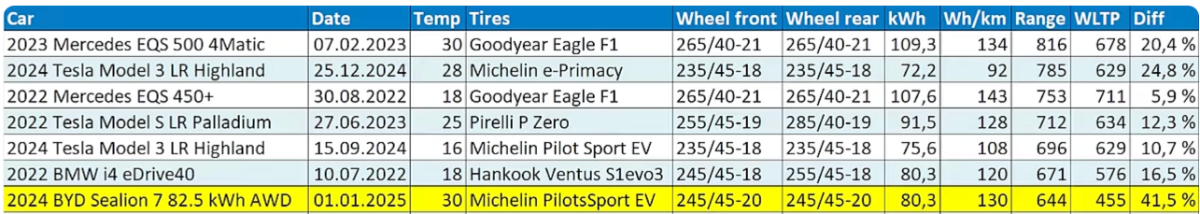

thanks for your reply .... i bought the byd sealion 7 awd at the discount price (motor expo) few months ago ... the sl 7 ticks nearly everything i was looking for ...

-

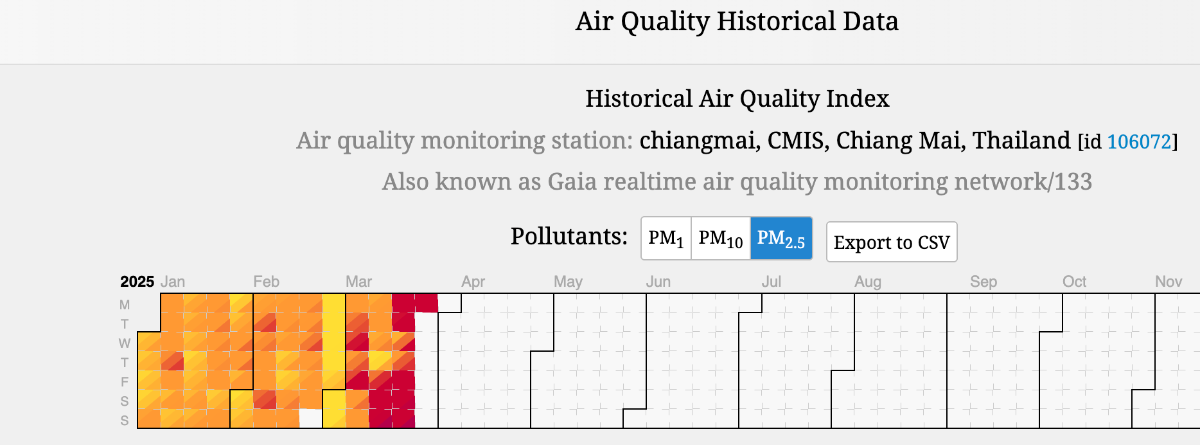

What makes people choose to live in bad air?

motdaeng replied to hotsun's topic in ASEAN NOW Community Pub

what a load of nonsense... the air in chiang mai has been unhealthy since the beginning of the year ... -

What makes people choose to live in bad air?

motdaeng replied to hotsun's topic in ASEAN NOW Community Pub

my brother loved to sun bathing a lot, we told him that couldn't be healthy ... it didn't concern him. he got an aggressive skin cancer and dead with 50 ... -

may i ask why you are waiting and what made you want to buy an electric car? i was in the same position for about three years, wanting to replace my own car, and now i've been driving electric for two months... i love it! i don't quite understand the hype around even faster charging and even greater range. for the average driver, 300 to 400 km is more than enough. on the rare occasions when longer trips are needed, an extra charging stop can be made ... faster charging with higher power levels can only be fully utilized if the necessary infrastructure is in place. however, high-power chargers (300+kw) are still rare in thailand, and this is unlikely to change suddenly in the near future. i believe that battery and vehicle technology will bring updates and improvements to the market every year. however, a real breakthrough that would be truly significant for the average driver (like most of us) will probably take more than just a few years ...

-

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

motdaeng replied to webfact's topic in Thailand News

do you think it's possible, in the future you will have to knock on the TRD door and not the other way around? interesting times ahead, especially for people putting their heads in the sand and hoping taxation foreigner in thailand never will happen ... -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

