sandyf

Advanced Member-

Posts

15,896 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sandyf

-

But a lot to do with the damaged inflicted.

-

It would appear to have been a plot that was to be used in conjunction with other moves. Apparently someone discovered a device that wasn't "normal", so the perpetrators had to use it or loose it. As you say the outcome would have been a lot more significant.

-

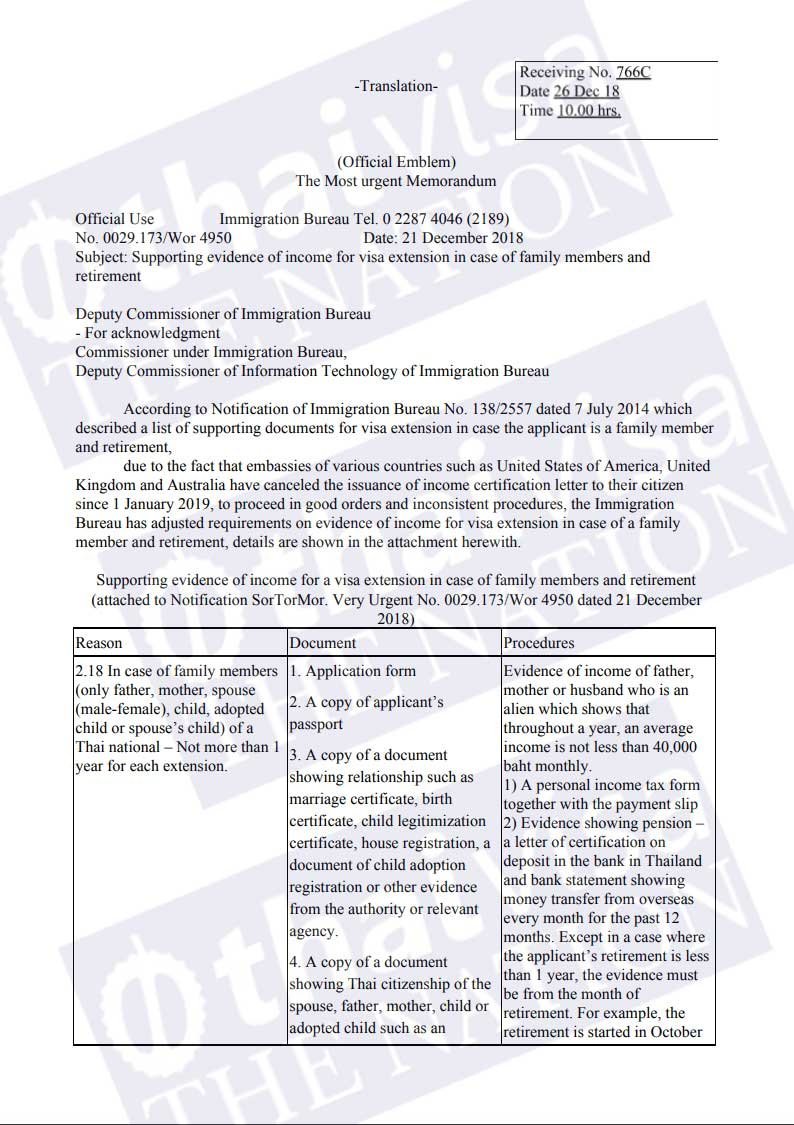

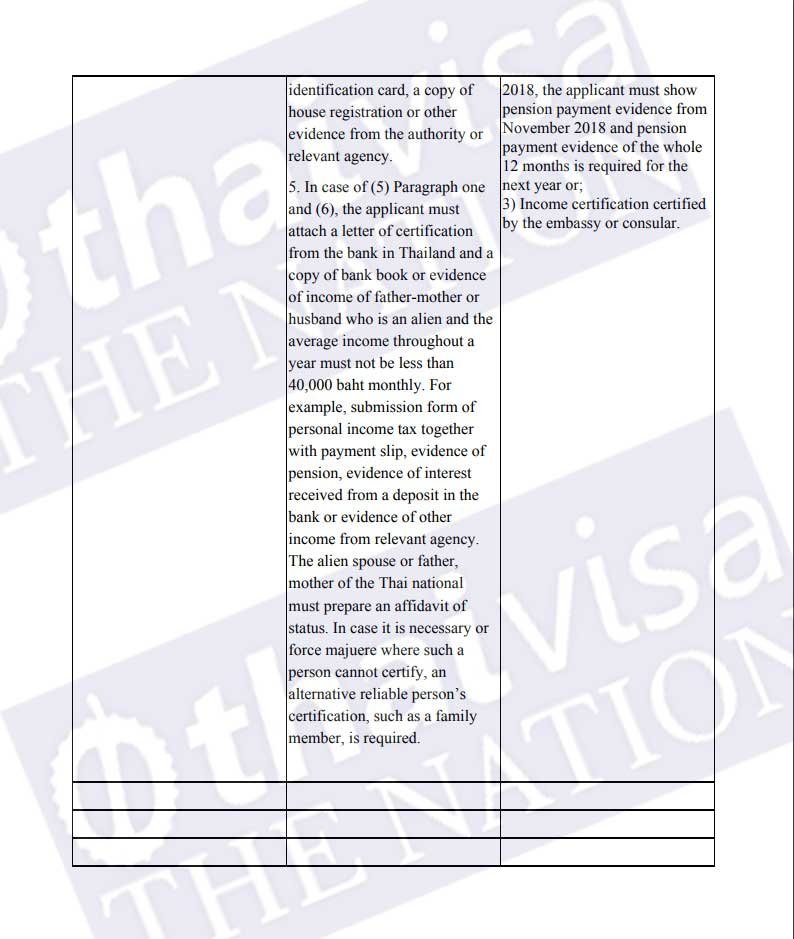

When people have dug themselves into a hole they start making things up based on their interpretation of the translation wording, for example using the literal because it suits. Differnent scenario when it doesn't suit. The order amending requirements for income based extensions is quite clear. If you arrive in October the first transaction would need to be in November, you get a month to open a bank account. Why would the OP be unable to open a bank account within a month? In the interest of simplicity, Immigration has a tendency when referring to "income" to use the word pension, you are however perfectly free to believe that only those with a "pension" can use the income method. You disputed my posts because you thought you knew better, referring to "leniency" when in fact there was an official order in effect. I said in the beginning that I tried this option and had a protracted conversation with the senior IO on the issue. Entirely up to you what you want to believe but you cannot try and make it fact. If the "exception" has not been rescinded then it is a perfectly valid option for the OP and up to him if he wants to look into it.

-

The post you replied to was referring to the "exception" granted under the Dec 2018 notice. The lack of reference to what I posted highlights the fact the post wasn't read and assumptions made. From the last sentence you appear to be denying the "exception" exists, obviously you would have evidence it has been rescinded.

-

