-

Posts

12,518 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

Thanks for your reply. It seems to be slightly different from office to office, what they demands or request. Where I live, we must make a new TM30-notification if being outside the province. Other places it is if outside the kingdom, and there was a police order stating that if you returned to same address, you don't need to file a new TM30-notofication, even if you have been abroad.

-

Actually your need to file a tax return form – I've even had a meeting this week with the Revenue Office director where I live about it – but you don't need to pay tax of the first 500k baht if you are retired and 65+ years old. That is also what the official images I shared and your refer to, says. It is fairly easy to do it with online E-filling, as long as you don't have to offset already paid foreign tax, which the online system cannot handle (seems to be a system error, according to the revenue director, he was surprised that it didn't work).

-

To my knowledge, you will need to file a TM30 where you are living for approval of your extension of stay, which might be difficult when living in a container on a construction site; i.e., who is registered as host. Why not just rent a cheap room, where yoy can have your formal address; it won't stop you for having your assets in a container on the construction site a spend the night there. To my knowledge, you don't need to file another TM30 when sleeping elsewhere within the province.

-

Please help settle an argument

khunPer replied to Delight's topic in Real Estate, Housing, House and Land Ownership

If married the farang has some rights. If she dies, it is depending of marriage, and her eventual last will. For inheritance due to last will they don't need to be married. A farang can inherit property, but cannot keep it, if it is land or within a Thai 51% share – I however don't know, if it can be relocated to 49% foreign holdings, if space available – and need to sell or transfer the property within 12 month. -

Koh Samui is only one day, April 13th, if you stay away from the nighlife area in April 12th evening...😉

-

If beachfront: Lolita Bungalow, Wandee Byngalow (might be prebooked already), Moon Hut. You can use Google Street View to walk the beach and find accommodations of interest, and check prices and availability on website or booking platform.

-

What is "reasonable priced" for you; i.e., what price level are you looking for?

-

Should I stay ou should I go? (Pattaya, Phuket)

khunPer replied to Franck60's topic in ASEAN NOW Community Pub

Thanks for your reply, you are welcome to ask questions. There can be a lot to consider when moving to a new country. Lifestyle: I changed lifestyle from my home country's four seasons to all year summer and barefoot Xmas. Further north you have winter, actually three seasons: Summer, rain and winter. Down south we only have two seasons: Summer and rain. Furthermore, I began living a life that I didn't have surplus – mainly time – to do, and might have missed when I was younger, being too busy to keep a self employment smaller company growing and surviving. Since I settled in Thailand I enjoy the nightlife, not bars, but beach parties and night clubs; I never danced before, I do now...😀 Thai language: I've never been good in language – still fighting being reasonable in English as second language – it might also be a question of where you settle, if you can manage with only being able to speak a tiny bit of the local language. I've decided for a tourist area where many locals speaks some level of English and prefers to try to speak English to you. Some times I manage with simple Thai words when shopping, which the Thai shop assistant understand, but answers in English. In more rural areas it's rare that someone speak, or just understand a bit of, English. I presume that if I had settles in a farmer village up north, learning more of Thai language would be a must. Spouse: I'm living together with a Thai girlfriend, who accepted to stay where I settled, and didn't try to make me settle in her village. I've already decided my move, before I met my girlfriend. Often a Thai lady dreams about a house in her home-village, both to make face – having a farang spouse – and to have a place when she gets old, as often the local spouse is the younger part. Bear in mind that family is important when one get old, as government support to elder people is very small and elder care homes are not normal in Thailand. Kind of age difference agreement between a foreigner and a younger Thai spouse can be like: "I take financially care of you now, in return you takes care of me when I get old." This is why I mentioned that where to stay also depends on having a Thai spouse, and budget. The latter, budget, is especially if you wish to build a home. Land prices and construction costs are lower in rural areas. A spouse's family might already have land or access to land at a very affordable price – a foreigner can own a house, but not the land under the house – while in major towns and tourist areas, land prices can be quite high, and construction costs also higher. An alternative is always to rent. Renting is the best in the beginning, when testing areas and the first periode when finding where to settle. It's easy to move on, if it was not the right choice. In long terms, to own one's home is cheaper than renting, but you need to look around 15 years ahead before an owned home – i.e. a condo that a foreigner can own – or construction costs and land arrangement for a house financially equals a rent. I built a house and owns it, and have a reasonable arrangement for using the land, under the house. Compared to rental price for similar in my area, investment equalled rent already after 10 years; so, I'm living almost "rent free" now, but still paying a tiny landtax on the land – a house for primary home is tax free for the first 10 million baht in value – and of course maintenance of a house. Depending of where you comes from and where you settle, things may last shorter time than you are used to at home. I live beach front, which can be slight hard on a house – things easily rust or corrode – than having a home further inland. -

