Thailand J

Advanced Member-

Posts

1,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

My Pattaya next door neighbor parked his car at the border when he went to Siem Reap. You should be able to do the same. May be search " parking" on google map near the border and start from there. I have never heard of any problems with immigration if you have non-o and re entry.

-

220 volt NON USB speakers for desktop pc/laptop - help anyone?

Thailand J replied to cliveshep's topic in Audio Visual AV

For movies on big screen TV I have an Onkyo amp and Polk tower speakers, which I am about to upgrade to the Reserve series soon. For PC use I have very old Creative T20 which I believe is not on the market. Edifier has taken over Creative market share on PC speakers. This one looks interesting: Edefier MR4, about 3200B on Shopee. -

Have you look into Interactive Brokers and Charles Schwab International account? Interactive Brokers account has no minimum to open and no monthly fee. First withdrawal of the month is free and it can be wire transfer or ACH, after the first it's $1 per ACH and $10 per wire. Thai address is acceptable and you can receive OTP on a Thai phone number. You can transfer from Wise to IB if this youtube video content is true:

-

If you are talking about TCL I cannot accept the quality. I went to Thai wasadu and Homepro to look at TCL units on display but decided on Haier. Installed 4 at my new house so far so good.

-

Pay a visit to this shop which has the lowest prices on A/C units I can find, not include installation of about 1500B. It's the yellow 3 bays shop. https://maps.app.goo.gl/PicPqu5aVLnc3LBLA

