-

Posts

12,543 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

Thai Govt Rejects Poll Showing Public Dissatisfaction

khunPer replied to webfact's topic in Thailand News

Today, news that a government don't like easily gets rejected with the stamp "Fake News"... -

As others have mentioned, it's a matter for the police. That is why TM30 registration is both needed and good, an easy way to find owners of lost passport.

-

Sole proprietorship in Thailand?

khunPer replied to JP-HB's topic in Thai Visas, Residency, and Work Permits

I'm not from UK, but it's probably not so different from other European cpountries, and like the situation for other Danes and myself that are living in Thailand and still owner of a business in our home country. It has nothing to do with Thailand, apart from personal income and eventual taxation of that. There might be rules in UK, just like there is in my home country – and those I know in similar situation from neighboring European countries – if you have a personal owned bsusiness, about vat-registration and an address etc. Most of us use a limited company registered in our home couintry. The company will pay tax in the country where it is registered. You shoukld check the DTA between Britain and Thailand concerning salary, fees and/or dividends paid to you, when you are tax-resident in Thailand. The DTAs are different from country to country, but in Denmark we don't pay Danish income tax of salary and fee, and can get tax reduction on dividends. Thai income tax is (much) lover than Danish taxation. If you do no business in Thailand, you don't need a company here. -

There was an article in 2023 about nursing home service for elders, the link is here: https://www.dailymail.co.uk/news/article-12703563/Thailand-retirement-resorts-British-retirees-NHS-social-care.html

-

Money transfer for buying condo

khunPer replied to Agusts's topic in Real Estate, Housing, House and Land Ownership

Might be best to use a bank transfer and foreign currency – i.e. your home country's currency – and do the exchange in Thailand. If you transfer a larger sum, make sure that you get a reciept from the Bank of Thailand declaration, you so can take the same amout of money out of Thailand, if you sell your condo. Be aware of income tax of foreign transfer, if you stay in Thailand for than 180 days during the calendar year when you do the transfer. You need to be able to prove that the funds is savings from before 2024, to avoid income tax. -

Is it possible/ worth it to unglue fittings attached to blue piping?

khunPer replied to BeastOfBodmin's topic in DIY Forum

Most plastic parts for blue pipes are so cheap that reuse is not worth it. -

British Family Seeks Aid to Bring Injured Traveller Home from Thailand

khunPer replied to webfact's topic in Koh Samui News

Samui's traffic is among the most dangerous in Thailand – if not the most dangerous – many tourists have accidents, and it seems like insurance is a returning subject. I have stopped counting the number of dead victims I've seen in the streets, some days up to three bodies. In average I see one or two traffic accidents per week, and I'm not driving that much on the island. If you head to Thailand as tourist, the most important part – after the ticket – is travel insurance. Make sure a relative at home get a copy of the policy, or at least the insurance number. Don't drive on a motorbike – even as pillion – before you know that your are covered by insurance.- 126 replies

-

- 14

-

-

-

-

Yellow book and moving

khunPer replied to Asean Tiger's topic in Thai Visas, Residency, and Work Permits

A house book belongs to the house, not to any person registered in the book. If you sell your condo – or house – the house book follows the house, listed on first page, and the new owner of the new owner of the property. However, residents that moves out from the house need to be delised in the house book. If it is same procedure as the blue house book, the house – or condo – owner will be informed to bring the house book to the local tessa ban district office, to get names delisted, when registered in another house book. For a foreigner to obtain a yellow house book – i.e., to be registered first time – is a precedure, which includes translation of passport and often witnesses, which in some districts can be little complicated. I suggest, that you keep copy of the first or eralier yelloe house book and bring when applying for a new yellow house book in the new flat, as when already being accepted, and also having a pink ID-card for foreigners, it should be easy to get a new yellow house book issued for a new condo or house. You need to be registered as host or house master – owner of the condo/house should be be registered as host – to be the one allowing names registered in a house book. I write "owner of house", as a foreigner can own a house; it's the land under the house that the foreigner cannot own. -

