-

Posts

12,513 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

If you apply for a non-O visa domestically, the 800k funds need to be transferred from abroad. Banks will often show a code, for example will Bangkok Bank show FTT – to my knowledge short for: Foreign Telegaphic Transfer – using Wise for transfor, you can also raquire a foreign code to be stated in your bankbook. If you have entered Thailand on a non-O visa and are thinking of the one year extension, there is no requirement for deposit(s) from abroad, just there is 800k baht in the bank two month before applying for extension of stay. However, if you use the monthly income of equivalent to minimum 65k baht per month, the funds need to be transferred from abroad.

-

Advice needed

khunPer replied to Bangkok Black's topic in Real Estate, Housing, House and Land Ownership

Your wife's address is registered as resident in the condo. The Blue House Book has nothing to do with ownership, it's only registration of resident(s). -

You shall not expect to change from visa exempt to non-O on Koh Samui; the immigration has from others history for not issuing non-O visas. However, you can always ask at Samui Immigration in Maenam Soi 1, if they'll do it. In the case that they'll do it, please share it in the local Samui-forum. May I kindly suggest that you get your non-O E-visa issued abroad. There is – to mine and other's knowledge – no such thing as a visa-agent on Samui like you find in Pattaya, the visa agent service is limited to help with paperwork and documentation for extension of stay. In the the local Samui-forum, there is a (long) pinned thread about immigration. Even that it is titled about "retirement extension", it also mention extension of stay based on marriage a few times. Be aware of booking time in person and show documents about one month before application for extension of stay, which you can find information about in the latest posts in the pinned thread. You can however easily get a 30 days extension to a visa exempt entry stamp – no need for booking time for that service – and probably also a 60 days extension based on marriage to a Thai; the latter should also be possible with a non-O visa. Opening a bank account without a long-stay visa might be difficult. You'll need an address verification letter from Samui Immigration, work permit with address (if address stil mentioned there), or a yellow house book. There are only few bank-branches left on the island, mainly in Central Festival in Chaweng and the head offices in Nathon. Bangkok Bank in Nathon might be best first option for you. Be aware that Bangkok Bank requires about a weeks notice if you need bank statements beyond a six month-period when applying for extension of stay. Kasikorn (K-bank) is also known to be friendly to foreigners.

-

I retired myself at age 56; today, I don't understand how if I ever found time to work – and, I wasn't a lazy government employee, but a busy self employed working more like double time to reach my goal, and some years just to survive. I've never been bored since I retired. You might find that you change your lifestyle when becoming a retiree and expat, so you might even change your preferred meals with bangers and mash with something, which might be cheaper than "down there", where to comes from. And, you might even find that some cheaper alternative is more tasteful, when you become a real expat. For lady-solution: Some says that the best solution is having a housekeeper to take care of the house, and just pay and play in the nightlife for the fun part. However, it might be at 3k baht level – or more, depending of personal preferences – every time you need some company or entertainment. There was an old job advertisement back in 1906 – or was it 1907? – seeking a foreign manager for Bangkok's first electricity supply. It said that a modest lifestyle in Thailand was cheap and healthy; luxury expensive. It seems like still be the case. So, if 3k baht – or much more – fom entertainmet is too expensive, the alternative is to find a stationary home-intertainment that is both house keeper and can supplement with company and entertainment. Depending of expectations, it might cost you the same a normal housekeeper. I believe that numerous call that kind of arrangement for "girlfriend". However, be aware, that kind of stationary entertainment can also be found in a variety of expensive luxury-versions. But, we are luckily all different; so. what you might find boring, I might find fun – and you might not like my lifestyle where I never find time to get bored. The only good advice is: Try to stay in Land of Smiles a good bit longer than a normal vacation, and stay here like an expat, to see if you get bore, and also to find out if you can afford it at all...

-

Then, you should forget to open a diner in Thailand...

-

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

khunPer replied to webfact's topic in Thailand News

Yes, thanks, that correct, it's 500,000 baht. -

Of course, when you get older, you begin to think more about the final encore. However, I don't worry too much about dying – when I'm, gone there is either no more, or I'm in a Seventh Heavens og some place below – but rather the time before. Who will take care of me, and how will it work out? I have a fairly younger than me girlfriend, and the original deal is that I took care of her – and still does – and she will in return take care of me when I get old enough to need caretaking. The only aber dabai is, if it will work that expected way in the end, when I get old and more grumphy than now, and even beginning to forget...