Your nephews are right...👍

-

800k baht bank deposit must be 2 month before application, 3 month after granted extension of stay.

-

Huge impact on my girlfriend – and also many of her friends that moved from rural farmland areas up in remote areas of Isaan down to "my island" to find a farang like me...🤣

-

All planned, or just the way it turned out ?

khunPer replied to The Cobra's topic in ASEAN NOW Community Pub

Structured plan since the end on the 1980s: Back then I saw my auditor had a new smart suitcase with a carryable computer inside and a yellow monochrome monitor in the lid. My dream was that when I some day could pack my company into such a thing and remotely control it all – and my bank accounts – i would move to a tropical island and sit and do all that in the shadow of a coconut palm while a couple of beautiful young ladies brought me cool drinks... We – inlcuding everybody I told ab out my dream – all laughed a lot about that idea...🤣 15 years later I bought a coconut palm on a tropical island – young ladies and cool drinks was the easy supplement – and here I still sit, happily living my dream... The photo is my coconut palm view from a relaxing state during a hard days remote banking work... -

Man Arrested for Blasting Car Stereo in Early Hours in Buriram

khunPer replied to Georgealbert's topic in Isaan News

The positive part of the story is that there is some official action when testing maximum distortion level of one's car-stereo after midnight... -

are you pale as a ghost or baked like a lobster?

khunPer replied to save the frogs's topic in General Topics

Like there are 50 shades of gray between black and white, there luckily is something similar between pale and red – I'm neither pale or red, I'm in one of the 50 other possible shades... -

Thailand Weighs Designated Drinking Zones for Tourists

khunPer replied to snoop1130's topic in Thailand News

Sounds just like being exhibited in the smoking rooms in airports...😳 – perhaps it's better to just stay home the few religious nights in a year... -

Should I stay ou should I go? (Pattaya, Phuket)

khunPer replied to Franck60's topic in ASEAN NOW Community Pub

Where to stay as retired in Thailand widely depends on personal lifestyle, eventual having a Thai spouse, and budget. Visit as many places as possible of interest, before you decide where to settle. Tourist places can have numerous advantages that you don't find in more rural areas, as well as disadvantages, all depending on individual life-style. You might even find that you wish to live another life-style when staying permanently in Thailand, than the lifestyle you had before, or expected to have when you retire here. There is a huge difference from looking around and checking areas as tourist and with the intention of living there on permanent basis. Hospital and shopping, transportation and even school, if you are having or planning children in the household, can be important issues. Also costs of either renting or buying a proper home. And especially checking different seasons, like hot period, rainy season and winter, if you look at places up north. Try to stay in places of interest for some days, or a week, during, in each period. When I first vistited Thailand – it was back in 1987 – I fell in love with Chiang Mai and had a feeling like that here I could live, perhaps sometime in the future. 18 years later I settled permanently in Thailand on early retirement – to enjoy my life, while stil.l able to do such thing – and I decided instead to stay on a southern island instead. Today I'm happy that I didn't decide for Chiang Mai – or any other place in Thailand – it's a personal choice, and we are all different. I mention this to be aware of that places change over time, even 13 years from 2012 can make a difference – in some places a huge difference – which m ight both be to the better or worse. It is also based on staying there as a resident instead of a turist's view, and of course depending on individual preferences. You might not like the same as me, so I shall not say that you of course shall settle the best place of all, namely where I stay...😀 -