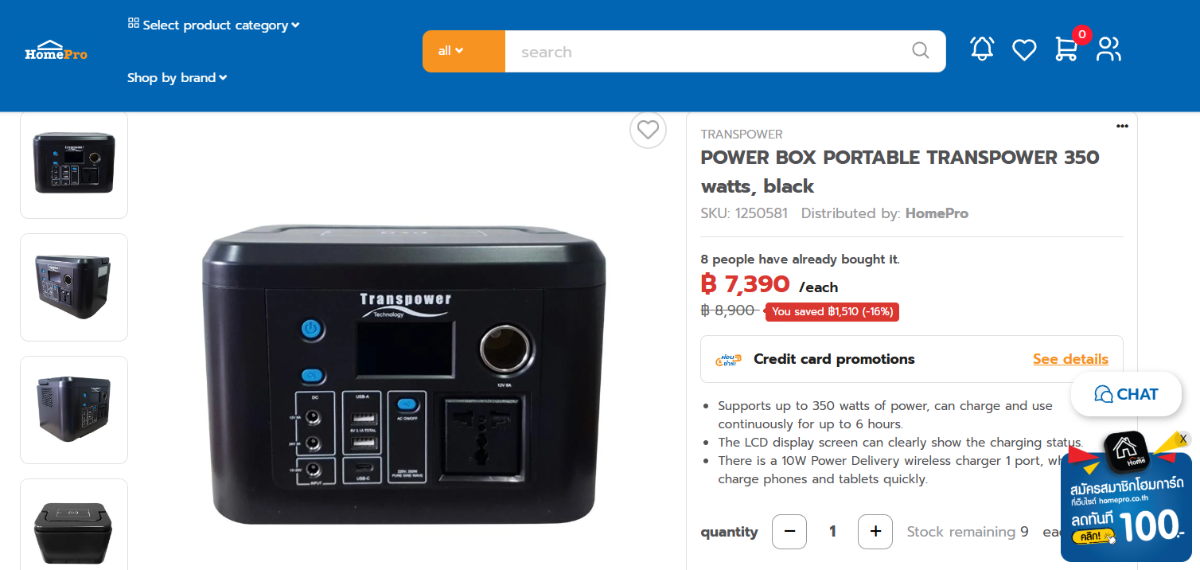

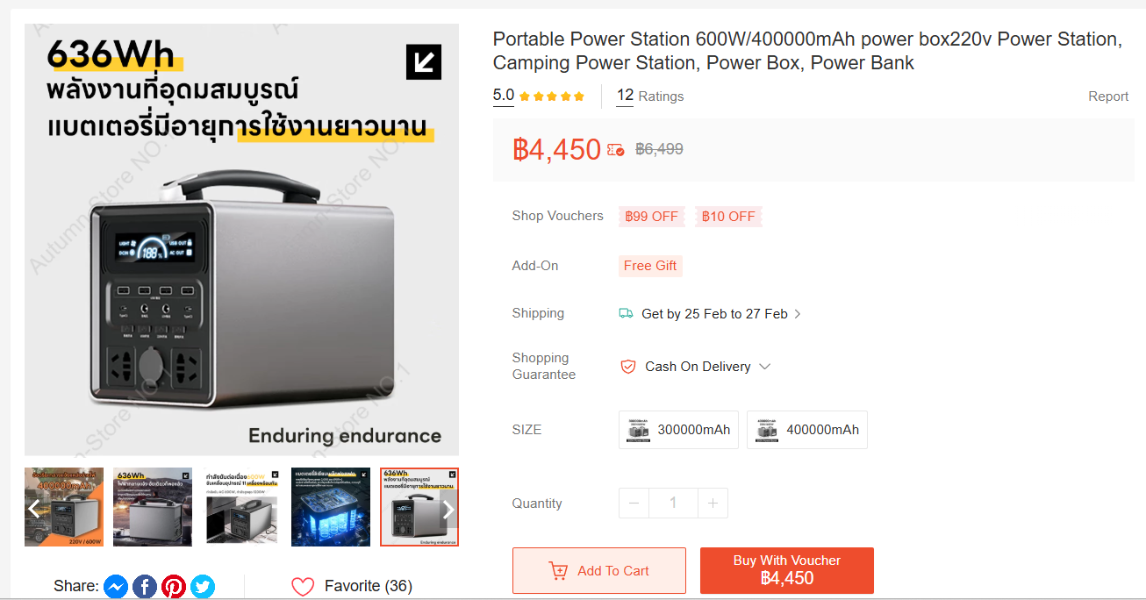

A typical UPS has a 8Ah battery. The time it can run depends on the load, but basically intended for enough time for short black outs (brown out) or time enough to safely close down. HomePro has a Power Box that they state can provide up to 6 hours power... feature Supports up to 350 watts of power, can charge and use continuously for up to 6 hours. The LCD display screen can clearly show the charging status. There is a 10W Power Delivery wireless charger 1 port, which can charge phones and tablets quickly. It has a battery capacity of 260Wh and comes with a Backup Lithium Battery of 70,000mAh. Can be charged with car power, home power, and solar panels, size 12-18V. Fully charged in 3-4 hours (depending on remaining battery power) Easy to carry, convenient to use, suitable for taking out to use outside the area. Hours of use depend on the electrical equipment used. Easy to carry, has a handle, suitable for keeping in the car and for use when traveling or camping. Product warranty for 1 year (according to company conditions) HomePro link: https://www.homepro.co.th/p/1250581?lang=th&gad_source=1&gclid=Cj0KCQiAq-u9BhCjARIsANLj-s3SkbQnOB2N_JU2hz07yywAsDH3ugvu5fN67Za1pdqStFjeMizPtqYaAnIREALw_wcB Shopee also offers a Power Bank... Shopee link: https://shopee.co.th/product/1381500814/28464179823?gads_t_sig=VTJGc2RHVmtYMTlxTFVSVVRrdENkVHQ3ZkZSUTMrR3pBWmZZNzdrcnRBMjdNbXFQeGtLRmdhOWF1UnZuNUZxek1pTTgwS1JzQXM3RndxWmp6bmRETjZxc3RVSzBHVHc4OGpJamw1VlJlVmcvUk5hNk13YVFWVlNCK2FFZVFRQ1h0b3dLZjFXNXdKY3dnWDVPN08rR3p3PT0&gad_source=1&gclid=Cj0KCQiAq-u9BhCjARIsANLj-s3ydK1yuJkddfgo6duMcIGqGC__5MpYxhbHzTbRvdwA4v9OydUQrpkaAsfZEALw_wcB

