Thailand J

Advanced Member-

Posts

1,621 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

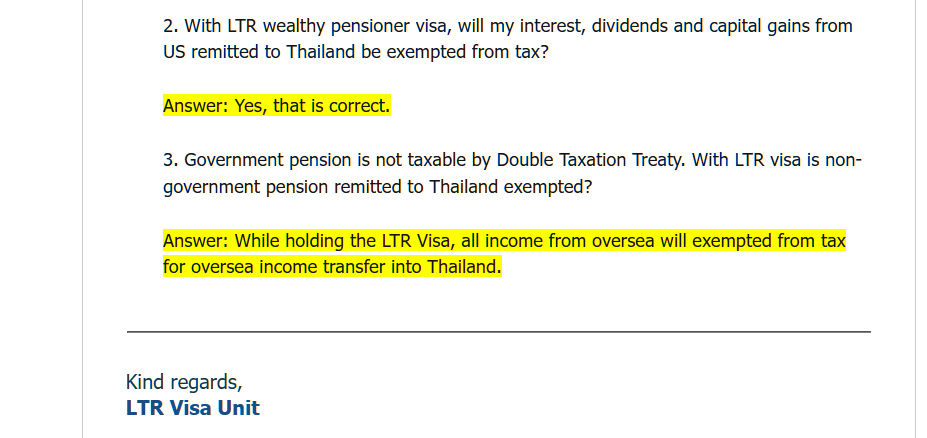

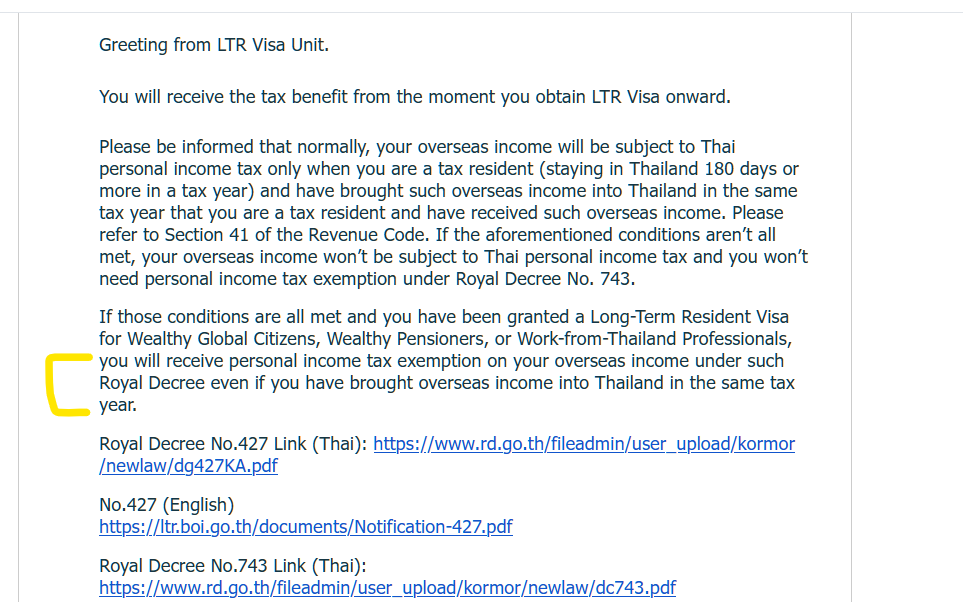

I live on investment returns which are not protected by US-Thai DTT, you can imagine my anxiety .Thanks to you I am one step closer to confirming what are exempted, though nothing is certain. Applying for LTR was easy since I have my documents online. I had submitted my application on Oct 11 but I did not sleep well with the fact that someone has my US tax returns and investment accounts information. Early next day I signed on and deleted the uploads. The status changed from pending to draft. Middle of this week after I had submitted redacted documents the status changed to government agency review in a few hours. The next day I got a request for proof of health insurance and the status had changed to document request. I am going to AXA insurance office on Monday and will get my LTR visa soon. Cheers!

