-

Posts

1,527 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by motdaeng

-

I do agree with you ... with one exception, " welcome back EOW"!!! he was a t.... before he had his long break, and he is still the same annoying t..... to spam every ev topic! he should go back under his rock or spend more time with his family ... best, do not feed this t... again!

-

A Visit to the Tax Office

motdaeng replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

some good points ... but if you like to play safe, you should know what to do ... listen to a friend or to a front office staff at TRD without getting any written confirmation, that's not playing safe ... but anyway, it's up to you ... -

Legal Strategies to Reduce Thai Tax

motdaeng replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

yes, that's correct. but if the TRD ask or audit you, you need a solid prove for it ... -

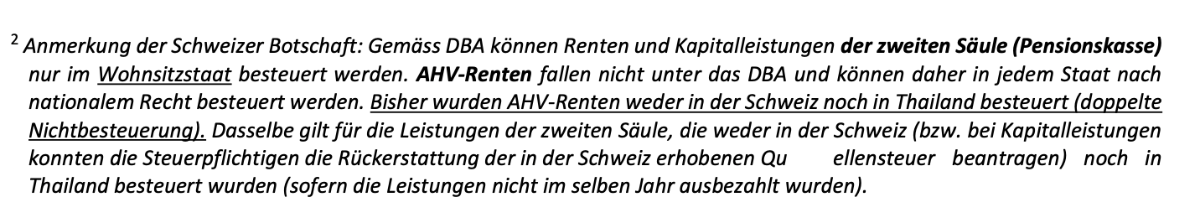

Swiss Pension - taxable?

motdaeng replied to patrickl's topic in Jobs, Economy, Banking, Business, Investments

-

i filled out the tax return without uploading any documents. later, the TRD informed me which documents i needed to upload. for my wife's and child's online tax return, we didn't upload any documents at all because the data (bank, life-insurance etc) was already correct in the system. within a few days, they received the refund ...

-

i completely understand your concerns. this year, we filed our tax return online for the first time. even with my wife helping me, it wasn't easy, especially the first time online. the refund for my wife's and our child's bank withholding tax was transferred within 10 days without any issues. my own tax return was a bit more complicated, and i had to submit additional documents later (36 doc's to upload). the final review by the tax office is still pending. our experience, as well as that of other forum members with the local TRD, has been very positive. they are friendly, helpful, and happy to assist with filling out the tax return. for years, my wife brought all the documents to the tax office, and they completed the forms for us. we've always had good experiences, even though we've only filed tax returns for the withholding tax so far ... this is just my/our personal experience ...

-

thanks for your reply. sorry, my post was not meant to be disrespectful. we have been filing tax returns for over 10 years and have never received the tax forms by mail ... personally, for my peace of mind and because i prefer to follow the rules, i would do the following: go to the bank to get the receipt for the withheld tax, have a thai person help fill out the tax return, and enter the remitted money (around 380k) as income / pension, even though it's covered by the DTA! just ignore and don’t mention the DTA to the tax office ... since you're over 65, your total tax-free allowance is around 500k. no need to worry, you won’t have to pay anything, and you even will get some pocket money back from your withheld bank tax ... that’s what i would do in your place, but of course, it’s up to you. good luck, though i don’t think you’ll need it ...

-

well done! i'm sure you will enjoy the sealion 7 and love it ...

-

i have just started trying out Intelligent ICC (intelligent cruise control) and ACC (adaptive cruise control) in my new byd sl7. i'm not yet sure if i will get used to them ... or will i use it at all ... what do you think about ICC and ACC? do you use them regularly? thanks, motdaeng

-

i'm not up to date with all the visa rules... if you trade money, do you need a work permit and have to pay income taxes in thailand as a thai tax resident?

-

my first few charging attempts with different providers went smoothly. i knew it wouldn't always be like that ... yesterday, i tried test charging with elexa for the first time. everything went well including the "handshake", but after three minutes, no electrons had reached the sealion 7. i could only abort the chargerhead form my car using the red emergency button. on my second attempt, it was the same result. maybe this charging head has issues, so i tried the other free dc chargerhead, and this time it worked without any issues! do you report defective charging stations? is there a feature on any app to report faulty charging stations? it would be really useful since calling the operators and explaining everything can be a hassle ...

-

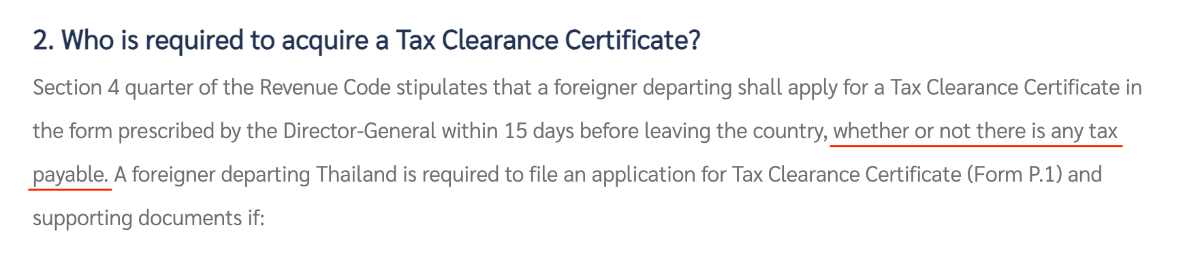

if you want to be cautious (both now and for your future in thailand), just file your tax return to reclaim the bank tax that was withheld. some people prefer to follow the laws, rules, and customs as guests and foreigners in thailand. others might call us stupid or idiots for doing so. i know which kind of people i prefer ... i think the thai people do too ...

-

thanks for your explanation! about the fine print: this year, we filed our (familiy) tax return for the first time online. we assumed that our daughter could deduct the full 100k for her life insurance. however, the online form only deducted about 67k. when we inquired with the TRD, we learned that, according to the fine print, our daughter does not have enough income to claim the full deduction! this is not a problem for her, since she filed the tax return solely to get her refund of withheld tax. after just 10 days, she already received the money from the TRD. so far, so good!

-

if i did that, i didn't mean to, sorry about that... maybe i misunderstood the post (english isn't my first language), maybe you can help me understand what was really meant of "using foreign credit-cards, don't really count since the funds are never transferred into Thailand?" i do assume that the tax experts and tax lawyers from the TRD have addressed this in the fine print; otherwise, this would be a simple loophole and an invitation for money laundering and tax evasion ...