-

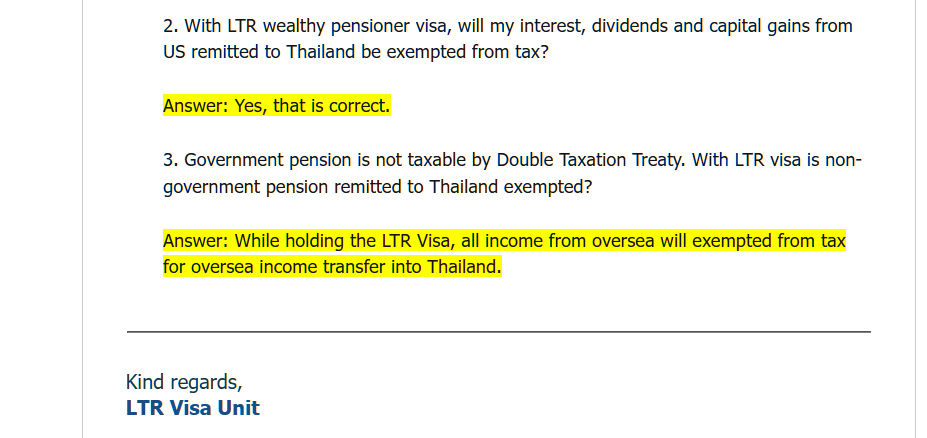

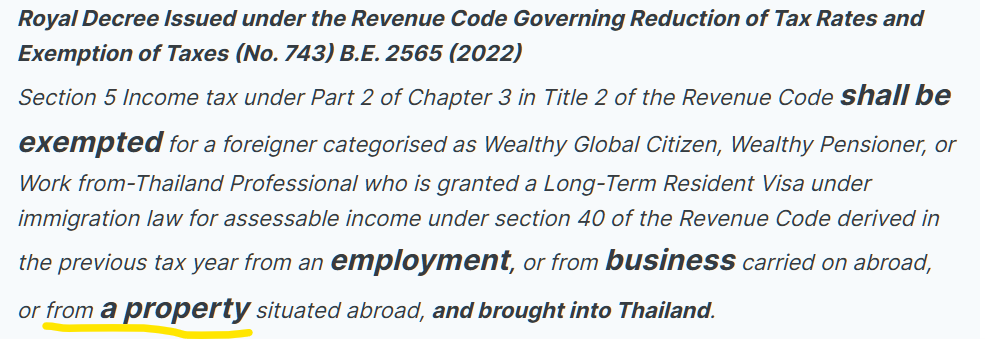

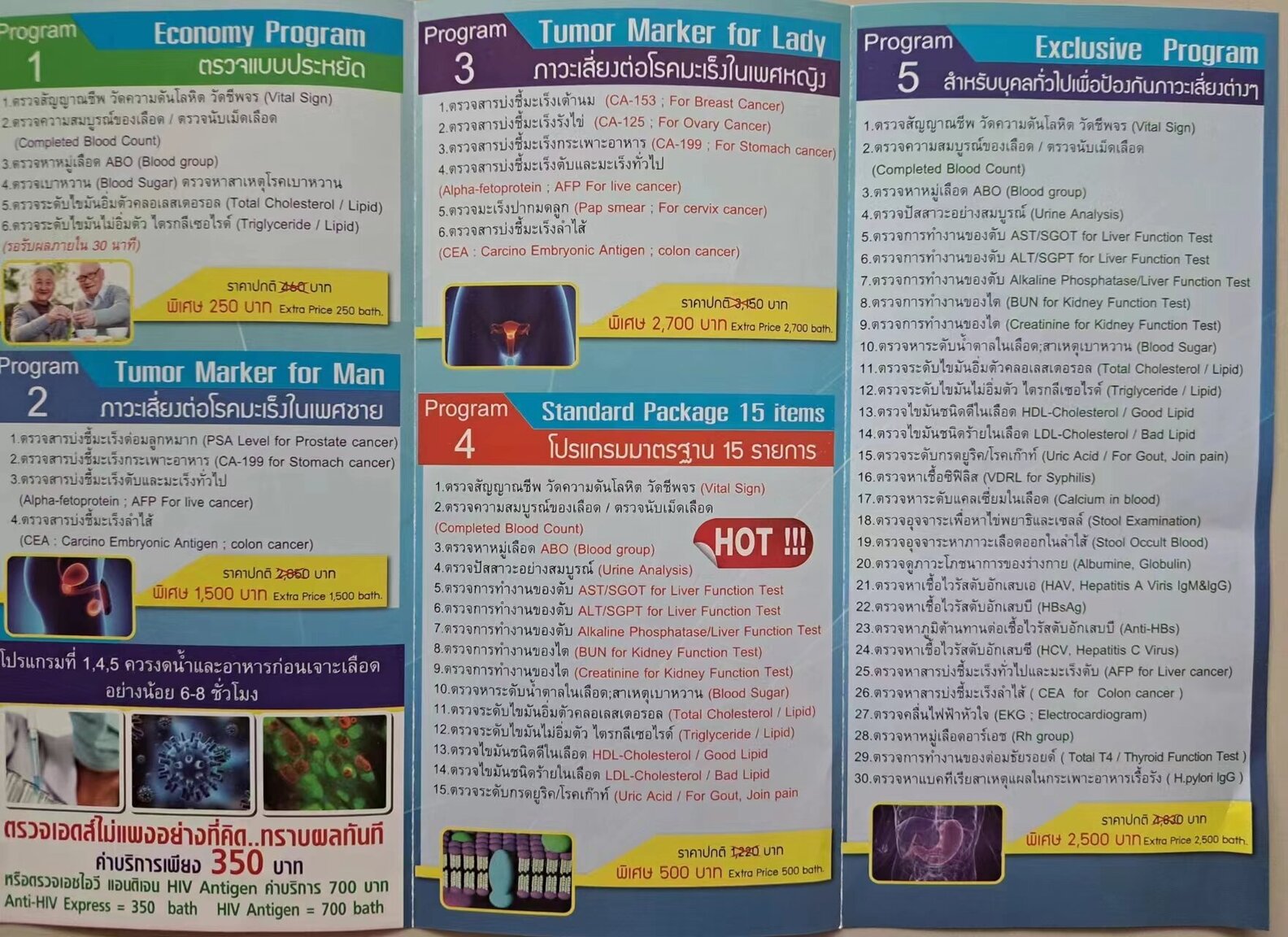

I live on investment returns which are not protected by US-Thai DTT, you can imagine my anxiety .Thanks to you I am one step closer to confirming what are exempted, though nothing is certain. Applying for LTR was easy since I have my documents online. I had submitted my application on Oct 11 but I did not sleep well with the fact that someone has my US tax returns and investment accounts information. Early next day I signed on and deleted the uploads. The status changed from pending to draft. Middle of this week after I had submitted redacted documents the status changed to government agency review in a few hours. The next day I got a request for proof of health insurance and the status had changed to document request. I am going to AXA insurance office on Monday and will get my LTR visa soon. Cheers!

-

On my last road trip I paid no corkage at Tawandeang Buriram. Blend 285 signature was only about 400B at 7-Eleven. Took the left over to Tawandeang Pisanuluk the next night paid 100B only.

