Thailand J

Advanced Member-

Posts

1,562 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

US taxes IRA distribution if you are a US citizen. If there is another state that is able to and actually does impose tax on the the same distribution then there will be an arrangement such as tax credit. so far it has not happen with US -Thai tax where US IRA is taxed in Thai. I am not sure why you try so hard. Open your eyes, non of us here who stay in Thailand ever paid Thai tax on our IRA distributions.

-

The first stop was right after the turn into Suk. The second stop was at the pedestrian bridge near south Pattaya Tai. https://maps.app.goo.gl/3RpNj231dqAt7Dxc6 https://maps.app.goo.gl/tXRdah9bLP6d7ZKr6

-

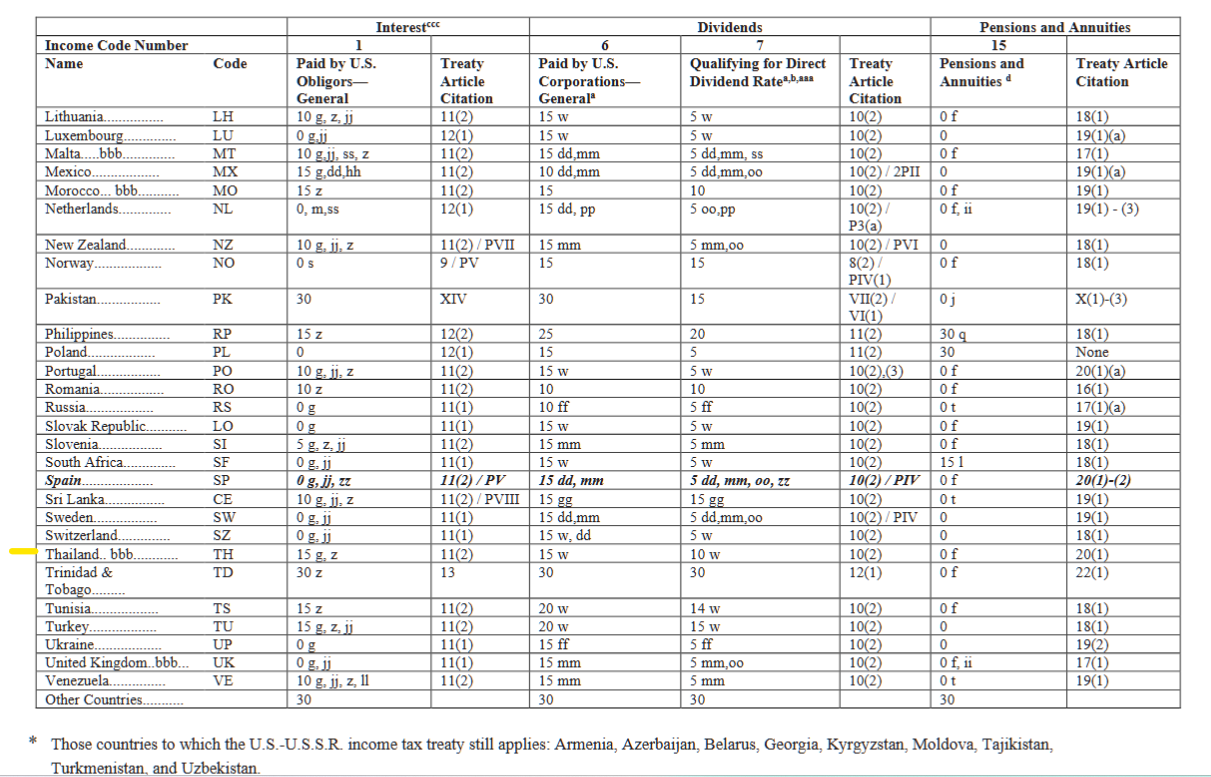

every tax treaty is different. Different income different rates etc. You can't replace a country name and make an arguement. as of today thai tax law tax no IRA benefits remitted the year after. and with 162/2566 it's a complete different game. Does Swits has the exact same DTA with US as Thai? Does Swiss has the same tax rules regarding foreign incomes as Thai?