-

On my last road trip I paid no corkage at Tawandeang Buriram. Blend 285 signature was only about 400B at 7-Eleven. Took the left over to Tawandeang Pisanuluk the next night paid 100B only.

-

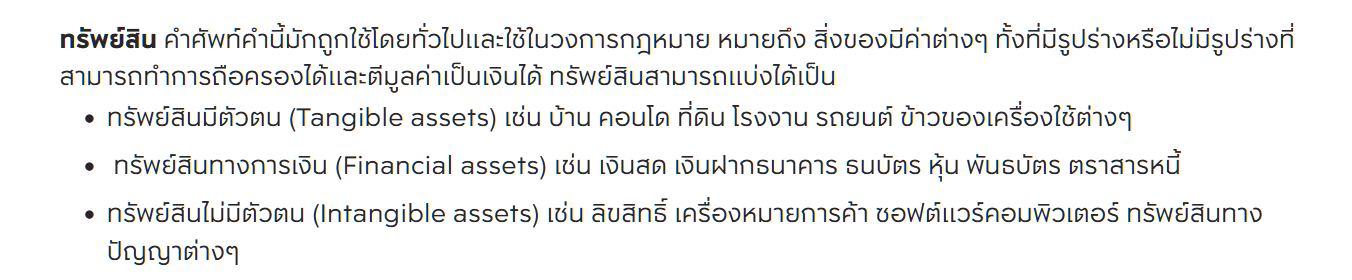

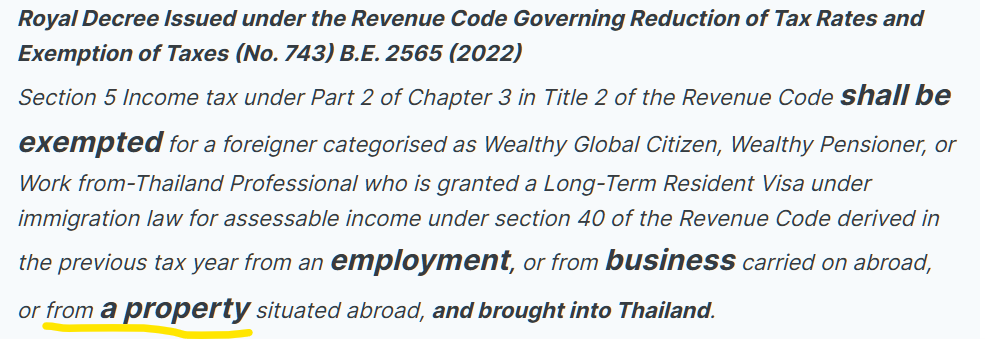

On the tax form in the section pertaining to rental income, ทรัพย์สิน has to mean real estate. I still believe on RD 743 it includes all investments. We'll see. It's strange that RD 743 Section 5 mentioned only 3 out of 4 types of LTR visa holders. https://www.apthai.com/th/blog/know-how/knowhow-what-is-asset

-

Misstating Condo Sale Price

Thailand J replied to Fortunateson's topic in Real Estate, Housing, House and Land Ownership

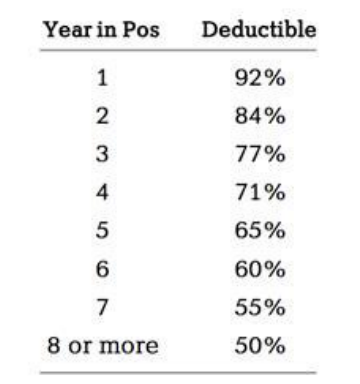

If you sell after one year of ownership, 92% of the sales price/land office value is tax free. After two years it's 84% and so on, as per table below. So dont worry if the seller lowers your cost basis on paper. -

Misstating Condo Sale Price

Thailand J replied to Fortunateson's topic in Real Estate, Housing, House and Land Ownership

the 35% reduction will lower your cost basis but in thailand the cost basis will not be used to calculate your capital gain tax when you sell in the future. In Thailand real estate capital gain tax is based on market value and years of possession, nothing to do with your cost basis. The land department will also accept market value instead of actual sales price. -