-

Would you talk to a famous Youtuber if you saw them?

khunPer replied to Harrisfan's topic in ASEAN NOW Community Pub

I wouldn't know it was a "famous youtuber"... -

How do you fit in a plane seat ?

khunPer replied to georgegeorgia's topic in ASEAN NOW Community Pub

-

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

khunPer replied to webfact's topic in Thailand News

"ATM Withdrawals and Payments Expats often ask if withdrawing cash in Thailand from an overseas account or paying a third party, like school fees with a foreign credit card, counts as a remittance taxable in Thailand. The answer is yes. Both types of transactions are seen as remittances into Thailand and are taxable. Under the CRS, these transactions are automatically reported to the Revenue Department, making them aware of these financial activities." Source link: https://www.expattaxthailand.com/how-crs-enables-thailands-tax-authorities-to-track-your-finances/ -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

khunPer replied to webfact's topic in Thailand News

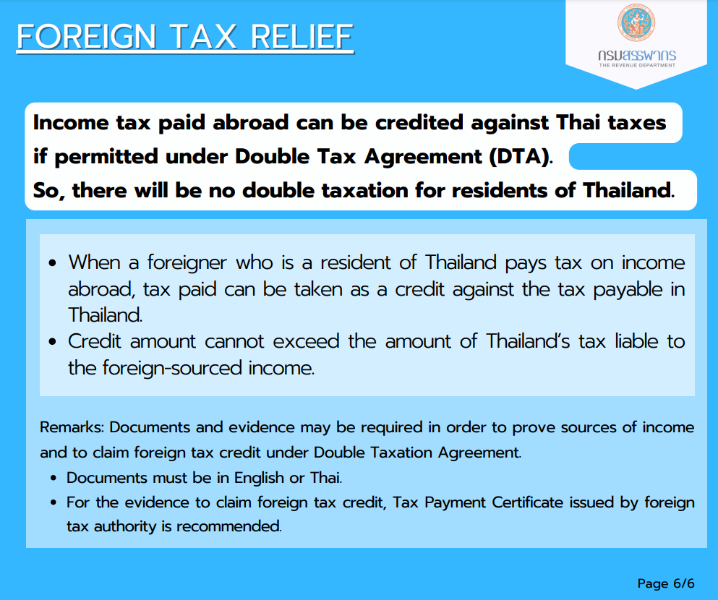

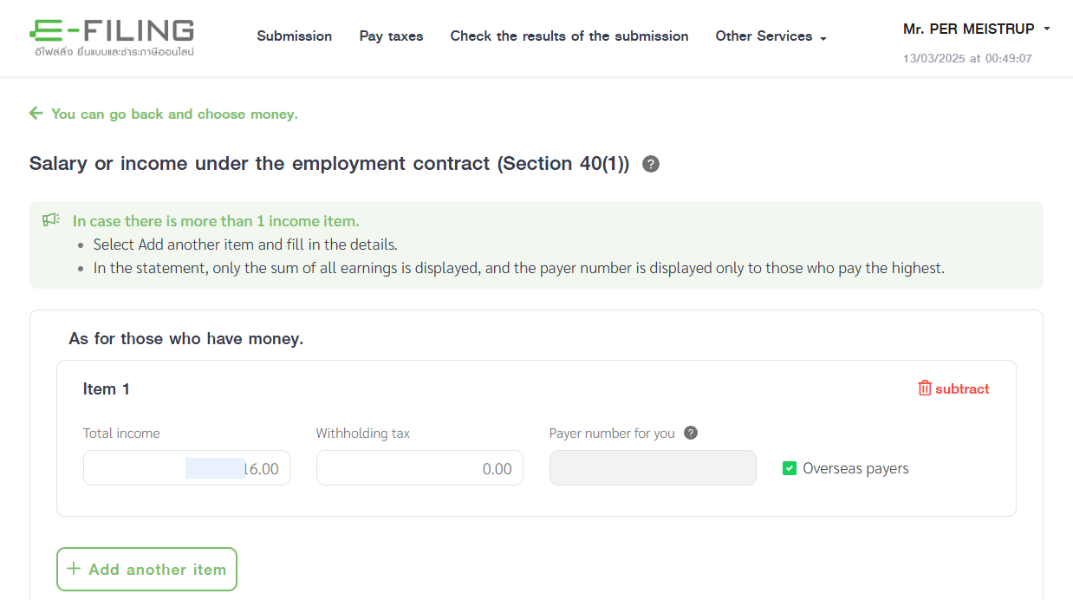

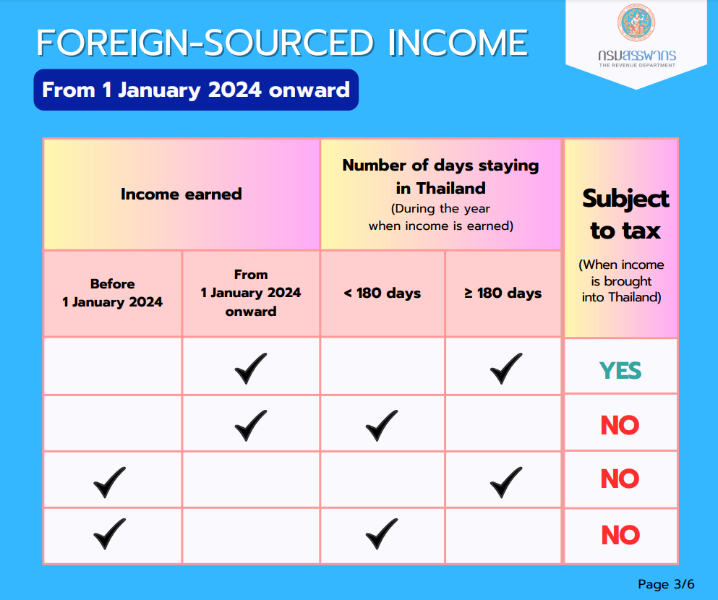

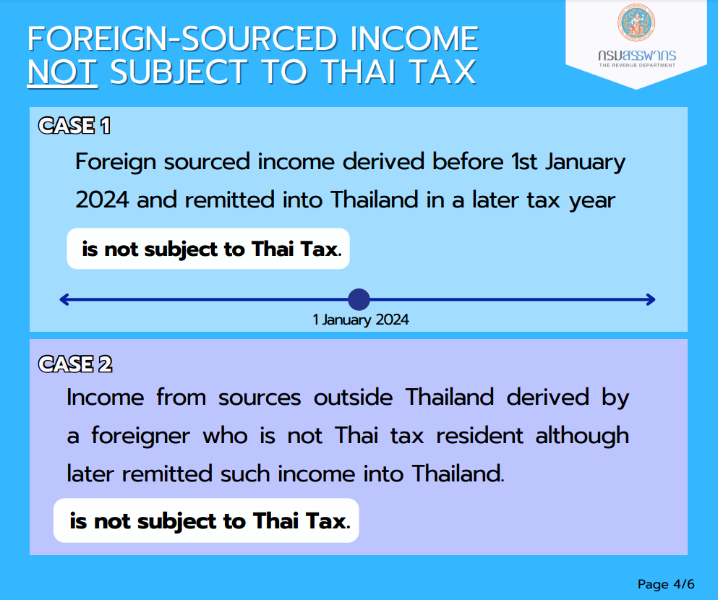

At the beginning of the change of the savings-taxation and demand for foreigners' taxation, we were told that details would come later. Deadline is 31st March for 2024-tax year. Due to the official postings, tax-resident foreigners need to declare taxable income – i.e., anything earned after 1st January 2024 and transferred into Thailand, including ATM withdrawals on foreign cards – but can be credited already paid foreign income tax for those amounts that has already been taxed abroad and is covered by a DTA (Double Taxation Agreement). Bear in mind that DTAs are slightly different from country to country, so you need to check you own home country's DTA. A had a meeting – actually two, see more below – with the local revenue office director, who insisted that foreign already taxed income – for example retirement pension – shall be registered in the tax return form. However, income tax covered by a DTA shall be credited. Easy to be done online with E-filing... However, there seems to be a system-error. You can only mark "Overseas payers" if "Withholding tax" is 0.00. And if you place any amount in the "Withholding tax"-field, a Thai "Payer number for you" is needed. I've set my browser to translate the Thai characters in E-filling to English, which is why you see English in my screen dump. A second meeting with Big Boss in revenue department unveiled that it was impossible to credit foreign paid tax. The staff tried with access