-

Posts

1,223 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Jenkins9039

-

Cashing out crypto in Thailand, under the new tax rules of 2024

Jenkins9039 replied to cleanac's topic in Cryptocurrency News

As a UK citizen it would be tax free to sell overseas and wise the funds into Thailand (pay income tax in Thailand). -

No real need for one

-

I'm guessing this will go through the domestic Immigration system also (flag for holding passenger). Rather stupid, kinda like a Chinese process. I remember arriving at Phuket Airport back in the day and boarding the flight 10-15 mins later for Bangkok.... Having said that always used passport (confirm Identity) but as mentioned above, suspect this is more of a scan process for IO.

-

Mining with Solar on the roof of the garage (10kw pannels) Seems ok.

-

French to the South, American to the North, multiple Swiss to the NWW & W, German to the NW. Muslim family to the South. Just finished building a observation tower, mainly concerned about the French, already had one major (many) run-ins with, Covid didn't finish him off, and the Gov had to draw lines on a chart and make him knock half his garage roof down for encroachment on Anglo soil.

-

Clever but Sloppy Tax Changes

Jenkins9039 replied to chai333's topic in Thai Visas, Residency, and Work Permits

Nah, pretty sure it's the entire tax year not from the day you become tax resident lol -

It's basically rather easy to re-structure yourself to reduce your tax overheads within Thailand, if you own a vehicle(s) or property that's your main costs, then everything else can be structured or reduced onshore by changing somethings. For example we bough the land behind us late last year just after they announced these changes to grow fruit and veg, chickens (eggs) etc which reduces another massive on-going cost. As i understand that saves us 450 THB a day for the household food costs (excluding meat/fish). = 164,250 on average per year, at a cost of 1,000,000 THB within 6yrs (slightly over) the 1,000,000 THB sunk costs then become paid off. at the same time due to the cost(s) of living and factoring the tax bracket 35% we'd have been hit by (again savings) - the tax on that 450 x 365 = 165,000 roughly = 57,750 in taxes. We are pretty much entirely green (water, power, heating/cooling) so I imagine collectively on-shore we'd be spending roughly 120,000 THB a month going forward - which should be tax free due to the deductions (children, parents, etc). So they've lost 'income tax' (technically savings) for the wife. They've lost VAT (by offshoring) They've lost local community fund flow (spending money into the community). So their little jaunt has probably cost them 1.5-2m THB in direct-indirect taxes in our household. X That across the country (i know many people in the HNW doing the same) and it will be a nasty shock for them.

-

Dollar will decline in spending power due to the 8+ trillion they need to put in the Fed Balance Sheet. So Thailand will have to devalue their currency like all other countries to remain competitive for exports (10,000 THB bribe makes sense then). So yeah, if holding fiat convert to something else...

-

Identification at airport

Jenkins9039 replied to LauChan's topic in Thai Visas, Residency, and Work Permits

Thailand has biometrics. Only way to get around that is to hack the Gov server and delete everything. Notice the hackers have never done that but hacked just about every other system over the years.. probably one of the most secure archives within Thailand lol. -