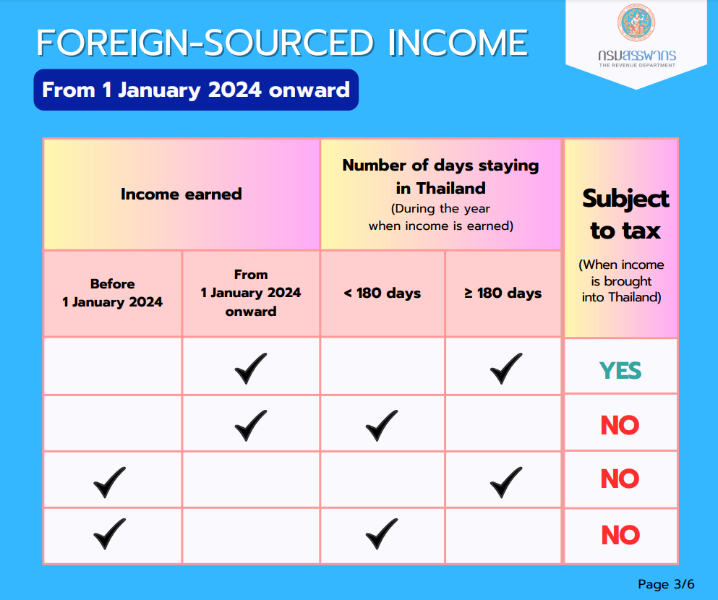

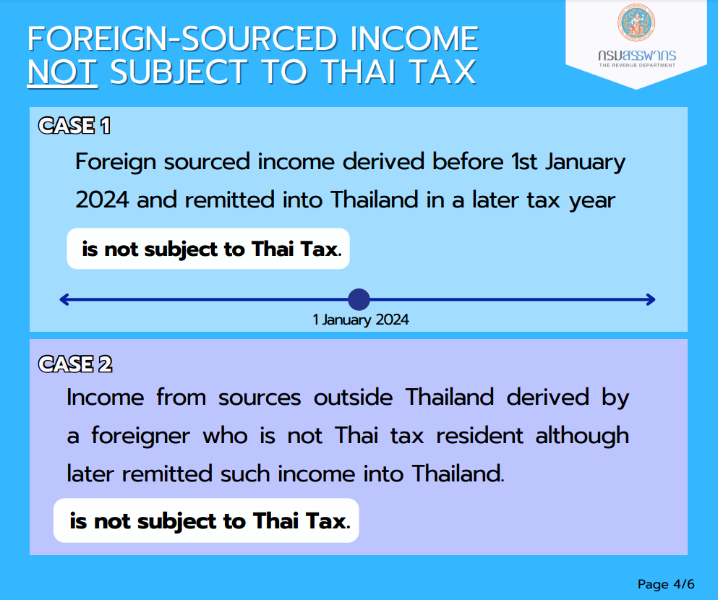

All DTAs are slightly different, so what the rule is for us Danes, might not be the same for tax residents from other countries. You need to check the individual DTA between your home country and Thailand. In general it seems like that if you have already paid tax in your home country for a retirement pension, and the tax is higher than income tax in Thailand, and your home country has a DTA with Thailand, you don't need to report it in a tax return-form. B ut you need to keep proper documentation for already having paid income tax, if your are later checked and asked about it. Especially for us Danish citizens, we can have a general letter from our tax-office, which states that we pay tax of retirement pension in Denmark, and furthermore a letter for each inbdividual tax year. Danes can read more about Thai tax-rules here, where you can see examples of such statements from the Danish tax office... https://samesame-butdifferent.dk/doc/flytte-og-bo/Skatteguide.php In general: Any funds/money transferred into Thailand that has not been income taxed in one's home country – or is proven savings from before 1st January 2024 – shall be decleared in the Thai tax return-form, if you are tax resident in Thailand (the 180 days rule). But check with eventual DTA what the specific rule is, it might even be an advantage to pay Thai income tax, like it is for us Danes with dividens from stocks. You can find all the Thai DTAs in English language here: https://www.rd.go.th/english/766.html

-

The waitress said I had 4 beers, when I only had 3...

khunPer replied to Robert_Smith's topic in ASEAN NOW Community Pub

A problem that is easy to solve; In the future just pay every time you order something, instead of the bin-method...