to my E-filling profile, and even a call to "someone important" up in Bangkok didn't solve the problem. If you need to deduct foreign withheld tax in accordance with a DTA, you need to fill in a paper P.N.D.90 tax return form – which has to be the one in Thai language and you name and address in with Thai characters; perhaps your local tax department in the Aphor-office might do it for you. You need to attach proof of paid tax in English or preferably Thai language. Now, your deductions are: 60,000 baht personal deduction 100,000 baht maximum deduction, taken as 50% of your income 190,000 baht if you are a 60 years or elder retiree 150,000 baht untaxed base ----------- 600,000 baht total; but can be little more if you are married and spouse no income, and have minor children with your spouse. The below screen dump shows the deductions in my E-filing-attempt... If you are 65 year or elder, and total taxable foreign transferred income is not more than around 600,000 baht, just fill in the tax return on E-filing and avoid any problems. Thai income tax begins with 5% of the first taxable 150,000 baht, so even if you taxable income is a little more than the tax free base, it might be worth just paying a few baht instead of making a P.N.D.90-paper tax return form; especially if you need paid help from an accountant of tax service agent. And remember that savings from before 1st January can be transferred free of tax. It might be a good idea to keep a home country tax office-statement of your savings by 31st December 2023. -

Yellow book and moving

khunPer replied to Asean Tiger's topic in Thai Visas, Residency, and Work Permits

When you move out of an address, you name shall in principle be cancelled in the house book. Normally the procedure mfor a name in a blue house book is that a name is cancelled, when it's registered in a new house book. I'm not sure if the book shall follow the home, you need to ask at the tessa ban-office. Your Thai ID-number from the yellow house book might well eligible you for being registered in a yellow house book in your new condo. -

Bitcoin is said to use an incredible amount of electricity to keep running – i.e., the so-called mining – and it seems that the costs are becoming that high, compared to the gain, that fraud with electricity is necessary. I wonder what happens when even less coins are mined, if the value of Bitcoin for one-or-other reason also falls...🤔

-