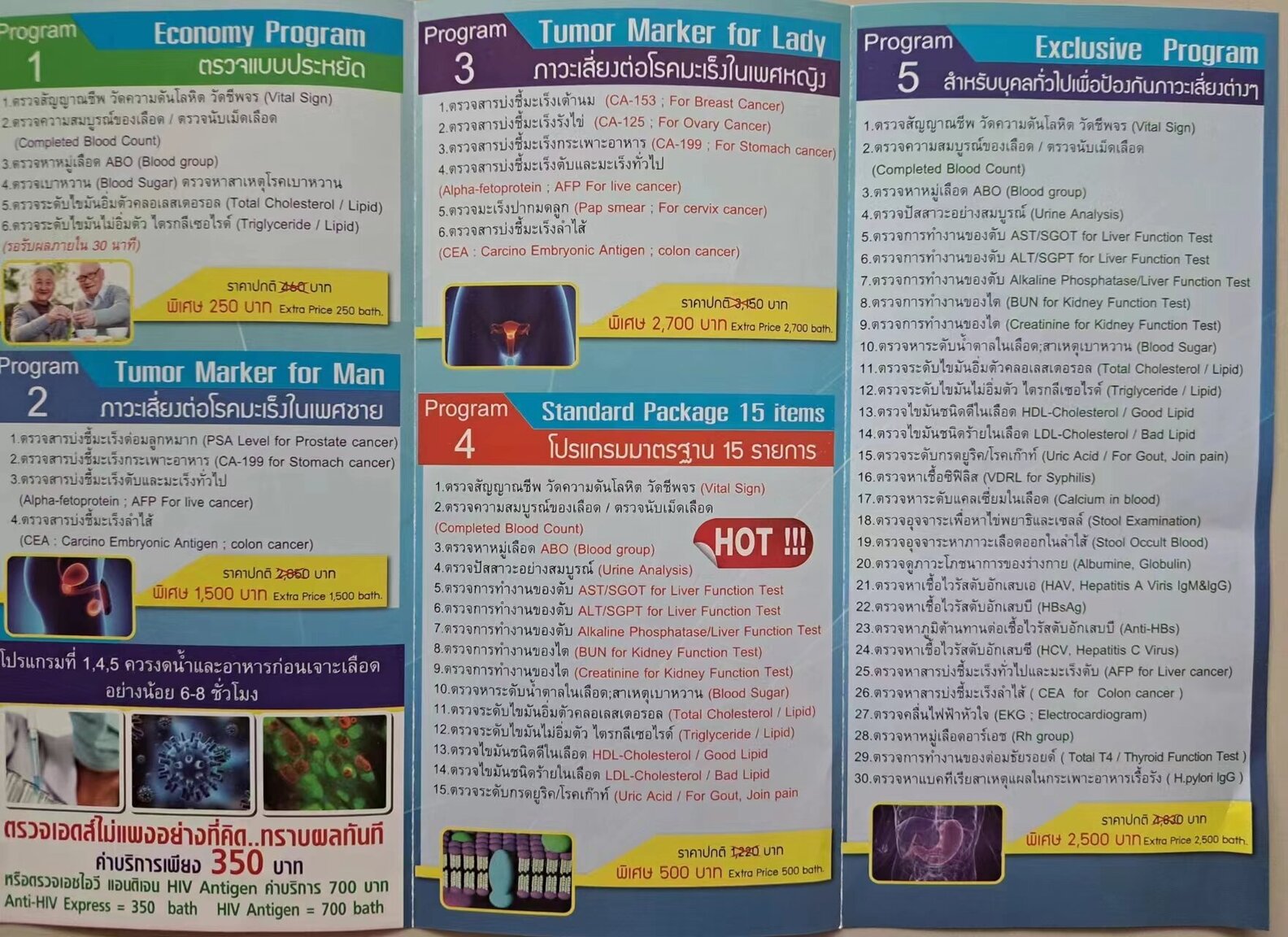

Lifecare : https://maps.app.goo.gl/19jDSrsxmwYJPrHbA General check up : Program 1 Economy, Program 4 Std and Program 5 Exclusive. This brochure may not be the latest:

-

I don't think they want to see proof of insurance yearly. The LTR is not 10 yr visa. They want you to pay for 10 years upfront but the stamp in your passport is only 5 years, after 5 years you may have to submit new documents to get another 5 years stamp, so you should keep the insurance policy effective. You can submit your application without an insurance policy,and buy the insurance once your application is approved. Submit this form instead of an insurance policy: https://ltr.boi.go.th/documents/Document-Request-Acknowledgement-Form-for-LTR-Application.pdf

-

What USA banks use IACH with Thailand?