-

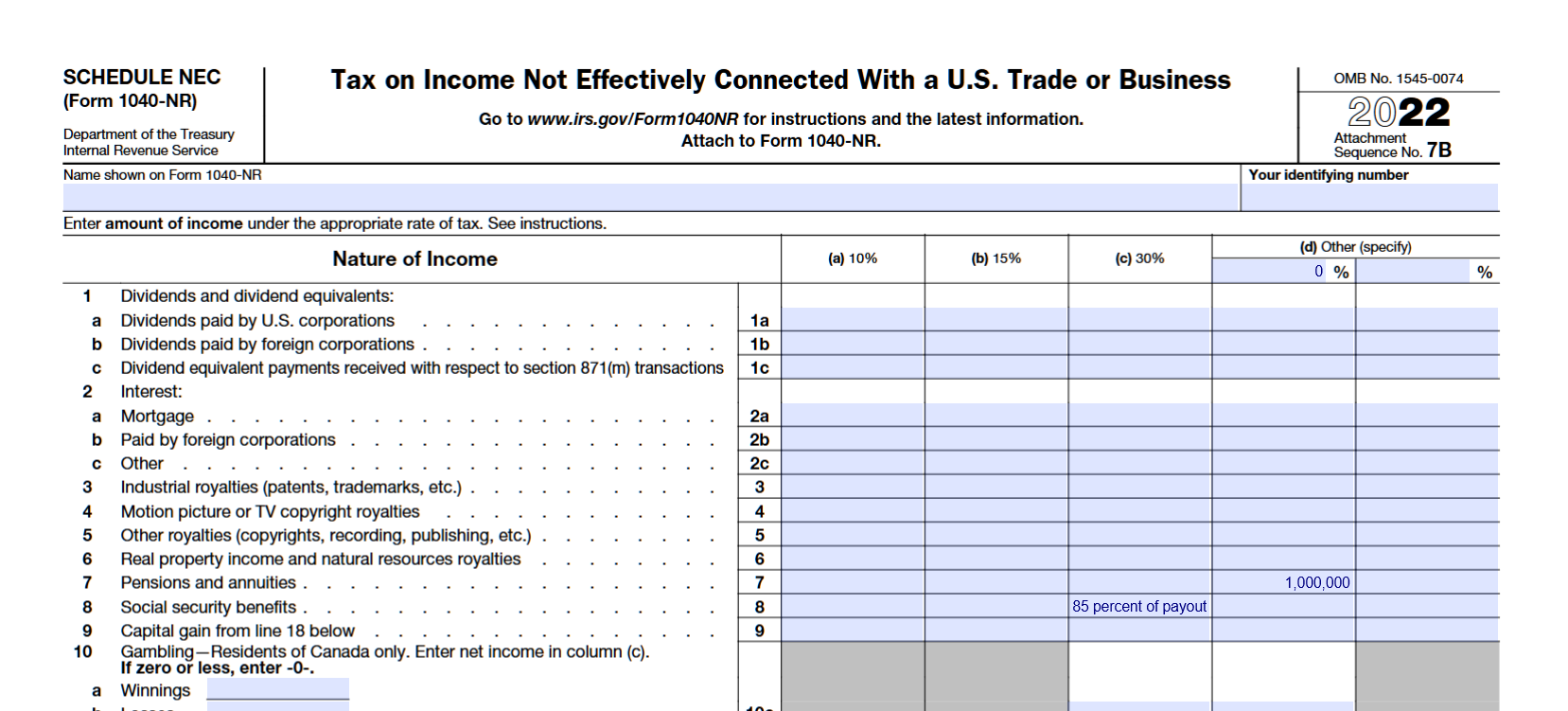

The above form should stop the IRA custodian from withholding any distributions, but in case there is any withholding, ypur spouse can file form 1040NR to claim it. Pension goes to line 7 on Schedule NEC, 0% tax, example below.

