Etaoin Shrdlu

Advanced Member-

Posts

2,434 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Etaoin Shrdlu

-

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

No, I'm not blaming Trump for everything. Only those things for which he is responsible. -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

That's what everyone thought. Don't take Trump literally. Then the leopards ate their faces. -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

When he said that kids would have to settle for two dolls or five pencils for Christmas. Perhaps Fox News didn't report on that. -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

The fraud is in the Oval Office. -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

Trump is openly saying that he's going to make people poor. Two dolls and five pencils are enough! -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

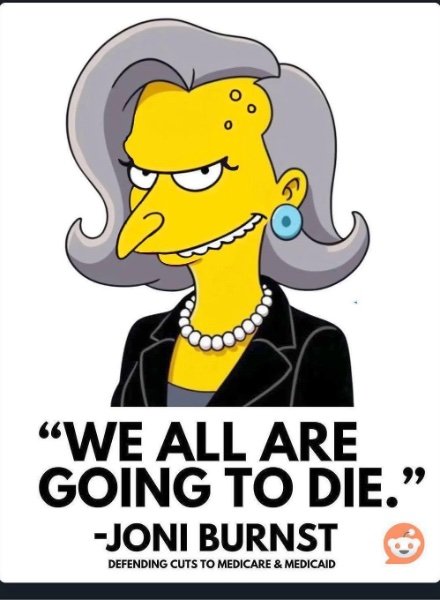

You don't care that poor people have to pay higher prices due to the tariffs? Tariffs are a very regressive tax and that's why the wealthy like them. Yeah, take Medicaid away from the poor and kick them to the curb where they belong, huh? -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

Somewhere around forty percent of households don't make enough money to pay Federal income taxes. They won't get any benefit from tax cuts but will pay higher prices for goods due to the Trump tariffs. Many will also face cuts to their Medicaid. Whether anyone will receive a big enough tax cut to outweigh the extra cost imposed by the tariffs is another question, but if there are such taxpayers, they won't be from the lower and middle classes. -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

Yes, one of the purposes of the Trump tariffs is to generate revenue that is lost by tax cuts that will accrue primarily to the wealthy. Whether it will actually accomplish that is another matter. This is part of Project 2025. https://thehill.com/business/5238587-why-trumps-tariffs-may-do-little-to-pay-for-tax-cuts/ -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

Tump's tariffs are very regressive taxes that will impact the lower and middle classes disproportionately in order to give large tax cuts to to the wealthy, plus he's giving money to Big Ag to counteract the effects of his tariffs. When MAGAs rail against things like Medicare for all they cry "Socialism", even though it does not involve the state owning the means of production. This is Trump Socialism. Take money from the poor and give it to the wealthy. -

More Trump Socialism

Etaoin Shrdlu replied to Etaoin Shrdlu's topic in US & Canada Topics and Events

It isn't classical socialism. It's Trump socialism. You know, rob the poor to give to the rich. -

After the Vietnam War, the Communists did indeed run the country. There were re-education camps and many military and civilian government workers were interned, some for quite long periods. Private companies and banks were nationalized with no compensation given to the owners. The economy was in shambles for a long time and to this day dissent or freedom of speech or assembly is not tolerated. Sure, they'll take your money, but won't allow their own people the right to peaceful political speech. Laos and Cambodia also fell to communist regimes, so there was a hint of truth to the domino theory. It just didn't go as far as some claimed it would. https://www.thevietnamese.org/2024/05/post-1975-tragedy-the-grim-reality-of-life-in-vietnams-re-education-camps/

-

April vs Axa krungthai vs Axa vs allianaz

Etaoin Shrdlu replied to chawarmas's topic in Insurance in Thailand

If you do a bit of digging on April's website, you can find a phone number for their office in France. Note that April is an insurance broker and not an insurance company. I don't know which insurer they might use for an expat in Thailand wishing to have cover from a non-Thai insurer. I note that their website defaults to their Thai office if one selects Thailand as the country of coverage. You'd have to call them to see if they can help you. AA Brokers won't be able to help you find offshore coverage as like all Thailand-based insurance brokers they are limited to working with insurers licensed by the OIC here in Thailand. -

April vs Axa krungthai vs Axa vs allianaz

Etaoin Shrdlu replied to chawarmas's topic in Insurance in Thailand

You might wish to consider whether outpatient coverage is needed at all. Many expats insure for inpatient coverage only and self-insure outpatient. Save premium funds for catastrophic cover and fund outpatient from current income. -

April vs Axa krungthai vs Axa vs allianaz

Etaoin Shrdlu replied to chawarmas's topic in Insurance in Thailand

Thailand has no statutory limit on how far back an insurer can go in order to determine whether the policyholder disclosed all material facts relevant to accepting the application for insurance. In reality, it is limited to how far back a policyholder's records go and can be obtained. Depending upon the policy limits, coverage, deductibles, financial security of the insurer, etc., $450 per month isn't that expensive. You may also be better served by an insurer that is regulated in a country that has better industry oversight and consumer protection laws. I would also suggest using a broker to find something that best fits your needs. -

-

Views on this latest action from Trump

Etaoin Shrdlu replied to fredwiggy's topic in ASEAN NOW Community Pub

Perhaps the convictions he received were for the weakest of the charges he could have faced given J6 and the Georgie election. He certainly could have appealed his conviction. -

Views on this latest action from Trump

Etaoin Shrdlu replied to fredwiggy's topic in ASEAN NOW Community Pub

Well, I think for non-violent offenses, perhaps community service might be appropriate. But serving as POTUS isn't the type of community service that is appropriate. -

Views on this latest action from Trump

Etaoin Shrdlu replied to fredwiggy's topic in ASEAN NOW Community Pub

Against convicted criminals. -

Views on this latest action from Trump

Etaoin Shrdlu replied to fredwiggy's topic in ASEAN NOW Community Pub

Trump was sworn to uphold the Constitution. When asked if he was obliged to do so, he said "I'm not a lawyer. I don't know". That tells you all you need to know as to whether he's "doing his job". -

Views on this latest action from Trump

Etaoin Shrdlu replied to fredwiggy's topic in ASEAN NOW Community Pub

Wanna bet? -

I also don't put much stock in Russians eating dogs, although I believe anyone in extremis probably would. Donald Trump hasn't shown any sign of standing up to Vladimir Putin so far and Trump's the leader of the Republican party. Trump kneecaps anyone who resists. Who in the Republican Party would challenge him on this point?