Minimum Deposit Of 50,000 Baht For New Savings Account

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

102

US CDC report shows no link between thimerosal-containing vaccines and autism

Any paper that points to that Sir? If that were so, the parents would show different characteristics from, say 70 years ago, til now. Interesting. I'll have a read up. -

8

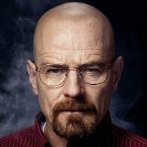

Report Thailand Halts Controversial Casino Bill Amid Political Turmoil

The unseen gentleman on the right is about to break the casino bank........! I seem to remember they made a song about him ! -

0

Report Thai Gamblers Caught After Pawning Passports for Bets

Picture courtesy of KhaoSod In a dramatic turn of events at the Thai-Cambodia border, five Thai men have been apprehended attempting to re-enter Thailand from Poipet without proper documents. This incident unfolded on 7th July, revealing a cautionary tale of gambling gone awry. The Burapha Task Force, in collaboration with the Aranyaprathet Special Unit and the 1201 Ranger Company, intercepted the group. Investigations have revealed that these individuals were gamblers who, in desperation, had pawned their passports to continue betting, but eventually found themselves penniless. Four of the men disclosed that although they travelled to Poipet separately months ago, they met at a casino there. As misfortune would have it, their gambling ventures did not pan out, prompting them to pawn their passports for additional funds. Unfortunately, their luck remained unchanged, leaving them stranded—without money or the necessary documents to return to Thailand officially. As they sought alternative ways to cross the border, they met 33-year-old Yongyut, an assistant chef at a Poipet restaurant, who was in a similarly precarious situation. With his visa expired and fines looming, Yongyut also needed to return to Thailand. The group decided to attempt the crossing on foot, only to be intercepted by vigilant rangers. Upon being caught, the five men were handed over to Khlong Luek Police Station in Sa Kaeo province. They now face charges related to illegal border crossing. This incident underscores the risky entanglements of gambling abroad and the drastic measures individuals might resort to when faced with dire financial straits. It serves as a stark reminder of the complex challenges associated with gambling, particularly when it involves international travel and the forfeiture of critical identification. As the legal proceedings begin, these men’s plight highlights the importance of responsible gambling and the potential consequences of financial desperation. If convicted, they may face penalties, fines, or further legal actions back in Thailand. The unfolding of this situation at the border is not just a local issue but reflects broader social and economic challenges that resonate far beyond Poipet. Those involved in regional security and policy-making might consider this a case study in the complexities of cross-border regulation and personal agency. In a financial context, gambling debts and related issues remain a significant concern. This story might prompt further discussions on effective measures and policies to support individuals at risk of falling into similar patterns. Ultimately, the fate of these individuals will be determined by Thai judicial processes, and the hope is that their story serves as a cautionary lesson to others. Adapted by ASEAN Now from The Thaiger 2025-07-08 -

170

Older Retirees and Younger Partners in Rural Thailand: Accepted or Not?

Elder men with younger wives/girlfriends are generally accepted, as it is not uncommons in Thai-Thai relationships. If you as a foreigner is accepted in the local community depends generally upon your own behavior and how you treat with other villagers; language – i.e, speaking Thai – is not a major subject. -

2

Honda Wave

The Honda ct 125 is a good small displacement bike for long rides. The wave is great on fuel though taxing on the butt, certainly not good choice for long distance unless one improves the seat. -

19

USA New Video Footage Chilling School Attack Foiled by Teens Amid Alleged Honor Killing Attempt

The so called prophet married Aisha when she was 6 and he was 50, he raped her three years later. His nasty book condones marriage to re pubescent girls and the rape of captives. This is the man they think was perfect.- 1

-

-

-

Popular in The Pub

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now