-

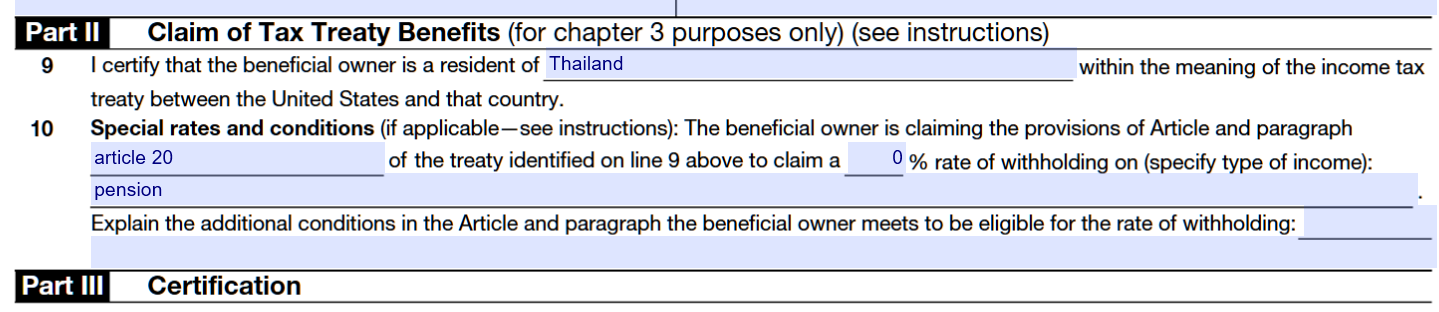

There are 3 parts on the form, part I is personal data ,part III certification signature. For IRA's, part II should look like the picture below. If your spouse is non US citizen and non US resident she can claim double tax treaty article 20 which prevents US from taxing the IRA benefits. On Thai side she may have to pay tax on the oversea remittance pending Thai revenue department new rules.

-

From my experience, yes two sets of documents were required, meaning two sets of passport copies. Medical cert can't be copied, both had to be original . Residency cert can be a copy for the second set. There are shops across the street if you needed to copy documents.

-

Paragragh 1 emcompass private retirement plans. Self administered IRA accounts are not part of any private retirement plan, it's just an account defined as savings account by the IRS.Per RD DI 162/2566 the remittance of the withdrawals into Thailand should be tax exempted. This has nothing to do with double tax treaty.