-

Smoking cannabis openly in the streets in Thailand

khunPer replied to DonniePeverley's topic in Thailand Cannabis Forum

Cannabis is not allowed for "recreational use" in public areas...😉 -

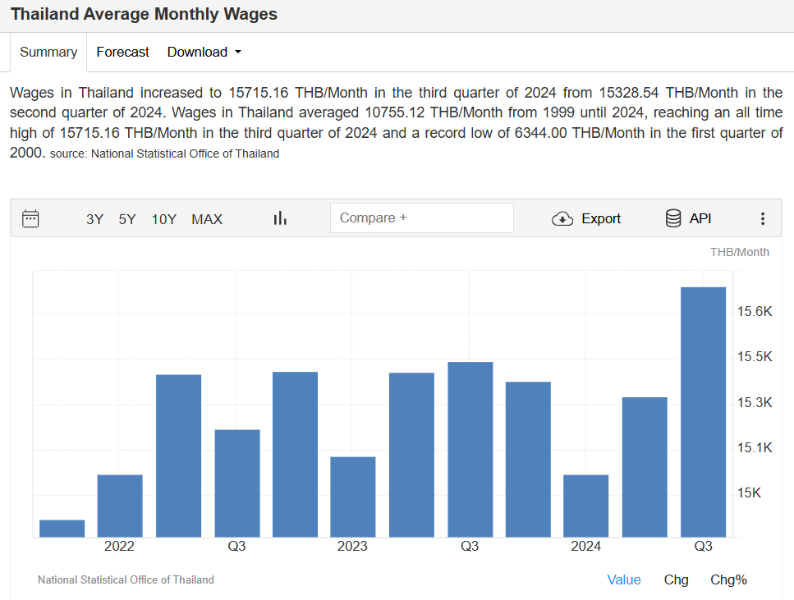

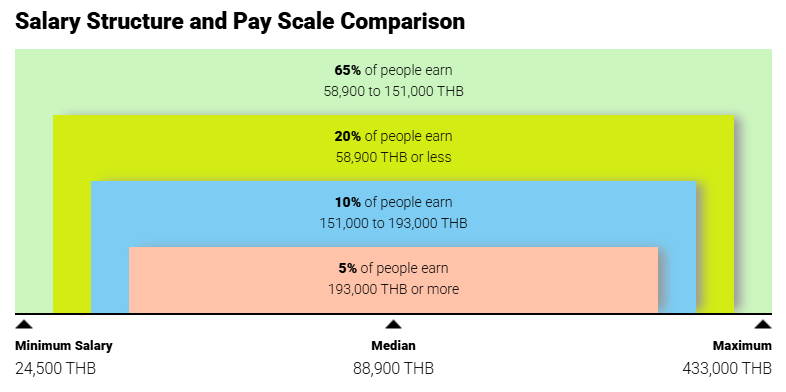

"Middle class" seems to be a quite wide classification, more like lower middle class, middle middle class and upper middle class. The latter below the level of real rich people. Many Thais are now in the 15,000 baht per month income group – which also is the average monthly income – is that middle class, perhaps low middle class? This income level also means that they are paying the maximum Social Security, 1,500 baht per month, and obtain the benefits – including retirement pension – from that. If a household has double income it is in average around 30,000 baht per month. (Source link: https://www.statista.com/statistics/1030220/thailand-average-monthly-income-per-household-by-region/) As stated from above, the average household income in Bangkok is around 40,000 baht per month. The median salary is – perhaps a bit surprising – stated by Time Doctor to be 88,900 THB per month; implying that 50% of the population earns more than 88,900 THB, while the other 50% earns below 88,900 THB. (Source link: https://www.timedoctor.com/blog/average-salary-in-thailand/) However, this median salary might be based on foreigner's income level, or positions with education and some level of experience, as it range from 24,500 baht to 433,000 baht per month. (Source link: https://www.salaryexplorer.com/average-salary-wage-comparison-thailand-c215) So, the area around 90,000 baht per month could be the midlle of the middle class. And how do you save from that income. To me, it seems like a major saving is real estate – i.e., to own your home – and furthermore some might well be in deductible retirement savings, when we are up in that income level. With the mortgage typically around 50% of the property value, there could be quite a bit of saving there. My girlfriend told me that when she visited our Thai next door neighbour – good friends that I considered as being somewhere in the middle class level – the were making their budget. She told me the had 300,000 baht disposal income. I was a bit surprised, because that is 25,000 baht per month, I thought they had little more. My girlfriend replied: "It not per year, it per month! How would you else expect them to send their two kids in expensive schools?" Suddenly – me, the farang that many Thais are supposed to consider as "rich" – I fell a little poor...

-

Pattaya Bars Empty Amid Low Season and Shifting Tourism Trends

khunPer replied to webfact's topic in Pattaya News

No wonder the girlie-bars are empty, Pattaya is a family destination... -

Lifting Alcohol Restrictions Could Boost Thai Economy by Billions

khunPer replied to webfact's topic in Thailand News

Sounds more like wishful thinking, tourist destinations are already serving alcohol after midnight in the nightlife... -

The fund needed for extension of stay or visa application in a Thai bank, preferably as a 12 month fixed accounf, which might give you around 1.5% annual interest (before withholding tax). I use Bangkok Bank, but check around for both best interest and service in local branch. For excess funds beyond the needed visa or extension fund, I use fund book (mutual fund) from a bank, based on cash terms (lowest risk), which gives me around same outcome as fixed account interest, or slighgtly higher return, but can be sold (in lots) at any time with cash available within a few banks days; i.e. no interest loss upon withdrawal. I have fund books in both Bangkok Bank and SCB, but check yourself where you might get best return. Immigration don't accept fund books for extension of stay.