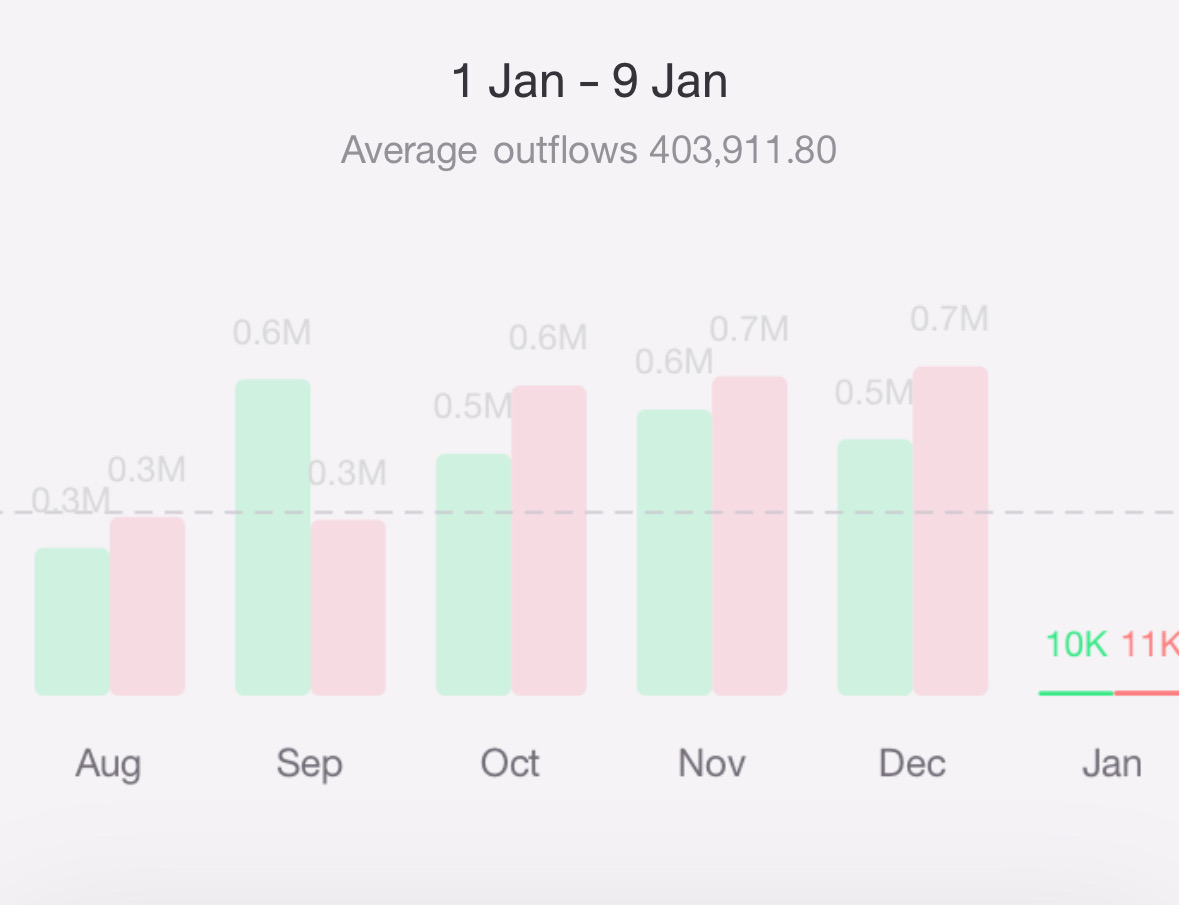

Before Jan 1st. We'd spend anywhere from 400,000-700,000 THB a month, and then additional 120,000 THB (wife) a month. Since Jan 1st we've moved ALL our insurances overseas (parent companies), we've moved ALL our additional costs where possible (boating costs etc) to their parent companies, all purchasing we do overseas (Amazon etc), basically anything that can be dealt with via a parent/sister company has been routed overseas to those companies, kids education, medical, etc all parent companies overseas. I'd hazard a guess the Gov are loosing roughly 120,000 THB minimum a month from just my credit card VAT payments. That's without all the other costs, even staff are now paid from overseas, we lost a couple, as they didn't want that, they wanted to continue to be paid in cash from my wife (which we paid tax -reported which was 'savings' - but just so we had no issues...). I looked at my credit card the other day, 3,000 THB spent, bank 10,000 THB.

-

We've done 3m THB in cash, 1m THB in cash in previous years. Both times the seller insisted on cash (first time the woman didn't walk and didn't have accounts - had to be carried into the LO and the cash was counted in her car with the LO officer in presence). Second time Thai guy had debts, wanted cash, was counted in the LO in front of the LO officer.

-

Thai gov is interested in the tax information they hold.

-

Thai man demands responsibility for explosion after fridge repair

Jenkins9039 replied to webfact's topic in Bangkok News

Oh boy.. got one under the old garage (converted to a gym/maid bedroom) got one under the patio (connected to an Annex bedroom) got one under the garage Got one beside a new bedroom If just one goes off i'd imagine we'd have 30mb of damage. -

Phuket officials to target ‘bad foreigners’ to enhance tourism

Jenkins9039 replied to webfact's topic in Phuket News

The bit between black and grey. Usually not 'illegal' but 'questionable'. -

Male citizens living abroad to be asked to join army

Jenkins9039 replied to CharlieH's topic in The War in Ukraine

150,000$ buys a alternative citizenship by investment Approx - ~ time to buy a second citizenship for the eloped ukrainians. $slavaukraine lol -

Are farangs inadvertently colonizing Thailand?

Jenkins9039 replied to bob smith's topic in ASEAN NOW Community Pub

Weird a lot of times i've seen Thai kids shipped back home with their parents the moment they need education because it's free there... To be fair i have two kids >1 yrs old and they cost something like 1,400 Euro a month in schooling and swimming lessons, then another 1,800 Euro a month for live in nannies. I guess in Europe it's cheaper. Mind i did meet one farang (Austrian) years ago who had two kids 10+ and no schooling, the kids were almost feral.