-

Posts

12,518 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

Nightmare at the Prachuap tax office

khunPer replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

To OP @thesetat: Always ask for "talk to someone important", a big boss that can speak English. There is another AN-thread here about one, who did that (opening post)... -

The first thing to do as tax resident foreigner in Thailand, is to check the DTA (Double Taxation Agreement) between Thailand and one's home country. Find the clauses that fits your income that are brought into Thailand. It's said that the DTAs are quite different from country to country, so the only general rules is: You are not being double taxed, but you will be taxed the highest income tax in question. Some DTAs might exclude taxation of retirement pension in Thailand, if the pension is already taxed in one's home country. In another thread (link in post above), a big boss in a local tax depart said that such pension shall not be included in one's tax report. Money that are brught into Thailand, which is not proven savings from 2023 or earlier, and not already income taxed, are taxable in Thailand. That money also includes ATM-withdrawals on foreign credit cards, according to an ASEAN NOW-news story. You have a personal deduction of 60,000 baht and other deductions depending of age and expenses. And the first 150,000 baht income after deductions is not taxed. So, for most of us with lower foreign transfers – and especially with some of the income already taxed in our home country, like retirement pensions – the Thai income tax will be between 0 and very low. The common practise is that you don't need to file an tex return form, if you have no taxable income; however, it is possible to file a 0-taxable foreign income in the form. My Danish home country's tax department issued me a statement in English, where they state that my retirement pension are fully taxed by them. I had an uanounced visit from a kind Thai tax-officer that accepted this statement, and she also saw another letter from my home country's tax department, in where they had issued a receipt for previous three years income tax. The officers only comment was a surprice over the very high tax I had already paid...

-

Withholding tax on interest and dividends don't need to be included in a tax return form, if you accept the tax as final. Some includes the interest and dividend earnings in a tax return, if they are eligible for some of the tax, or it all, to be returned from these witholdings. Accoring to the news all foreigners staying more than 180 days in Thailand should have a TIN. However, your home country might well have a DTA (Double Taxation Agreement) with Thailand covering already taxed retirement pensions from your home country. If your home country's income tax is higher than the Thai tax, you should not pay tax in Thailand. I'm not sure what UK's DTA covers – not my home country – but I think it is only partly covering retirement pensions. You can find Thailand's DTAs in this link: https://www.rd.go.th/english/766.html There are two possibilities for the Thai tax authorities. The easy one is not to tax foreign retirment pension that has already been taxed in their home country. The other one is to tax it – the amount transferred into Thailand – and later return the tax, as agreed under a DTA. Unfortunately, it seems like we foreigners are still missing information about how the system shall work in practise.

-

If you stay less than 180 days combined in Thailand during 2025, it's not a problem. Nor if you can prove the funds are savings from before 2024. If you stay 180 days or longer, you shall check the DTA beyween your home country and Thailand. If the funds are earned after 1st January 2024 and already taxed, it might be covered by a DTA. If the fund are taxable in Thailand, it will be a minor abount, as you have a personal deduction of 60,000 baht and the first 150,000 baht income is not taxable. Income tax of 400,000 baht will be 17,500 baht (i.e., 7,500 baht of the first 300,000 baht and 10% of the remaining part).

-

Thailand Introduces Biometric SIM Registration to Curb Scams

khunPer replied to webfact's topic in Thailand News

Google says: Biometric SIM card registration is a process that involves the capture of an individual's biometric information, such as fingerprints, iris scans, and facial recognition, and linking it to their SIM card registration details. What is the biometric process of SIM? Biometric SIM registration refers to completing the Know Your Customer (KYC) process during onboarding by registering an individual's face or fingerprint characteristics with the documentation. By submitting the biometrics, the individual's ID verification happens from a government database. 8. nov. 2567 BE -

Pattaya’s Mass Tourism Strain: Overcrowding and Ecological Harm

khunPer replied to webfact's topic in Pattaya News

So, Uncle Tu's suggestion for "quality tourists" was not that bad an idea, after all... -

Right, but however, not mentioned in the OP, which I quote and reply to...