-

Pai's Deportation of International Musician Sparks Outcry

khunPer replied to webfact's topic in Chiang Mai News

It seems to me like it begins with an unlicensed business; you can get work permits for foreign entertainment artists, but it might be hard to get an artist-work permit for an unlicensed venue. Just follow the law, then you avoid problems. -

Are your delivery drivers dropping off packages without a signature?

khunPer replied to connda's topic in General Topics

Yes, normal practise where I live. However, we have (so far) never had anything stolen. It might be that the local delivery person need to deliver the package within a certain time limite to be paid or fully paid – one of them told that their payment is 20 baht per package – in a few cases I got E-mail from the shop that the goods were delivered (scanned out), even not I haven't got it; the package arrived only next day. -

Recently sold house in UK

khunPer replied to kevtheblue's topic in Jobs, Economy, Banking, Business, Investments

I you talk about Thai income tax, the borderline is 1st January 2024; however, only the funds you transfer into Thailand are income taxable here. Savings from before 2024 are still free from income tax, so it's only any capital gain/profit from house sale that will be taxable. If the profit is already taxed in Britain, it might be covered by the DTA (Double Taxation Agreement). -

Insurance company only want to pay 50% of the claim

khunPer replied to advancebooking's topic in Insurance in Thailand

I.e., you didn't contact the insurance company and made a claim before asking for repair? -

Replacement CR 1616 battery for car remote on Samui.

khunPer replied to phetphet's topic in Koh Samui, Koh Phangan, Koh Tao

By the way @phetphet: If it's motorbike remote/key battery, Honda in Maenam will have it. -

Replacement CR 1616 battery for car remote on Samui.

khunPer replied to phetphet's topic in Koh Samui, Koh Phangan, Koh Tao

Special batteries like this is hard to find locally, your best option is Honda in Lipa Noi. -

Can Foreign Tourists in Pattaya Expect Fair Legal Treatment?

khunPer replied to webfact's topic in Pattaya News

"Some are more equal than others"... -

More Thais Staying Single, Impact on Weddings and Florists

khunPer replied to snoop1130's topic in Thailand News

Same as in some, if not several, Western countries. -

Yes, I had a TIN and had filed tax return. As I wrote: "I had an unannounced visit from a kind Thai tax-officer..." that came to my home. But it was not because I had file a tax return, but because all knowing long-term residents from my home country in the area should have a visit to check that they paid income tax either to their home country or to Thailand. They even showed me the full list with names to visit, also to show me that my name was on the list. I know from others that they also had a visit. I was told that it should be done country by country and in co-ordination with the said country's tax authorities. They started with Finland and Denmark. It was a few years ago, so it had nothing to do with the 1st January 2024 change of savings and taxable fund transfers, foreigners staying 180 days or longer in Thailand was already tax residents before 2024.