Yes, you are correct, to my understanding of the rules...👍 In my view it might be a benefit, to use one's documented savings from earlier than 1st January 2024, before beginning to use gain; i.e. live of one's savings, instead of interest and capital gain. If money-trail can be followed – which is what tax authorities normally wish to see – I presume that we ongoing can sell out of equity balance of 31st December 2023, transfer only the 2023-value, while keeping gain and reinvest that; i.e., one might need to sell bonds and equity and reinvest in some of them back again little later. The importance is to keep good trail and documentation of everything that financially happens after the 31st December 2023 savings statement.

-

According to the Thai revenue office, "ZERO assessable income" means no foreign transfers or foreign transfers of fund from before 1st January 2024, if you stay 180 days or longer in the nation within a calendar (tax) year. Income that has already been taxed abroad might be tax-deductible, depending of a DTA.

-

British Retirees Escape Thai Jail After Violent Land Dispute

khunPer replied to snoop1130's topic in Thailand News

A foreigner can surely own a villa in Thailand – no problem...👍– but a foreigner cannot own the land under the villa if not entering on "investment visa". However, land can easily be rented... -

Pay tax - how many times per year?

khunPer replied to zmisha's topic in Jobs, Economy, Banking, Business, Investments

You shall file a tax return not later than 31st March. You can do it online with E-filling, if you already has a Thai TIN; otherwise, get a TIN and file online. Link to E-filling: https://efiling.rd.go.th/rd-cms/tax If you already have paid foreign income tax, you cannot claim deduction online at the moment, in that case you need to file an old fashioned tax return on paper in Thai language. Due tax can be paid immediately, or you can apply for tax-payment in three installments. -

Thanks for your reply. It seems to be slightly different from office to office, what they demands or request. Where I live, we must make a new TM30-notification if being outside the province. Other places it is if outside the kingdom, and there was a police order stating that if you returned to same address, you don't need to file a new TM30-notofication, even if you have been abroad.

-

Actually your need to file a tax return form – I've even had a meeting this week with the Revenue Office director where I live about it – but you don't need to pay tax of the first 500k baht if you are retired and 65+ years old. That is also what the official images I shared and your refer to, says. It is fairly easy to do it with online E-filling, as long as you don't have to offset already paid foreign tax, which the online system cannot handle (seems to be a system error, according to the revenue director, he was surprised that it didn't work).