-

Western Food - when only this will do !

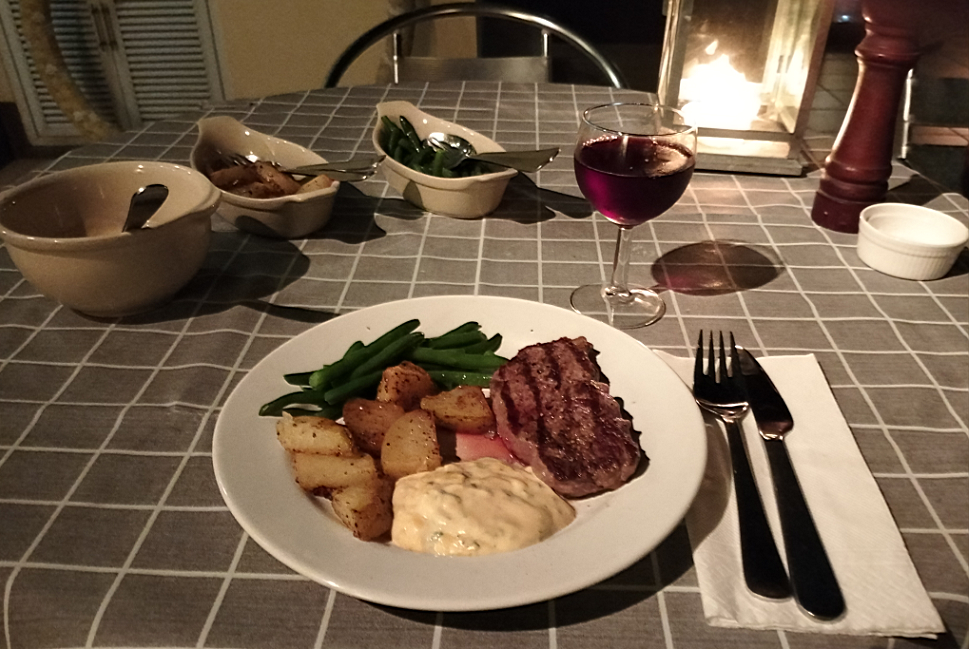

khunPer replied to CharlieH's topic in Western Food in Thailand

There might be difference in supply depending of where in Thailand you live; in touristed areas and major towns is should be quite easy to get, whan you need to make Western food at home. Online shopping might be a solution for some more specialized ingredients. Where I stay – a tourist area – I can get almost everything I need. It's a bit a combination of where to shop – also for best price and quality – but both BigC, Lotus's, Makro and especially Tops Food Hall all have a good selection; the latter almost everything in high quality. I cook Western food myself – while I let my lovely girlfriend cook delicious Thai dishes, she is the expert in that field – it's easy and often require less ingredients than a Thai meal. It's depending of your home country and food preferences, if you easily can find all you need. I'm from Denmark, and can generally find almost all I need for Dan ish style food. However, I prefere Mediterranian dishes; so, that is what dishes I mainly cook. There are a few items that are diffivcult in Thailand, like veal meat. I found that I in many cases can replace the bright veal meat with chicken breast, especially when there are some level of light spices in the dish. Also stuff like Bearnaise essence and Tarragon can be difficult to find locally. BigC had during their French Casino-ownership an acceptable ready made Bearnaise sauce in glass. However, the Bearnaise you can make yourself, or just do like I do, using a onion-and-oil dressing and bright vineager instead, and of course Tarragon-spices. I can order it online – and it cheaper than when finding it in shops – both onion-dressing and Terragon. Also my preferred sundired tomatos in glass I order online. Both Lazada and Shopee are excellent places to search. And by the way, if you wish to make Bearnaise sauce yorself; it's easy-peacy and great for both beef steaks, minced beef burgers and fish-and-chips. Enough for one person: 8 spoonfull double cream (cooking cream is the best), 2 spoonfull onion-and-oil dressing, one spoonfull apple vineager, 2 yolks, a little bit of salt and a teaspoon of Tarragon. Put it all in a pot and warm up under low heat, whip now a then, untill it boils. Then it's ready for serving...😋 -

A copy of the blue house book should be possible to get issued by the local "tessa ban" district office. As owner of the property, you shall be listed a "host" or "house master", so you is the one that can dicide who can be registered as living at that address. The blue house book follows the property and registers Thai residents. A yellow house book is for registration of foreign residents in the property.