That doesn't change the rules. When I was challenged I very politely referred to the notice issued. There followed a quite prolonged and civilised conversation on the issue during which she quite poliely pointed out the difference between a first extension and the first extension on a different visa.

-

Yes it is fairly easy to change from one method to the other. As I mentioned earler you don't need 12 months on a very first application. There is an execption in place for people just arriving in Thailand and I am quite sure you could claim that to be the case. In the attached document you can see down in the bottom left hand corner of the first page how it is applied.

-

What's doubtful? In Aug 2020 I was half way through an ME visa and had been getting auto extensions. They were due to come to an end so I went along to immigration and tried to get a 12 month extension based on 2 months of transactions. The IO initially nodded but looking through my passport suddenly shook her head and pointed to an extension a few years previous and said it would need to be 12 transactions. Not a big problem the auto extension went on another month which gave me the 12th transaction I needed. I think the OP would be fairly safe having been out of the country for 10 years.

-

I got married in 2008 and since then been in and out of the various visa scenarios. No big deal whichever way you decide to jump, really a question of what best suits your circumstances. Last Oct i came back on a new visa and new passport so when i went for the marriage extension in the Dec did expect some questions, not so, probably the smoothest one ever, only at the desk about 20 minutes.

-

I have had 5 home visits and no 2 have been the same, witnesses only required once. Last time only one guy came with a tripod, just took a couple of photos with him included. Must have been here all of 10 minutes. Your imagination has nothing to do with it, people are free to make whatever decision suits them best.