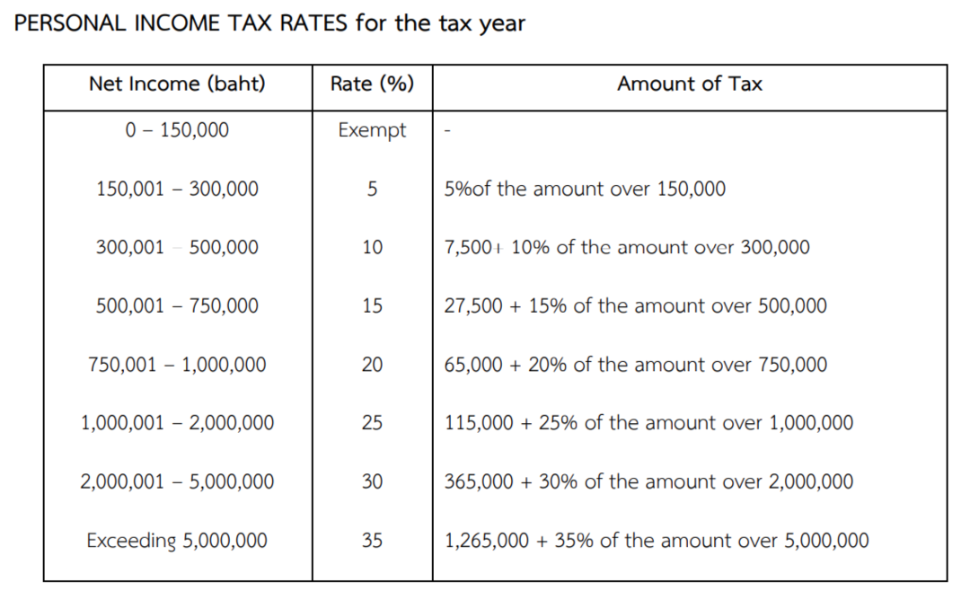

motdaeng replied to webfact's topic in Thailand News

in the future, you might have to explain to the tax office how you support yourself. you would then tell the thai tax office that you pay for everything with your foreign credit card and therefore believe you don’t have to pay taxes under thai tax law. but you do realize that, in the end, it’s the thai tax office (not you) that decides what you need to pay taxes on ... paying for your living expenses with a credit card doesn’t seem like the smartest choice, bad exchange rates, high fees, etc. as a tax resident over 65, you already have a tax-free allowance of at least 500k, and only after that do you need to pay taxes: -

EV Charger Recommendations

motdaeng replied to carlyai's topic in Alternative/Renewable Energy Forum

interesting, please report back on what special function this wall charger has for solar ... https://www.myenergi.com/au/zappi-ev-charger/ Our zappi lets you use any excess solar energy generated by your PV or wind systems to power up your electric car. That means you can enjoy some free kilometers courtesy of the sun! zappi simply connects with your PV system and will take power from the panels or grid, depending on which setting you select. -

EV Charger Recommendations

motdaeng replied to carlyai's topic in Alternative/Renewable Energy Forum

i have the feyree 3-phase 11kw wall charger installed. it is easy to use and works well (after one month... everything is going well so far.). you can hardly blame the product if you connect the polarity wrong and it gets damaged. i don’t have solar, and as far as i know, intelligent wall chargers for solar do exist, but they are not available in thailand at the moment ... -

i agree with you, it's not fair ... i know a first-world country where rich foreigners make flat tax rate deals with the tax authorities, completely legal. that's not fair either... in a corrupt country like thailand, there will never be a truly fair solution for anything what ever ... anyone living in thailand has to be able to look past these things ...

-

no, luckily, you got almost everything wrong ... by the way, i haven’t paid any taxes (all fully legal) for over 20 years living fulltime in thailand ... not in thailand and not in my home country. i don’t work, i’m too young for a pension ... but i’ve been filing tax returns in thailand for more than 10 years without any issues ... right now, i don't need an LTR because it doesn't give me any tax advantages ... as we all know, everyone's situation is different, and mine is no exception ...

-

tesla bjorn did a very slow "sunday driving" with the sealion 7 awd ... see the range result: 644 km !!!!!

-

as expected, the entire tax situation for tax residents in thailand is more or less a mess. different interpretations of laws, regulations, and the TDA by taxpayers, tax advisors, and tax office employees only add to the confusion ... to make thing clear is not something thai's are good in ... turning this into a functional, fair, and consistent tax system for foreign tax residents is hardly achievable for thailand ... even in the long run. with the LTV, taxes are waived, so why not offer a modest flat tax rate for those who prefer to skip all the bureaucracy and avoid filing a tax return? don’t get me wrong, i don’t want to pay taxes either, but i believe that in the future, we won’t be able to avoid contributing to the (corrupt) government’ even we do not get anything in return from the goverment ...

-

i've been driving the sealion 7 awd for a few weeks now and have covered around 1,900 km with an average consumption of 15.2 kwh/100 km, according to the display. for my driving style, this gives me a range of about 530 km. the actual range depends on several factors, with higher speeds increasing consumption disproportionately. if you stick to speed limits, a new sealion 7 can easily achieve 500+ km of range ... also according to other sealion 7 user ... @carlyai did you start your trip at 100%? or, to put it differently, how much battery percentage did you use for your 350km trip?

-

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

motdaeng replied to webfact's topic in Thailand News

good luck then .... do you think TRD is as stupid not seeing if someone try to use a loop hole? please give it a try and report back, thanks. -

if you have a bank account in thailand and 15% withholding tax was deducted from you in 2024, you have the right to get this tax refunded. for that, the tax office needs to issue you a TIN... some offices make it easy, while others might make it difficult for you to get one. do you have investments in thailand? did you send money to thailand in 2024? were you a tax resident in thailand in 2024?

-

Thai Opposition Agrees to Avoid Thaksin's Name in Debate

motdaeng replied to webfact's topic in Thailand News

the only time i agree with you on this subject is when it comes to sending all these generals and thaksin to jail where they all belong ... -

... what a mess ... your group solution sounds not very sustainable ...