Thailand J replied to jmd8800's topic in Jobs, Economy, Banking, Business, Investments

Scwab, IB and Fidelity brokerage accounts come with a US checking account , believe it or not. You can use the checking account ( ABA number and account number) to pay bills in US and to receive payments. -

What USA banks use IACH with Thailand?

Thailand J replied to jmd8800's topic in Jobs, Economy, Banking, Business, Investments

Instead of a bank account and IACH, consider brokerage account and wire transfer. Schwab, Interactive Brokers are user friendly, everything can be done online. Vanguard and Fidelity if you have the time to set up. -

In lieu of insurance you need to deposit $100,000 in a bank account. Thai bank or a foreign bank, but not deposit in a brokerage account which does not count. Insurance for LTR visa is availabke at AXA, The EasyCare Visa Health Plan where the premium depends on your age and the deductible, if you need an insurance policy just to please BOI. Invest your $100,000, and the return should be more then enough to pay for the the insurance. Example: with 300,000B deductible, yearly premium is only 5865B ( age 56-60) or 17350B (age 61-65). 4% return on $100000 is about 140,000B, 10% return is 350000B.

-

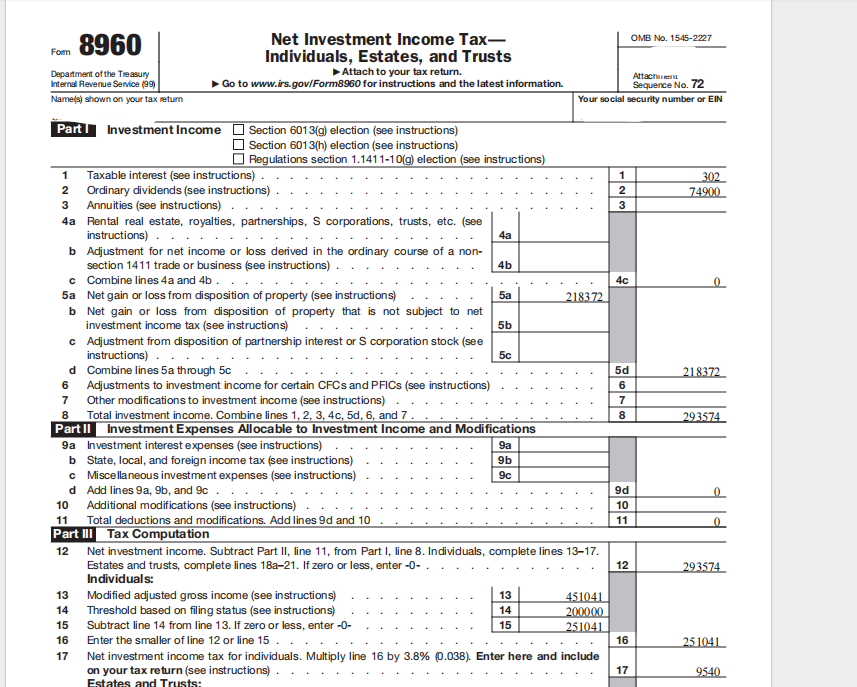

More tax on the rich. Net investment income tax of 3.8% on investments, including the sale of stocks and bonds for those who earn more than $200,000. IRS Form 8960. example:

-

-

the picture shows a wifi dongle, looks similar to but not a wifi modem which has a slot for sim card.

-

Rangzima Ceramic. https://maps.app.goo.gl/C5bPA3Z31PmWi8c6

-

Available on Lazada/Shopee Laos Bolaven Plateau and Chiang Mai HillKoff are excellent.