-

New OA Visa Financial Requirements?

sandyf replied to sqwakvfr's topic in Thai Visas, Residency, and Work Permits

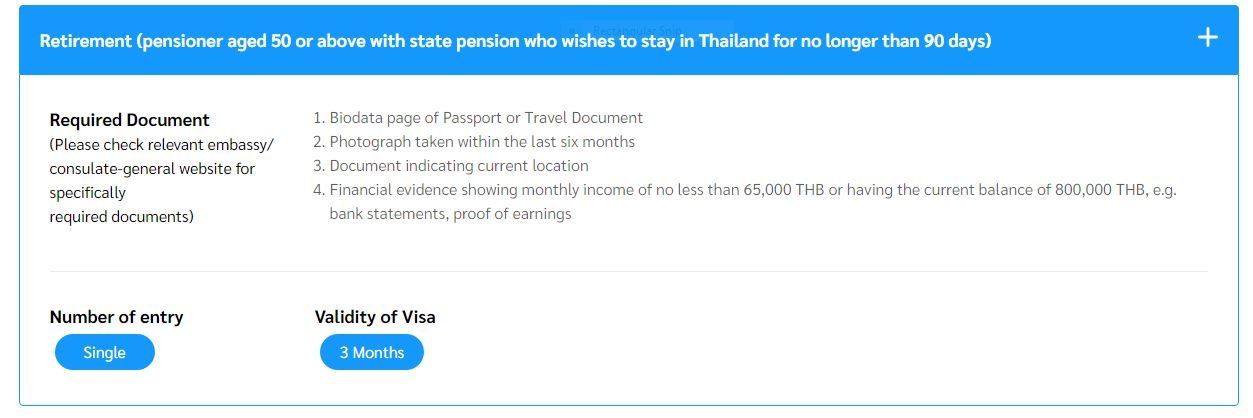

Quite. From the London site. Financial evidence showing monthly income of no less than 65,000 THB (£1,500) or having the current balance of 800,000 THB (£18,000), e.g. bank statements, proof of earnings - Applicant’s recent official UK/Ireland bank statement shows your name, address (Screenshots are not accepted). For monthly income of last 3 months no less than £1,500/month. https://london.thaiembassy.org/en/page/retirement-visa -

Indeed. Not going to rush into it again, may well try and get a lot more airports fitted out before flicking the switch.

-

I think you will find that the equipment was found to be unreliable and the 100ml limit has been re-introduced. The EU Commission made the decision to re-impose the longstanding rule at the end of July, but it takes effect today. It means the limit of 100ml for every individual container will be reintroduced in airports which had been using new technology to allow passengers to bring higher volumes of liquid. https://news.sky.com/story/eu-airports-see-100ml-liquid-rule-for-carry-on-baggage-reintroduced-13207614#:~:text=The EU Commission made the,bring higher volumes of liquid.

-

Don’t kill the golden goose! Tax reforms may drive away expats

sandyf replied to webfact's topic in Thailand News

The whole rhetoric of everyone seeing everyones business is getting out of hand. It is not a question of them(TRD) being able to identify your accounts somewhere else. The banks in other countries have a legal obligation to report accounts to another tax jurisdiction if it appears an account they hold belongs to someone who is a tax resident in that jurisdiction. If they decide to report an account, the information they provide is quite limited, mainly account value and any income credited. What is a bit vague is "how", as you suggest, they will identify the accounts. In the UK I think the NI number could be seen as a TIN, but I can't see how anyone in Thailand would know that. Each participating country will annually automatically exchange with the other country the below information in the case of Jurisdiction A with respect to each Jurisdiction B reportable account, and in the case of Jurisdiction B with respect to each Jurisdiction A reportable account:[16] Name, address, Taxpayer Identification Number (TIN) and date and place of birth of each Reportable Person. Account number Name and identifying number of the reporting financial institution; Account balance or value as of the end of the relevant calendar year (or other appropriate reporting period) or at its closure, if the account was closed. Distributions made to the account (dividends, interest, gross proceeds/redemptions, other) https://en.wikipedia.org/wiki/Common_Reporting_Standard#:~:text=The Common Reporting Standard (CRS,is to combat tax evasion. -

Don’t kill the golden goose! Tax reforms may drive away expats

sandyf replied to webfact's topic in Thailand News

The new regulations have started but nothing can be done until after the tax year ends in Dec, and it will be some time after that before any fallout will be seen, although some may go looking for it early Jan. -

