Do You Need To Pay V.a.t?

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

14

Three hundred Expat Stereotypes

Take a break and go to a different country for a bit, like Bangladesh. -

6

Trump wants to revoke the citizenship of Rosie O" Donnell, even though she was born in Ameri

There are a few here that will give you a thumbs down if you just posted the news. This happens because this is a public forum, and anyone, no matter how disturbed, can join. Also because you proved them wrong before, so they take "revenge" against you by giving you thumbs down, without an explanation, again no matter how much truth or unbiased your post is. There are maybe 4-6 here that do this all day long, every day, sometimes answering in one liners just to bait you. Some are against you because you are on a different political side, so just give you that thumbs down just because they don't like that you support that other side. They give likely 90%+ of the thumbs downs that occur here, so it's nothing against what you posted, but just because they're out where the buses don't run. -

-

-

6

-

13

Dead or alive thingy

Is it really that hard to mail 2 or 3 forms, by snail mail, about a week apart to Wilkes Barre. Where is the drama & stress in that. I do that, and simply put a little notation on it. "2nd mailing, if 1st arrived, ignore, THANKS" I don't even bother Manila, to see if it arrived as they have better things to do, and no mail service is that bad. Seriously, when was the last time you mailed something and someone didn't receive it or you didn't receive something.

-

-

Popular in The Pub

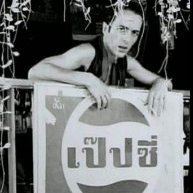

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now