-

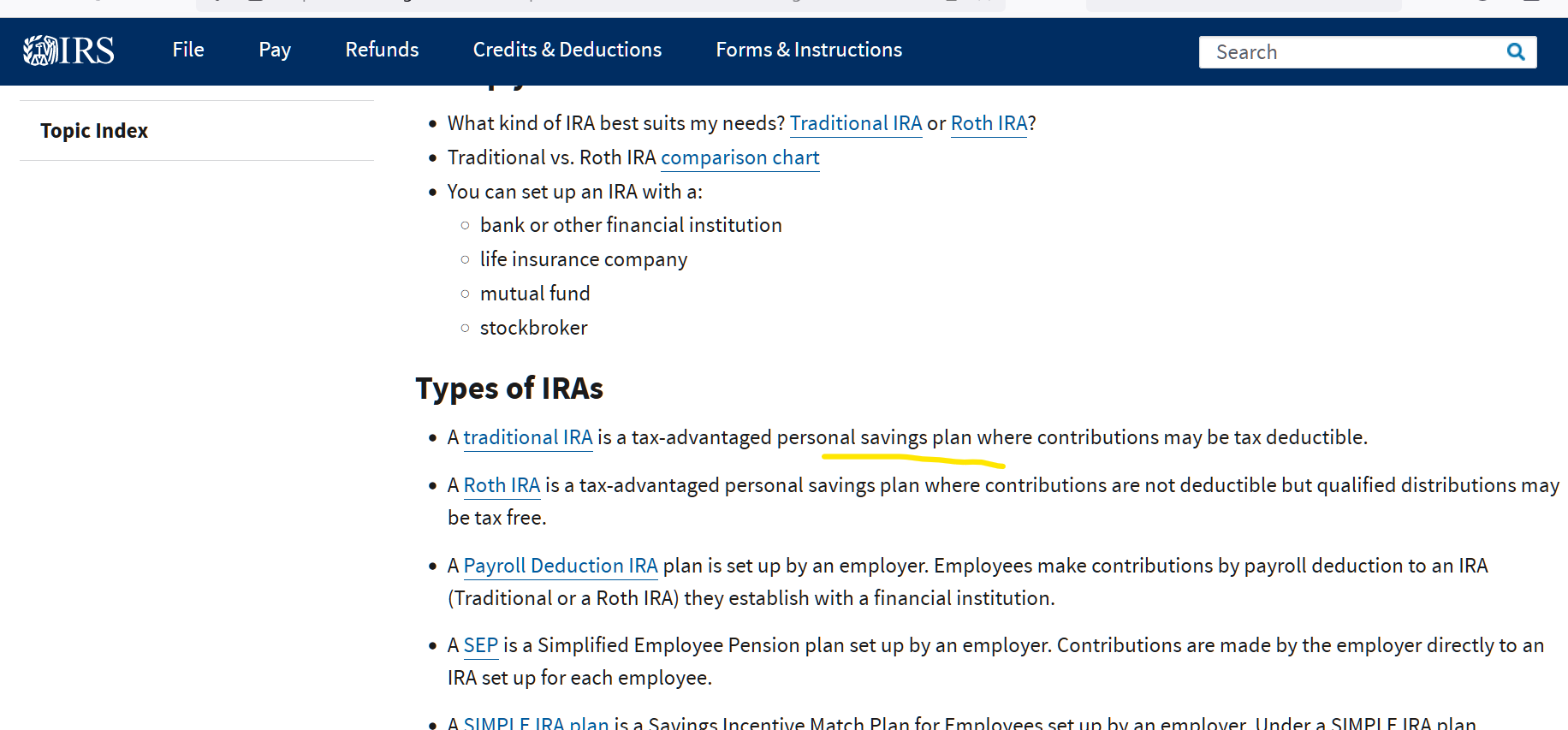

U S government pension and SS are exempted by DTA , that's clear. IRA's are not necessarily private pension plans. Both traditional and Roth IRA's are saving plans. Per RD DI 162/2566, the balance in any IRA prior to Jan 1 2024 is tax exempted if you tranfer into Thiland in the future years. This is my understanding. https://kpmg.com/th/en/home/insights/2023/11/th-tax-news-flash-issue-146.html