-

Best is to visit the area, or areas, you might settle in first, so you know what that part of Isaan is, where you are going to stay. There is a huge difference between cities, smaller towns and rural villages. Starting a business in Thailand as foreigner requires first of all a work permit, if you are going to active part, and not only an investor. Secondly establishing a company, which can be a partnership with a Thai wife – to avoid too many employed Thais, if you are going to have a work permiyt for the business – or a company limited, which often requires four employed Thais for a work permit for one foreigner. A foreigner can only own up to 49 percent and both you, and your partner or sharholder(s9 need capital to invest.

-

In a way yes, but I can live with it. The benefits og living "all year summer" in Thailand are still greater than staying home. However, it would make sense that after a certain number of year' uninterrupted extension of stay, retirees could get a little less strict conditions. It's not so much the financial proof og being self supported, but merely quqing up and waiting with the ongoing stack of same document each year, like address maps etc...

-

It's not only Thailand. In my Scandinavia home country things has become even more difficult. Part is caused to terroismen and money laundry, and it's all over most of the World that they check more-and-more. Things are still easy in Thailand compared to my home country, I'm happy that I moved and therefore have less to fight with in my home country; unfortunately still have some, including more demanding requirements from banks etc due to governmental demand...

-

Beautician from Thailand battles British heirs for £400k inheritance

khunPer replied to webfact's topic in Thailand News

The news-story shows the importance of making a will or change an existing – it's actually quite simple – if you intend to leave something to a "new" Thai partner. Even that a spoken word about heir is legal in court, you still need to prove it... -

Thai Workforce Faces Decline Amid Low Birth Rates, Experts Warn

khunPer replied to webfact's topic in Thailand News

Evolution and progress will automate more jobs in the future. -

Pheu Thai Dominates Provincial Elections with Bhumjaithai Trailing

khunPer replied to webfact's topic in Thailand News

However, Thai PBS wrote: "Thaksin’s political influence questioned by PAO election tally". Source link: https://world.thaipbs.or.th/detail/thaksins-political-influence-might-questioned-by-pao-election-tally/56395 -

British man’s Thailand trip goes from heaven to prison hell (video)

khunPer replied to webfact's topic in Thailand News

The photos are from a former Daily Mail story published January 20th at ASEAN NOW... -

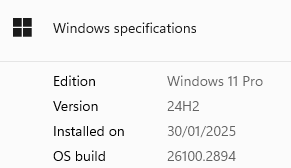

Not what you asked for in your OP, but doesn't matter. And to my opinion, even you didn't ask for it in OP: If you wish to use Microsoft programs, Windows' or Apple's OS are the best in mentioned order. Linux is great for running Internet-servers with an Apache – likely better than a Win-server – but as home PC, it's not...🙂

-

Bottle beers banned Koh Phangan

khunPer replied to Joinaman's topic in Koh Samui, Koh Phangan, Koh Tao

If you mean glass bottled Coca Cola, you can buy them in Makro as .25-bottle and in many restaurants as .33 bottle – it's great for nostalgic moments – many Thais think that glass bottles keep the gas better; perhaps they are right... -

However, not mentioned in your original post, apart from considering a Linux OS instead of Win11... I just tried to be helpful...😉

-

Often money can clear problems in Thailand.

-

If you have automatic updates, you should not worry, a new version will come automatically. I bought a Win10 Pro, this is what I have now from automatic updates...

-

Bottle beers banned Koh Phangan

khunPer replied to Joinaman's topic in Koh Samui, Koh Phangan, Koh Tao

Aluminium cans – and plastic bottles – has a value for garbage-collectors and will be recycled, glass bottles don't have enough value.