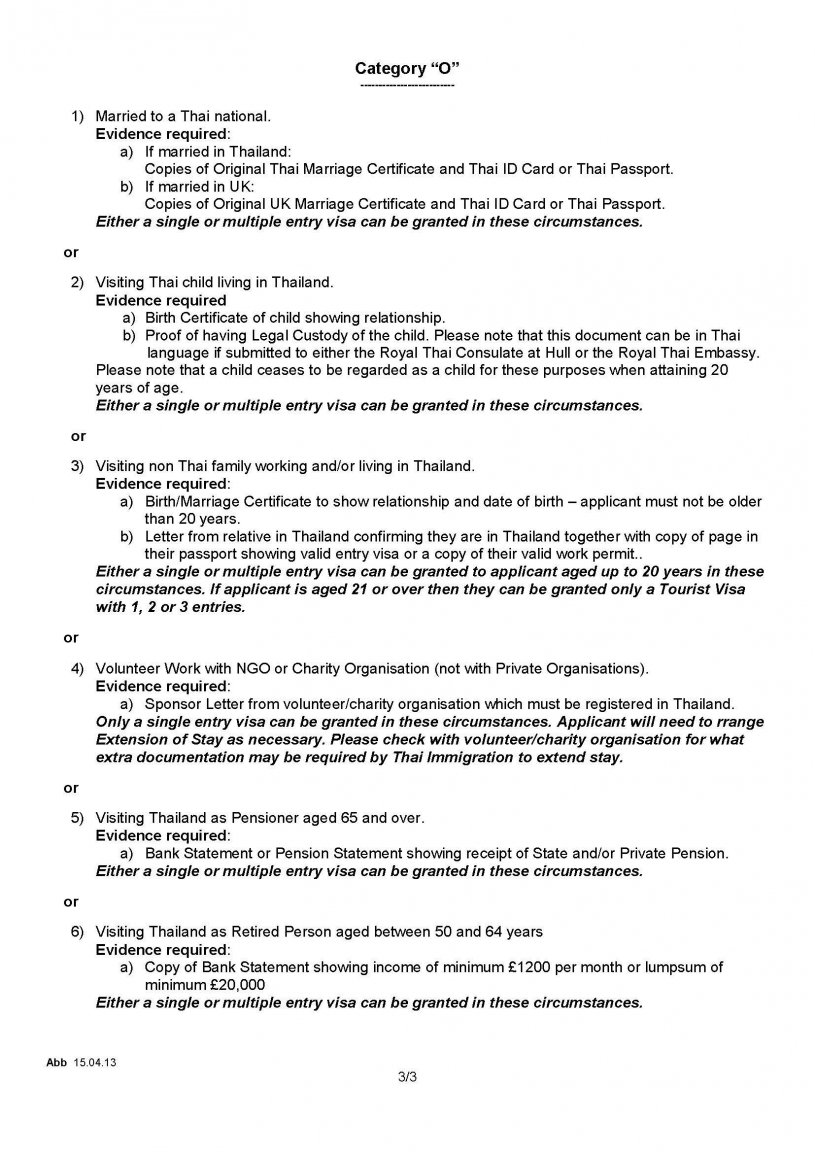

A recent thread was sidetracked over misinformation being posted in respect of visa Category "O". In response to one post I posted a link to the visa in question from the London E-visa site. In the desperation to ridicule both myself and the Thais this comment appeared. "Thanks for the incorrect info, as you should be aware, there is no requirement to be in receipt of a state pension to apply for a Non-O based on being over 50. (think of the UK, according to that info, you would not be able to apply until you were 67 years old!)" The assertion highlights the ignorance surrounding how the "retirement" options were managed in the UK. In the days of paper applications the guidance was more explicit and below is a copy in respect of Category "O" from 2013. The last 2 options should be noted, the policy being that the visa would be granted on the basis of a UK state pension irrespective of the financial requirements that would apply to those over 50. A few years later along came e-visas and automatic translation, people had to try and start reading between the lines rather than taking things literally. The text annotated to the visa option(Retirement) is not a singular requirement but rather an indication of options. This post is merely for clarification and as such no debate is necessary and should be closed to replies.

-

You have the wrong end of the stick entirely, the new State Pension is single tier arrangement so there cannot be a higher tier. As I said, between 1978 and 2016 the state pension was a 2 tier arrangement, the state pension came in 2 parts, the basic pension and the additional earnings related pension. Many pensioners are receiving their additional state pension as part of a workplace/private pension. There are however many that never contracted out that are receiving a state pension that consists of the basic pension plus earnings related components, I have 4 such components in my state pension.. I worked with people on shift that were earning twice as much as me as a manager, their state pension could be well over £400/week. As I also said everyone only ever refer to the old basic state pension and the new state pension, both in the singular, the additional state pension has been removed from the rhetoric.

-

Don’t kill the golden goose! Tax reforms may drive away expats

sandyf replied to webfact's topic in Thailand News

You are wrong, it is the banks that provide the information under the CRS agreements. The information however is limited to account value and and any income attributed to that account such as interest or dividends. Not everything or everyone is reportable. The account is only reportable if it appears to belong to someone in a different tax residency to where the account is held.