-

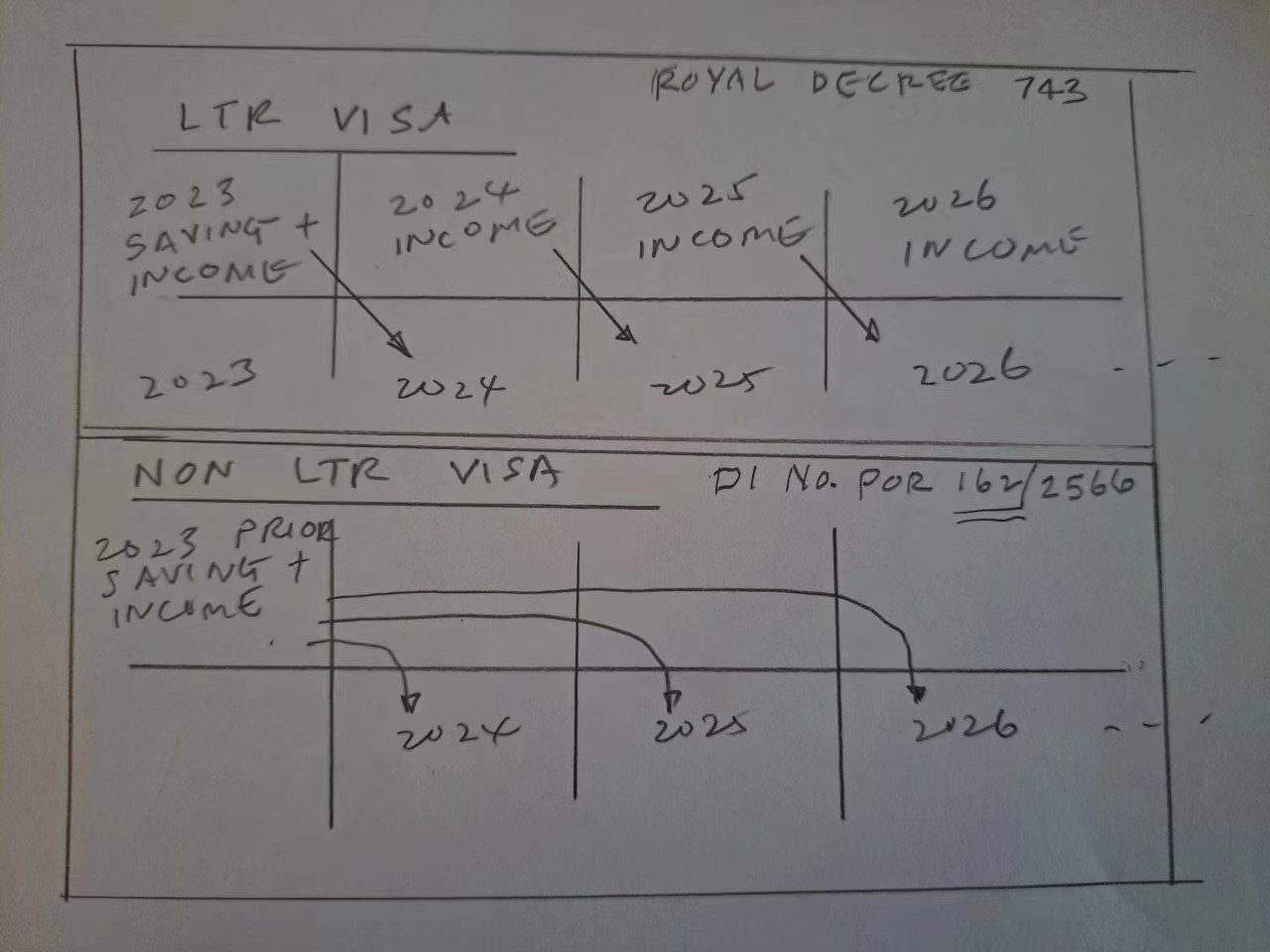

Looks like everyone has a way out. For most LTR visa holders, income from previous year is tax exempted by RD 473. For non LTR visa holders, income and prior savings from 2023 are tax exempted per Thai RD Departmental Instruction No. Por 162/2566. https://kpmg.com/th/en/home/insights/2023/11/th-tax-news-flash-issue-146.html

-

"Investors Corner", perhaps?

Thailand J replied to swissie's topic in Jobs, Economy, Banking, Business, Investments

small cap will go up 50% in 2024 according to Fundstrat's Tom Lee. https://www.cnbc.com/video/2023/12/14/small-caps-could-climb-50-percent-in-the-next-12-months-says-fundstrats-tom-lee.html -

Large private hospital in Pattanakarn Soi 50 area, Bangkok

Thailand J replied to Puccini's topic in Health and Medicine

I know what you are doing. Don't get yourself in trouble. -

SET50 vs Thai economy

Thailand J replied to RotBenz8888's topic in Jobs, Economy, Banking, Business, Investments