-

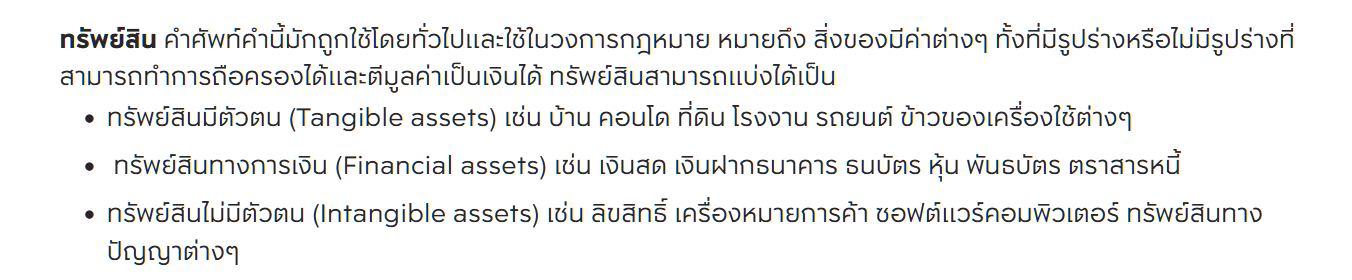

On the tax form in the section pertaining to rental income, ทรัพย์สิน has to mean real estate. I still believe on RD 743 it includes all investments. We'll see. It's strange that RD 743 Section 5 mentioned only 3 out of 4 types of LTR visa holders. https://www.apthai.com/th/blog/know-how/knowhow-what-is-asset

-

Misstating Condo Sale Price

Thailand J replied to Fortunateson's topic in Real Estate, Housing, House and Land Ownership

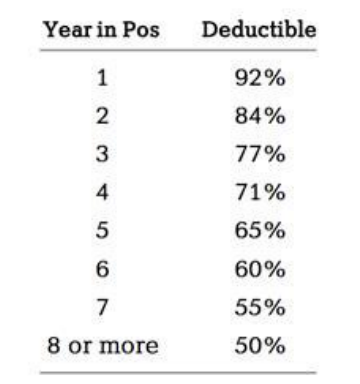

If you sell after one year of ownership, 92% of the sales price/land office value is tax free. After two years it's 84% and so on, as per table below. So dont worry if the seller lowers your cost basis on paper. -

Misstating Condo Sale Price

Thailand J replied to Fortunateson's topic in Real Estate, Housing, House and Land Ownership

the 35% reduction will lower your cost basis but in thailand the cost basis will not be used to calculate your capital gain tax when you sell in the future. In Thailand real estate capital gain tax is based on market value and years of possession, nothing to do with your cost basis. The land department will also accept market value instead of actual sales price. -

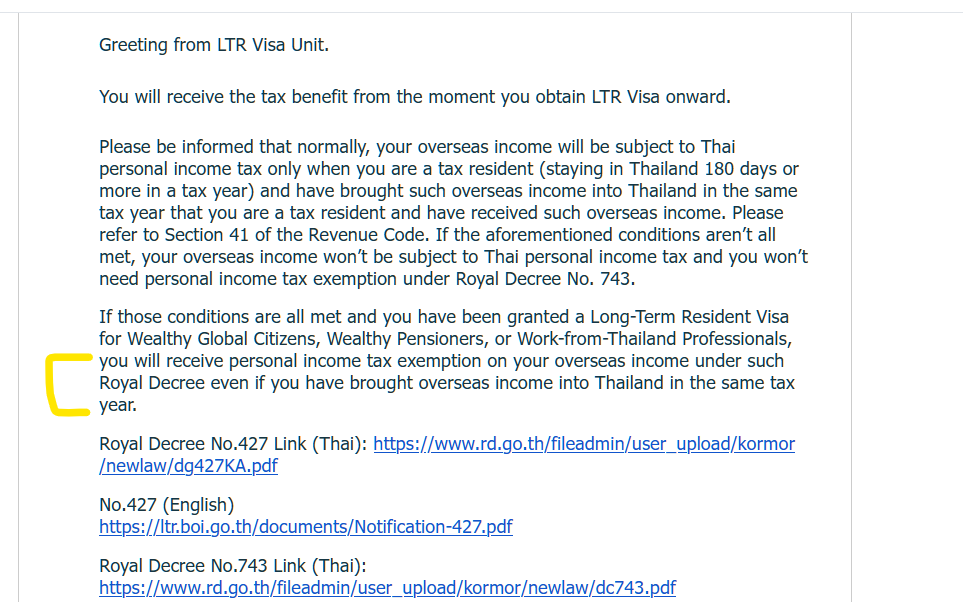

Lifecare : https://maps.app.goo.gl/19jDSrsxmwYJPrHbA General check up : Program 1 Economy, Program 4 Std and Program 5 Exclusive. This brochure may not be the latest:

-

I don't think they want to see proof of insurance yearly. The LTR is not 10 yr visa. They want you to pay for 10 years upfront but the stamp in your passport is only 5 years, after 5 years you may have to submit new documents to get another 5 years stamp, so you should keep the insurance policy effective. You can submit your application without an insurance policy,and buy the insurance once your application is approved. Submit this form instead of an insurance policy: https://ltr.boi.go.th/documents/Document-Request-Acknowledgement-Form-for-LTR-Application.pdf