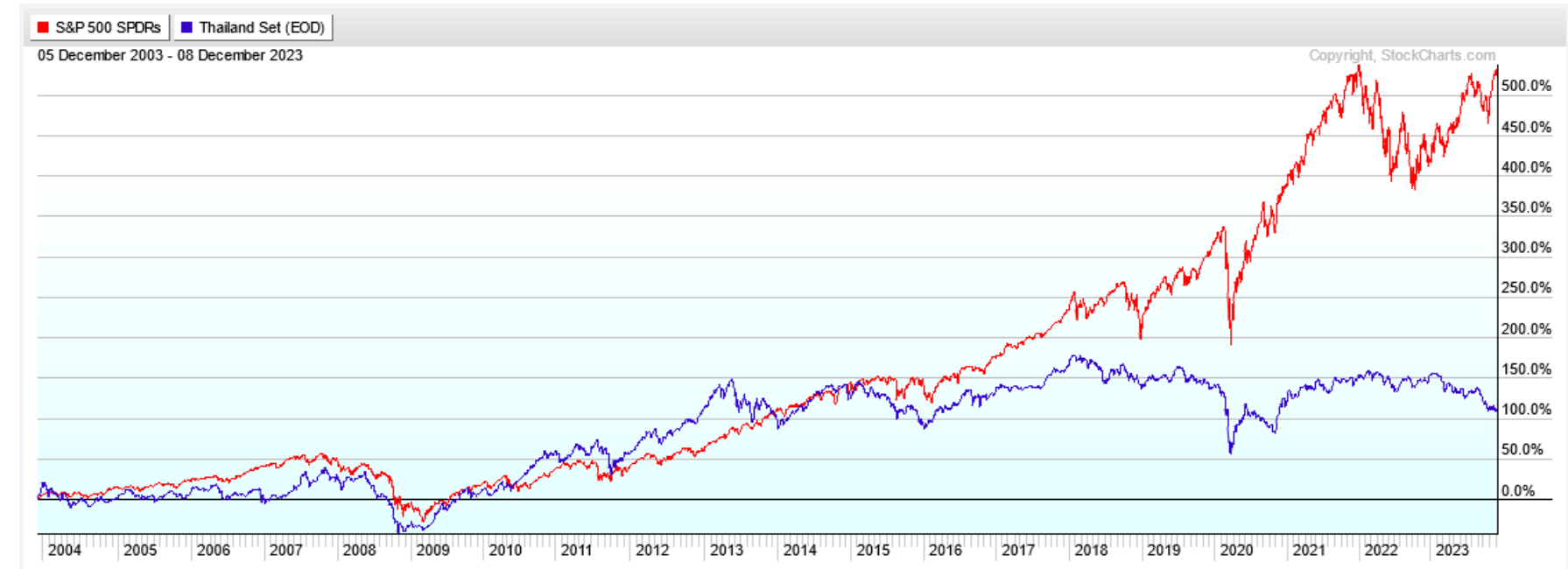

SET end of day value not including dividends compared to S&P 500 assume dividends reinvested, 5 yrs, 10 yrs and 20 yrs. -

Renewed my 5 year license last week. Had to goto DLT to make an appointment in person first. Documents needed on appointment day: 1. Passport, original and copies of photo and visa pages. 2. Driver license, original and copy of front and back. 3. Residency cert from Jomtein , original and copy if you also renew motorbike license. 4. medical cert. 5. Print out of the proof of the online class completion. Took 40 minutes to get the new license. I went there the day after my birthday, my new license expires on my birthday in 2029.

-

Charlie Munger dead at 99.

Thailand J replied to Thailand J's topic in Jobs, Economy, Banking, Business, Investments

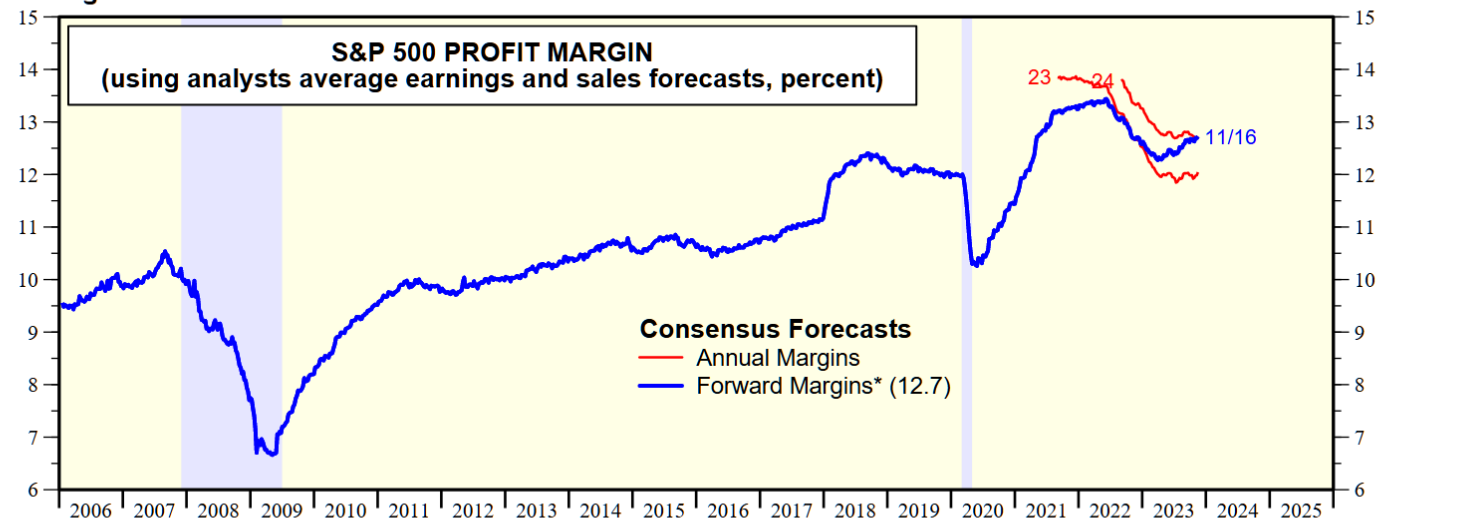

S&P 500 companies profit margin is 12.7%. I have never looked at my long term index investment as gambling. If you don't invest in stocks, find something you feel comfortable to invest. Don't just hold cash. I am much younger then 74, I am more concerned with what stocks to sell rather than which investment to get into.